Iowa Small Estate Affidavit for Personal Property Estates Not More than $50,000

Description

How to fill out Iowa Small Estate Affidavit For Personal Property Estates Not More Than $50,000?

Access one of the most comprehensive catalogs of sanctioned forms.

US Legal Forms is essentially a platform where you can discover any state-specific document in moments, including Iowa Small Estate Affidavit for Personal Property Estates Not Exceeding $50,000 samples.

No need to squander numerous hours of your time searching for a court-acceptable form.

After selecting a pricing plan, set up your account. Pay via credit card or PayPal. Download the document to your computer by clicking Download. That's all! You should complete the Iowa Small Estate Affidavit for Personal Property Estates Not Exceeding $50,000 form and submit it. To ensure everything is correct, contact your local legal advisor for guidance. Join and easily discover over 85,000 useful forms.

- To utilize the documents library, select a subscription and establish your account.

- If you've registered, simply Log In and then click Download.

- The Iowa Small Estate Affidavit for Personal Property Estates Not Exceeding $50,000 template will automatically be saved in the My documents tab (a section for every document you save on US Legal Forms).

- To create a new account, see the quick guidelines below.

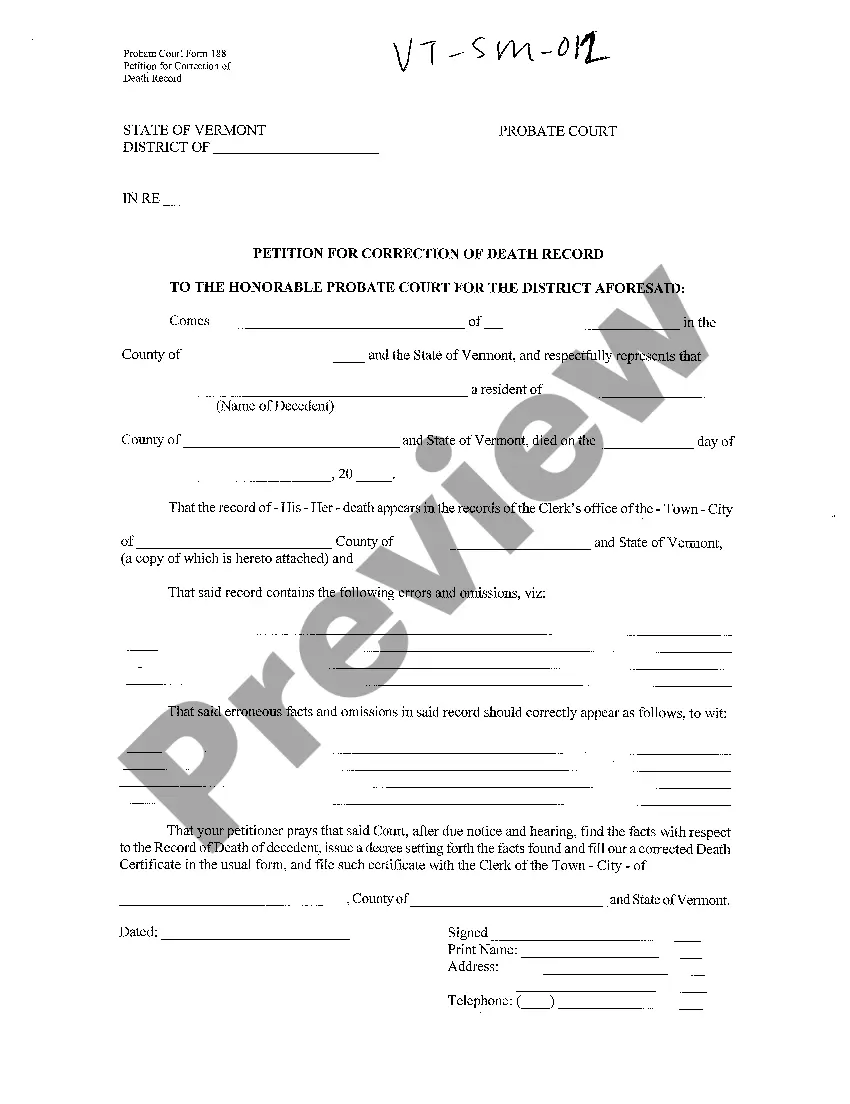

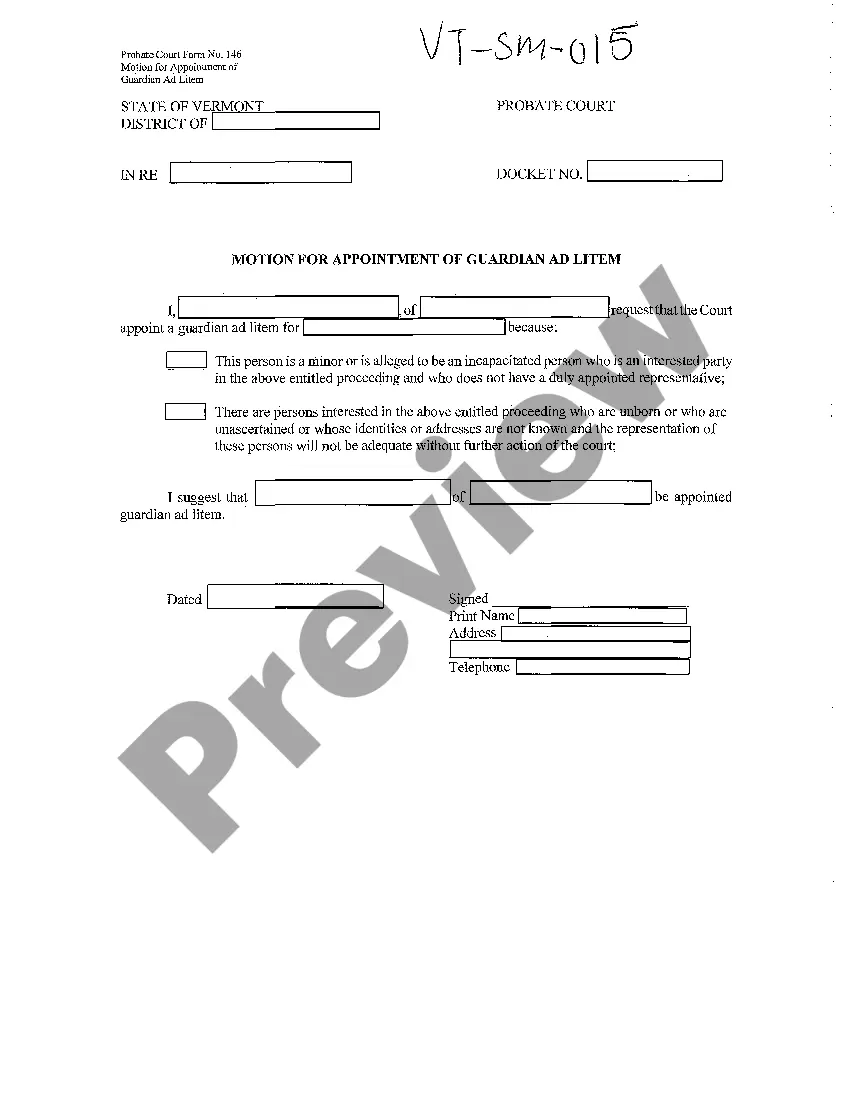

- If you need to use a state-specific example, make sure to specify the correct state.

- If possible, review the description to grasp all the details of the document.

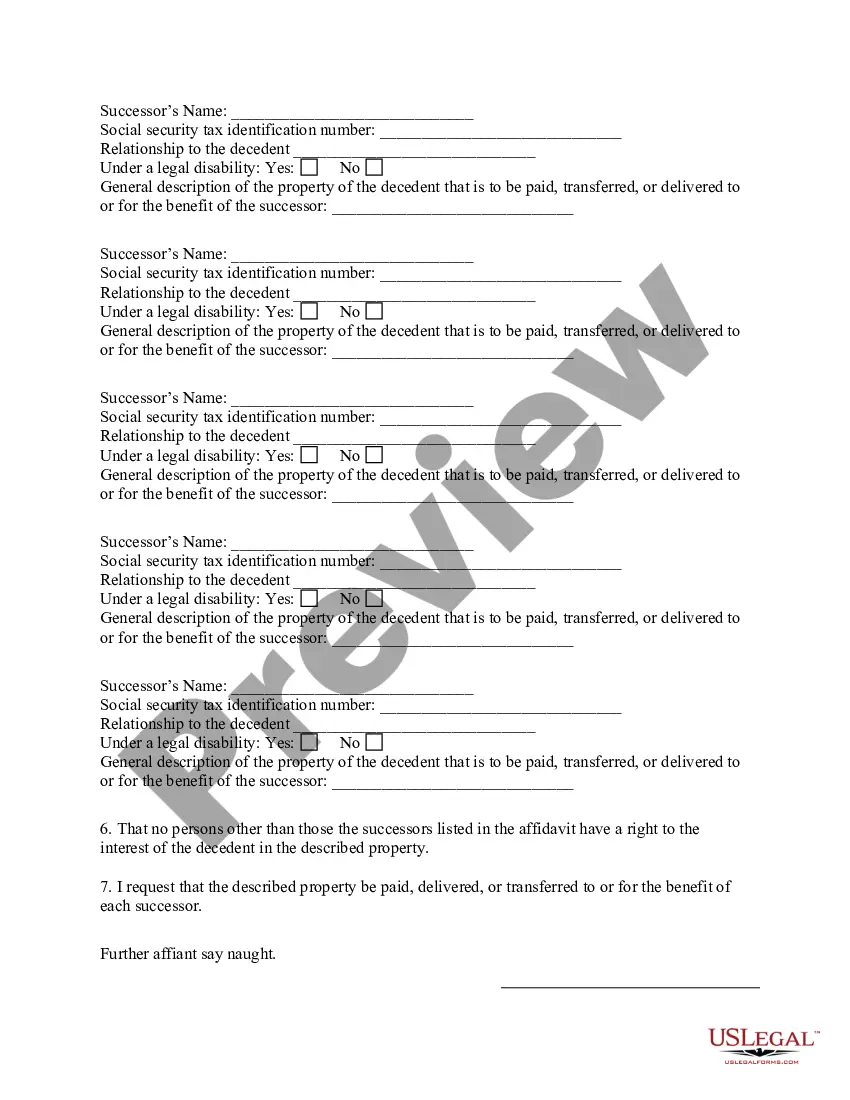

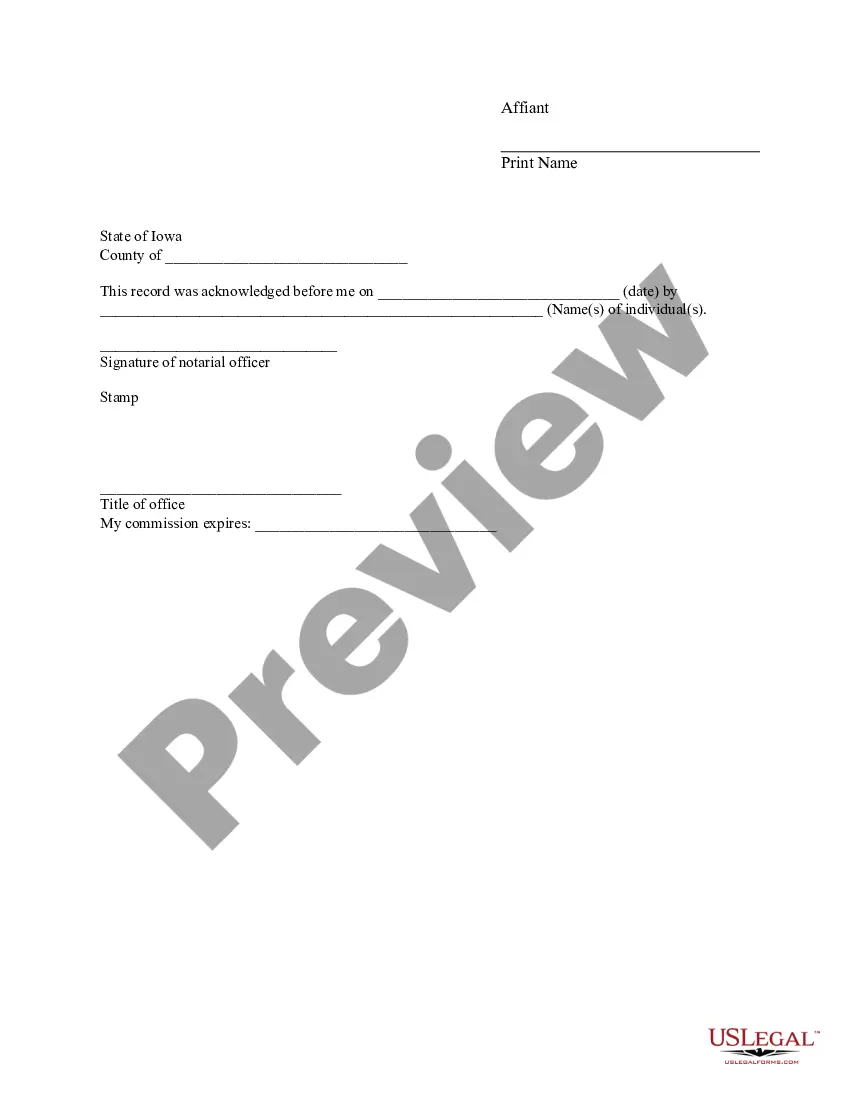

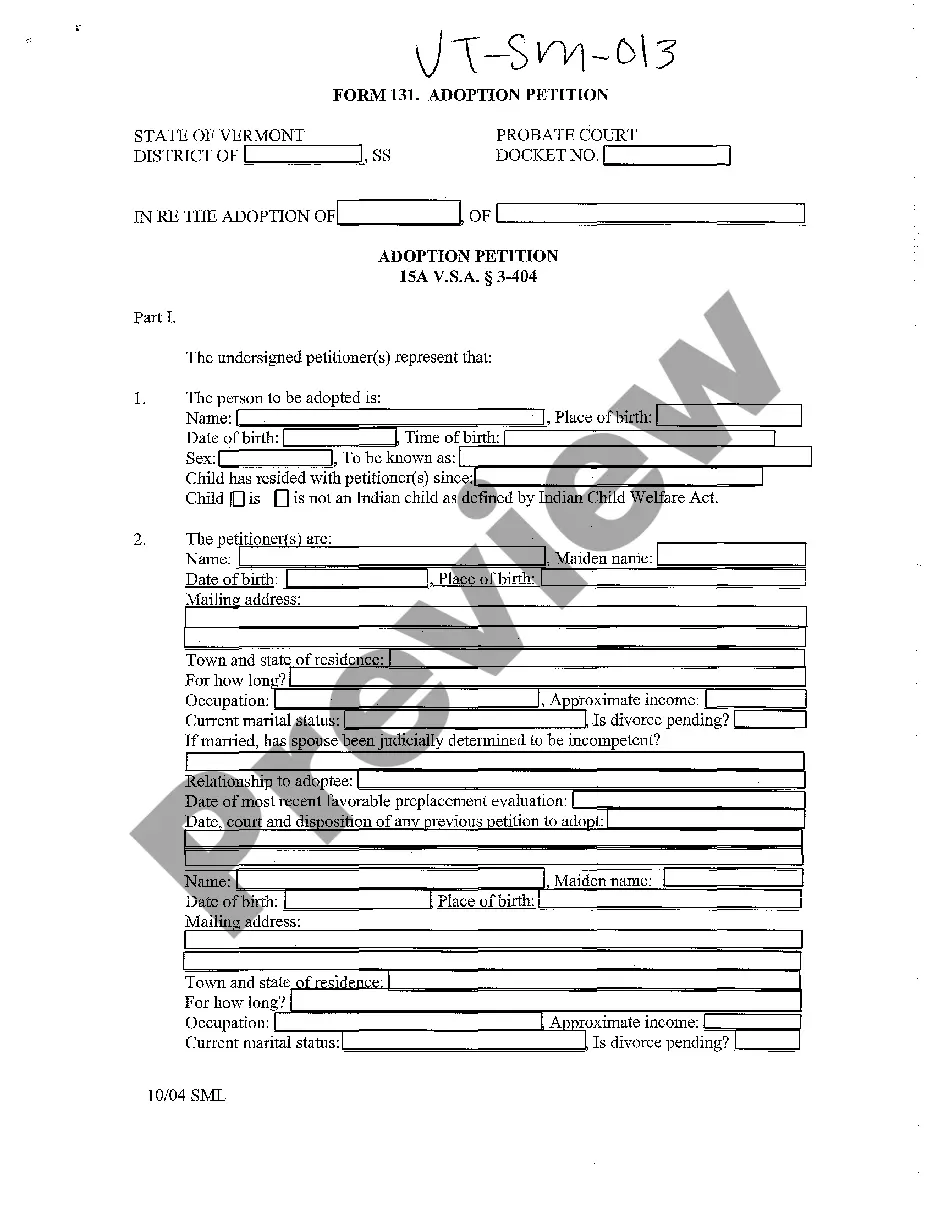

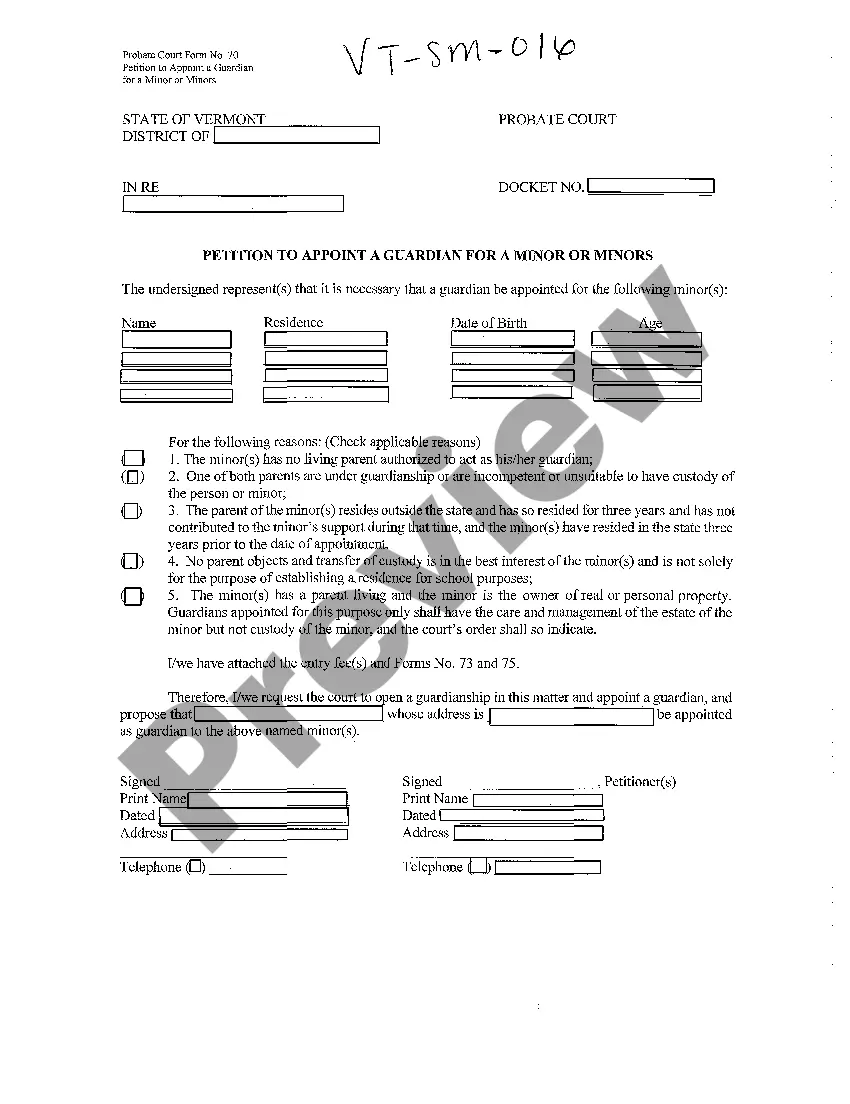

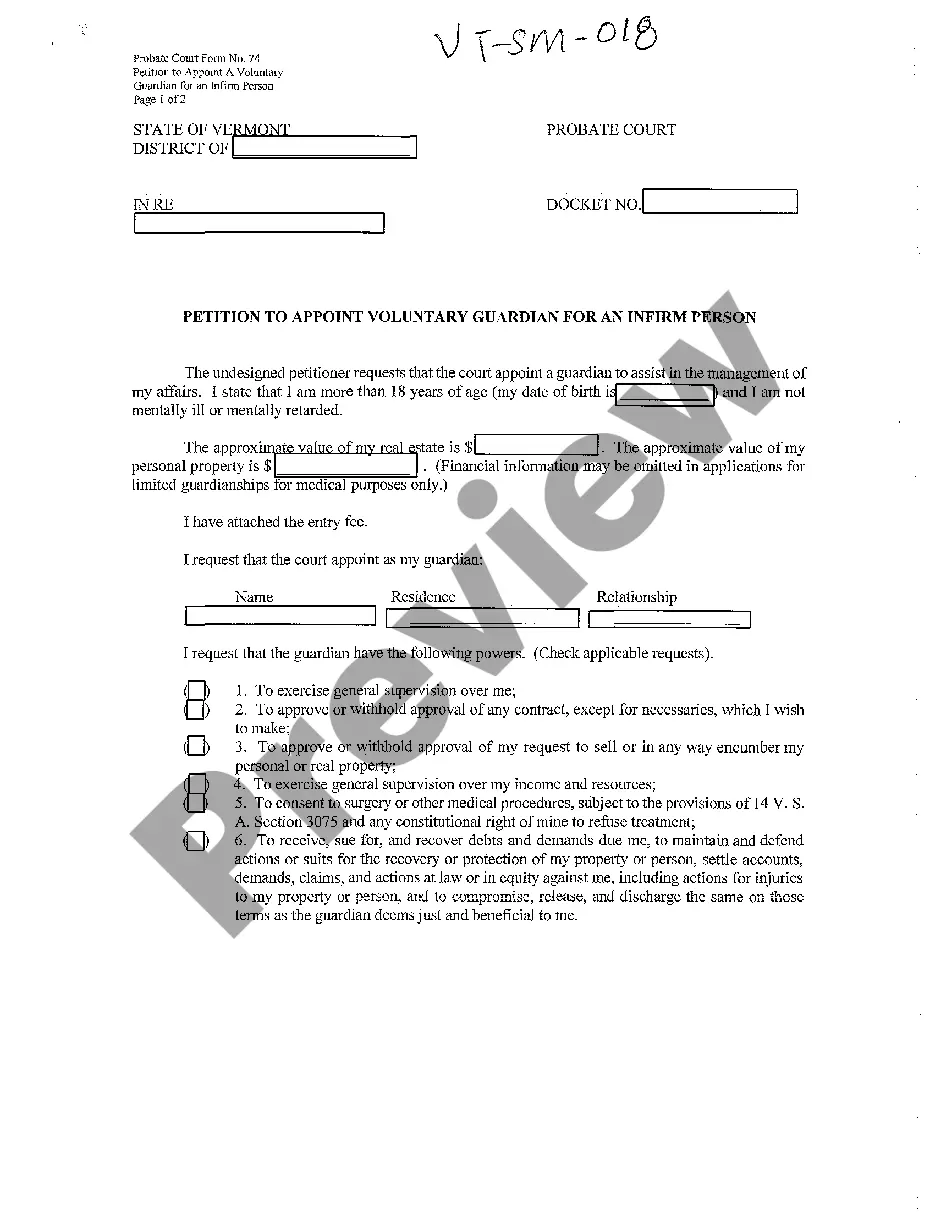

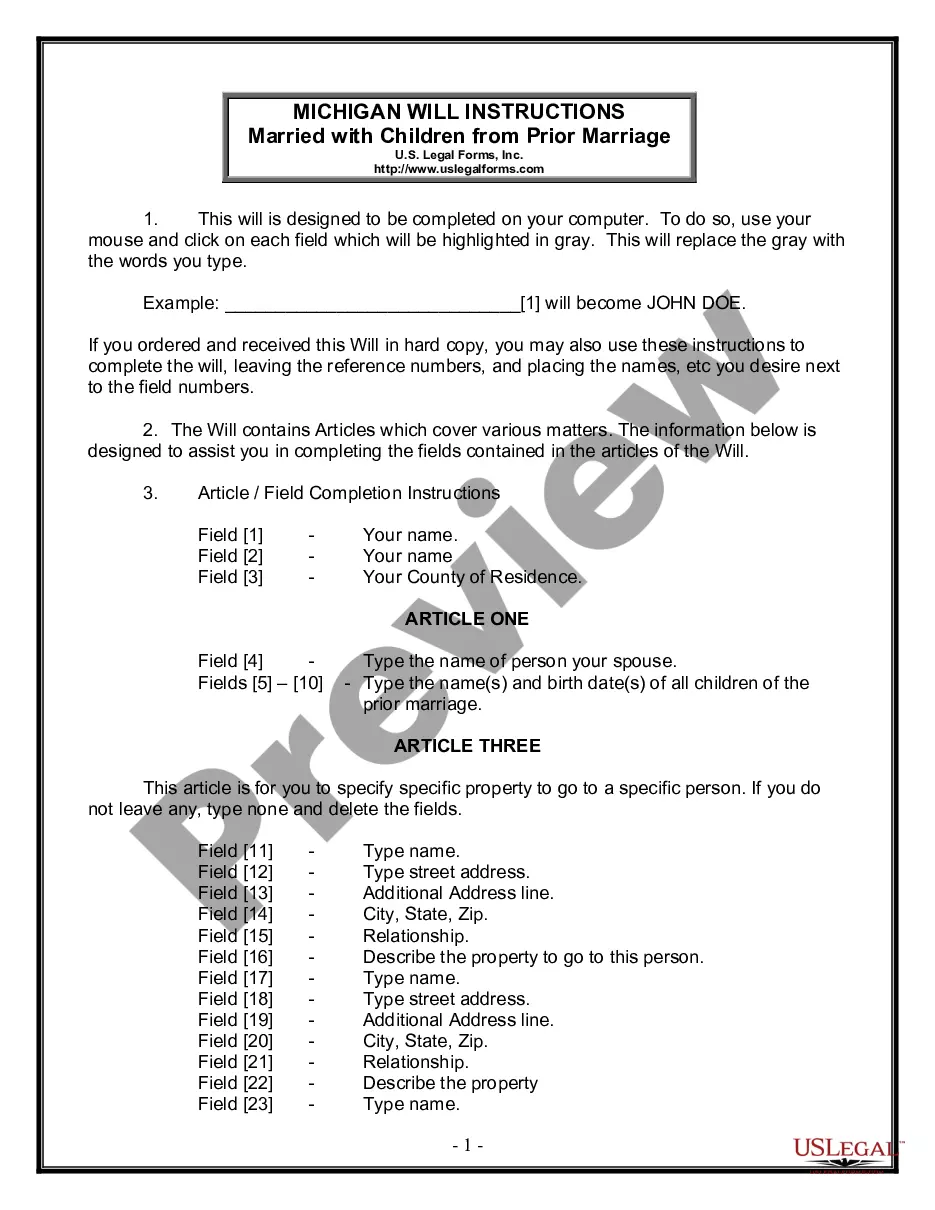

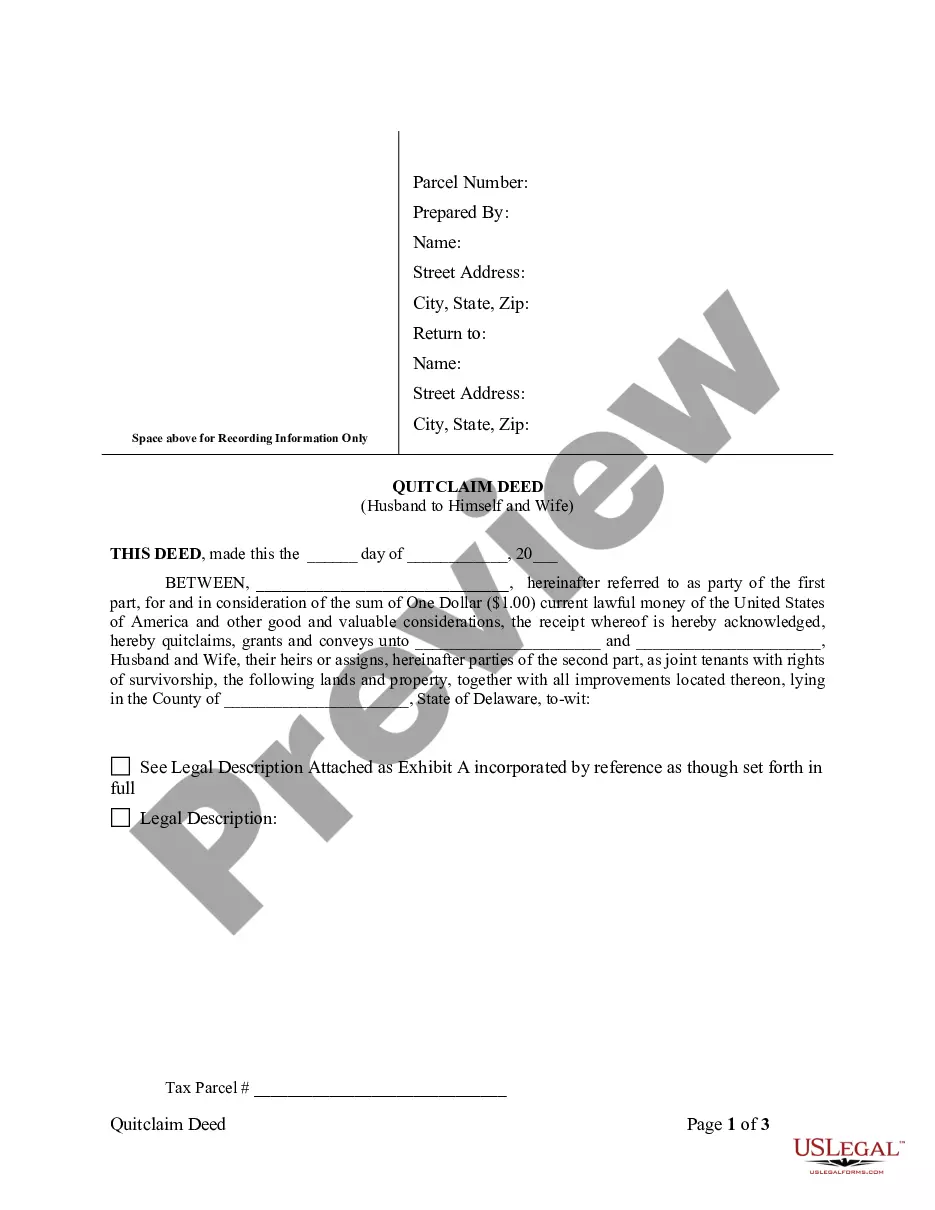

- Utilize the Preview feature if it’s available to inspect the document's content.

- If everything is satisfactory, click on the Buy Now button.

Form popularity

FAQ

To fill out an affidavit of inheritance, you need to gather relevant details about the decedent and the distributions to the heirs. Be sure to clearly describe the assets involved, and use the appropriate form designed for inheritance. If you are dealing with an estate under $50,000, consider using the Iowa Small Estate Affidavit for Personal Property Estates Not More than $50,000 for a more straightforward process. Platforms like USLegalForms provide resources to assist you in this process.

In Washington state, real property typically does not have to go through probate if it is left to a surviving spouse or registered domestic partner. However, if there are other heirs or complications, you may need to follow the probate process. It is important to check whether the Iowa Small Estate Affidavit for Personal Property Estates Not More than $50,000 applies in your situation, as it generally concerns personal property.

No, an affidavit of heirship and a small estate affidavit serve different purposes. The affidavit of heirship identifies the rightful heirs of an estate, while the Iowa Small Estate Affidavit for Personal Property Estates Not More than $50,000 allows for the transfer of personal property without going through probate. Understanding these distinctions can help you choose the right document for your needs.

To fill out an affidavit form, start by gathering the necessary information about the estate and the decedent. Clearly state the purpose of the affidavit, and ensure all details are accurate and complete. When preparing the Iowa Small Estate Affidavit for Personal Property Estates Not More than $50,000, follow the instructions carefully. If needed, resources like USLegalForms can provide templates and assistance to simplify this task.

The threshold for Probate can range from £5,000 to A£50,000, depending on which banks and financial institutions are holding the deceased person's assets.

Probate is required when an estate's assets are solely in the deceased's name. In most cases, if the deceased owned property that had no other names attached, an estate must go through probate in order to transfer the property into the name(s) of any beneficiaries.

Probate is a legal process that's sometimes needed to deal with a deceased person's property, money and assets (their Estate). Probate is not always required for small Estates in England or Wales. This is because some assets up to a value of £5,000 can usually be transferred without going through the Probate process.

Fortunately, not all property needs to go through this legal process before it passes to your heirs.The quick rule of thumb is probate is not required when the estate is small, or the property is designed to pass outside of probate. It doesn't matter if you leave a will.

Visit the appropriate court office. Check the court's limits for the estate's value. Obtain the correct affidavit form. Fill out the affidavit in full. Sign the affidavit. Obtain a death certificate.

Iowa has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.