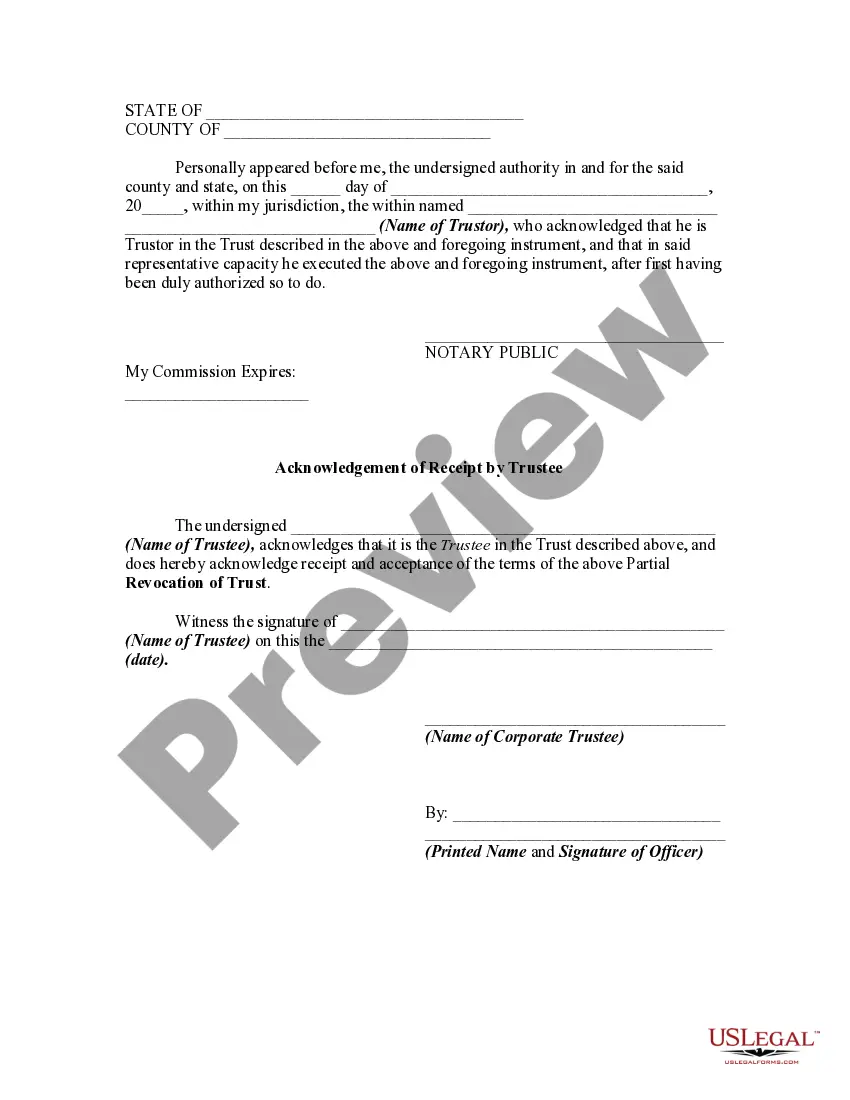

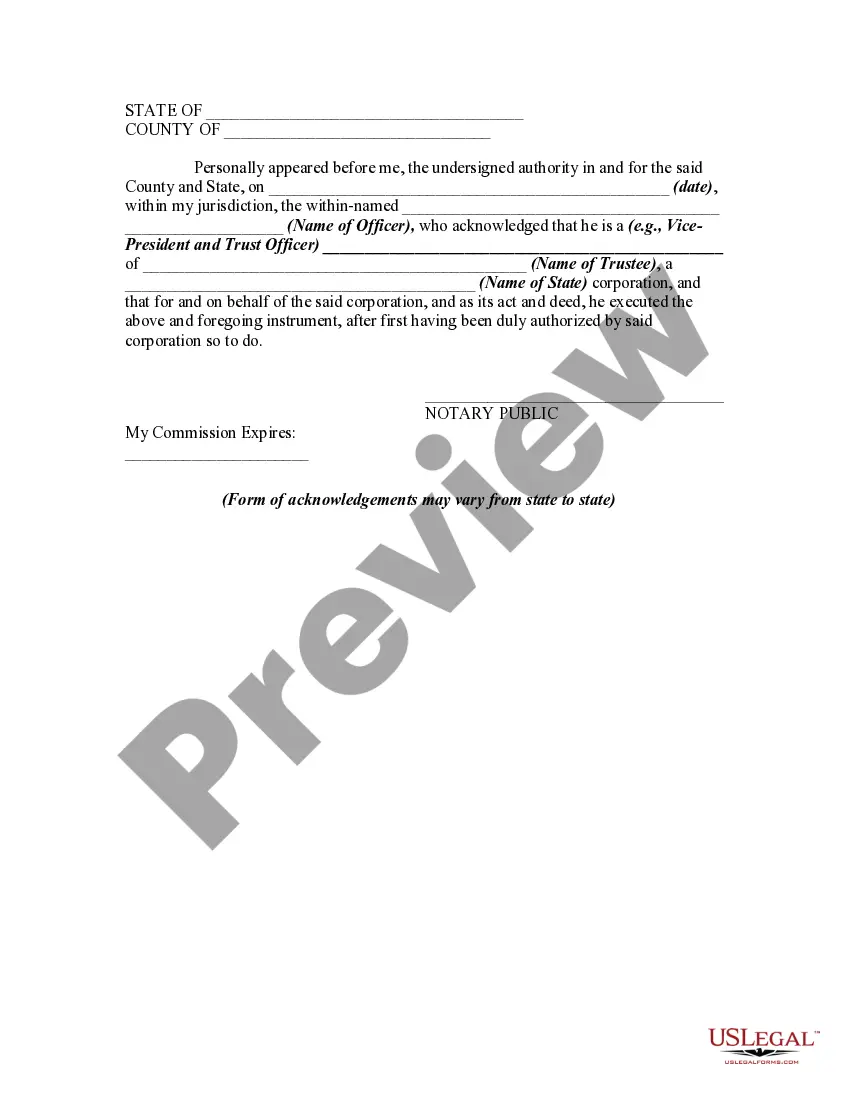

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

Aren't you tired of choosing from hundreds of templates each time you need to create a Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee? US Legal Forms eliminates the wasted time countless American people spend browsing the internet for appropriate tax and legal forms. Our professional group of attorneys is constantly upgrading the state-specific Forms catalogue, to ensure that it always provides the right documents for your scenarion.

If you’re a US Legal Forms subscriber, simply log in to your account and click the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have an active subscription should complete easy actions before being able to get access to their Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee:

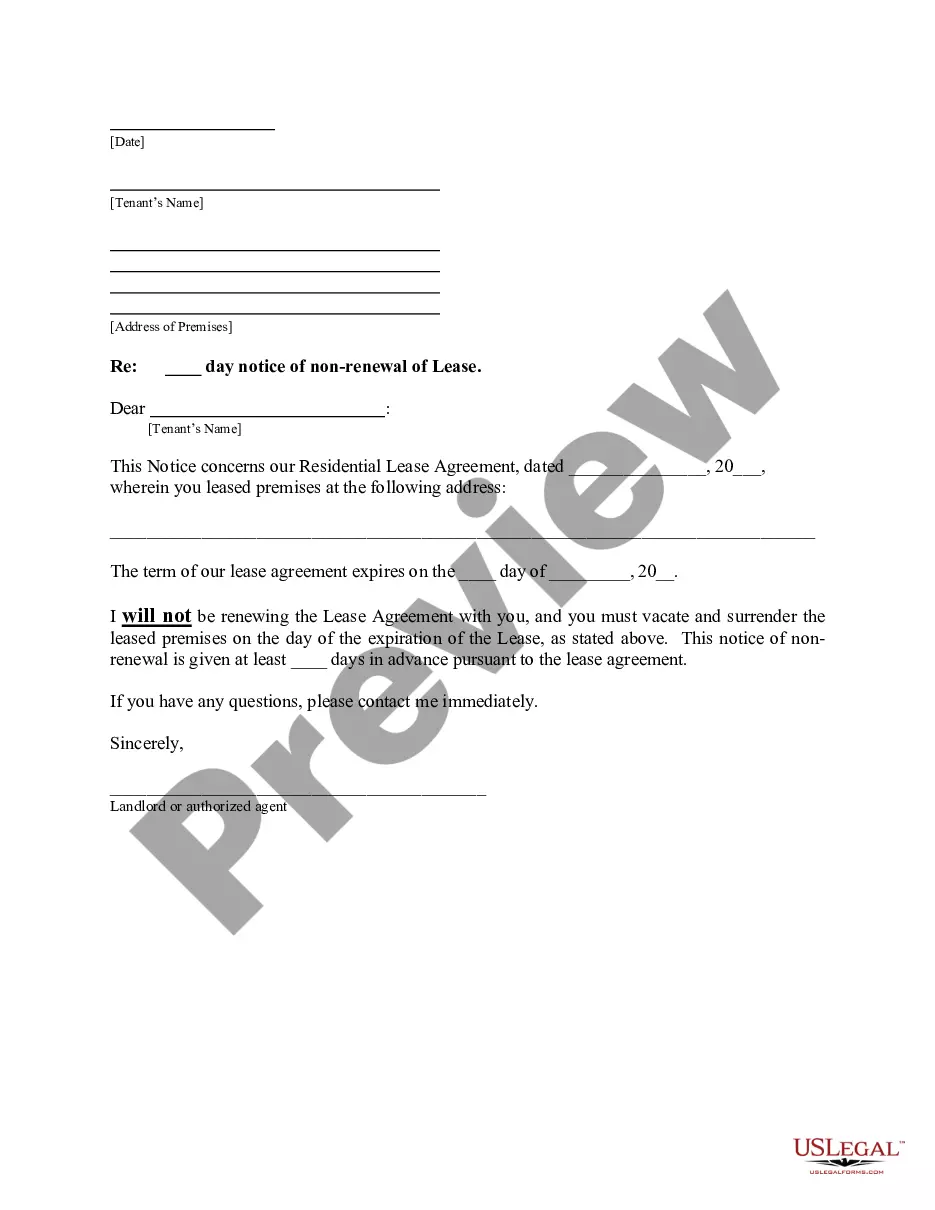

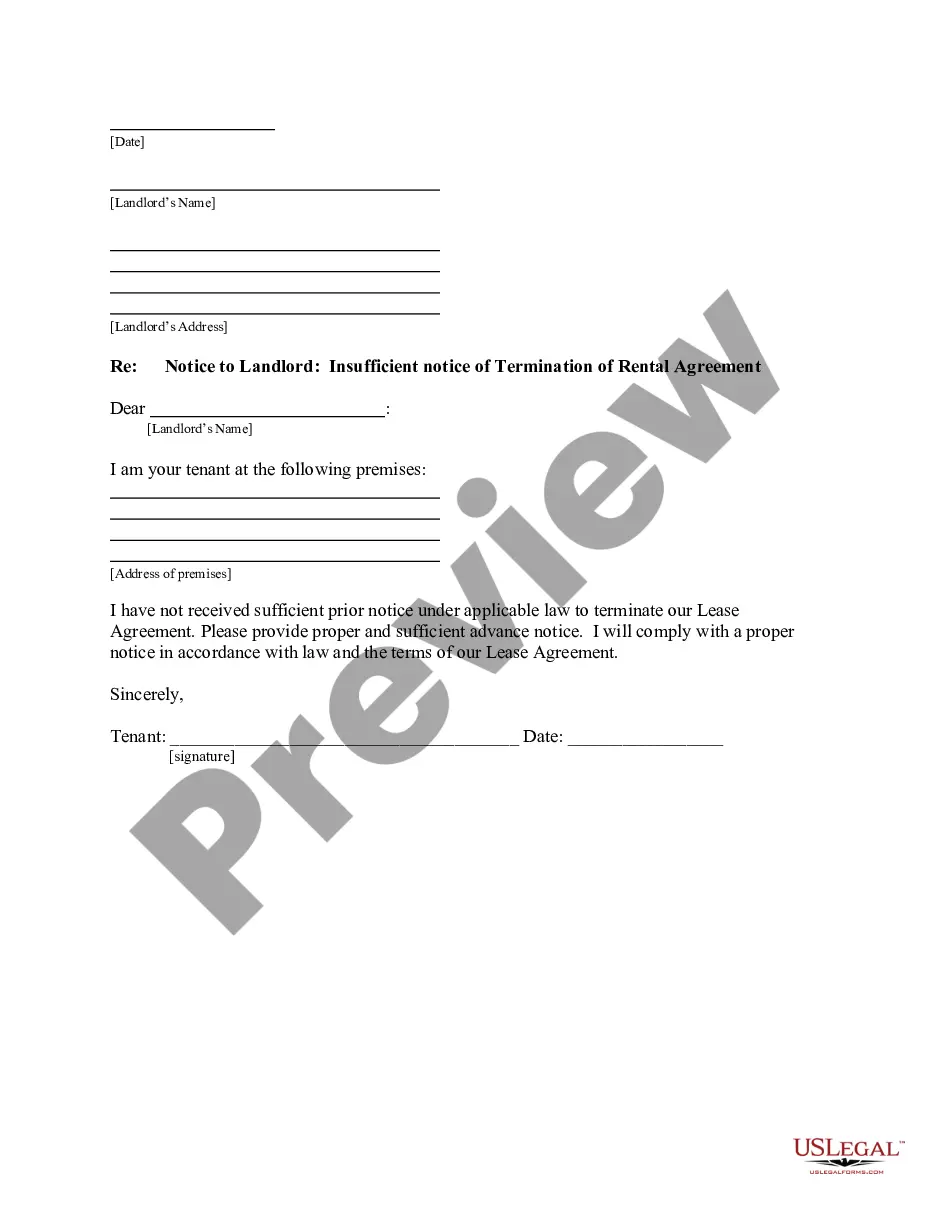

- Utilize the Preview function and look at the form description (if available) to make certain that it’s the best document for what you are trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the right example for your state and situation.

- Utilize the Search field on top of the page if you want to look for another document.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Download your sample in a convenient format to complete, print, and sign the document.

Once you have followed the step-by-step recommendations above, you'll always be able to sign in and download whatever document you want for whatever state you need it in. With US Legal Forms, completing Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee templates or any other legal files is not difficult. Get going now, and don't forget to examine your examples with accredited attorneys!

Form popularity

FAQ

According to Ohio law, if the revocable trust instrument doesn't provide for a way to revoke or amend, the settlor can revoke or amend the trust in any way that manifests "clear and convincing" evidence of their intentexcept by a will or codicil.

If you want to revoke your trust, you must formally take all of the trust assets out of the living trust and transfer title back to you. Basically, you must reverse the process you followed when you transferred ownership of the property to yourself as trustee.

How Long to Distribute Trust Assets? Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

You must actually transfer or place property in the trust. That means the trust, with you as trustee, owns the property in it.You can also take property out of the trust if your needs change or if you want to give it to your beneficiary.

In order to close the Trust, the bills of the Trustors will need to be paid and the assets of the Trust should then be distributed to the intended beneficiaries. This process begins by the new Trustee locating the Trust document, the Wills and any other estate planning documents that the Trustors created.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.

Irrevocable trusts can remain up and running indefinitely after the trustmaker dies, but most revocable trusts disperse their assets and close up shop. This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer.

The procedure for settling a trust after death entails: Step 1: Get death certificate copies. Step 2: Inventory the assets in the estate. Step 3: Work with a trust attorney to understand the grantor's distribution wishes, timelines, and fiduciary responsibilities. Step 4: Asset appraisal. Step 5: Pay taxes.