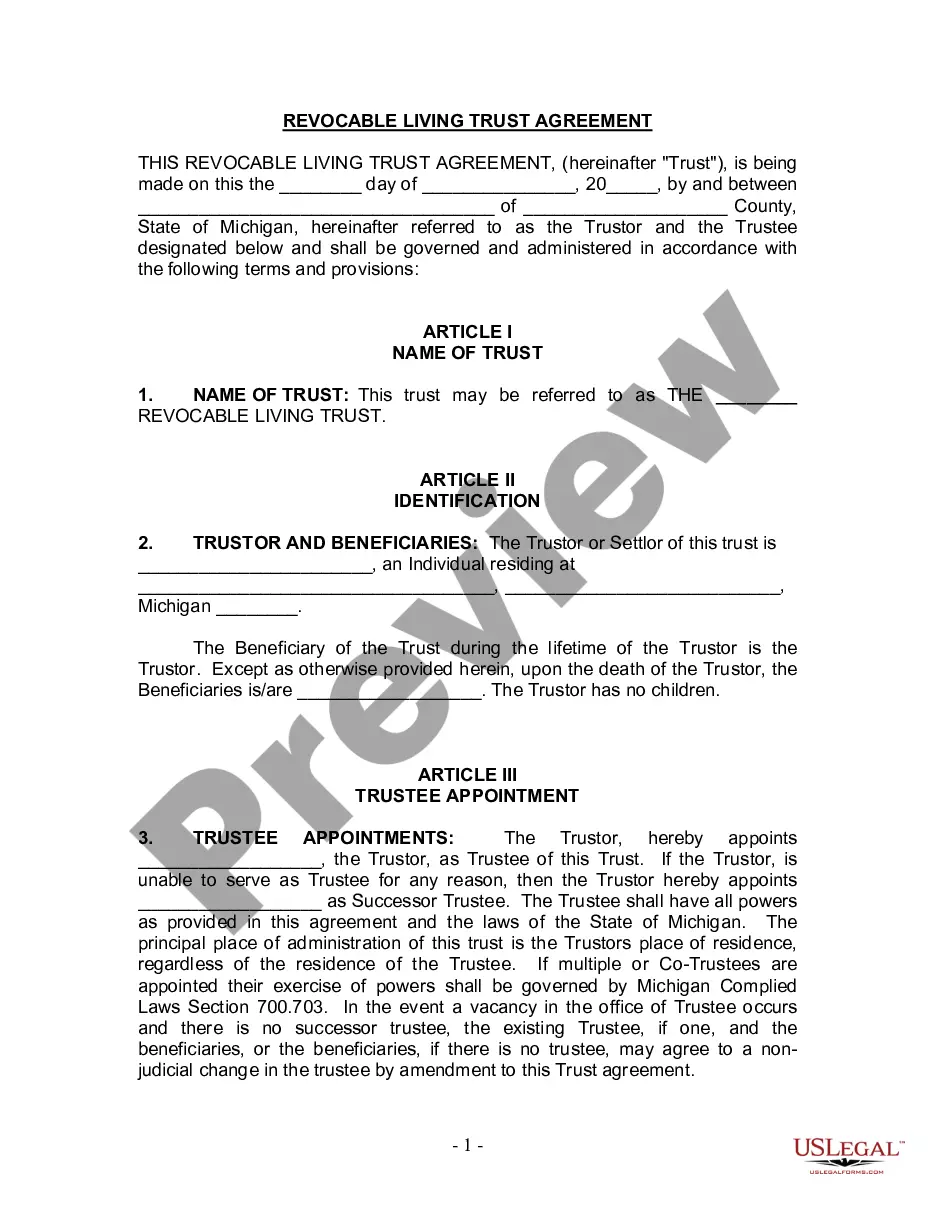

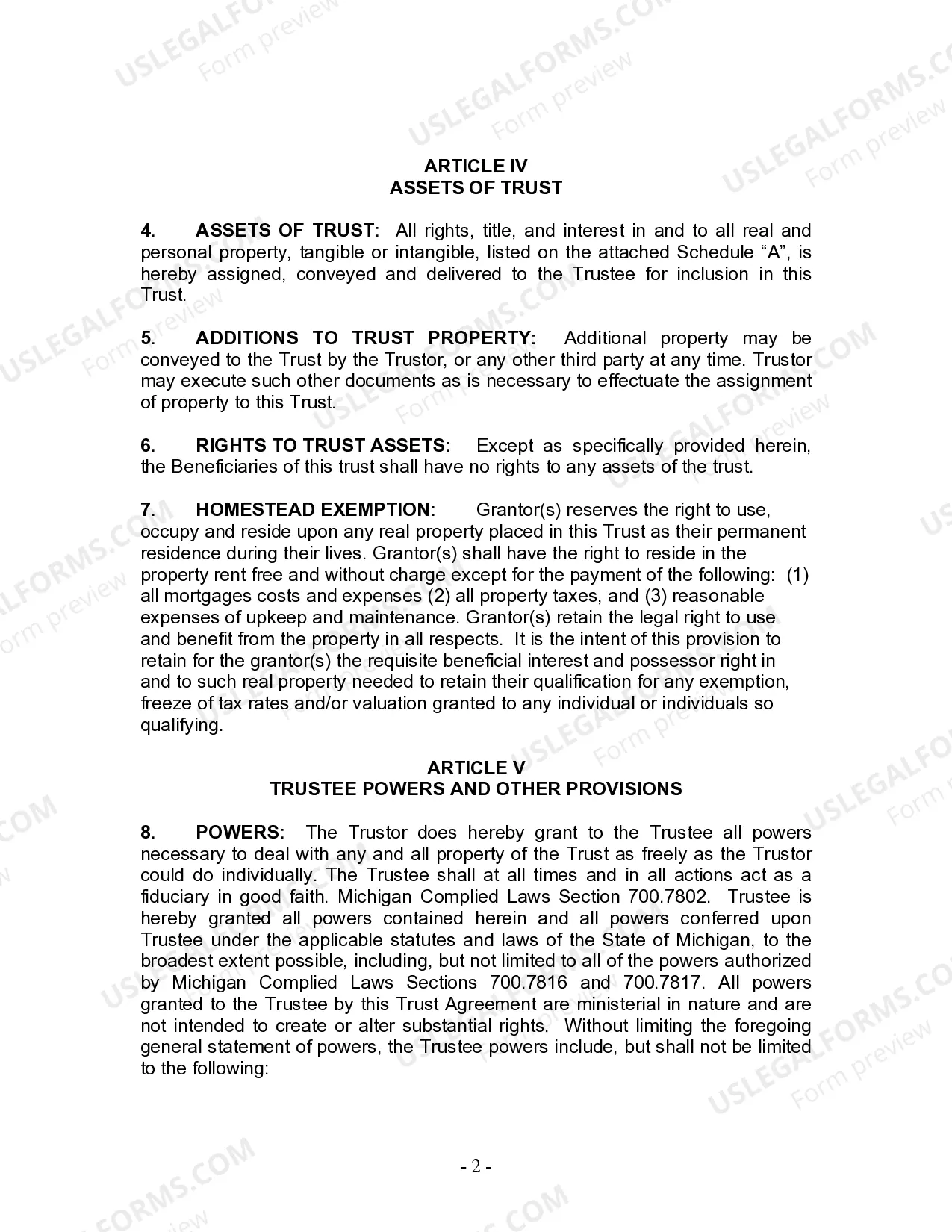

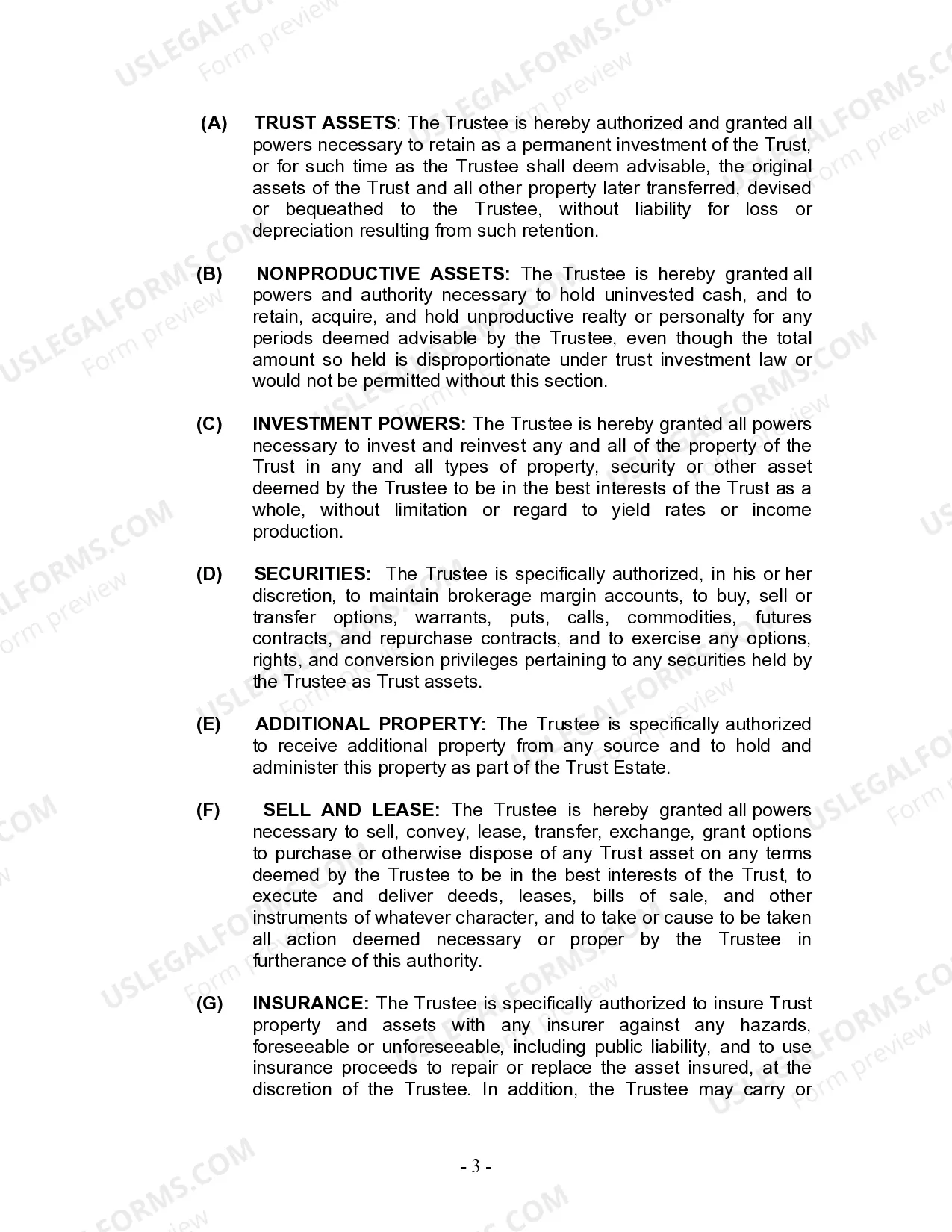

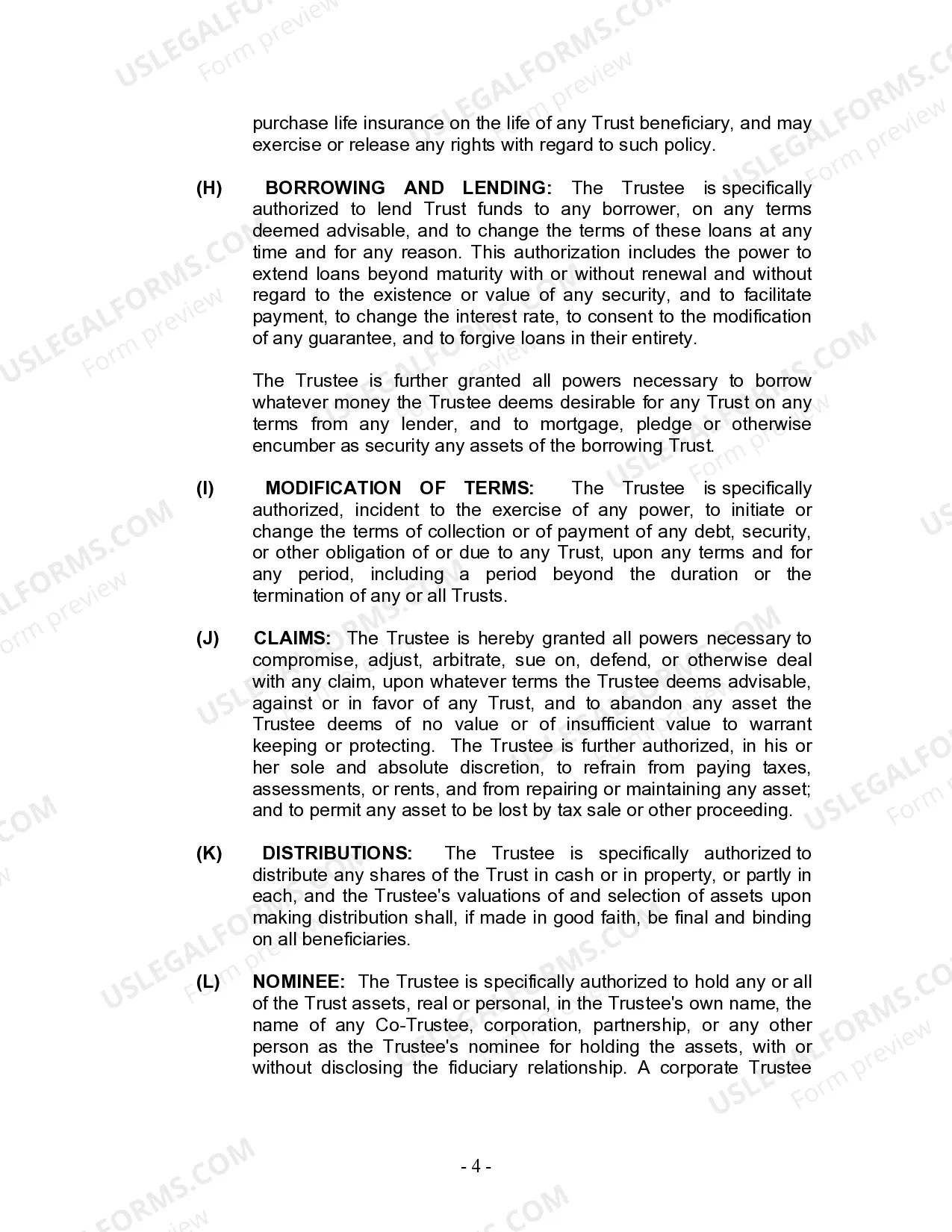

Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With No Children?

Access any template from 85,000 legal documents like the Michigan Living Trust for Individuals Who Are Single, Divorced, or a Widow (or Widower) Without Children online with US Legal Forms.

Each template is crafted and revised by licensed legal experts in the state.

If you hold a subscription, Log In. Once on the form’s page, select the Download button and navigate to My documents to access it.

With US Legal Forms, you will always have immediate access to the appropriate downloadable template. The platform offers a collection of forms and categorizes them to facilitate your search. Utilize US Legal Forms to obtain your Michigan Living Trust for Individuals Who Are Single, Divorced, or a Widow (or Widower) Without Children quickly and efficiently.

- Verify the state-specific prerequisites for the Michigan Living Trust for Individuals Who Are Single, Divorced, or a Widow (or Widower) Without Children you intend to utilize.

- Review the description and examine the template.

- When you confirm that the sample meets your needs, click Buy Now.

- Choose a subscription plan that fits your budget.

- Establish a personal account.

- Complete the transaction using one of two convenient methods: with a credit card or through PayPal.

- Select a format to download the document in; you have two options (PDF or Word).

- Save the document to the My documents section.

- After your reusable template is prepared, print it or store it on your device.

Form popularity

FAQ

Yes, you can create your own Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children. However, it's important to understand the legal requirements and implications involved. Utilizing resources from uslegalforms can help you draft the necessary documents correctly, ensuring that your trust meets Michigan’s laws. This approach provides peace of mind, knowing your estate will be managed as you intend.

While a Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children offers many benefits, there are some downsides to consider. Establishing a trust requires time and funds for setup, and maintaining it involves ongoing management and paperwork. Additionally, trusts do not provide asset protection from creditors. Therefore, evaluating your specific situation is crucial to weigh the pros and cons effectively.

Yes, you can create a Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children without a spouse. In fact, many individuals choose to establish a living trust to ensure their assets are managed according to their wishes. This type of trust allows you to have complete control over your estate. Working with a legal platform like uslegalforms can simplify the process, guiding you through each step.

A single person with no kids should seriously think about a Michigan Living Trust for Individuals Who are Single, Divorced or Widow (or Widower) with No Children. While it may seem unnecessary, a trust secures your assets and clarifies your wishes for distribution. It can also protect your estate from lengthy probate processes. By taking this step, you make sure your legacy is handled as you intend.

Yes, a single person with no children should consider a Michigan Living Trust for Individuals Who are Single, Divorced or Widow (or Widower) with No Children. This type of trust protects your assets and ensures they are distributed according to your wishes. It can also provide tax advantages and privacy for your estate. Making this choice now can prevent complications later.

Having a trust while going through a divorce does not nullify the trust itself. However, it is crucial to reevaluate the Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children for any necessary updates. With platforms like US Legal Forms, you can streamline this process, ensuring that your trust accurately reflects your current intentions.

If you get divorced, your living trust remains intact, but its terms may need to be reviewed and modified. Updating your Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children post-divorce helps ensure that your assets are allocated in accordance with your new circumstances. Engaging with a professional can provide valuable guidance in this transition.

The 2 year rule generally refers to a period during which a trust may be allowed to distribute certain assets without incurring tax penalties. In the context of a Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children, it’s key to understand how this rule can impact your estate planning decisions. Consider consulting with an expert to navigate this aspect accurately.

Absolutely, you can set up a living trust as an individual in Michigan, even if you are single, divorced, or a widow/widower without children. A Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children allows you to maintain control over your assets. This flexibility provides security and clarity in your estate planning.

Yes, you can write your own trust in Michigan. This allows you to create a Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children tailored to your specific needs. However, it is advisable to use resources from platforms like US Legal Forms to ensure that your trust complies with Michigan laws and effectively addresses your goals.