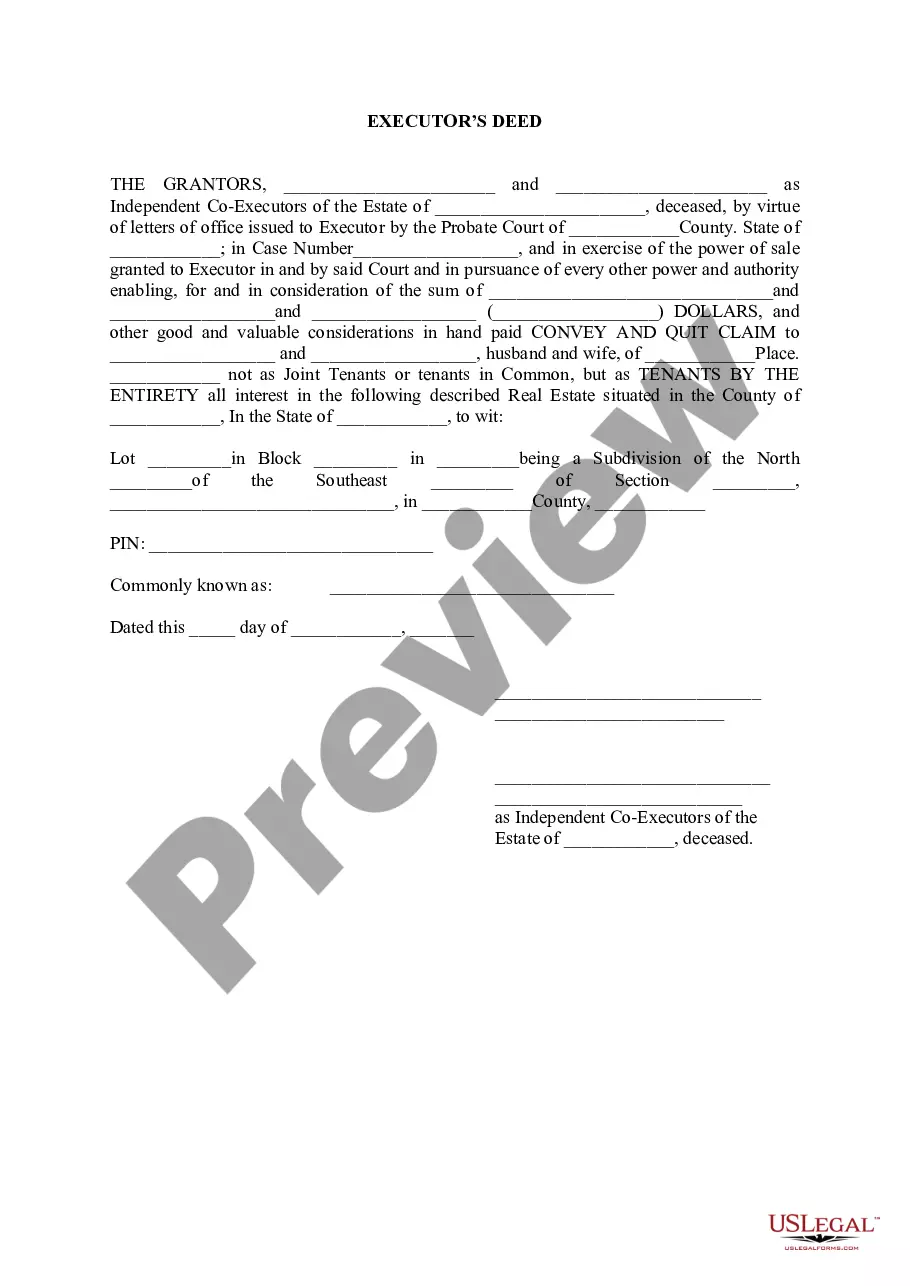

Illinois Executor's Deed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Executor's Deed?

Utilize US Legal Forms to acquire a printable Illinois Executor’s Deed.

Our court-acceptable templates are crafted and frequently refreshed by experienced attorneys.

Our collection offers the most extensive catalog of forms online and delivers cost-effective and precise templates for individuals, legal practitioners, and small to medium-sized businesses.

Select Buy Now if it is the document you require. Establish your account and make payment through PayPal or credit card. Download the template to your device and feel free to reuse it repeatedly. Use the Search field if you need to find another document template. US Legal Forms provides a vast array of legal and tax documents as well as packages for business and personal requirements, including the Illinois Executor’s Deed. Over three million users have successfully used our service. Choose your subscription plan and acquire high-quality documents in only a few clicks.

- The documents are organized into state-specific categories, and several can be previewed prior to download.

- To download examples, users must hold a subscription and Log In to their account.

- Click Download next to any template you wish and locate it in My documents.

- For users without a subscription, adhere to the following steps to easily locate and download the Illinois Executor’s Deed.

- Ensure you have the correct form pertaining to the necessary state.

- Examine the document by reviewing the description and using the Preview feature.

Form popularity

FAQ

Executor's Deed: This may be used when a person dies testate (with a will). The estate's executor will dispose of the decedent's assets and an executor's deed may be used to convey the title or real property to the grantee.

Locate the most recent deed to the property. Create the new deed. Sign and notarize the new deed. Record the deed in the Illinois land records.

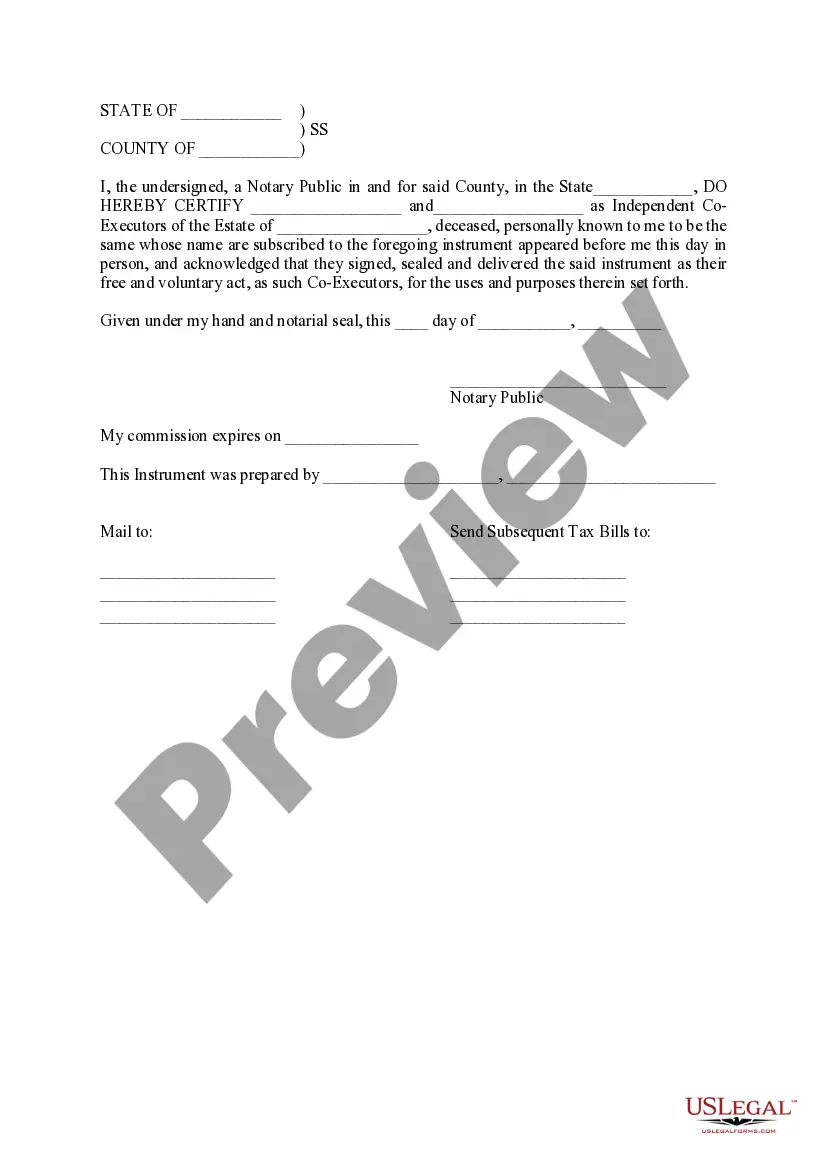

During the administration of the estate those Executors who have obtained a Grant of Probate (more of which later) must act jointly. That is to say that they must all agree on a course of action and each sign any documents, etc. Clearly there may be problems if those appointed do not get on.

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.