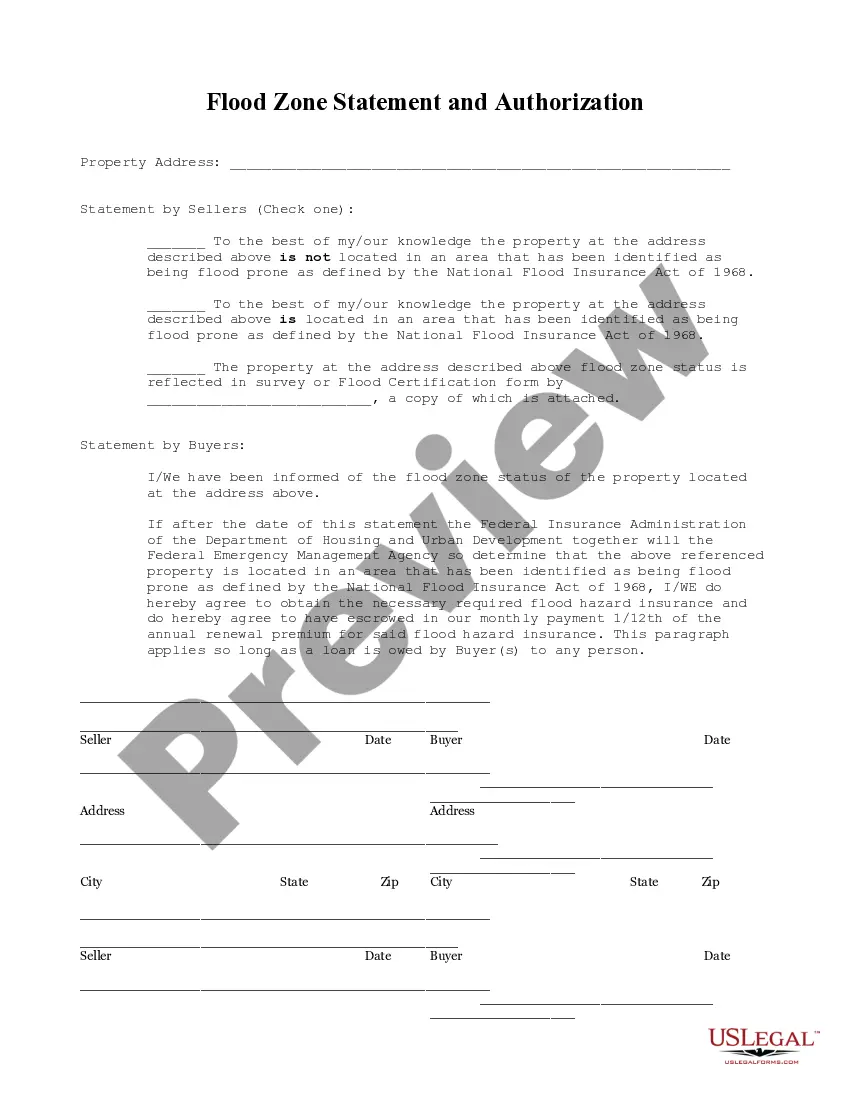

Connecticut Flood Zone Statement and Authorization

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Flood Zone Statement And Authorization?

The greater the number of documents you need to produce - the more anxious you become.

You can discover numerous Connecticut Flood Zone Statement and Authorization templates online, however, you're unsure which ones to trust.

Remove the stress of finding samples by using US Legal Forms. Obtain expertly crafted documents that meet state requirements.

Provide the necessary information to create your account and complete your purchase using PayPal or a credit card. Choose a convenient file format and obtain your copy. Access each document you download in the My documents section. Simply visit there to prepare a new copy of your Connecticut Flood Zone Statement and Authorization. Even with professionally prepared forms, it's still advisable to consider having a local attorney review the completed sample to ensure your document is filled out correctly. Achieve more for less with US Legal Forms!

- If you are already a US Legal Forms member, Log In to your account, and you'll see the Download option on the Connecticut Flood Zone Statement and Authorization’s page.

- If you haven't used our site before, complete the registration process by following these steps.

- Verify if the Connecticut Flood Zone Statement and Authorization is applicable in your state.

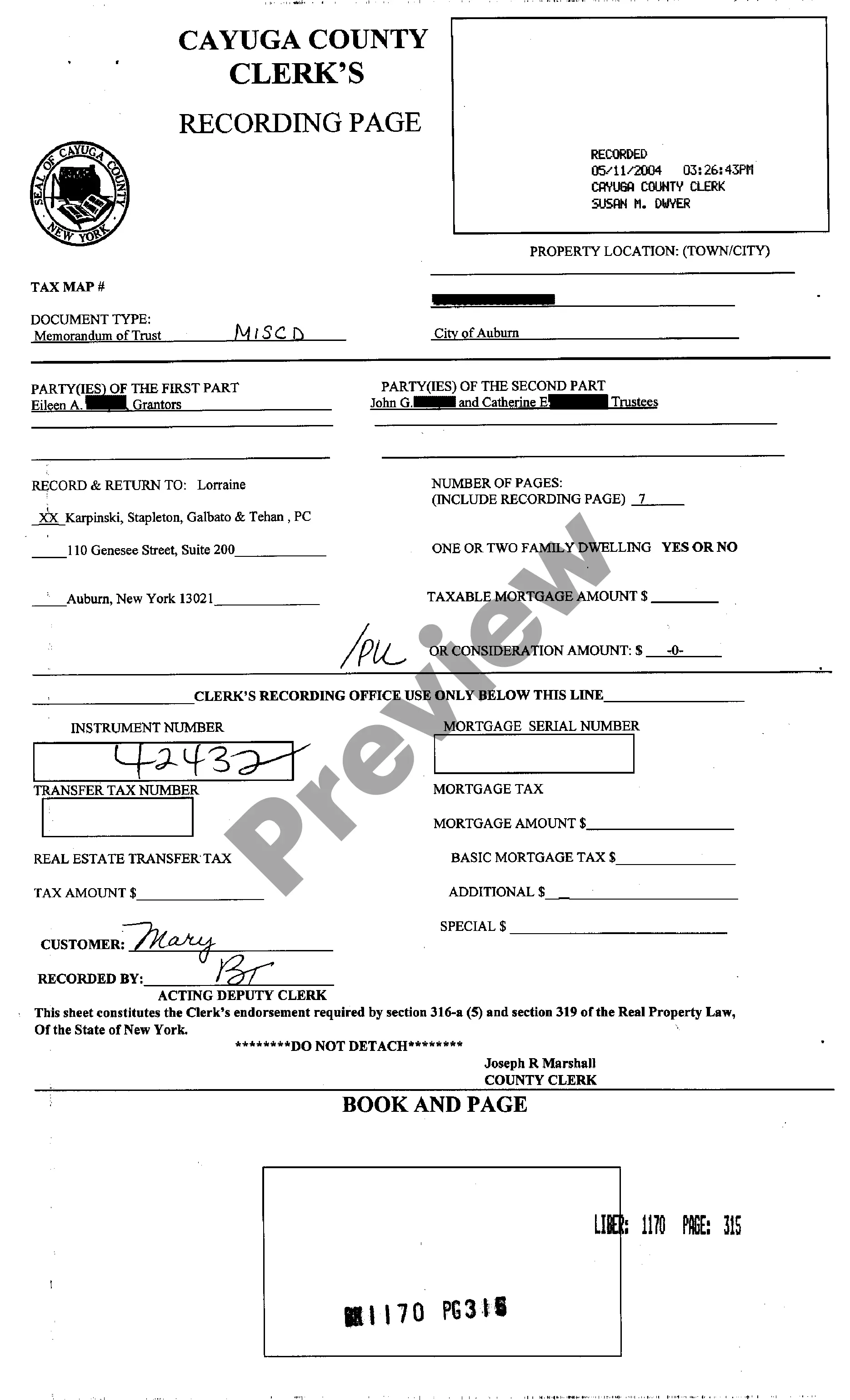

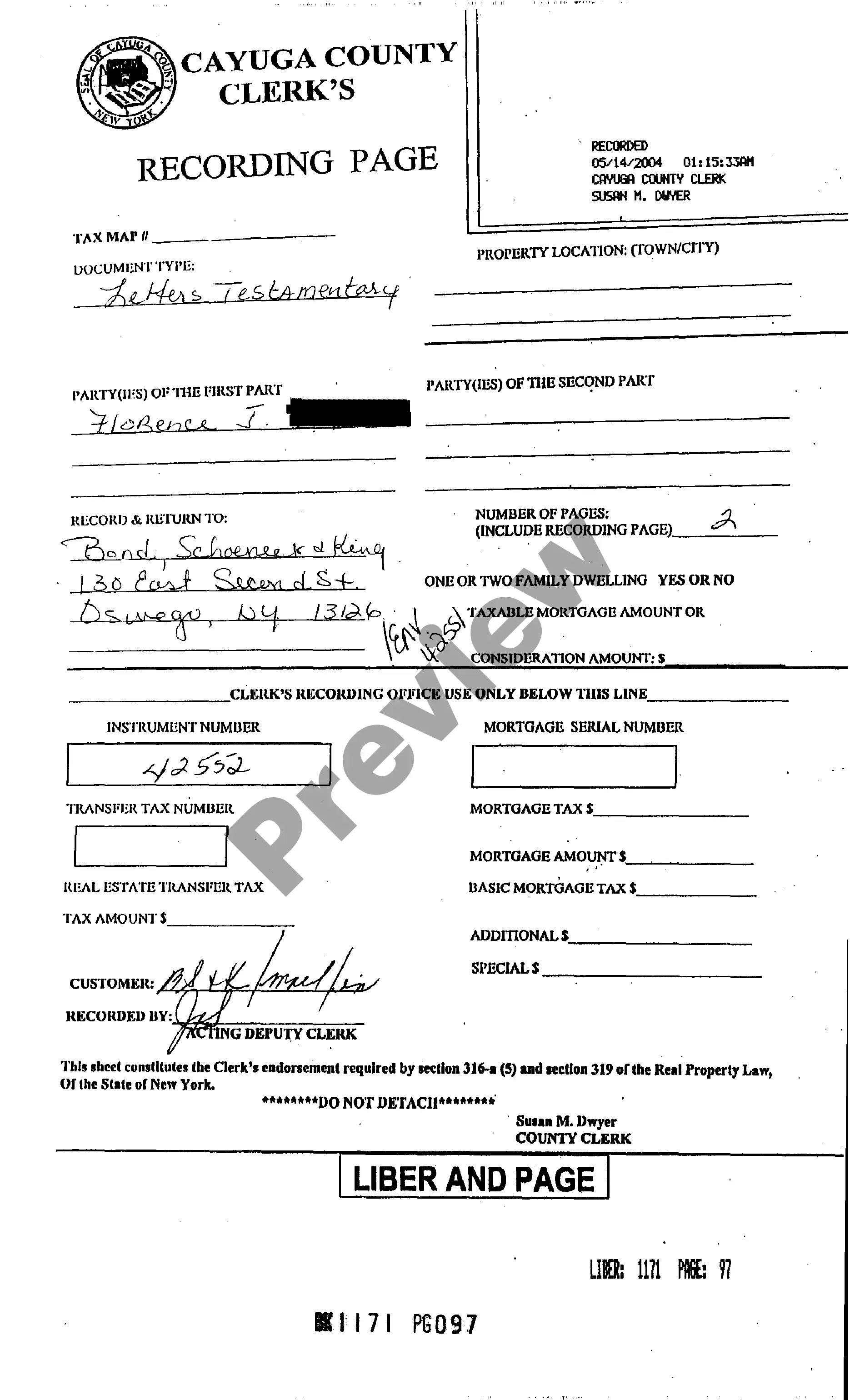

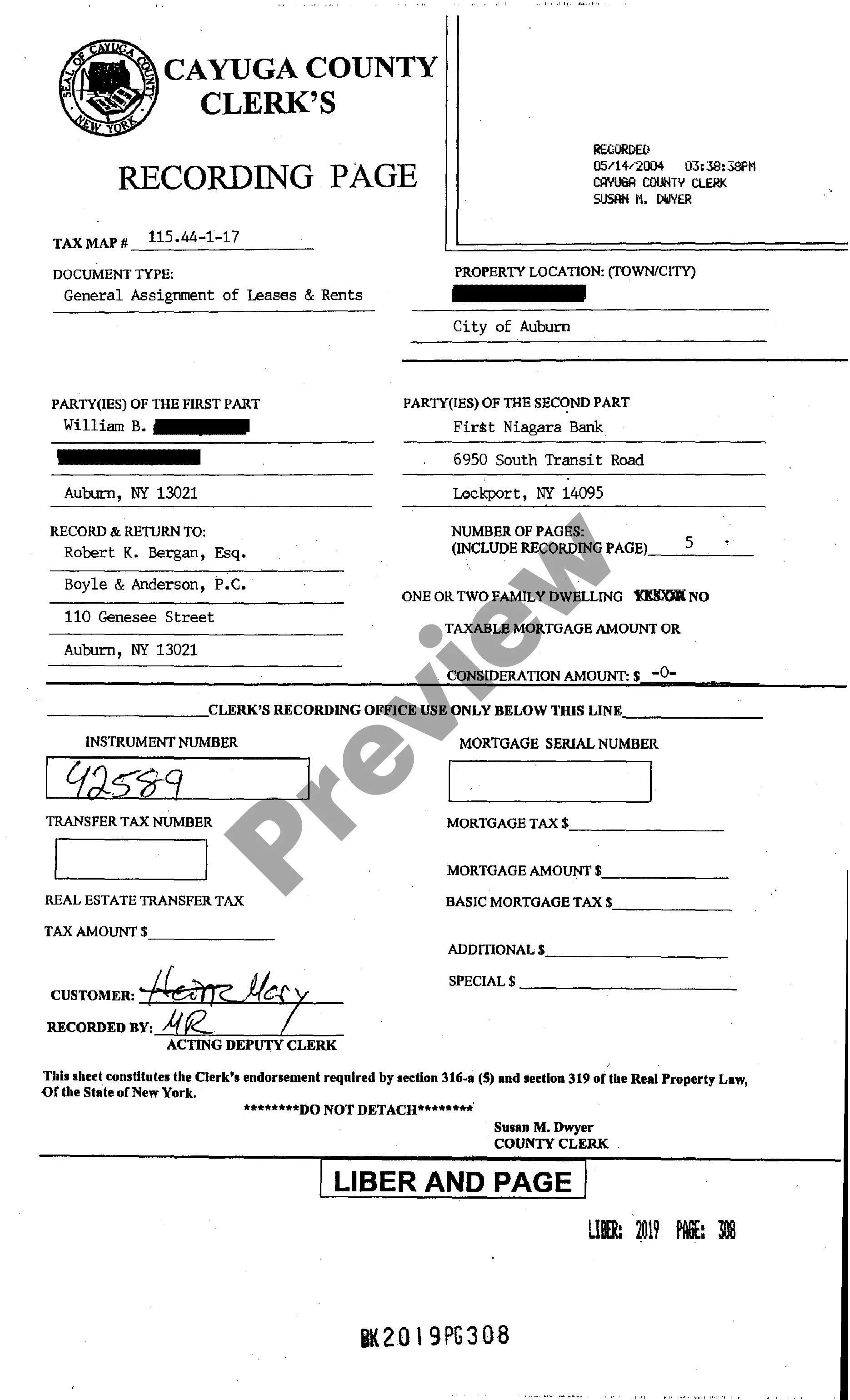

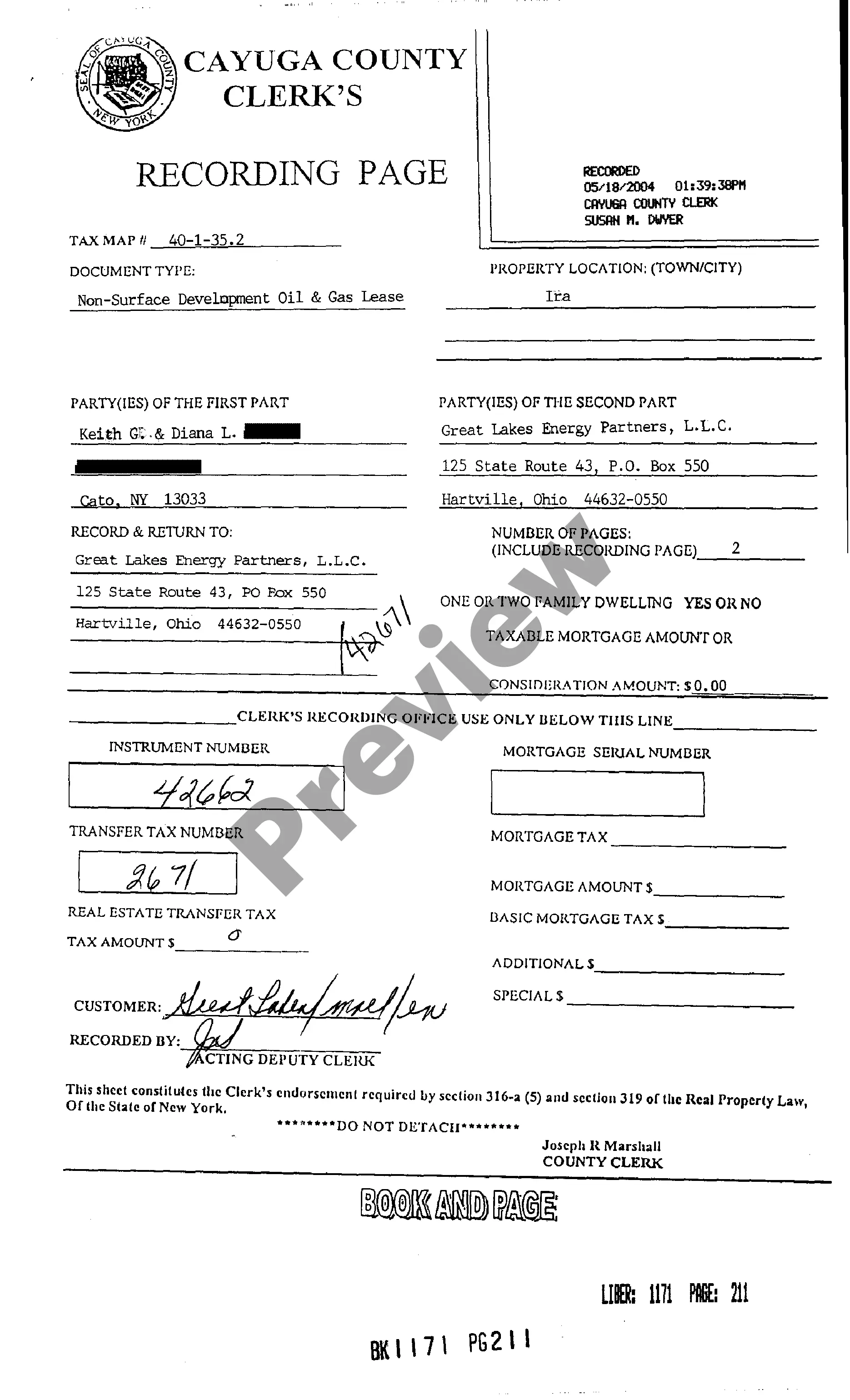

- Confirm your choice by reviewing the details or utilizing the Preview mode if available for the chosen document.

- Click on Buy Now to commence the registration process and select a pricing plan that suits your requirements.

Form popularity

FAQ

Yes, if your property is located in flood zone AE, you will need flood insurance, especially if there is a mortgage involved. The risks of flooding in this zone are significant, which is why the Connecticut Flood Zone Statement and Authorization emphasizes the importance of obtaining coverage. Protecting your property with insurance is a responsible decision that can save you from potential losses. Review your options with an insurance expert.

In Connecticut, flood insurance is mandatory for properties located in designated flood zones, particularly those with a mortgage. The Connecticut Flood Zone Statement and Authorization clarifies these requirements. Homeowners in these areas should also consider additional coverage to protect their investments. Understanding your obligations will help you make informed decisions.

To obtain a flood zone certificate, you must request an elevation certificate from a qualified surveyor or engineer. This certificate provides essential data regarding your property's elevation compared to flood zone regulations outlined in your Connecticut Flood Zone Statement and Authorization. You can submit your completed elevation certificate to your local officials for confirmation. This document is crucial for insurance and property compliance.

Yes, flood zone AE typically requires flood insurance in Connecticut, especially for properties with mortgages. Lenders often mandate this coverage due to the elevated risk of flooding. Your Connecticut Flood Zone Statement and Authorization will outline your financial obligations regarding insurance. It is wise to consult with your insurance provider to understand your options.

An AE flood zone in Connecticut is a designated area that has a one percent or greater annual chance of flooding. This classification is a part of the National Flood Insurance Program’s mapping guidelines. Knowing the specifics of your Connecticut Flood Zone Statement and Authorization helps you understand the risks and insurance requirements associated with properties in these zones. This information is vital for homeowners.

To dispute a flood zone determination, begin by reviewing your Connecticut Flood Zone Statement and Authorization. You can gather evidence, such as elevation certificates or other relevant documentation, to support your case. It is advisable to submit a formal dispute to your local floodplain administrator or FEMA. Use their resources to guide your dispute process effectively.

Yes, properties located in flood zones are generally considered high-risk due to their susceptibility to flooding. Insurance companies often categorize these areas differently, affecting policy rates and availability. A Connecticut Flood Zone Statement and Authorization can provide vital information about the flood risk and any necessary mitigation measures to protect your investment.

Buying a house in a flood zone can be a good investment if you understand the risks and associated costs. Ensuring the property meets insurance requirements and obtaining a Connecticut Flood Zone Statement and Authorization is necessary. This information can guide your decision-making process and help mitigate potential financial impacts.

Deciding to buy a property in a flood zone requires careful consideration. While there may be attractive property features, evaluating flood risk is essential. Obtaining a Connecticut Flood Zone Statement and Authorization can help clarify the flood risk and any insurance requirements, assisting you in making an informed decision.

Selling a property in a flood zone can present challenges, but it is not impossible. Buyers may have concerns about flood risks, requiring clear disclosures and documentation. A comprehensive Connecticut Flood Zone Statement and Authorization can offer reassurance to potential buyers about the property's status and necessary precautions, making the sale smoother.