New York Memorandum of Trust

Description

How to fill out New York Memorandum Of Trust?

Among countless free and paid templates which you find on the internet, you can't be certain about their reliability. For example, who made them or if they are competent enough to take care of what you require these to. Keep calm and use US Legal Forms! Locate New York Memorandum of Trust templates made by skilled legal representatives and prevent the costly and time-consuming process of looking for an lawyer or attorney and after that paying them to write a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you are looking for. You'll also be able to access all of your previously downloaded files in the My Forms menu.

If you are making use of our service the first time, follow the instructions below to get your New York Memorandum of Trust easily:

- Make certain that the file you discover applies where you live.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another sample using the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

When you have signed up and bought your subscription, you may use your New York Memorandum of Trust as many times as you need or for as long as it remains valid where you live. Change it with your favorite online or offline editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Create the certificate of trust Sign the living trust in front of a notary public to notarize it. In case your spouse or partner made the trust together, you both need to sign the certification. If one has died, the surviving part can make a certification.

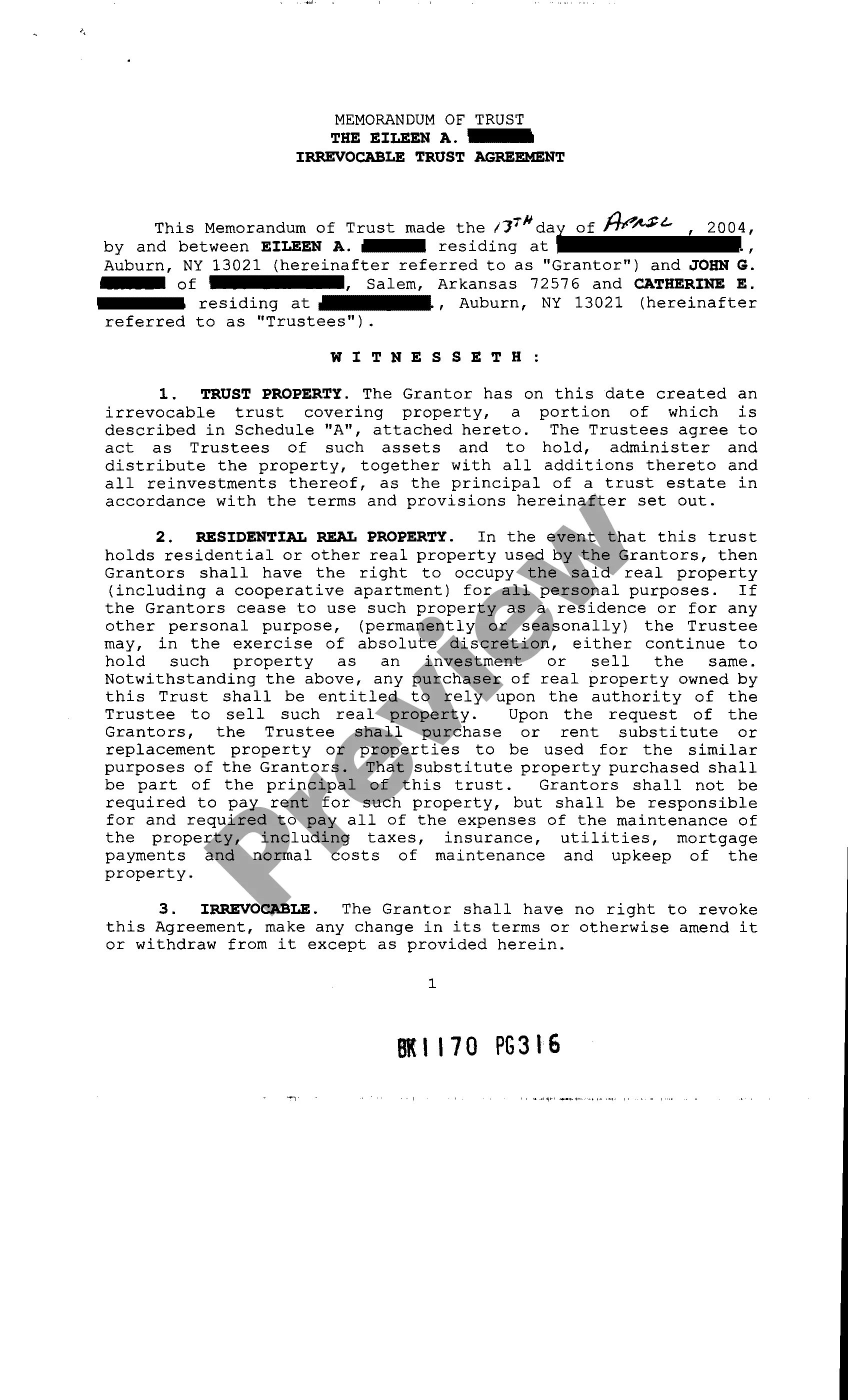

Under O.R.C. 5301.255, the memorandum of trust is a document that certifies a trustee has the authority to act on behalf of an existing trust. The trustee is the person or entity who holds title to a trust's assets on behalf of a settlor.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

The declaration of trust is your trust. The certificate of trust is not needed but can help keep things private and provide a easier way to open bank or stock accounts...

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

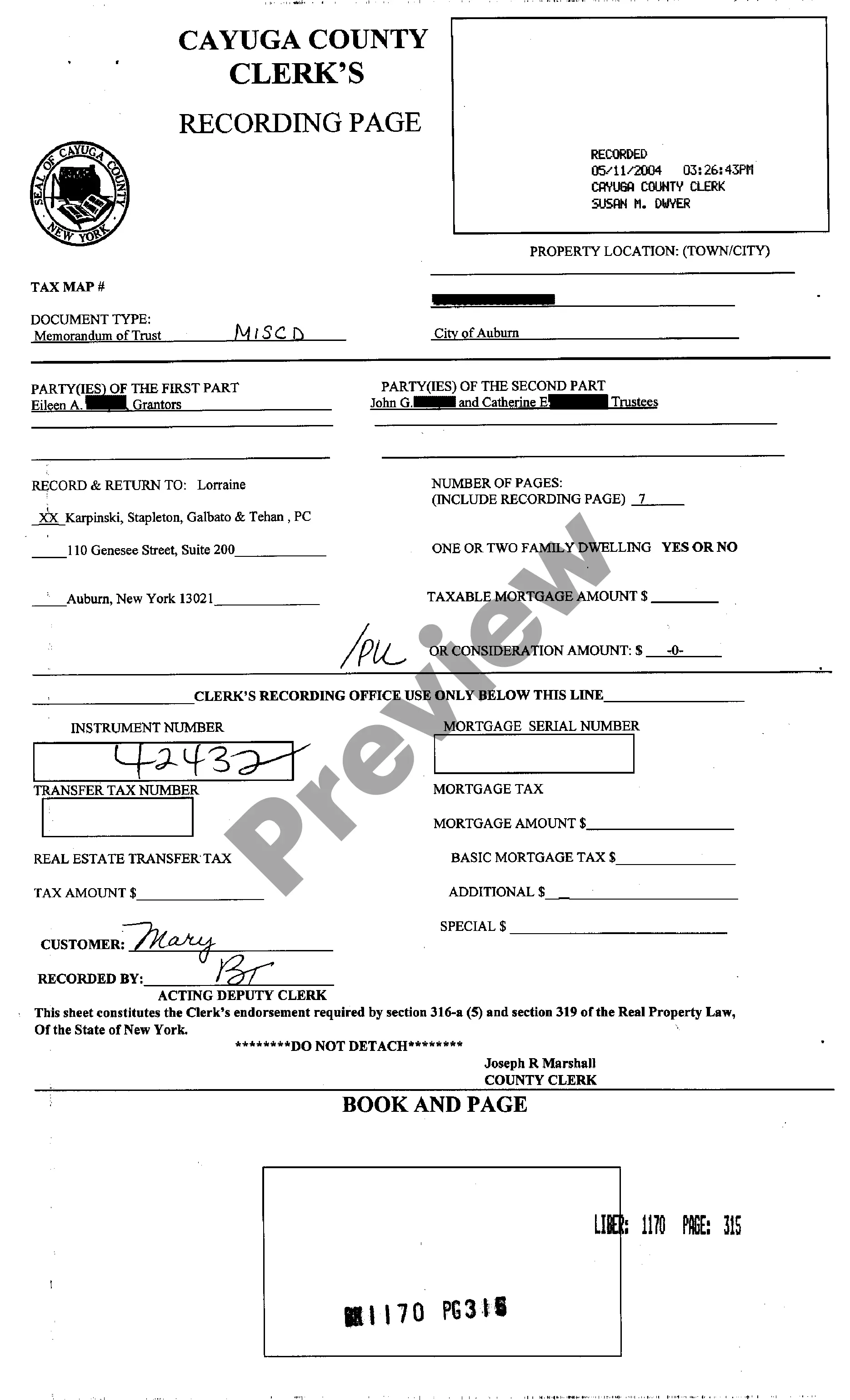

A Memorandum of Trust is a synopsis of a trust that is used when transferring real property into a trust. It's then recorded in county in which the property is owned. The Memorandum of Trust is used in place of the actual trust to identify the grantor and trustees as well as the basic details of the trust.

A certificate of trust is used by an acting trustee or trustees of a trust to prove to financial institutions or other third parties that he/she/they has/have the authority to act on behalf of the trust.The certificate also specifies how the trust will vest title to real property.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.