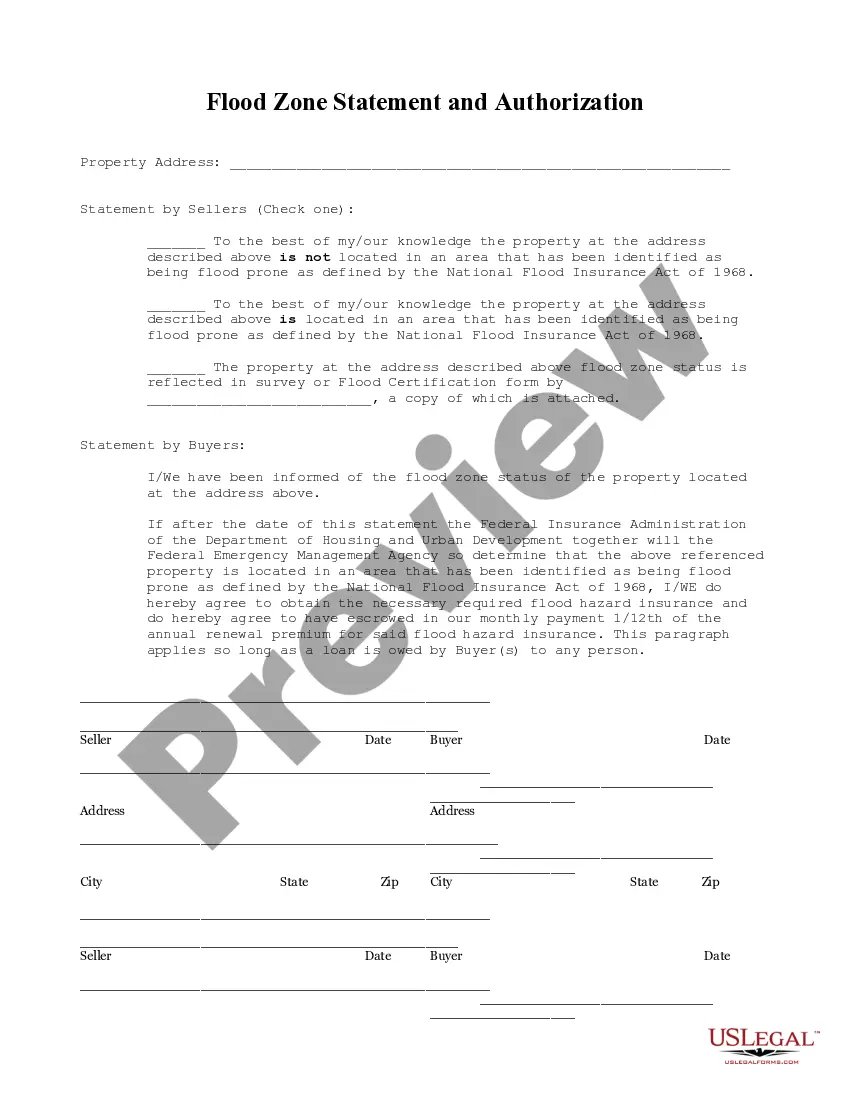

This Flood Zone Statement and Authorization form is for seller(s) to sign, stating the flood zone status of the property and for the buyers to acknowledge the same and state that should the property ever be determined to be in a flood zone, that they will obtain flood insurance.

Alabama Flood Zone Statement and Authorization

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama Flood Zone Statement And Authorization?

Utilizing Alabama Flood Zone Statement and Authorization templates developed by proficient attorneys provides you with the chance to evade stress when finalizing paperwork.

Easily obtain the template from our site, complete it, and ask a lawyer to confirm it. By doing so, you can save significantly more time and expenses than seeking legal advice to draft a document from scratch tailored to your requirements.

If you’ve previously purchased a US Legal Forms subscription, just Log In to your account and navigate back to the form webpage. Locate the Download button adjacent to the template you are reviewing. After downloading a template, you will find all your saved files in the My documents tab.

Once you have executed all the aforementioned steps, you will be able to complete, print, and sign the Alabama Flood Zone Statement and Authorization template. Remember to meticulously check all entered details for accuracy before submitting or sending it. Minimize the time you spend on document preparation with US Legal Forms!

- If you don’t have a subscription, it’s no issue.

- Simply adhere to the steps below to register for your account online, obtain, and complete your Alabama Flood Zone Statement and Authorization template.

- Verify and ensure that you’re downloading the correct state-specific form.

- Utilize the Preview feature and examine the description (if available) to determine if you require this particular template, and if so, click Buy Now.

- Search for another sample using the Search bar if necessary.

- Select a subscription that accommodates your needs.

- Initiate the process with your credit card or PayPal.

- Choose a file format and download your document.

Form popularity

FAQ

To remove flood insurance requirements, you typically need to demonstrate that your property's flood risk has changed, or that you are no longer in a flood zone. This often involves obtaining updated flood zone maps and submitting documentation to your lender. Using the Alabama Flood Zone Statement and Authorization can streamline this process and help clarify your position.

To obtain a flood insurance declaration page, contact your insurance agent or provider directly. This page summarizes your coverage and is necessary for proving flood insurance. If you need guidance navigating the processes, the Alabama Flood Zone Statement and Authorization can assist you in ensuring you have all necessary documentation.

Exemptions from flood insurance typically apply to properties that are not located in high-risk flood zones. You will need to provide evidence of your property's status to your lender or insurance provider. The Alabama Flood Zone Statement and Authorization is a valuable resource to determine if you qualify for an exemption.

While it's challenging to completely circumvent the requirements for flood insurance, you can explore options like seeking a private insurance plan or focusing on risk mitigation strategies. Understanding your flood risk through the Alabama Flood Zone Statement and Authorization can aid in finding alternative solutions. Remember, maintaining coverage is often a safer choice.

To appeal a flood zone determination, you need to gather relevant evidence and submit a formal appeal to your local floodplain administrator. This process often requires additional documentation to support your case. Using the Alabama Flood Zone Statement and Authorization can help clarify your position and increase your chances of a successful appeal.

You can cancel your flood insurance policy by contacting your insurance provider directly. They will guide you through the cancellation process and inform you about any implications. Always consider the potential risks of living in a flood-prone area, as the Alabama Flood Zone Statement and Authorization highlights the importance of flood insurance.

In certain situations, you might be able to opt out of flood insurance, particularly if your property is not located in a designated flood zone. However, if your lender requires flood insurance, you must comply with their requirements. It's essential to review the Alabama Flood Zone Statement and Authorization to understand your specific circumstances.

To provide acceptable proof of flood insurance, you can submit a copy of your flood insurance policy, including the declaration page. This document details your coverage, policy limits, and the effective dates of your flood insurance. If you need assistance obtaining this documentation, the Alabama Flood Zone Statement and Authorization can guide you through the process.

To get a letter of map amendment (LOMA) from FEMA, you must submit a request that includes data about your property, including the flood elevation certificate. This process verifies whether your property is eligible for amendment based on the Alabama Flood Zone Statement and Authorization. For assistance with this process, consider using US Legal Forms, which can guide you through the necessary steps and help streamline your application.

To obtain a flood zone certificate, you need to contact a licensed surveyor who can conduct an elevation survey of your property. After the survey, the surveyor will prepare the certificate ensuring it meets the requirements of the Alabama Flood Zone Statement and Authorization. You can find qualified professionals through the US Legal Forms platform, where you can also access various resources related to flood zone compliance.