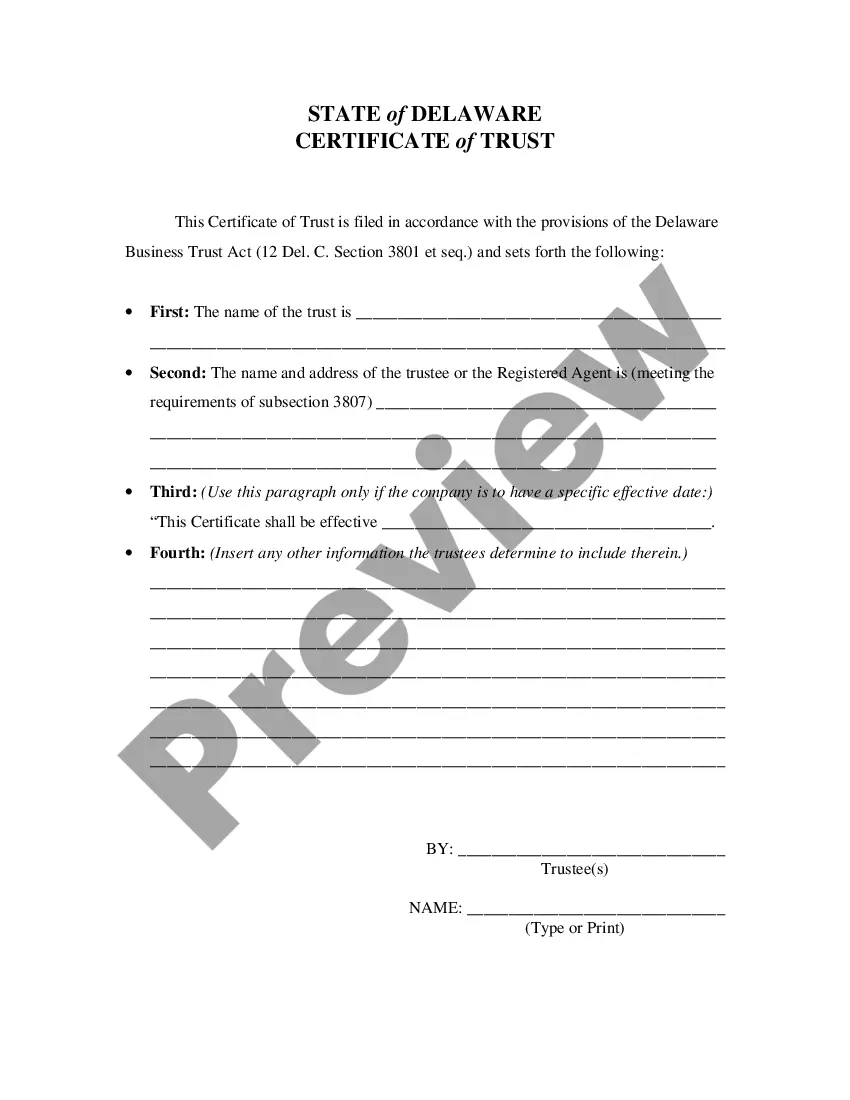

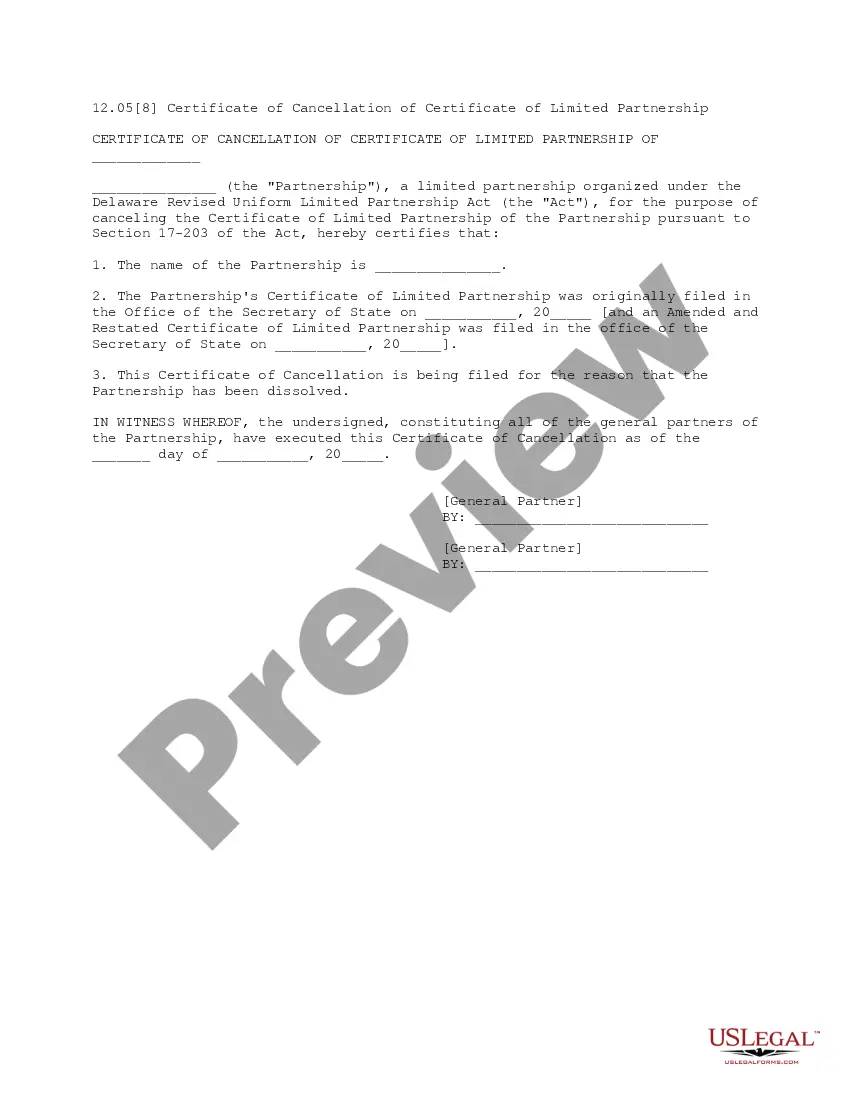

A Delaware Certificate of Cancellation of Statutory Trust is a legal document used to dissolve a statutory trust in the state of Delaware. It is filed with the Delaware Secretary of State and provides evidence that the trust has been officially terminated. There are two main types of Delaware Certificate of Cancellation of Statutory Trust: a Certificate of Cancellation of Statutory Trust and a Certificate of Cancellation of Statutory Trust for Limited Liability Companies. The Certificate of Cancellation of Statutory Trust is used to terminate a trust that was created in accordance with the Delaware Statutory Trust Act. The Certificate of Cancellation of Statutory Trust for Limited Liability Companies is used to terminate a trust that was created in accordance with the Delaware Limited Liability Company Act. Both documents must be signed by the trustee, or a majority of them if the trust has multiple trustees, and state the name of the trust, the date of its formation, and the date of its dissolution. The Certificate of Cancellation must be filed with the Delaware Secretary of State in order to officially terminate the trust.

Delaware Certificate of Cancellationof Statutory Trust

Description

How to fill out Delaware Certificate Of Cancellationof Statutory Trust?

US Legal Forms is the easiest and most economical way to discover appropriate formal templates.

It is the largest online collection of business and personal legal documents that have been drafted and reviewed by legal experts.

Here, you can access printable and fillable templates that adhere to federal and state regulations - just like your Delaware Certificate of Cancellation of Statutory Trust.

Review the form description or preview the document to ensure you’ve located the one that meets your requirements, or search for an alternative using the search bar above.

Select Buy now when you are confident of its compliance with all necessary criteria, and pick the subscription plan that suits you best.

- Acquiring your template requires only a few straightforward steps.

- Users who already possess an account with an active subscription just need to Log In to the website and download the document onto their device.

- Subsequently, they can locate it in their profile under the My documents section.

- Here’s how you can obtain a professionally created Delaware Certificate of Cancellation of Statutory Trust if you are using US Legal Forms for the first time.

Form popularity

FAQ

One downside of a Delaware Statutory Trust is the potential for ongoing administrative requirements and costs, including annual fees and compliance obligations. Additionally, it may involve more complex regulations than other business structures. Knowing these aspects is essential if you are considering establishing a trust; resources like uslegalforms can help clarify any uncertainties.

A certificate of dissolution officially terminates a business entity's existence, while cancellation refers to the revocation of a business's rights and privileges. In Delaware, these processes often overlap but have different legal implications. Understanding the nuances between these documents, like the Delaware Certificate of Cancellation of Statutory Trust, is crucial for ensuring smooth business closure.

Dissolution refers to the legal process of ending an entity, while termination often implies a complete stoppage of operations without necessarily following formal legal procedures. In Delaware, proper dissolution will typically involve filing documents, like the Delaware Certificate of Cancellation of Statutory Trust. Both terms highlight the end of business activities, but dissolution is more formal.

The statute of dissolution for an LLC in Delaware is governed by specific provisions in the Delaware Limited Liability Company Act. Generally, an LLC can dissolve voluntarily by a vote or by filing a certificate of dissolution. Seeking guidance from platforms like uslegalforms can help simplify this process and ensure compliance with state laws.

To cancel an entity in Delaware, you'll need to file the appropriate documents with the state, such as the Delaware Certificate of Cancellation of Statutory Trust. This document formally signals the state that you intend to end your business. Ensure that all legal and financial obligations are settled before proceeding with cancellation to avoid future liabilities.

In Delaware, dissolution typically refers to the legal process of ending an entity’s existence, whereas cancellation may involve removing the business entity from the state's register. The processes can be interrelated but represent distinct stages in closing a business. It's wise to understand both terms thoroughly to ensure compliance with Delaware laws.

Dissolution of an LLC in Delaware involves formally concluding its operations, while cancellation specifically refers to the revocation of the entity's legal existence. Both processes require specific actions, including the necessary documentation. When terminating a Delaware LLC, you may need to file a Delaware Certificate of Cancellation of Statutory Trust if applicable.

Yes, a Delaware Statutory Trust is generally required to file a tax return. It may also have to provide annual reports, depending on its income and legal agreements. Proper understanding of tax obligations is essential, so be sure to consult relevant resources or legal professionals about the specifics related to your trust.

Dissolution refers to the formal process of ending a business's existence under state law, while withdrawal is the act of a business entity ceasing its operations in a state. In Delaware, dissolution of a Statutory Trust involves filing the Delaware Certificate of Cancellation of Statutory Trust. It is important to follow the correct procedures to avoid any legal complications.

Reporting a Delaware Statutory Trust involves several steps. First, you should gather all relevant documents, including the Delaware Certificate of Cancellation of Statutory Trust, which is essential for formal closure. You need to ensure compliance with any state regulations and tax obligations. For an efficient process, consider using platforms like US Legal Forms, which offer guidance and tools to help you navigate the reporting process smoothly.