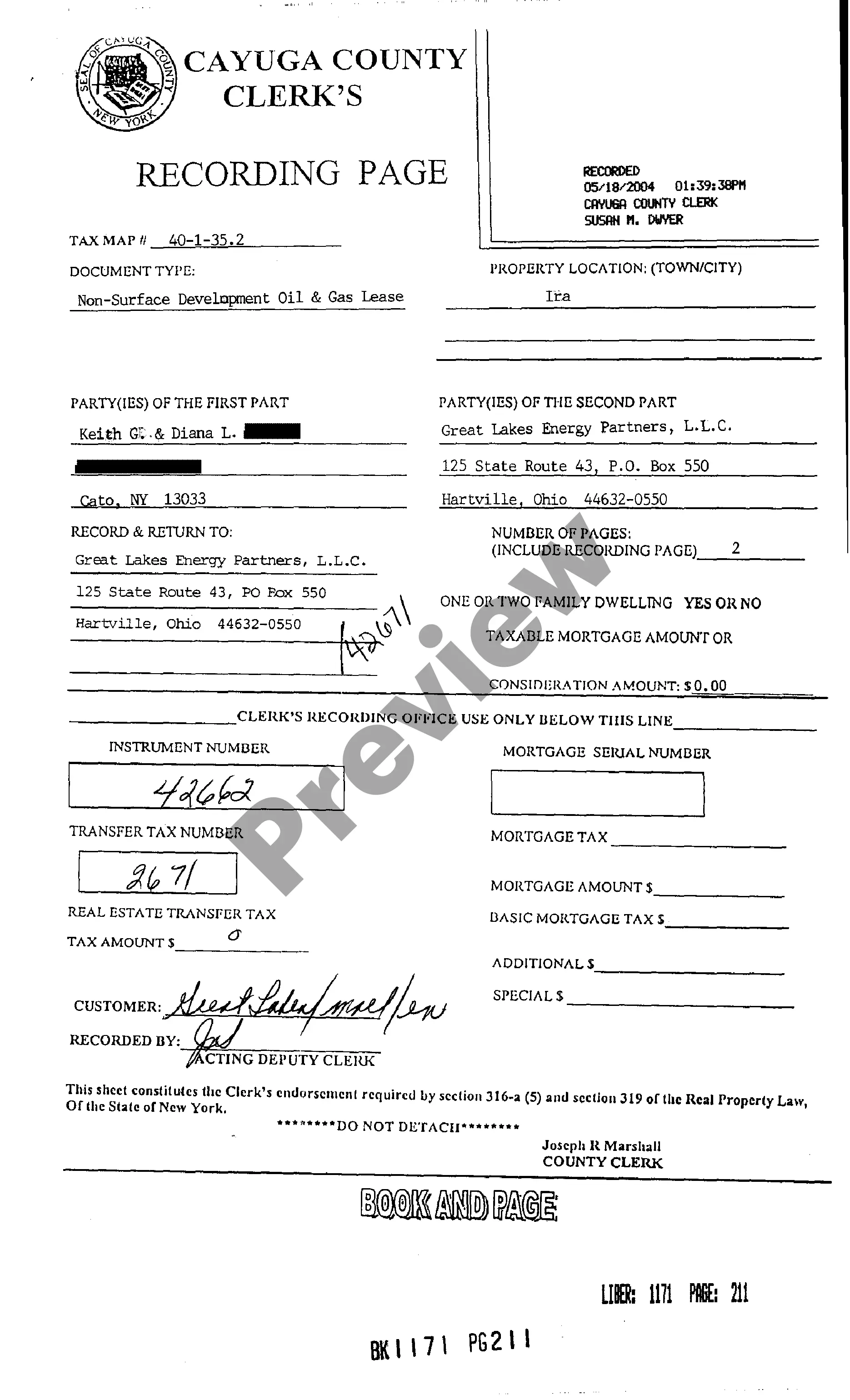

New York Non-Surface Oil and Gas Lease

Description

How to fill out New York Non-Surface Oil And Gas Lease?

Among numerous paid and free examples that you find online, you can't be sure about their reliability. For example, who made them or if they’re competent enough to take care of the thing you need them to. Keep relaxed and utilize US Legal Forms! Locate New York Non-Surface Oil and Gas Lease templates developed by professional lawyers and avoid the costly and time-consuming procedure of looking for an lawyer and then paying them to write a document for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button next to the form you’re seeking. You'll also be able to access all of your previously acquired files in the My Forms menu.

If you are making use of our service the very first time, follow the tips listed below to get your New York Non-Surface Oil and Gas Lease quickly:

- Make certain that the document you see applies where you live.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another sample using the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

Once you’ve signed up and paid for your subscription, you can use your New York Non-Surface Oil and Gas Lease as many times as you need or for as long as it stays active where you live. Change it in your favored online or offline editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

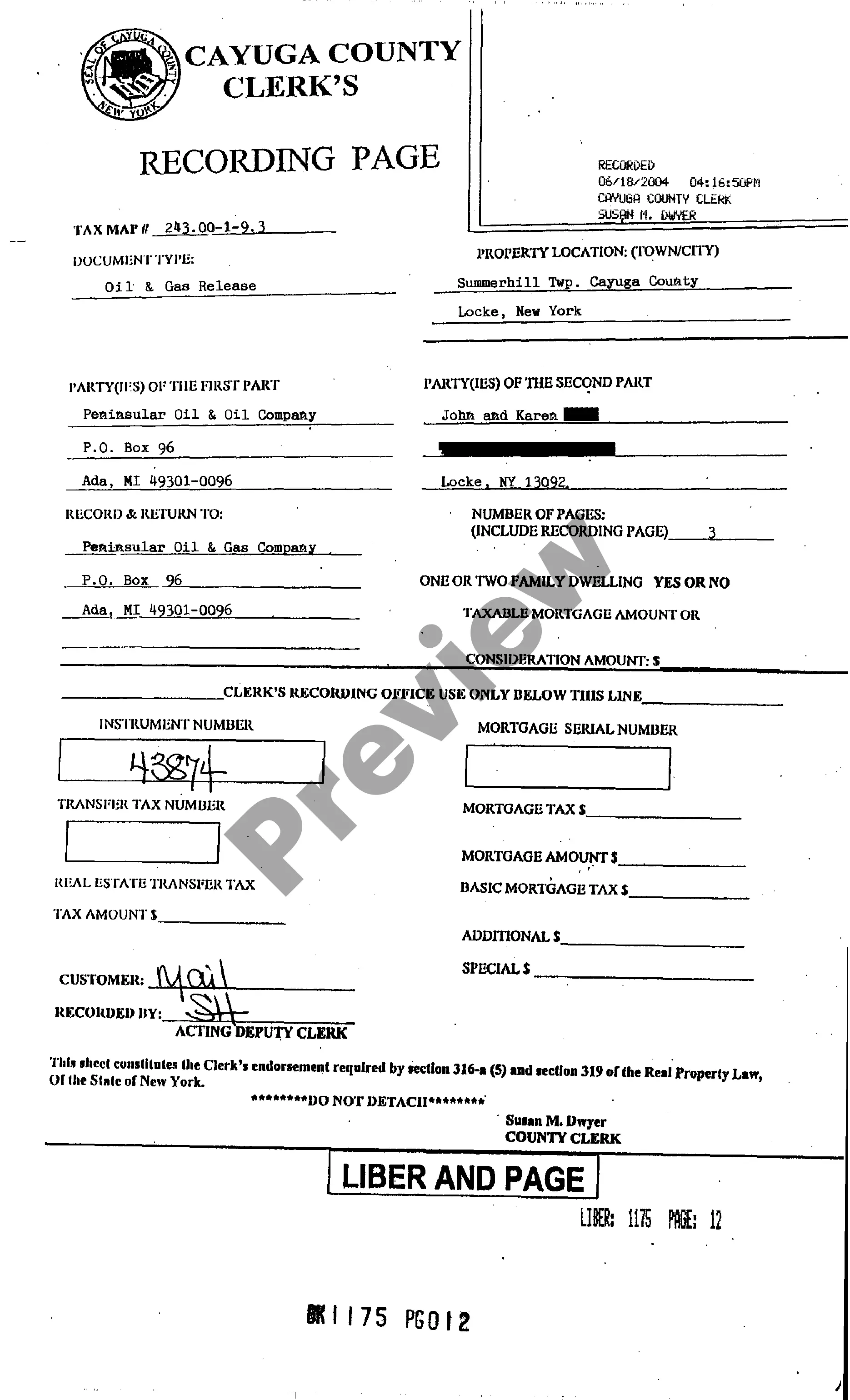

Are mineral rights public records in Oklahoma? You can find out who owns the mineral rights on a tract of land by conducting a title search. Oklahoma real estate records are publicly registered with the Registrar of Deeds.

Oil and gas lease is an agreement between a mineral owner (lessor) and a company (lessee) in which the owner grants the company the right to explore, drill and produce oil, gas, and other minerals below the surface of the earth.

If you're interested in who owns your Texas Mineral Rights located below your property, the best place to start is your local County Clerk's Officenot only is this a free resource; they typically have some of the most up-to-date information you can find.

Buying a Home, Land or a Farm In many areas the sale of mineral rights is recorded in the government record in a different deed book or database than the sale of surface property. This means that the deed to the surface property might not mention mineral rights which have been sold away.

Further, annual rental fees for onshore oil and gas leases $1.50 per acre during the first five years and $2 per acre each year thereafter allow drilling companies to hold and explore mineral leases for the price of a cup of coffee.

¹ The term of an oil and gas lease is divided into two parts, a primary term and a secondary term. The primary term is usually for a set amount of years, 1, 3, 5, 7 or 10 years.

Not necessarily. Where your royalty is based on volume of production and your lease is for a period of years and as much longer as oil and gas is produced, or similar language is contained in your lease, your lease may not automatically expire at the end of its primary term.

Landowners who are considering purchasing, or have already purchased a property can search their county Register of Deeds registry to determine if an oil and gas lease is recorded.A search of the public records at the county register of deeds office is necessary.

An oil lease is essentially an agreement between parties to allow a Lessee (the oil and gas company and their production crew) to have access to the property and minerals (oil and gas) on the property of the Lessor. The lease agreement is a legal contract of terms.It establishes the primary term of the lease.