Georgia Executor's Deed

What is this form?

The Executor's Deed is a legal document used to transfer ownership of real property after the death of an individual. Unlike standard property deeds, this specific deed is executed by the executor of a deceased person's estate, as designated in the last will and testament. It serves to formalize the transfer of property from the deceased to the heir or beneficiary, ensuring all legal requirements are met in accordance with Georgia state laws.

Main sections of this form

- Grantor and Grantee information: Names and addresses of both the executor and the beneficiary.

- Description of the property: Clear identification of the real estate being transferred.

- Consideration clause: Statement of any monetary value associated with the transaction, typically a nominal amount.

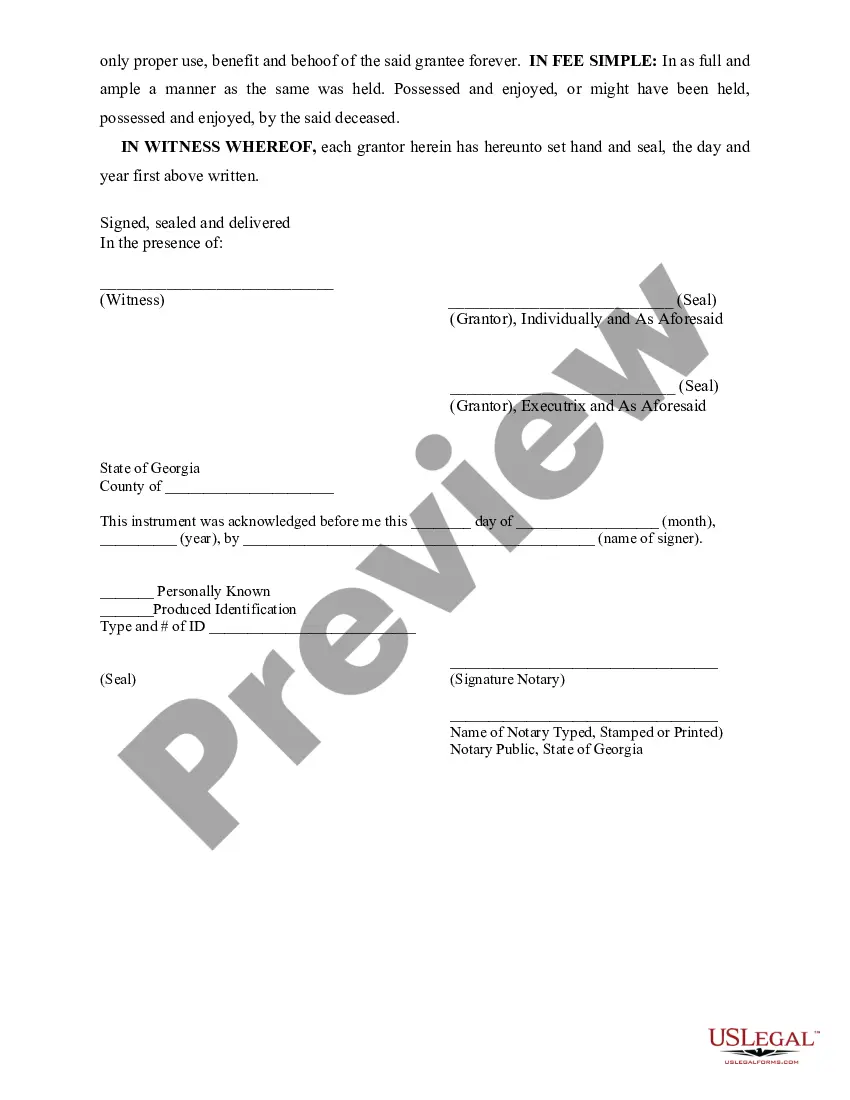

- Signature and seal: Requires signature from the executor and may involve a witness and notary acknowledgment.

- Date of execution: The specific date the deed is signed.

When this form is needed

You should use the Executor's Deed when transferring property that belonged to a deceased individual to an heir or beneficiary. This form is essential in situations where the executor needs to finalize the distribution of assets according to the terms of the will, especially in estate settlements where real estate is involved.

Intended users of this form

- Executors of an estate managing the property transfer following a death.

- Heirs or beneficiaries of a deceased individual's estate who are receiving property.

- Lenders or title companies requiring documentation for real estate transactions involving an estate.

How to prepare this document

- Identify the parties involved: Fill in the names of the grantor (executor) and grantee (beneficiary).

- Describe the property: Include a detailed description of the real estate being transferred.

- Specify the consideration: Indicate the nominal value, typically ten dollars, in the consideration clause.

- Enter the date of execution: Write the date on which the deed is being signed.

- Gather necessary signatures: Ensure the executor signs, along with a witness and notary public as required.

Is notarization required?

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide a complete legal description of the property.

- Not including all necessary signatures (e.g., witness, notary).

- Leaving the date of execution blank.

- Not specifying the consideration amount appropriately.

- Using incorrect names or titles of the parties involved.

Benefits of completing this form online

- Convenient access: Download your form instantly from anywhere.

- Edit and customize: Tailor the form to suit your specific needs easily.

- Reliable legal language: Form is drafted by licensed attorneys to ensure compliance with state laws.

- Cost-effective: Save on legal fees by using pre-drafted templates.

- Guidance available: Access support to clarify any form-related questions.

Main things to remember

- The Executor's Deed facilitates the transfer of real estate after a person's death.

- Correctly filling out the form is crucial to avoid legal pitfalls.

- This form is specifically designed for use in Georgia, adhering to state laws.

- Notarization is required to enhance the legal validity of the deed.

Looking for another form?

Form popularity

FAQ

When a joint owner dies, the process is relatively simple you just need to inform the Land Registry of the death. You should complete a 'Deceased joint proprietor' form on the government's website and then send the form to the Land Registry, with an official copy of the death certificate.

Georgia does not allow real estate to be transferred with transfer-on-death deeds.

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

Deed of Sale (if the property has been sold to a third party) Deed of Extrajudicial Settlement of Estate. Owner's Duplicate Copy of Title.

Petition the Georgia probate court if you are the executor of the will. Notify all the heirs and creditors, and wait for four weeks. Pay all debts to the creditors and begin the asset-transfer process. Obtain and distribute new deeds for all the property in the will.

Georgia does not allow real estate to be transferred with transfer-on-death deeds.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

Once the beneficiaries and their shares, rights and liabilities are decided, the property has to be transferred in their names. For this you need to apply for property transfer at the sub-registrar's office. In most of the cases (documents needed are) Will; or Will with probate or succession certificate.