Power Poa Form Withdrawal

Description

How to fill out Oregon Power Of Attorney Forms Package?

There’s no longer a need to spend countless hours searching for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in one centralized location and streamlined their availability.

Our platform provides over 85k templates for any business and personal legal situations categorized by state and area of application.

Utilize the Search field above to find another template if the previous one wasn’t suitable. Click Buy Now next to the template title once you locate the right one. Choose your preferred pricing plan and either create an account or Log In. Make payment for your subscription using a card or via PayPal to continue. Select the file format for your Power Poa Form Withdrawal and download it to your device. Print your form to complete it manually or upload the sample if you prefer using an online editor. Preparing legal documents in accordance with federal and state regulations is fast and easy with our library. Try US Legal Forms today to keep your documentation organized!

- All forms are properly drafted and verified for authenticity, allowing you to trust that you are getting an up-to-date Power Poa Form Withdrawal.

- If you are acquainted with our service and already possess an account, make sure your subscription is active before retrieving any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents whenever needed by accessing the My documents section in your profile.

- If you’ve never utilized our service before, the process will require some additional steps to complete.

- Here’s how new users can acquire the Power Poa Form Withdrawal from our collection.

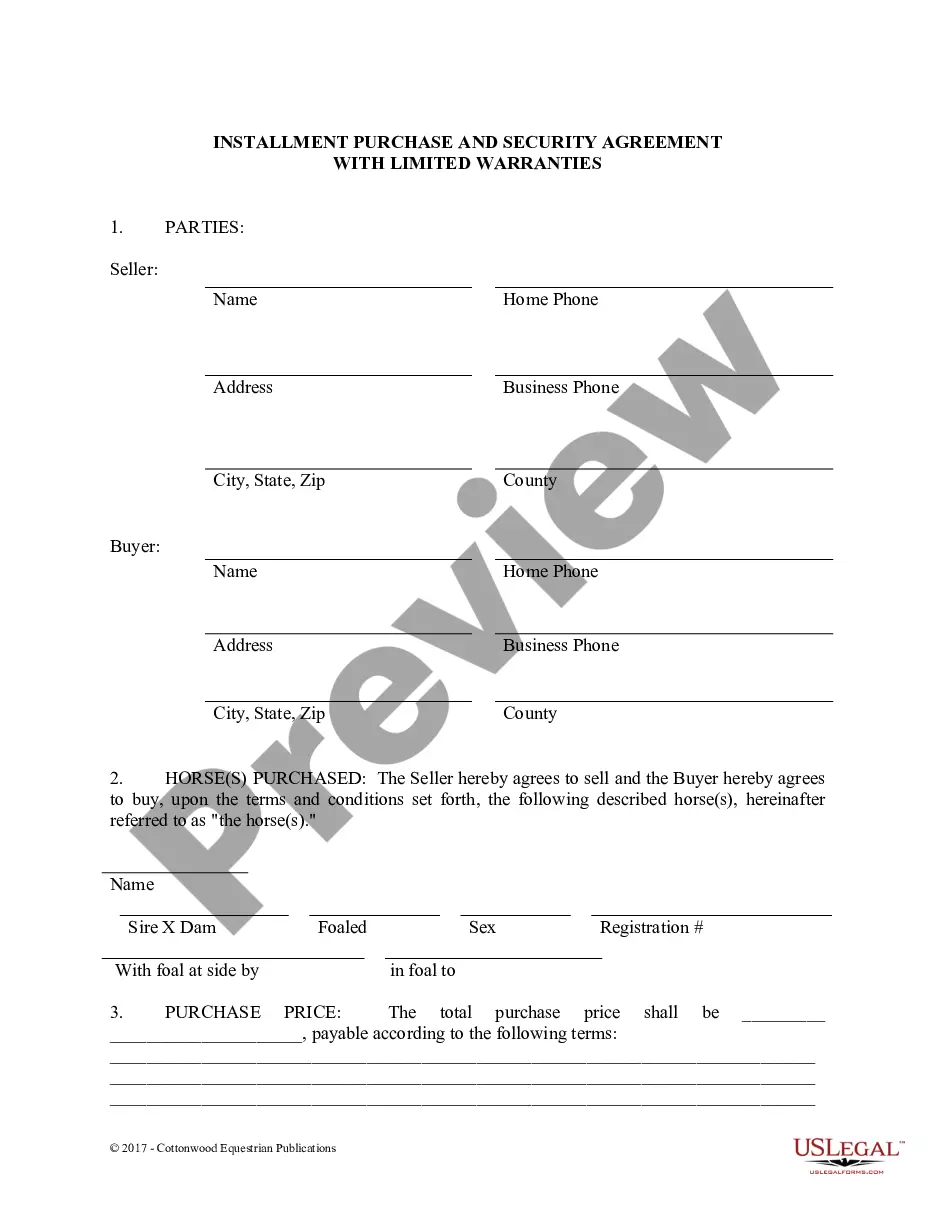

- Examine the page content thoroughly to confirm it contains the sample you require.

- To assist with this, make use of the form description and preview options if available.

Form popularity

FAQ

IRS Form 2848 authorizes individuals or organizations to represent a taxpayer when appearing before the IRS. Authorized representatives, include attorneys, CPAs, and enrolled agents. Signing Form 2848 and authorizing someone to represent you does not relieve a taxpayer of any tax liability.

Filing and withdrawing a Form 8821 is simple. It requires only your client's signature. You can fax it directly to the IRS CAF unit, and the IRS will typically recognize your authorization within two weeks.

The fax and mail options for submitting Forms 2848 and 8821 are still available, however signatures on such forms must be handwritten. Using the online option will not accelerate the time necessary for the IRS to process the authorizations, which is currently estimated to be five weeks.

If you want to revoke a previously executed power of attorney and do not want to name a new representative, you must write REVOKE across the top of the first page with a current signature and date below this annotation.

That mailing address or fax number depends on the state in which you live. You can find the address and fax number for your state in the 'Where to File Chart' included with the IRS Instructions for Form 2848. An IRS power of attorney stays in effect for seven years, or until you or your representative rescinds it.