Florida Installment Purchase and Security Agreement With Limited Warranties - Horse Equine Forms

What this document covers

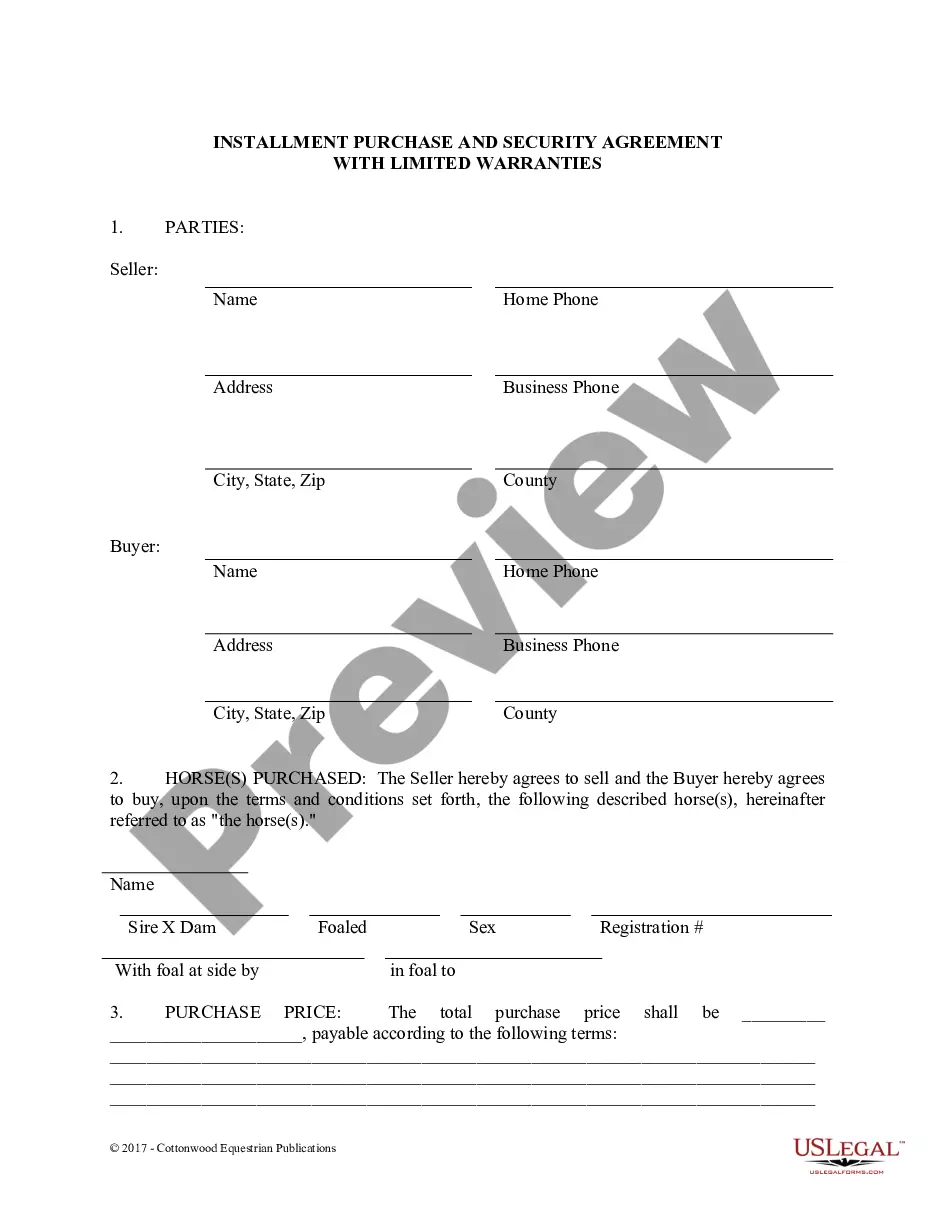

The Installment Purchase and Security Agreement With Limited Warranties is a legal document designed for purchasing a horse through an installment payment plan. This agreement ensures that the seller retains a security interest in the horse until the buyer has fully paid the purchase price. Unlike a simple sales agreement, this form includes specific provisions for warranties and the buyer's obligations, making it crucial for securing the interests of both parties in the equine transaction.

What’s included in this form

- Parties involved: Identifies the seller and buyer, including their contact details.

- Horse description: Detailed identification of the horse being purchased, including registration information.

- Purchase price: Specifies the total cost and payment terms.

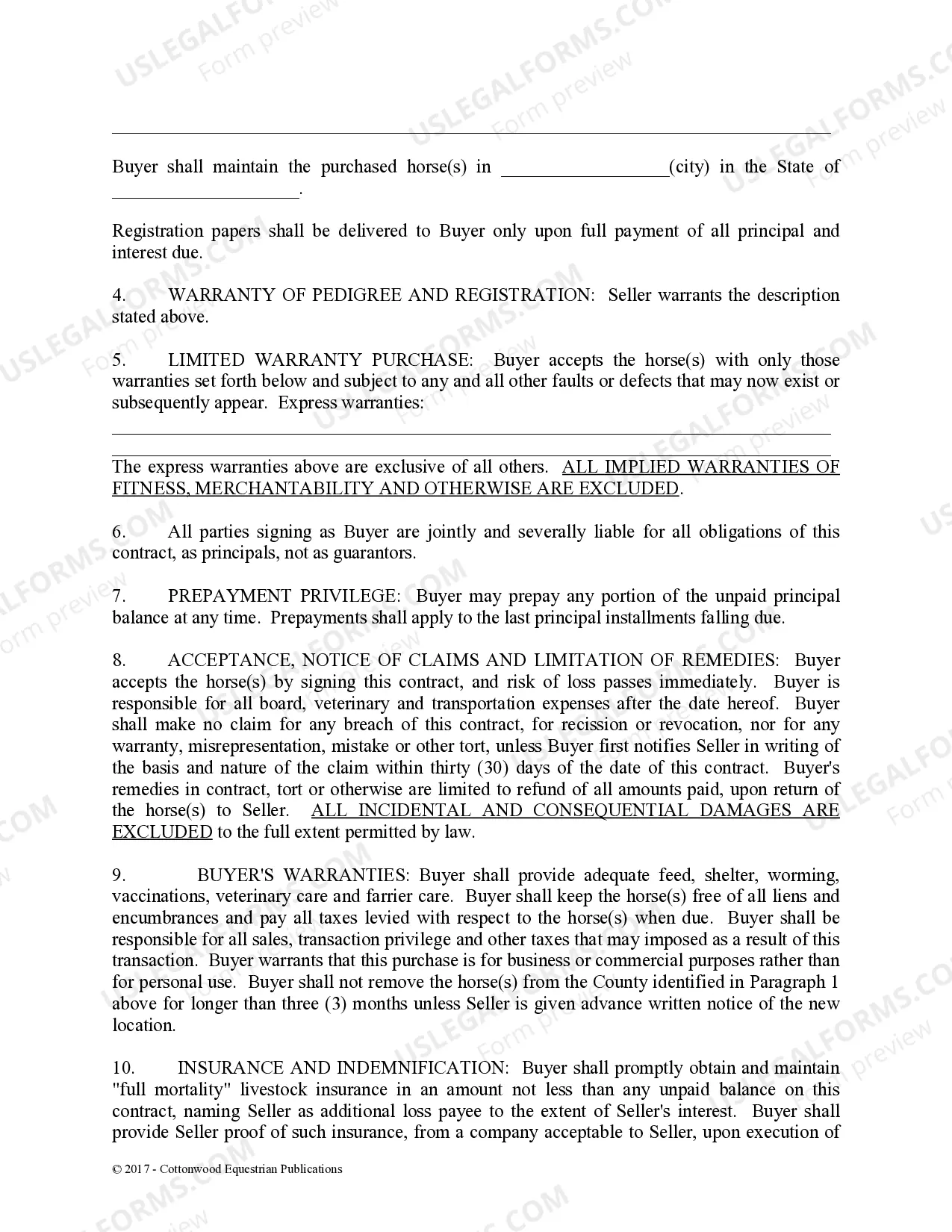

- Warranties: Outlines any express warranties related to the horse's pedigree and condition.

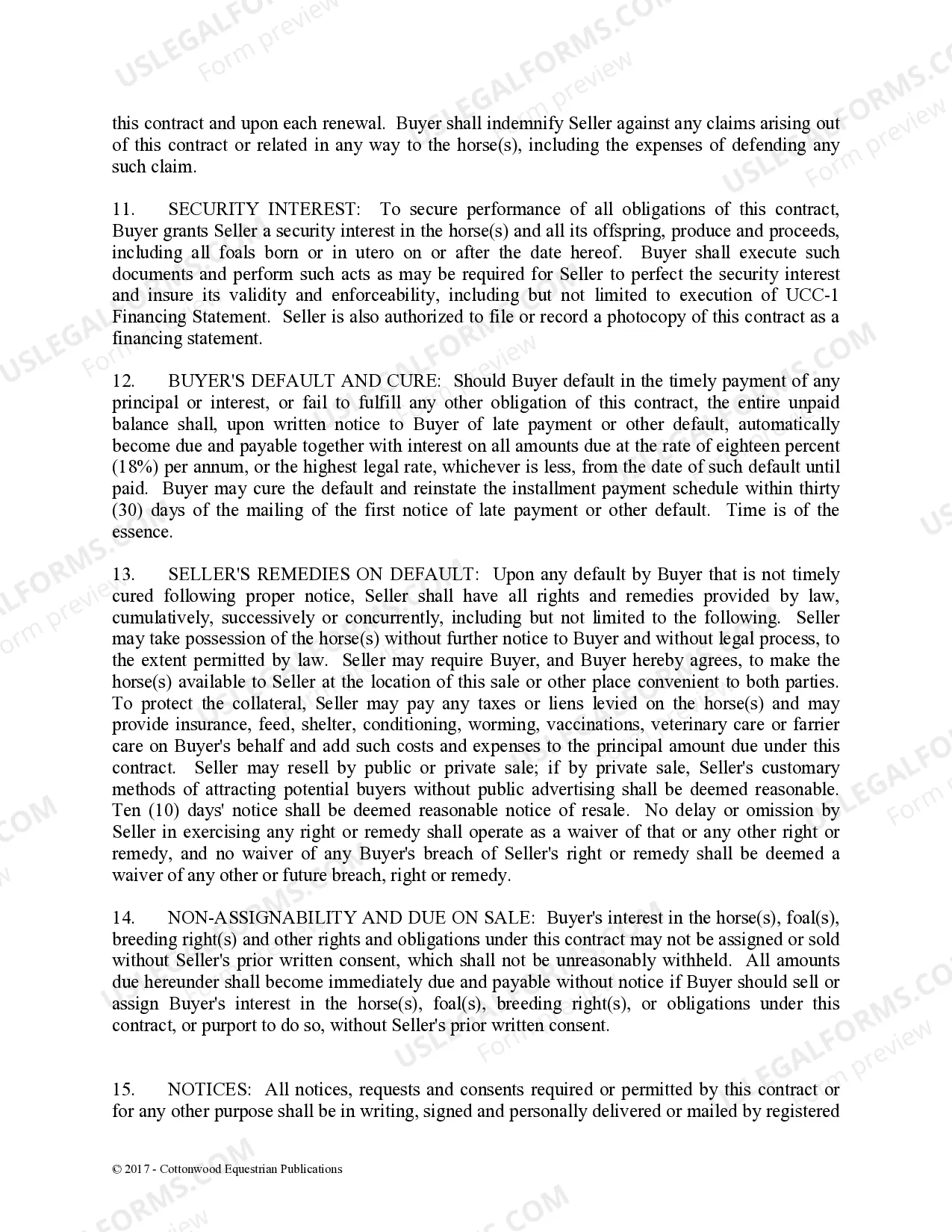

- Security interest: Grants the seller a security interest in the horse until payment is complete.

- Buyer's obligations: Lists responsibilities for the care of the horse, including insurance and veterinary care.

When to use this form

This form is ideal when purchasing a horse through installment payments. It should be used when the buyer is unable to pay the full purchase price upfront, allowing for a structured payment plan. The agreement is also appropriate for situations where the seller wishes to retain a legal interest in the horse until it is fully paid for, providing security for both parties in the transaction.

Who this form is for

- Individuals or businesses purchasing a horse on an installment basis.

- Sellers who want to ensure their interests are protected until the buyer pays in full.

- Equine professionals handling sales involving limited warranties.

How to complete this form

- Identify the parties by entering the seller's and buyer's names and contact information.

- Describe the horse being purchased, including its name, sire, dam, and registration information.

- Specify the total purchase price and payment terms in the designated fields.

- Sign the agreement to accept the terms laid out in the contract.

- Ensure that all parties keep a signed copy of the form for their records.

Is notarization required?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide complete and accurate information about the horse.

- Neglecting to clearly outline payment terms, such as the due dates and amounts.

- Overlooking the need to keep a copy of the signed agreement.

Advantages of online completion

- Convenient access: Download and complete the form at your own pace.

- Editability: Easily make changes to the form as needed before finalizing.

- Reliable legal templates drafted by licensed attorneys, ensuring validity and comprehensiveness.

Legal use & context

This agreement serves as a legally binding contract between buyer and seller. It is essential for guaranteeing that both parties understand their rights and obligations in the sale of the horse, especially when payment is structured over time. Ensure diligence in fulfilling all terms to maintain the enforceability of the agreement.

Key takeaways

- This form facilitates a structured payment plan for purchasing a horse.

- It provides essential protections for both buyers and sellers.

- All parties involved must clearly understand their responsibilities to avoid potential disputes.

Looking for another form?

Form popularity

FAQ

A general security agreement creates a security interest in all present and future assets of the borrower. This means the lender would have access to all assets your business owns now and any future assets your business purchases as collateral for the loan issued.

A General Security Agreement (GSA) is a contract signed between two parties a creditor (lender) and a debtor (borrower) to secure personal loans, commercial loans, and other obligations owed to a lender. General security agreements list all the assets pledged as collateral.

A security agreement is not used to transfer any interest in real property (land/real estate), only personal property.The document used by lenders to obtain a lien on real property is a mortgage or deed of trust.

Security agreements and financing statements are often confused with one another. The primary difference is that the financing statement largely serves as notice that a creditor possesses security interest in the debtor's assets or property. The financing statement is not a contract.

Sign two copies of the agreement, one for you and one for the other party. Depending on the nature of its terms, you may decide to have your agreement witnessed or notarized. This will limit later challenges to the validity of a party's signature. If your agreement is complicated, do not use the enclosed form.

After five years, it becomes invalid and must be renewed every five years. It is very important to check all the information provided under the agreement regarding the presented items.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

A security interest is a legal right granted by a debtor to a creditor over the debtor's property (usually referred to as the collateral) which enables the creditor to have recourse to the property if the debtor defaults in making payment or otherwise performing the secured obligations.

A secured party should have no trouble determining the correct lapse date of a record that perfects a security interest in fixtures. If perfected by the filing of a financing statement, the record is effective for five years. If perfected by a record of mortgage, the record does not lapse.