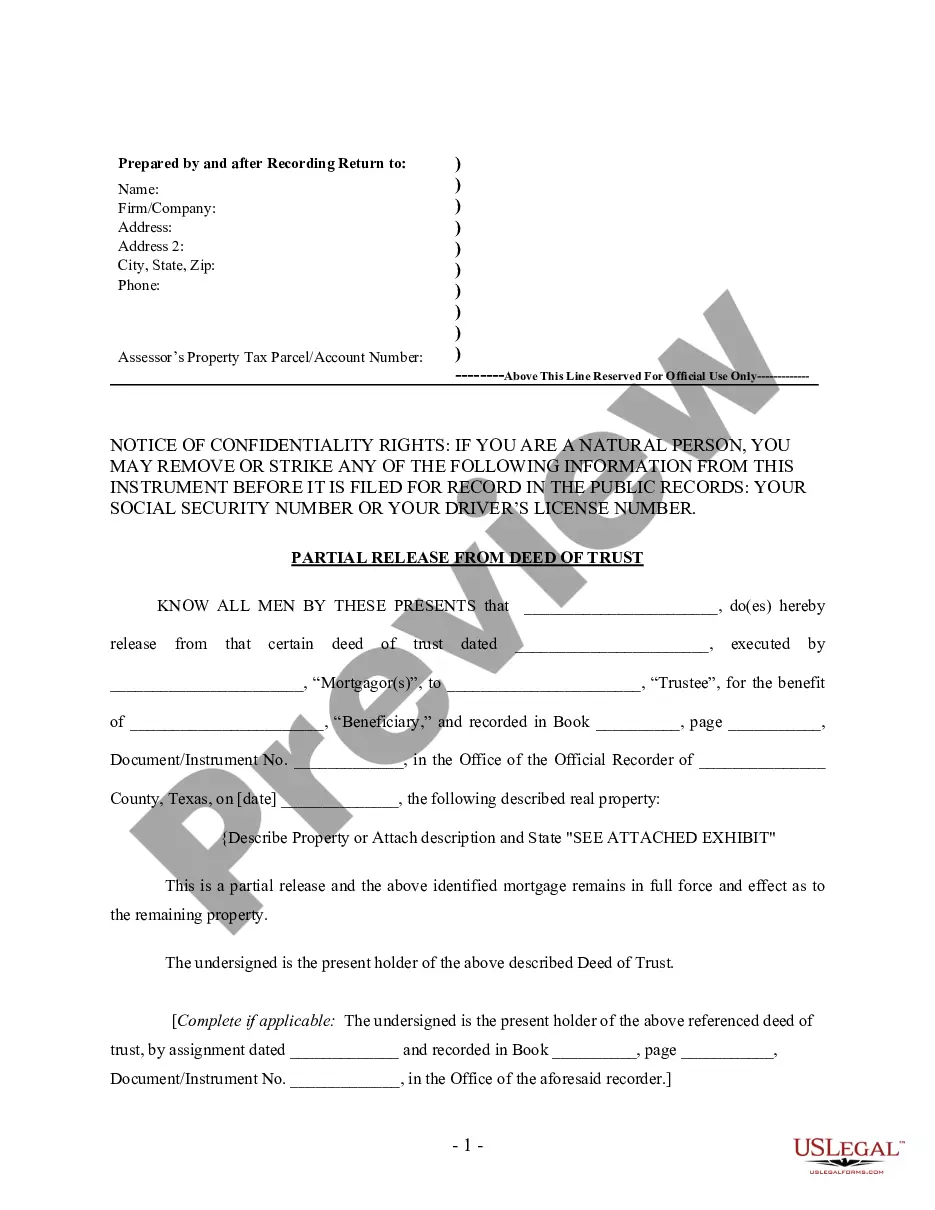

Texas Partial Release of Property From Deed of Trust for Individual

About this form

The Partial Release of Property From Deed of Trust for Individual is a legal document used by a lender or holder of a deed of trust to release a specific portion of the property identified in the deed. This form ensures that the existing deed of trust remains valid for the remaining property, distinguishing it from a full release or discharge of a mortgage.

Key components of this form

- Identification of the parties involved, including the mortgagor, trustee, and beneficiary.

- Details of the deed of trust being partially released, including dates and recording information.

- Description of the specific property being released, with the option to attach an exhibit.

- A statement affirming that the remaining property is still under the original deed of trust.

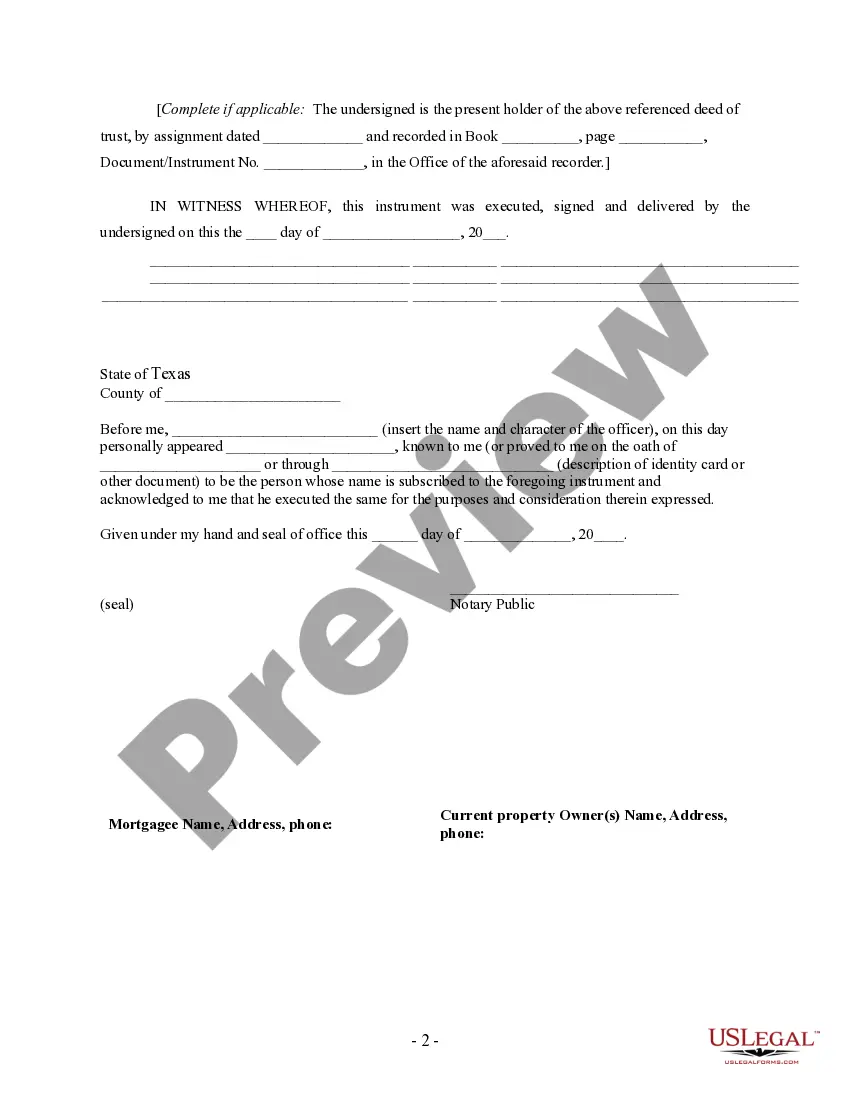

- Signature lines for the current holder of the deed of trust to formally execute the release.

- Notary acknowledgment section to validate the execution of the document.

State law considerations

This form is tailored for use in Texas and adheres to the legal standards and requirements specific to that jurisdiction.

Situations where this form applies

This form is typically used when a property owner wishes to sell or refinance a portion of the property secured under a deed of trust, while still maintaining the security interest in the remaining property. Common scenarios include subdividing land, granting an easement, or during transactions involving multiple parcels of land.

Who can use this document

This form is suitable for:

- Property owners who have existing deeds of trust.

- Lenders or mortgage holders looking to release part of the collateral.

- Real estate professionals involved in transactions that require a partial release.

- Attorneys representing clients in real estate dealings.

How to complete this form

- Identify all parties involved, including the mortgagor, trustee, and beneficiary.

- Specify the date of the original deed of trust and provide recording details.

- Describe the property being released or attach a separate description as needed.

- Confirm that the remaining property is still secured by the deed of trust.

- Sign and date the form at the designated area.

- Arrange for the form to be notarized to ensure its legality.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Mistakes to watch out for

- Failing to accurately describe the property being released.

- Not providing complete details of the original deed of trust.

- Omitting signatures or necessary notarization.

- Using outdated or incorrect recording reference numbers.

Advantages of online completion

- Easy access to a professionally drafted document anytime.

- Quick download and customization options for your specific needs.

- Reliable source with forms created by licensed attorneys for accuracy.

- Convenient and secure storage of your documents online.

Form popularity

FAQ

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

In Texas, a deed must be in writing and signed by the person transferring the land, otherwise known as the grantor. The person the grantor is transferring the land to is known as the grantee. No particular words must be used in order to constitute a legally effective transfer, but whatever words are used must show

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

An acknowledgment technically is not required for a deed to be valid; however, in most states, a deed without an acknowledgment cannot be recorded in the official public records. It is usually not necessary to record a deed for the transfer of title to be valid.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

About the release form This form should be filed with the recorder's office in the Texas county where the lien was originally recorded. Texas law requires claimants to file a lien release within 10 days after the lien is satisfied, or upon request from the property owner.

Now, people can convey clear title to their property by completing a transfer on death deed form, signing it in front of a notary, and filing it in the deed records office in the county where the property is located before they die at a cost of less than fifty dollars.

Witnessedwritten, two witnesses; holographic-handwritten or typed, signed by testator; approved-on a pre-printed form approved by the state; nuncupative-written by a witness from testator's oral statement; generally not valid for real estate transfer.

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more: