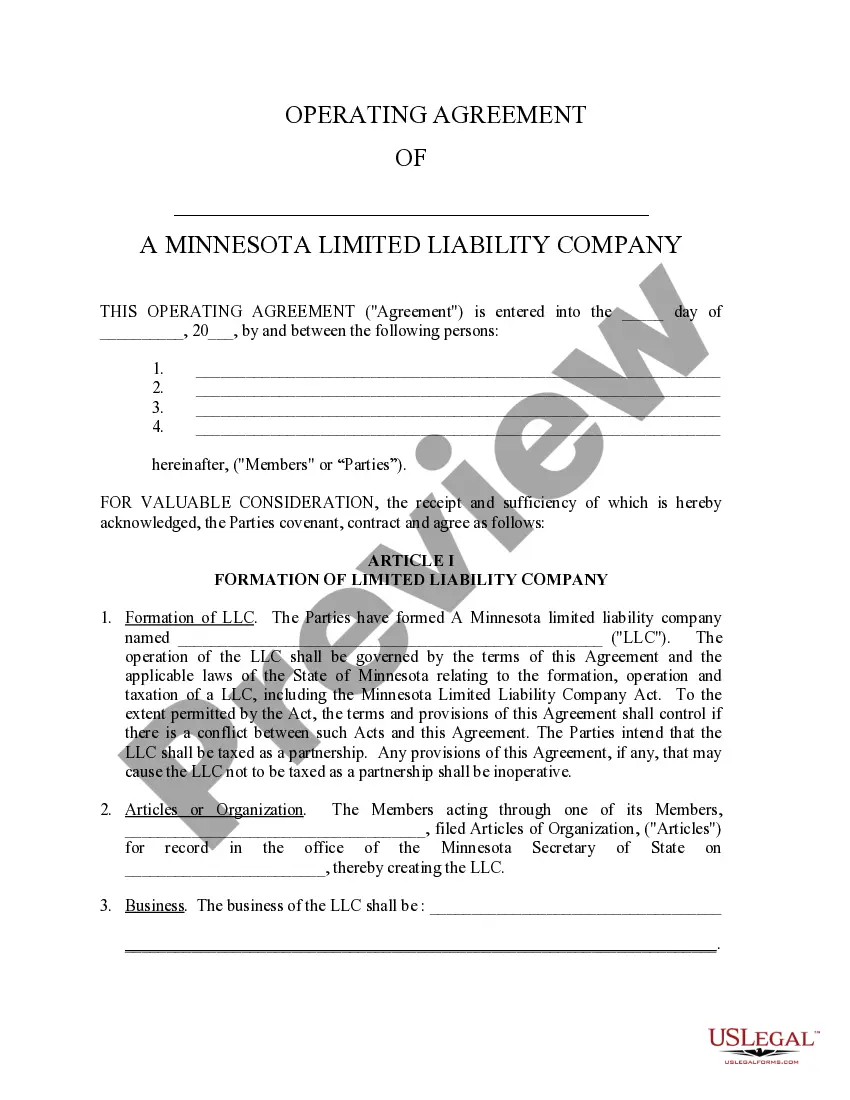

Minnesota Llc Operating Agreement With Non Voting Members

Description

How to fill out Minnesota Limited Liability Company LLC Operating Agreement?

Accurately prepared legal documents are one of the key safeguards for preventing issues and legal disputes, but acquiring them without the help of an attorney may require time.

Whether you need to swiftly locate a current Minnesota LLC Operating Agreement with Non-Voting Members or any other templates for employment, family, or business scenarios, US Legal Forms is always ready to assist.

The procedure is even more straightforward for existing users of the US Legal Forms library. If your subscription is active, simply Log In to your account and click the Download button next to your selected file. Additionally, you can retrieve the Minnesota LLC Operating Agreement with Non-Voting Members at any time later, as all documents ever obtained on the platform remain accessible within the My documents section of your profile. Save time and money on generating official documents. Experience US Legal Forms today!

- Verify that the form fits your needs and area by reviewing the description and preview.

- Search for different samples (if necessary) using the Search bar in the top header.

- Click Buy Now after you find the appropriate template.

- Select a pricing plan, Log In to your account or create a new account.

- Choose your preferred payment method to acquire the subscription plan (using a credit card or PayPal).

- Select PDF or DOCX file format for your Minnesota LLC Operating Agreement with Non-Voting Members.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

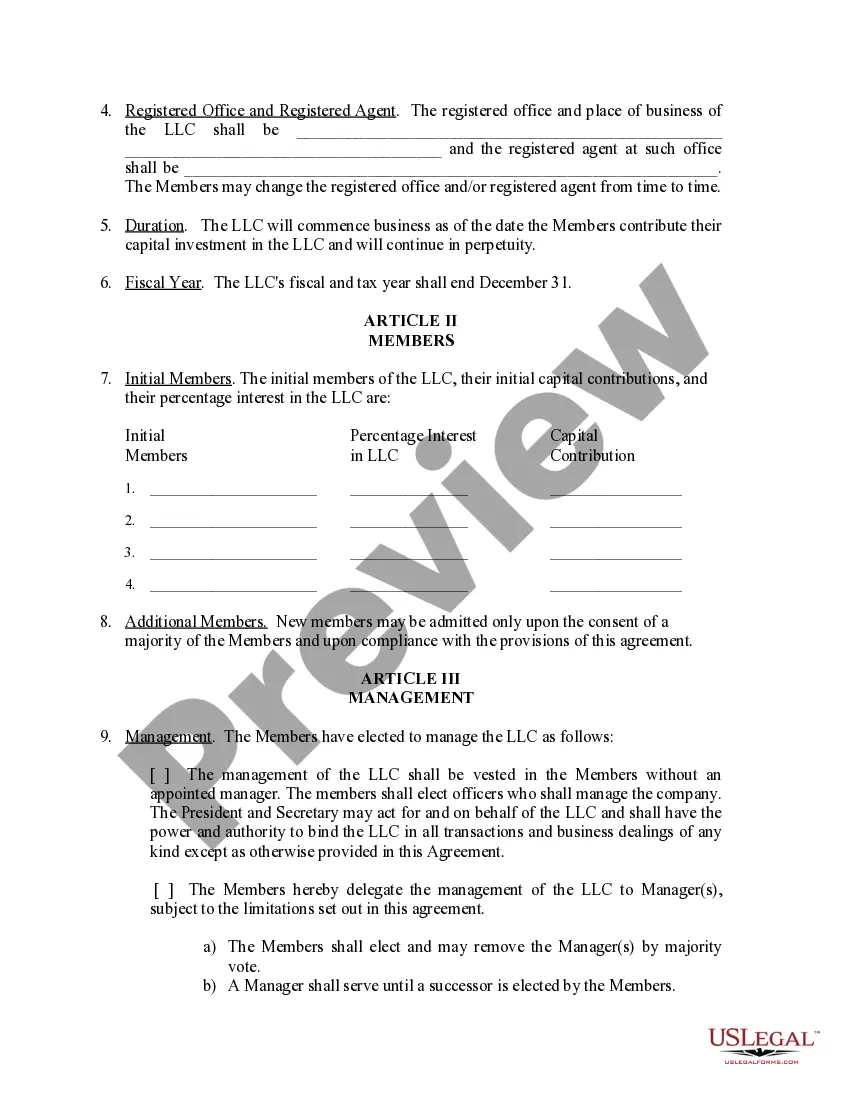

Every Minnesota LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?