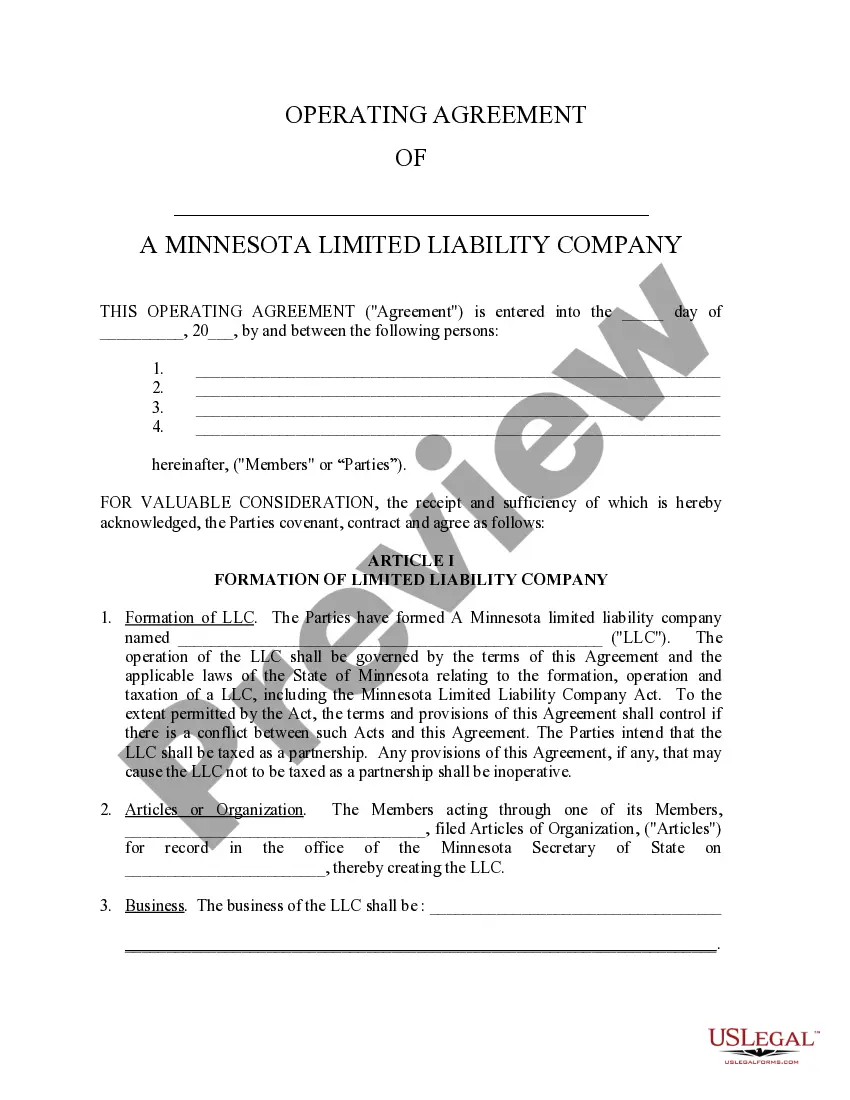

Minnesota Limited Liability Company LLC Operating Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Limited Liability Company (LLC): An LLC is a business structure in the United States wherein the owners are not personally liable for the company's debts or liabilities. LLC Operating Agreement: A legal document that outlines the operating procedures and financial management of a limited liability company. This agreement covers aspects like member compliance, roles of a registered agent, and how disputes are governed.

Step-by-Step Guide to Creating an LLC Operating Agreement

- Choose the Members and a Registered Agent: Start by identifying all the members of the LLC and appoint a registered agent who will handle legal documents.

- Define Member Roles and Responsibilities: Clearly outline each member's responsibilities, including financial contributions and duties.

- Draft Financial Management Protocols: Establish protocols for managing company finances, including member contributions, profit distribution, and fiscal responsibilities.

- Include Clauses for Dispute Resolution: Define how internal disputes will be managed and resolved, specifying any conditions where disputes are governed by particular laws or arbitration.

- Review and Formalize the Agreement: Review the agreement with all members, make necessary adjustments, and sign it to enforce its terms.

Risk Analysis of Inadequate LLC Operating Agreements

- Increased Personal Liability: Without a clear operating agreement, members might face unexpected personal liability for company debts.

- Financial Disputes: Lack of clear financial management guidelines can lead to disputes among members over profit distribution and expenses.

- Legal Challenges: An incomplete or unclear operating agreement can lead to legal challenges, particularly regarding the roles and duties of members.

Key Takeaways

An effective LLC Operating Agreement is crucial for ensuring clear operational roles, resolving member disputes, and protecting members from personal liability. Members should focus on comprehensive drafting and consensus in the agreement process.

Best Practices for Drafting an LLC Operating Agreement

- Consult Legal Professionals: Engage a lawyer experienced in company law to provide guidance tailored to the specifics of your state and business type.

- Prioritize Clarity: Use clear and precise language to avoid ambiguity, making sure all potential scenarios are covered.

- Regular Updates: Regularly review and update the operating agreement to reflect any changes in the business structure or member roles.

Common Mistakes & How to Avoid Them

- Ignoring State-Specific Rules: Ensure compliance with the specific requirements of the state where your LLC is registered.

- Overly Generic Templates: Avoid using generic templates. Tailor your agreement to reflect the unique aspects of your business and membership.

- Lack of Dispute Resolution Mechanisms: Always include clear protocols for conflict resolution to prevent disputes from escalating.

How to fill out Minnesota Limited Liability Company LLC Operating Agreement?

Obtain any template from 85,000 legal documents like the Minnesota Limited Liability Company LLC Operating Agreement online with US Legal Forms.

Every template is created and revised by state-recognized legal experts.

If you have an existing subscription, Log In. When you are on the form’s page, click the Download button and navigate to My documents to access it.

With US Legal Forms, you will consistently have immediate access to the appropriate downloadable sample. The service provides you with access to forms and categorizes them to enhance your search. Use US Legal Forms to obtain your Minnesota Limited Liability Company LLC Operating Agreement quickly and effortlessly.

- Verify the state-specific criteria for the Minnesota Limited Liability Company LLC Operating Agreement you wish to utilize.

- Examine the description and look at the sample.

- When you are sure that the template meets your needs, click Buy Now.

- Choose a subscription option that fits your financial plan.

- Establish a personal account.

- Pay using one of two convenient methods: by credit card or through PayPal.

- Select a format to download the document in; two choices are available (PDF or Word).

- Download the file to the My documents section.

- After your reusable template is downloaded, print it out or save it to your device.

Form popularity

FAQ

Yes, you can write your own operating agreement for your Minnesota Limited Liability Company LLC. Creating your own document allows you to tailor it specifically to your business goals and member roles. Just be sure to include essential elements such as management structure, decision-making processes, and profit-sharing arrangements. Utilizing tools from platforms like US Legal Forms can simplify the process and ensure completeness.

You can obtain an operating agreement for your Minnesota Limited Liability Company LLC through several means. One option is to draft it yourself using available templates, which you can find on resources like US Legal Forms. Alternatively, you may choose to hire an attorney who specializes in business law to ensure your agreement meets all legal requirements. Regardless of the method, ensure your agreement reflects your business's unique structure and needs.

While an operating agreement is not legally required for a Minnesota Limited Liability Company LLC, it is highly recommended. Having an operating agreement can help clarify the roles and responsibilities of members, thus preventing potential disputes in the future. It also adds credibility to your LLC and can be beneficial when dealing with banks or investors. Creating one is a wise step, even if it's not mandatory.

Yes, you can create your own operating agreement for your Minnesota Limited Liability Company LLC. A customized agreement allows you to outline the specific rules and management structure that suits your business needs. However, ensure that your agreement complies with Minnesota state laws to avoid any legal issues. You may also consider using templates available through platforms like US Legal Forms for guidance.

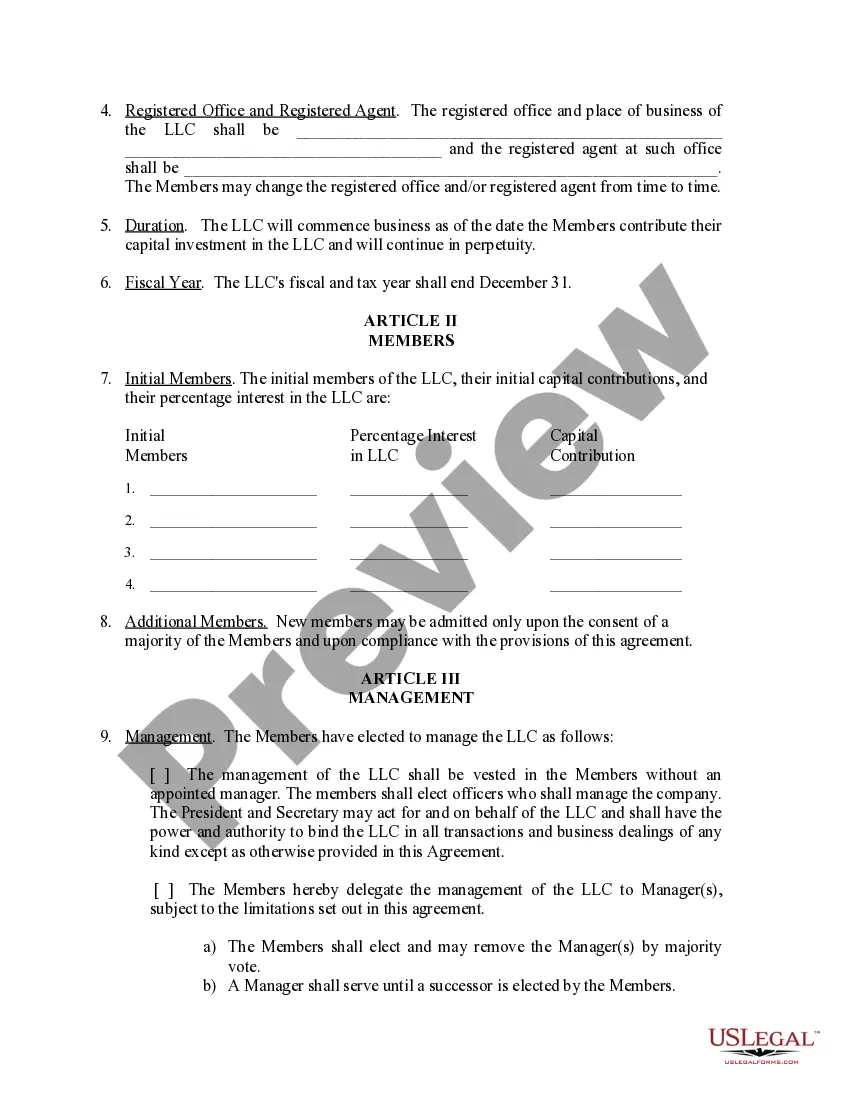

A Minnesota Limited Liability Company LLC Operating Agreement should include key elements such as the management structure, member responsibilities, and procedures for adding new members. It should also outline the distribution of profits and losses among members, as well as the process for handling disputes. Including these components helps clarify expectations and reduces potential conflicts in the future. For tailored assistance, consider using the US Legal Forms platform, which provides templates and guidance for creating a comprehensive operating agreement.

In Minnesota, you do not need to file your Limited Liability Company LLC Operating Agreement with the state. Instead, you keep this document on file at your company's principal place of business. It is essential to have it accessible for members and to present it if any legal or financial issues arise. US Legal Forms offers an easy way to generate and store your operating agreement securely, ensuring you have everything organized for your LLC.

Minnesota does not legally require a Limited Liability Company (LLC) to have an operating agreement. However, having a Minnesota Limited Liability Company LLC Operating Agreement is highly recommended as it outlines the management structure and operational procedures of your LLC. This document can help prevent misunderstandings among members and provides clarity on the roles and responsibilities within the company. Using a platform like US Legal Forms can simplify the process of creating a customized operating agreement that meets your specific needs.