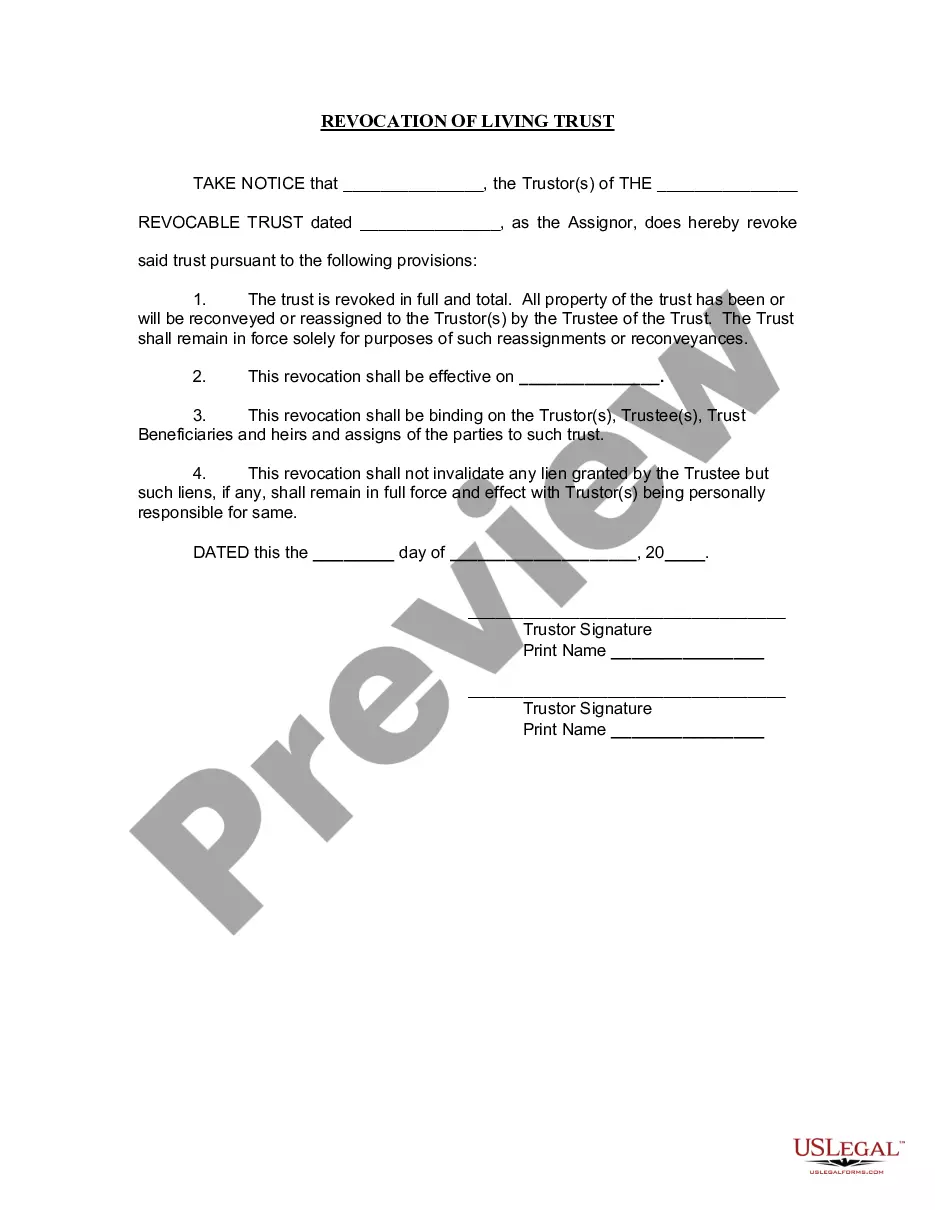

Revocation Living Trust With A Trustee

Description

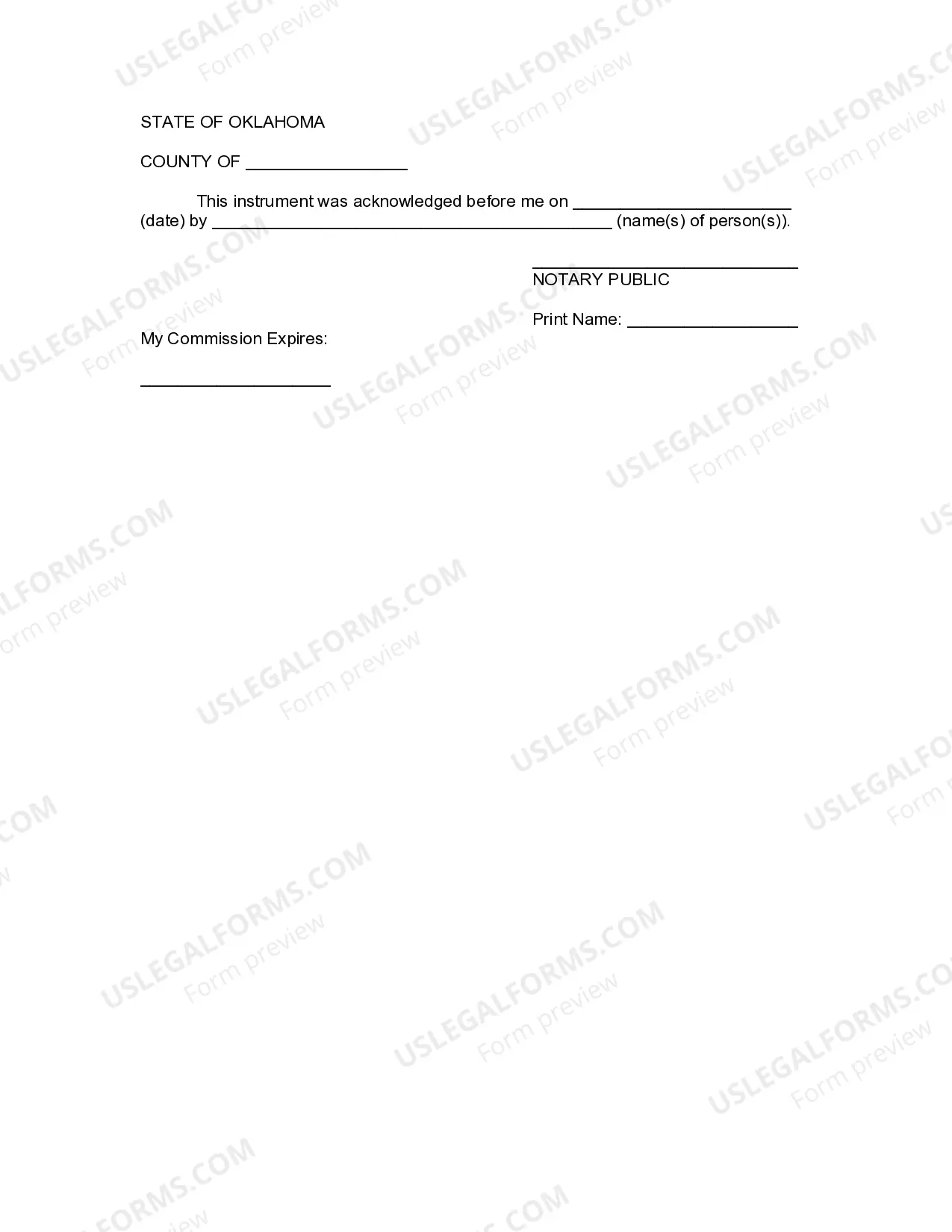

How to fill out Oklahoma Revocation Of Living Trust?

- Log in to your US Legal Forms account. Ensure your subscription is active; if it's not, consider renewing to continue accessing the resources.

- Preview the document and read its description to confirm it aligns with your requirements and complies with local jurisdiction regulations.

- Should you find discrepancies or need a different form, utilize the Search tab to locate the appropriate template.

- Once you find the correct document, click 'Buy Now.' Choose your desired subscription plan, register an account for full access.

- Complete your purchase by entering your payment details or using your PayPal account to facilitate the transaction.

- Download the completed form to your device and access it later via the 'My Forms' section in your profile.

In conclusion, with US Legal Forms, the process of revoking a living trust becomes manageable and efficient. Their extensive library and expert support make sure you have the right tools to proceed with confidence.

Start simplifying your legal document needs today and empower yourself with US Legal Forms!

Form popularity

FAQ

A trust can be rendered void due to factors such as lack of capacity, improper execution, or illegal purposes. For instance, if the creator of a revocation living trust with a trustee was not of sound mind when establishing the trust, it can be contested. Additionally, trusts that serve fraudulent intentions will not hold up in court. Seeking legal advice is beneficial to ensure your trust remains enforceable.

The 5 year rule for trusts typically refers to the time frame in which certain actions must occur to avoid negative tax implications. In the context of a revocation living trust with a trustee, if modifications or distributions happen within five years, it may affect estate tax calculations. Understanding this rule can help you manage your trust effectively. For guidance tailored to your situation, consider utilizing resources like US Legal Forms.

A trust can become invalid for several reasons, such as lacking the necessary legal requirements during its formation. This includes not having proper signatures, not being created by a qualified individual, or failing to specify beneficiaries. If your revocation living trust with a trustee does not meet legal standards, it may be challenged in court. Regularly reviewing the trust with legal assistance can help you maintain its validity.

To remove a trustee from your revocation living trust with a trustee, start by reviewing the trust document. The document often includes specific instructions regarding trustee removal and replacement. If the trust allows for removal, you'll typically need to execute a formal amendment to the trust. Consider consulting a legal expert or using a platform like US Legal Forms to ensure the process aligns with your state’s laws.

A revocable trust becomes irrevocable when the grantor passes away or when the trust document specifies a change in status. At this point, the assets in the trust are generally out of the grantor's control, making it essential to plan accordingly. Understanding this transition is vital for effective estate management, particularly in a revocation living trust with a trustee.

Revoking a revocable trust generally requires specific actions as outlined in the trust document. This usually involves drafting a formal revocation notice and ensuring all assets are redistributed. You should communicate with all parties affected, ensuring a smooth transition. Using resources from uslegalforms can help streamline the revocation process for your trust.

In most cases, nursing homes cannot take your revocable trust directly. However, they can claim against your assets if you need long-term care or if you exhaust personal resources. It's essential to consult with a legal professional regarding asset protection strategies for your revocation living trust with a trustee while considering long-term care needs.

To remove trustees, first review the revocation living trust with a trustee for procedures on removal. Prepare the necessary legal documents, which may include a letter of resignation from the trustee being removed. After this, ensure that new trustees are appointed and that all parties involved are informed of the changes. This careful approach maintains the trust's integrity and flow.

Removing a trustee from a revocable living trust typically involves following the procedures outlined in the trust document. You may need to prepare a written notice of removal, informing the trustee of their termination. In addition, you should appoint a new trustee if necessary, updating the trust records to reflect this change. Using platforms like uslegalforms can simplify this entire process.

Yes, a trustee can be removed from a revocable trust at any time, as long as the trust’s terms allow it. The process of removal may require formal documentation to reflect the change in management. This flexibility ensures that your revocation living trust with a trustee can adapt as your circumstances change. Remember to communicate any updates to the involved parties.