Advocate With Trust Account

Description

How to fill out Power Of Attorney By Trustee Of Trust?

Managing legal documents can be exasperating, even for seasoned experts.

When you are looking for a Lawyer With Trust Account and lack the opportunity to dedicate time to find the appropriate and current version, the processes may be stressful.

US Legal Forms addresses any needs you may have, spanning from personal to commercial documents, all in one location.

Employ advanced tools to create and manage your Lawyer With Trust Account.

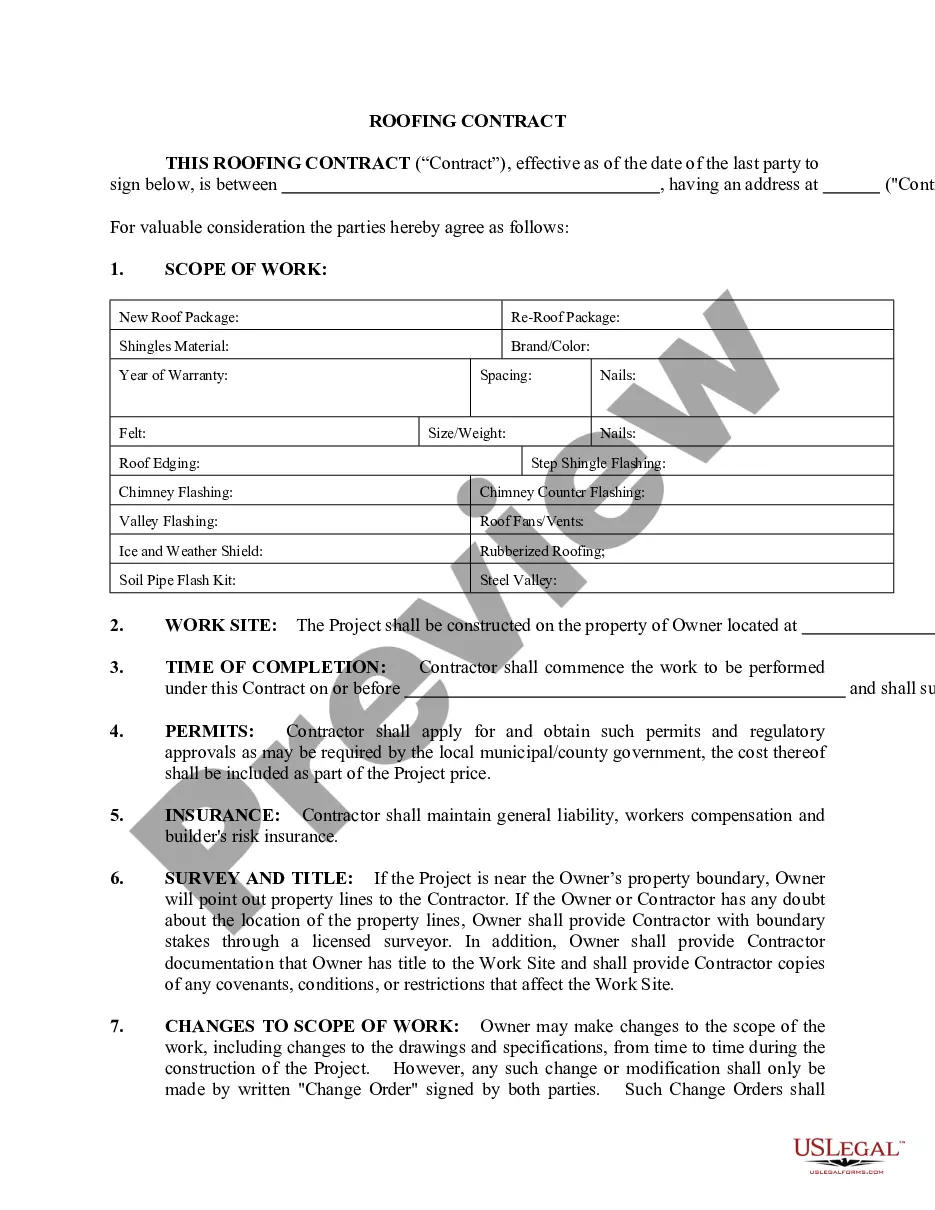

Here are the steps to follow after locating the form you need: Verify that this is the correct form by previewing it and reviewing its details.

- Explore a valuable resource repository of articles, guides, tutorials, and materials pertinent to your situation and needs.

- Conserve time and effort in seeking the documents you require, and leverage US Legal Forms’ sophisticated search and Preview feature to locate Lawyer With Trust Account and obtain it.

- If you possess a monthly subscription, Log In to your US Legal Forms account, search for the document, and get it.

- Examine your My documents section to view the documents you've previously downloaded and to organize your folders as desired.

- If this is your first encounter with US Legal Forms, create a complimentary account and gain unrestricted access to all the benefits of the library.

- Utilize an extensive online form directory that could be a decisive factor for anyone aiming to handle these scenarios effectively.

- US Legal Forms stands as a frontrunner in the realm of online legal documents, with more than 85,000 state-specific legal forms available to you at any time.

- Access legal and organizational forms specific to your state or county.

Form popularity

FAQ

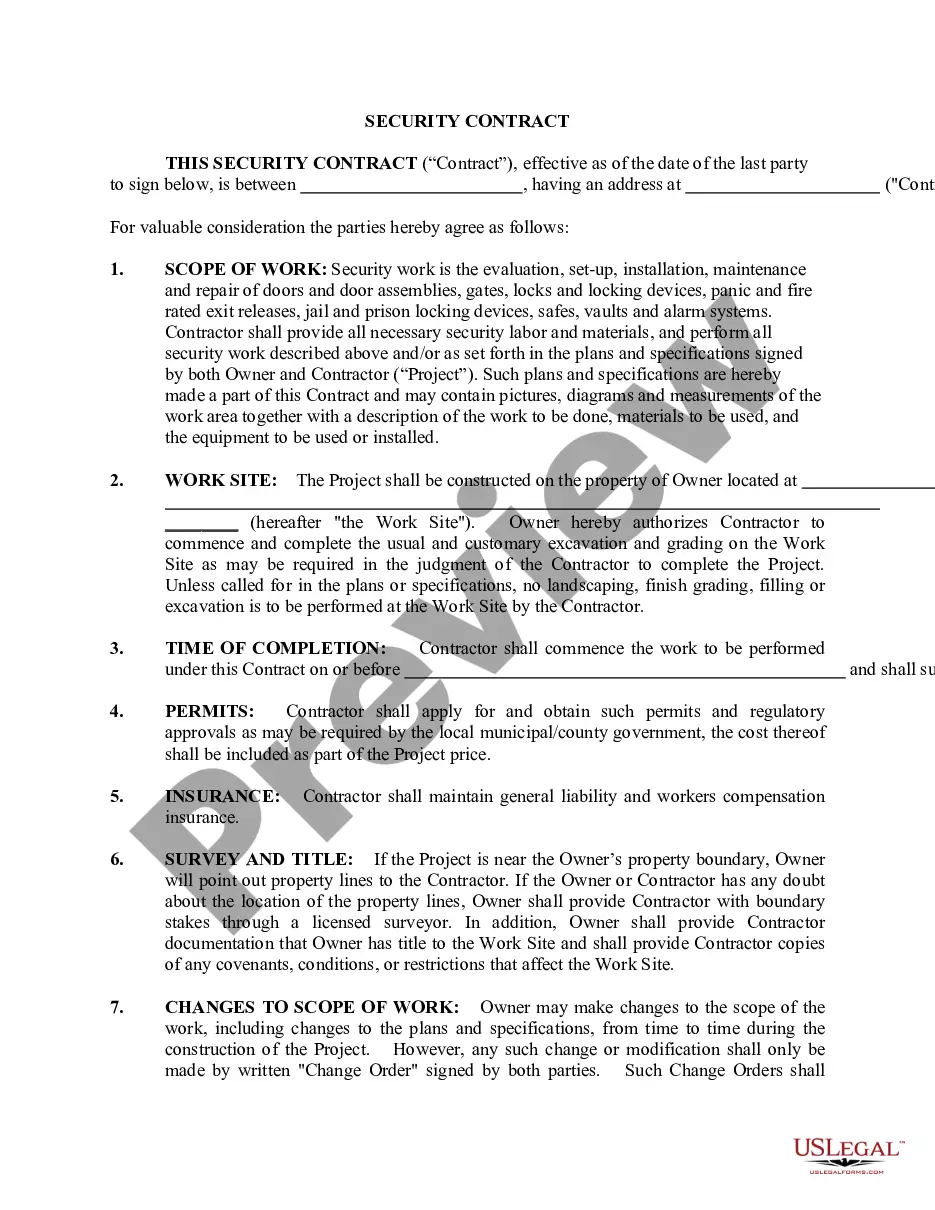

SCR .15(f) requires trust account checks to be pre-printed and pre-numbered. The rule further specifies that the name and address of the lawyer or law firm and the name of the account must be printed in the upper left corner of the check.

The cover page of your statement shows your account information. It includes the date of the statement, the account number, account name, your name and address, and contact information for who to call with questions. Many trusts have more than one investment or underlying accounts that make up their Trust.

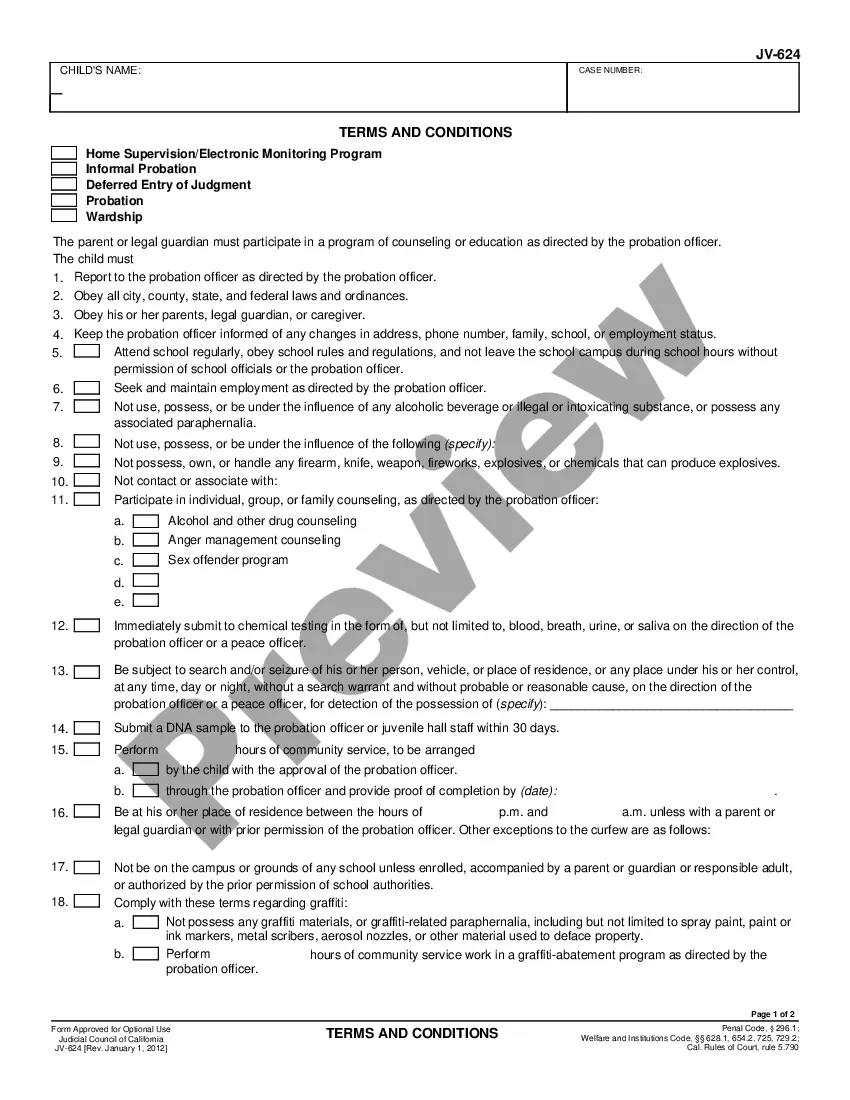

What is a trust account? In short, a trust account is an account used by lawyers to hold money on behalf of clients. There are two types of trust accounts.

Separate Record for Each Beneficiary or Transaction The record must show the following in chronological order: date of deposit; amount of deposit; name of payee or payor; check number; date and amount; and balance of the individual account after posting transactions on any date.

One example of an account in trust is a Uniform Gifts to Minors Act (UGMA) account. This type of account in trust created allows minors to legally own the assets held in these accounts. However, they can't have access to the account's principal and income until they reach legal age.