North Dakota Trust For The Future

Description

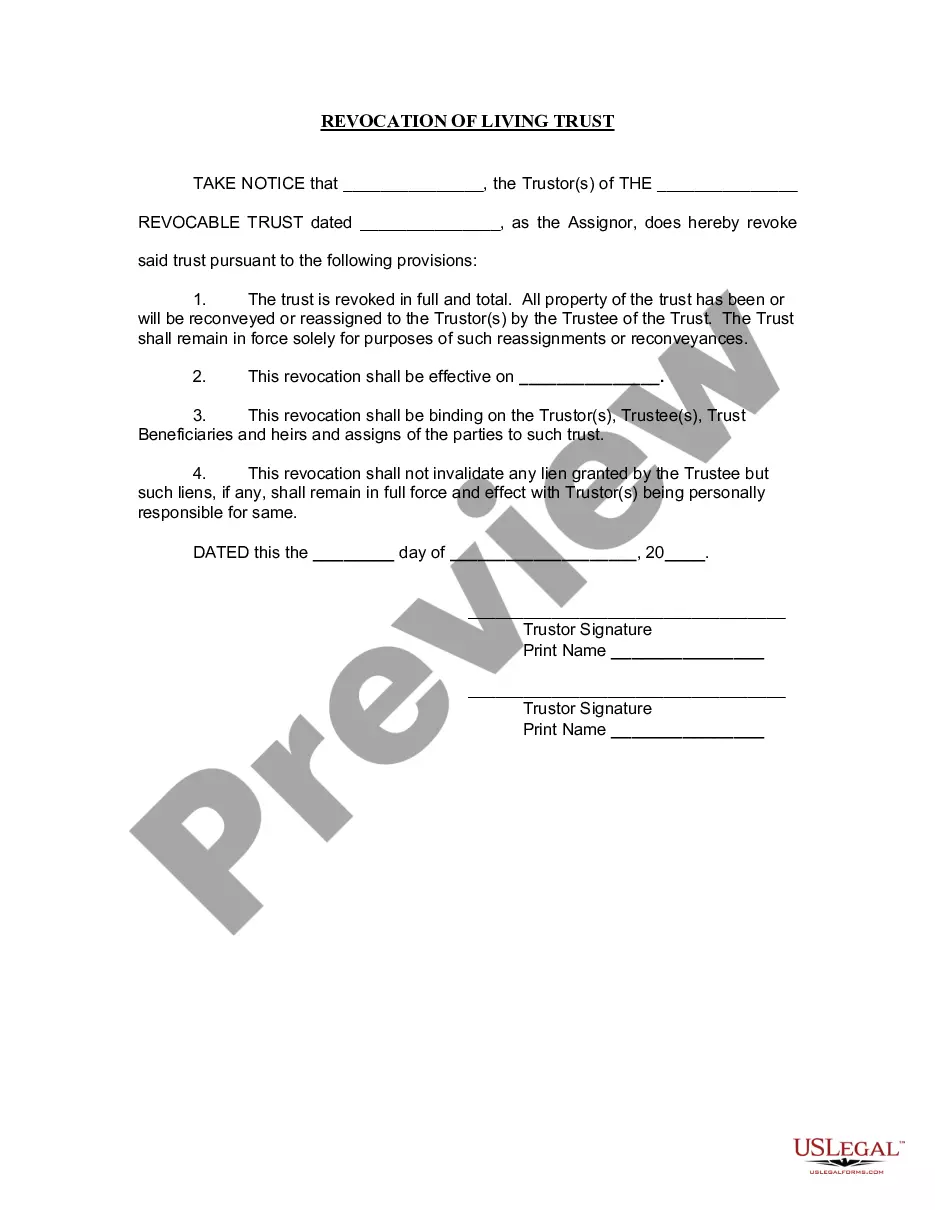

How to fill out North Dakota Revocation Of Living Trust?

- Access your account on US Legal Forms if you are a returning user, and verify your subscription status. Log in and click the download button for your desired form.

- If you are new to the service, begin by examining the preview mode and detailed description of the forms available, ensuring it meets your local jurisdiction's requirements.

- Use the search function if you need to explore additional templates to find one that aligns perfectly with your needs.

- Select the 'Buy Now' option, and choose from various subscription plans while ensuring you register for full access to the legal library.

- Complete your purchase by providing your payment information, whether via credit card or PayPal, to unlock your subscription.

- Finally, download the template you need and save it for future access, available in the 'My Forms' section of your account at any time.

In conclusion, US Legal Forms simplifies the process of creating a reliable trust for your future in North Dakota. With an extensive library and support from legal experts, you can ensure your documents are completed accurately and efficiently.

Start your journey today by exploring US Legal Forms and secure your future with the right legal documents!

Form popularity

FAQ

Yes, you can write your own will in North Dakota, but there are specific legal requirements you must follow to ensure its validity. Utilizing templates or services like USLegalForms can help guide you as you create a document that meets the state's standards. Crafting a will is a vital step for securing your North Dakota trust for the future, ensuring that your wishes are honored. It is always wise to seek legal advice if you have any concerns about the process.

Driving on North Dakota trust land is generally permitted, but it’s important to check local regulations. Trust land can be managed differently depending on its designation, and some areas may have restrictions. Always ensure you respect the rules specific to North Dakota trust for the future, as drivers must adhere to the policies established to protect these lands. For your convenience, resources on the regulations can usually be found through state agencies.

Yes, trust income must be reported to the IRS, and it is essential for beneficiaries to understand their reporting responsibilities. Generally, the trust itself will report its income, and beneficiaries will report their share of that income on their personal returns. Staying compliant with IRS regulations is crucial for your North Dakota trust for the future.

Yes, North Dakota does accept federal extensions for trusts. If you require extra time to gather necessary documents and prepare your return, you can file for an extension. However, it's important to stay informed about state-specific requirements and deadlines to ensure your North Dakota trust for the future is managed effectively.

Filing income from a trust involves filling out the appropriate tax forms based on the type of trust you have established. Trusts are often required to file Form 1041 with the IRS. To simplify this process, you may want to utilize resources provided by US Legal Forms that can guide you in filing accurately and efficiently for your North Dakota trust for the future.

Documenting trust income involves accurately recording any earnings from trust assets. You should maintain detailed records of transactions, including bank statements and distribution records. This documentation is essential for tax purposes and will help you ensure compliance with federal and state reporting requirements for your North Dakota trust for the future.

Reporting income from a trust requires attention to detail and familiarity with tax regulations. Trust income generally passes through to the beneficiaries, who must report it on their individual tax returns. In North Dakota, make sure to adhere to state-specific requirements so you can effectively manage your North Dakota trust for the future.

Setting up a trust in North Dakota involves several steps. First, you need to decide on the type of trust that suits your needs, whether it’s a revocable trust or an irrevocable one. Next, gather the required documentation, including a detailed inventory of your assets. Finally, consider using platforms like US Legal Forms to access state-specific forms and guidance to help you craft a North Dakota trust for the future.

A living trust, including a North Dakota trust for the future, has its disadvantages. It does not provide protection from creditors, meaning that assets in the trust can still be vulnerable. Furthermore, establishing a living trust requires transferring assets into it, which can be a complex and time-consuming process for some individuals.

One prevalent mistake parents make when creating a trust fund is not clearly defining their wishes in the trust document. This uncertainty can lead to confusion among beneficiaries and may result in legal disputes. Additionally, failing to regularly review and update the trust as family situations change can undermine its effectiveness in ensuring a secure future.