Connecticut Sample Certificate Form R1325d

Description

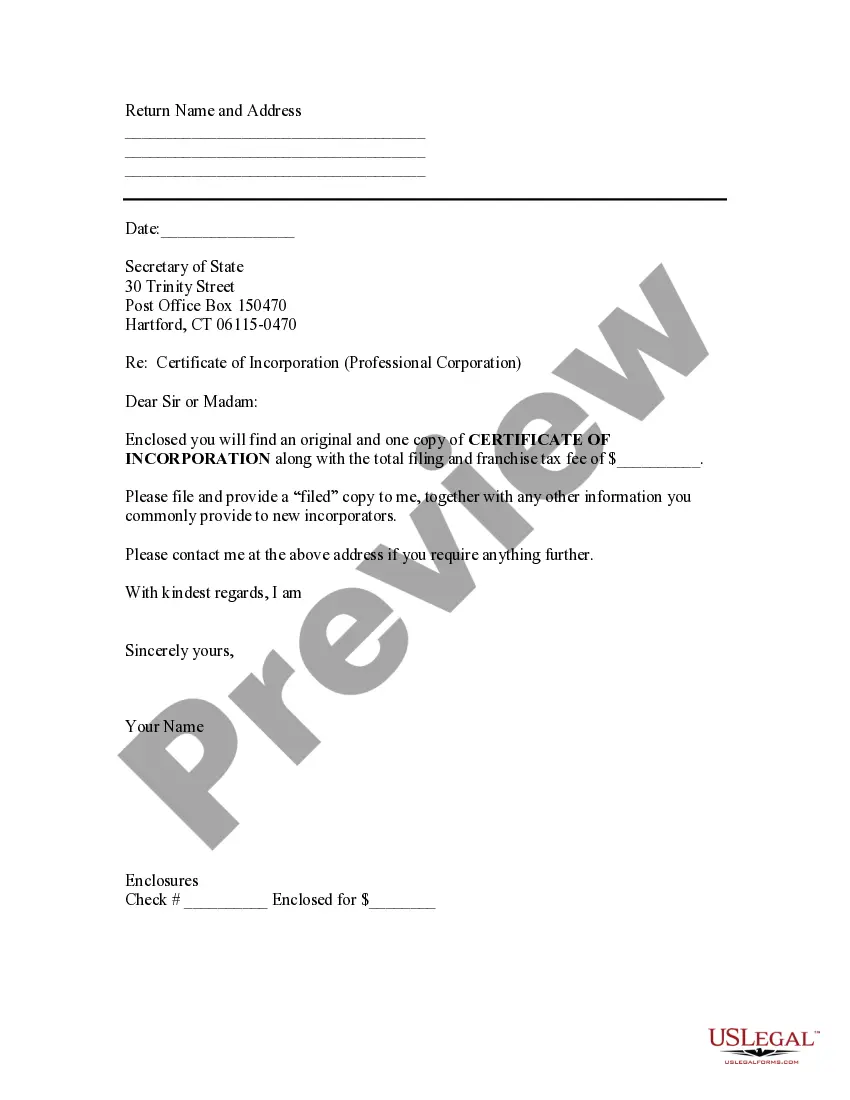

How to fill out Connecticut Sample Transmittal Letter For Certificate Of Incorporation?

Bureaucratic processes require meticulousness and exactness.

If you do not manage the completion of documentation like Connecticut Sample Certificate Form R1325d on a daily basis, it might lead to some misunderstandings.

Choosing the proper sample from the outset will ensure that your document submission will proceed smoothly and avoid any hassles of resubmitting a document or starting the same task over again.

If you are not a registered user, finding the necessary sample will require a few additional steps: Find the template using the search bar. Ensure the Connecticut Sample Certificate Form R1325d you’ve found is suitable for your state or district. Open the preview or read the description containing the details on the use of the sample. When the result aligns with your search, click the Buy Now button. Select the appropriate choice among the available pricing plans. Log In to your account or create a new one. Complete the purchase using a credit card or PayPal payment option. Acquire the form in the file format of your preference. Locating the right and updated samples for your paperwork is a matter of minutes with an account at US Legal Forms. Eliminate the bureaucratic uncertainty and simplify your work with forms.

- You can always discover the appropriate sample for your paperwork in US Legal Forms.

- US Legal Forms is the largest online collection of forms that holds over 85 thousand templates covering various subject areas.

- You can locate the latest and most relevant version of the Connecticut Sample Certificate Form R1325d by simply searching it on the website.

- Find, save, and download templates in your profile or check the description to confirm you have the correct one available.

- With an account at US Legal Forms, it is simple to collect, store in one place, and browse through the templates you save for easy access.

- When on the webpage, click the Log In button to authenticate.

- Then, proceed to the My documents page, where the history of your forms is archived.

- Review the description of the forms and download the ones you require whenever necessary.

Form popularity

FAQ

A certificate of responsibility typically indicates that an individual or business can financially cover liabilities in certain scenarios, such as vehicle accidents. In Connecticut, this certificate is crucial for legal and insurance purposes. You may want to reference a Connecticut sample certificate form r1325d to learn more about obtaining this documentation and what it entails.

In Connecticut, certain documents do not meet the requirements for proof of financial responsibility. Commonly accepted forms include insurance cards and financial responsibility certificates, while documents like vehicle listings or mere receipts may not suffice. To avoid potential issues, understanding the acceptable proofs as outlined in a Connecticut sample certificate form r1325d is beneficial.

Filling out a Connecticut registration and title application involves providing essential information about the vehicle and its owner. You will need details such as the vehicle identification number, title number, and your personal information. For guidance, consider using a Connecticut sample certificate form r1325d, which can help clarify the requirements and ensure accuracy in your application.

A certificate of financial responsibility proves that a vehicle owner can cover costs associated with property damage or injuries from a car accident. In Connecticut, having this certificate is crucial for vehicle registration and compliance with state laws. The Connecticut sample certificate form r1325d is an excellent resource to help you understand and acquire this necessary documentation.

A certificate of organization in Connecticut is a legal document required to establish a limited liability company (LLC). This certificate outlines essential information about your LLC, including its name and address. If you're setting up an LLC, you may find that using a Connecticut sample certificate form r1325d can help you navigate the process efficiently.

Yes, in Connecticut, both parties typically need to be present for a title transfer. This process ensures that the transaction is legitimate and that both the buyer and seller agree on the details. If you're unsure about specific requirements, a Connecticut sample certificate form r1325d can provide clarity. This form can also simplify various aspects of the title transfer procedure.

In Connecticut, registering a business requires specific documentation, including the Connecticut sample certificate form r1325d. This certificate serves as an essential legal document for business entities, validating their existence and compliance with state regulations. You will also need additional forms, such as proof of residential address and identification. Using a platform like US Legal Forms can simplify this process and ensure you have all the necessary paperwork completed accurately.

Tax exempt form 119 in Connecticut is a formal document that allows eligible buyers to make purchases without incurring sales tax. This form is essential for non-profit organizations and others who qualify under state tax laws. Utilizing the Connecticut sample certificate form r1325d can guide you through the necessary steps to maintain compliance and successfully utilize form 119.

A withholding exemption certificate is used by employees to indicate that they are exempt from income tax withholding. This document helps employers understand who qualifies for withholding exemptions based on specific criteria. If you're navigating this process in Connecticut, the Connecticut sample certificate form r1325d can help you understand your options and responsibilities.

Form Cert 119 is a Connecticut exemption certificate that allows eligible buyers to make tax-exempt purchases. This certificate is particularly useful for organizations that qualify for tax exemptions under state law. If you need to demonstrate your tax-exempt status, the Connecticut sample certificate form r1325d is a helpful tool that may accompany your Cert 119 form.