This form package provides the forms necessary to form a professional corporation for the practice of a state-licensed profession in Connecticut. You fill in the name of your profession in the blanks provided.

Professional Corporation Package for Connecticut

Description

How to fill out Professional Corporation Package For Connecticut?

Amid numerous paid and complimentary templates available on the internet, one cannot guarantee their precision. For instance, who created them or if they possess adequate expertise to fulfill your specific needs.

Stay calm and utilize US Legal Forms! Obtain the Professional Corporation Package for Connecticut templates crafted by proficient attorneys and sidestep the expensive and time-consuming task of searching for a lawyer and subsequently compensating them to draft a document that you can easily acquire yourself.

If you hold a subscription, Log In to your account and locate the Download button adjacent to the file you seek. You will also gain access to all your previously saved samples in the My documents section.

Once you have registered and purchased your subscription, you can utilize your Professional Corporation Package for Connecticut as frequently as you require or for as long as it is valid in your area. Modify it with your chosen online or offline editor, complete it, sign it, and create a physical copy. Achieve more for less with US Legal Forms!

- Ensure that the file you find is applicable in your location.

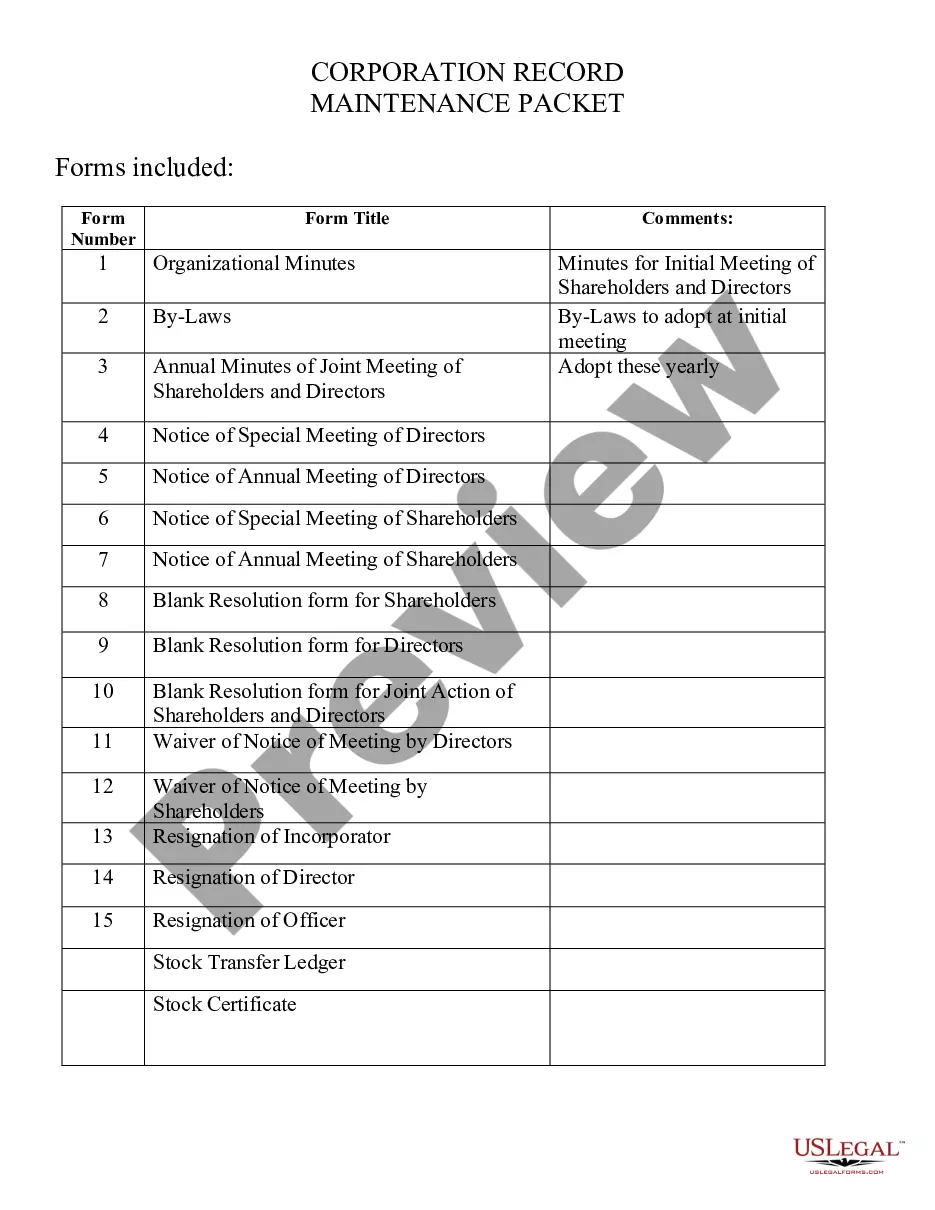

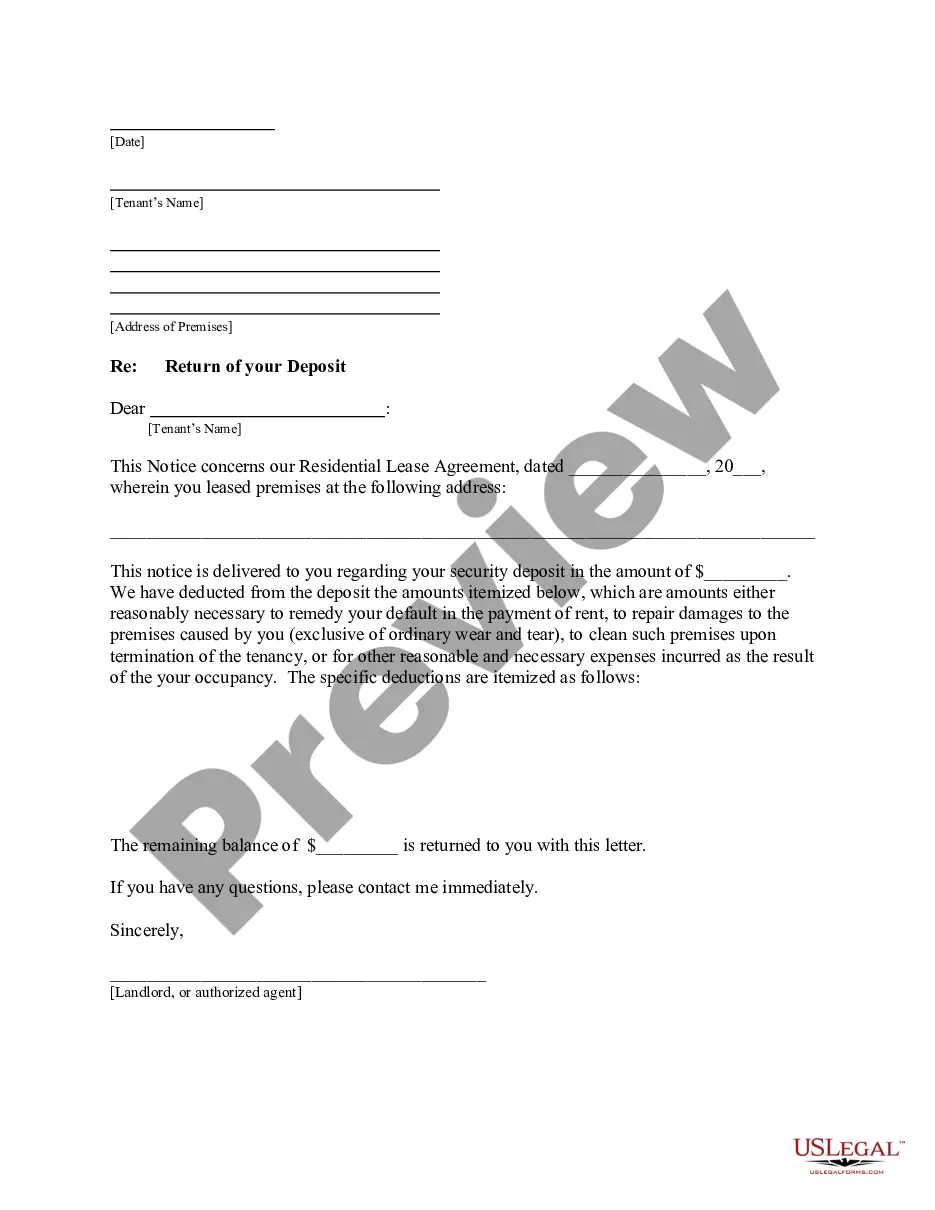

- Examine the template by checking the description using the Preview feature.

- Hit Buy Now to initiate the purchasing process or search for another template using the Search box in the header.

- Select a pricing option and set up an account.

- Make the payment for the subscription using your credit/debit card or Paypal.

- Download the document in the desired file format.

Form popularity

FAQ

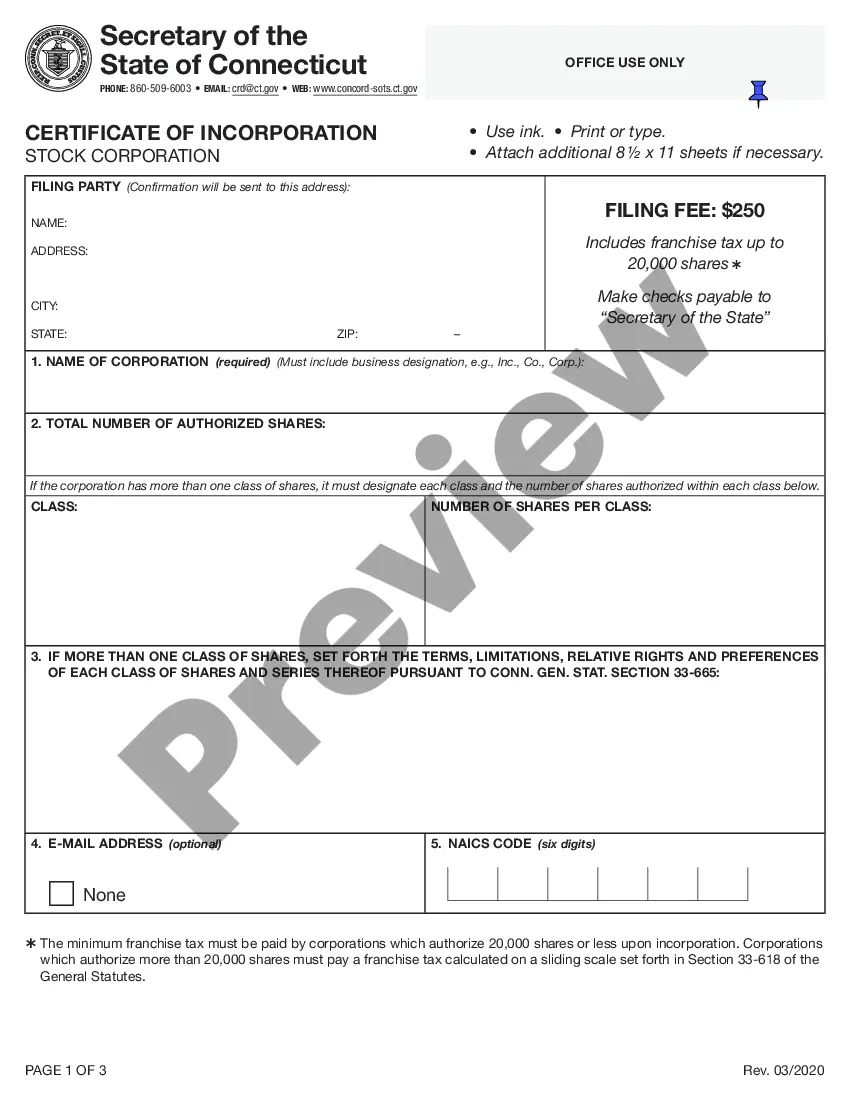

Setting up a corporation in Connecticut involves several key steps. First, choose a unique corporate name and file the Certificate of Incorporation with the Secretary of the State. Using a Professional Corporation Package for Connecticut can streamline this process by providing templates and guidance tailored to your needs. Once established, ensure compliance with state regulations to maintain your corporation's standing.

Yes, you can start a corporation by yourself in Connecticut, provided you meet the state requirements. This includes appointing a registered agent and filing the necessary documentation. To facilitate this process, consider a Professional Corporation Package for Connecticut, which provides guidance and resources tailored for individual entrepreneurs. It simplifies the steps, allowing you to establish your corporation confidently.

In Connecticut, corporations are subject to a minimum tax of $250. This applies regardless of income levels, ensuring that all registered corporations contribute to state revenue. By investing in a Professional Corporation Package for Connecticut, you can easily manage your tax obligations and stay compliant with state laws. Taking these steps helps ensure your corporation operates smoothly and avoids penalties.

A professional corporation is designated for licensed individuals in fields such as law, medicine, or accounting. To qualify, the majority of shareholders must hold appropriate professional licenses related to the business. Using a Professional Corporation Package for Connecticut helps these professionals navigate the incorporation process while ensuring they meet the necessary qualifications. This establishes a formal business structure that provides both protection and legitimacy.

A professional corporation, or PC, is a corporate entity formed by professionals to provide specialized services. An example is a dental practice operating as a professional corporation, which allows the owner to limit personal liability. By utilizing a Professional Corporation Package for Connecticut, such entities can streamline the formation process and adhere to state regulations. It's an effective way to ensure that professional standards are maintained while protecting personal assets.

A professional company includes businesses that require a specific license to operate, such as law firms, medical practices, and accounting firms. For instance, a law firm that operates as a professional corporation is a prime example. By forming a Professional Corporation Package for Connecticut, these businesses benefit from limited liability protection while meeting their legal obligations. This ensures that professionals can focus on serving their clients confidently.

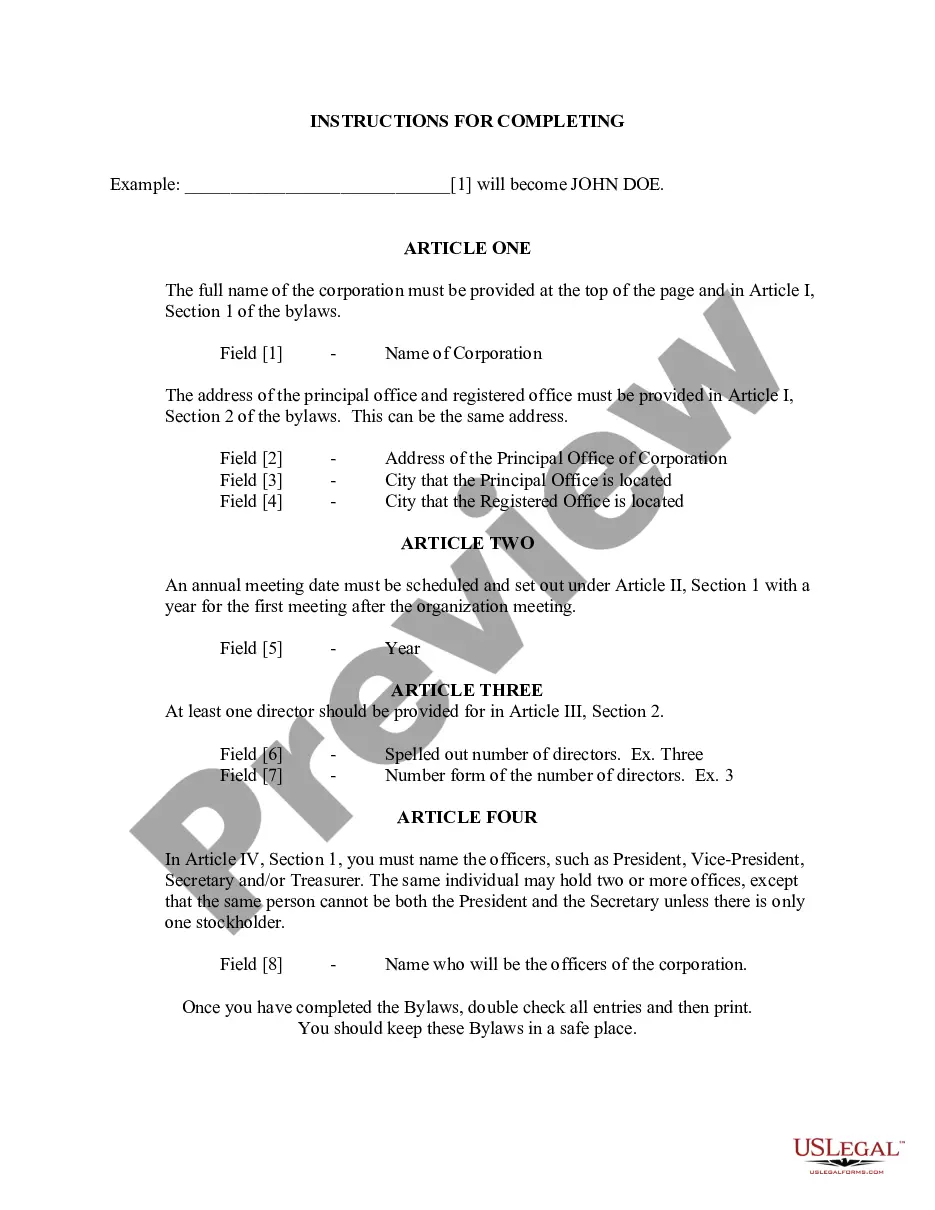

To form a corporation in Connecticut, you must file a Certificate of Incorporation with the Secretary of the State. This document outlines essential details such as the corporate name, registered agent, and purpose. Choosing a reliable Professional Corporation Package for Connecticut simplifies this process and ensures compliance with state regulations. Additionally, you may need to draft corporate bylaws and hold an organizational meeting.

To create a professional corporation in Connecticut, you must first choose a unique name that complies with state regulations. Next, you need to file your Articles of Incorporation with the Connecticut Secretary of State, including details about the corporation’s purpose and structure. Additionally, you may want to consider using a Professional Corporation Package for Connecticut to simplify the process, as it typically includes essential documents and compliance assistance. After the filing, ensure that you meet all ongoing requirements like licenses and permits to operate within your profession.

While PLLCs offer many benefits, they also have some disadvantages, such as increased administrative maintenance and compliance requirements. Additionally, some states impose limitations on the types of licensed professionals who can form a PLLC. Being aware of these drawbacks is crucial for making informed decisions. The Professional Corporation Package for Connecticut can guide you through the complexities of PLLC formation.

A Professional Corporation often enjoys several tax advantages, such as potential deductions for certain business expenses and the ability to choose a tax structure that may minimize liabilities. These benefits can lead to increased savings over time. Understanding these tax strategies is critical for professionals looking to optimize their financial health. The Professional Corporation Package for Connecticut provides valuable insights into leveraging these benefits.