Arizona Living Trust Rules

Description

How to fill out Arizona Revocation Of Living Trust?

Acquiring legal document examples that adhere to national and local regulations is essential, and the web provides a multitude of selections to pick from.

However, what is the benefit of squandering time searching for the suitable Arizona Living Trust Guidelines example online if the US Legal Forms digital library has already compiled such templates in one location.

US Legal Forms is the most comprehensive online legal directory with over 85,000 fillable documents created by lawyers for various business and personal situations.

Retrieve any documents you find through US Legal Forms as reusable. To redownload and complete forms you have previously purchased, visit the My documents section in your profile. Experience the broadest and most user-friendly legal documentation service!

- They are straightforward to navigate with all files categorized by state and intended use.

- Our experts keep track of legal changes, ensuring your form is always current and compliant when you acquire an Arizona Living Trust Guidelines from our site.

- Securing an Arizona Living Trust Guidelines is quick and effortless for both existing and new users.

- If you already have an account with an active subscription, Log In and download the document sample you require in the desired format.

- If you are new to our site, follow the steps below.

Form popularity

FAQ

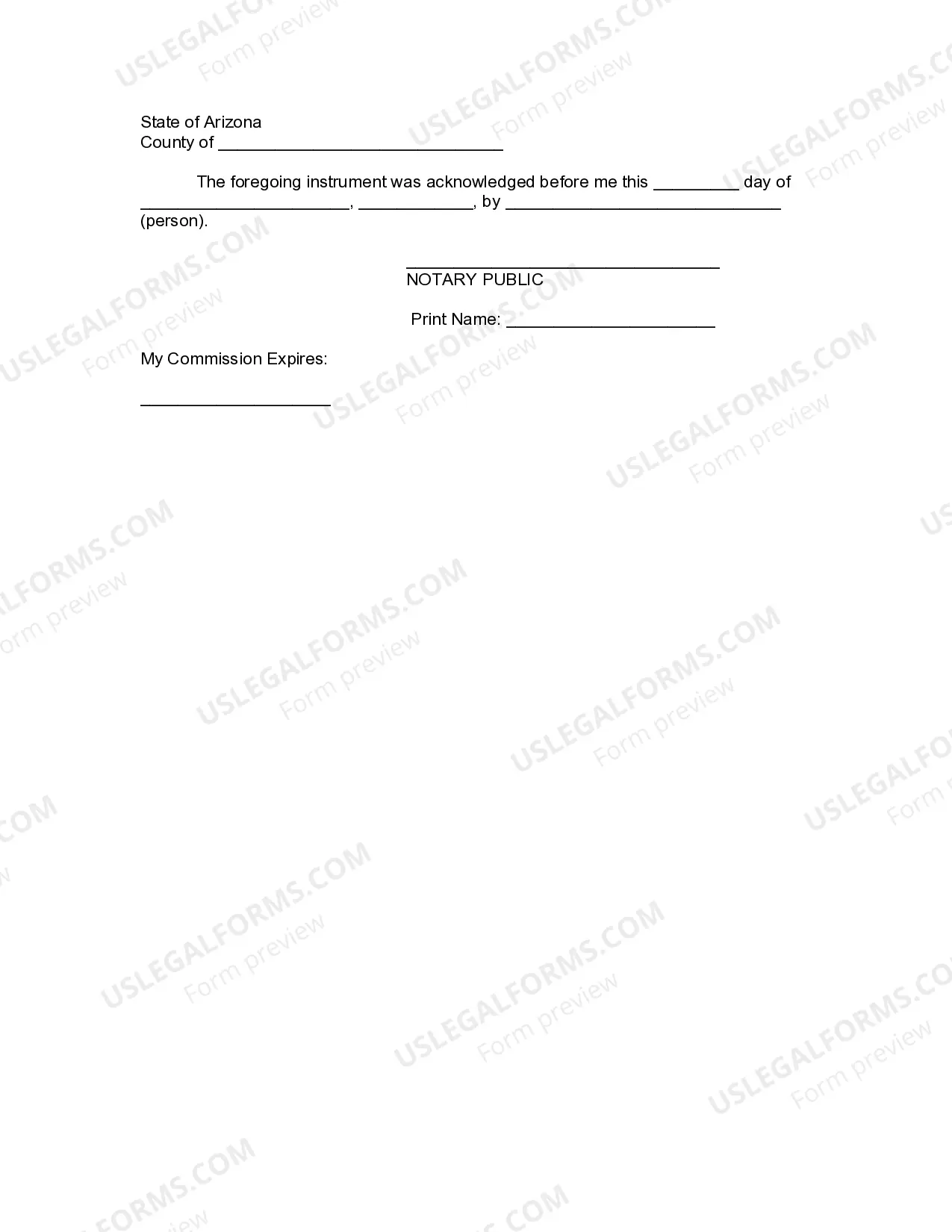

To create a living trust in Arizona you need to create a trust document that lays out all the details of your trust and names the trustee and beneficiaries. You will sign the document in front of a notary. To complete the process, you fund the trust by transferring the ownership of assets to the trust entity.

In Arizona, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Some types of assets do not have to go through probate under Arizona law, including: Assets transferred to a living trust: Such assets are owned by the trust at the time of a decedent's death and therefore are not considered part of the decedent's estate.

Arizona trusts require: The settlor creates a trust. Settlor indicates their intention to create a trust. A trustee is a person or professional fiduciary administering the trust. The trust must have at least one beneficiary receiving trust assets. Duties the trustee must perform. A sole trustee may not be a sole beneficiary.

You can set up a living trust by yourself. However, if you're not experienced, it might make more sense to get professional advice. If your estate is worth a lot, you may benefit from a living trust. The Uniform Probate Code, however, does simplify the probate process for estates without a trust in Arizona.