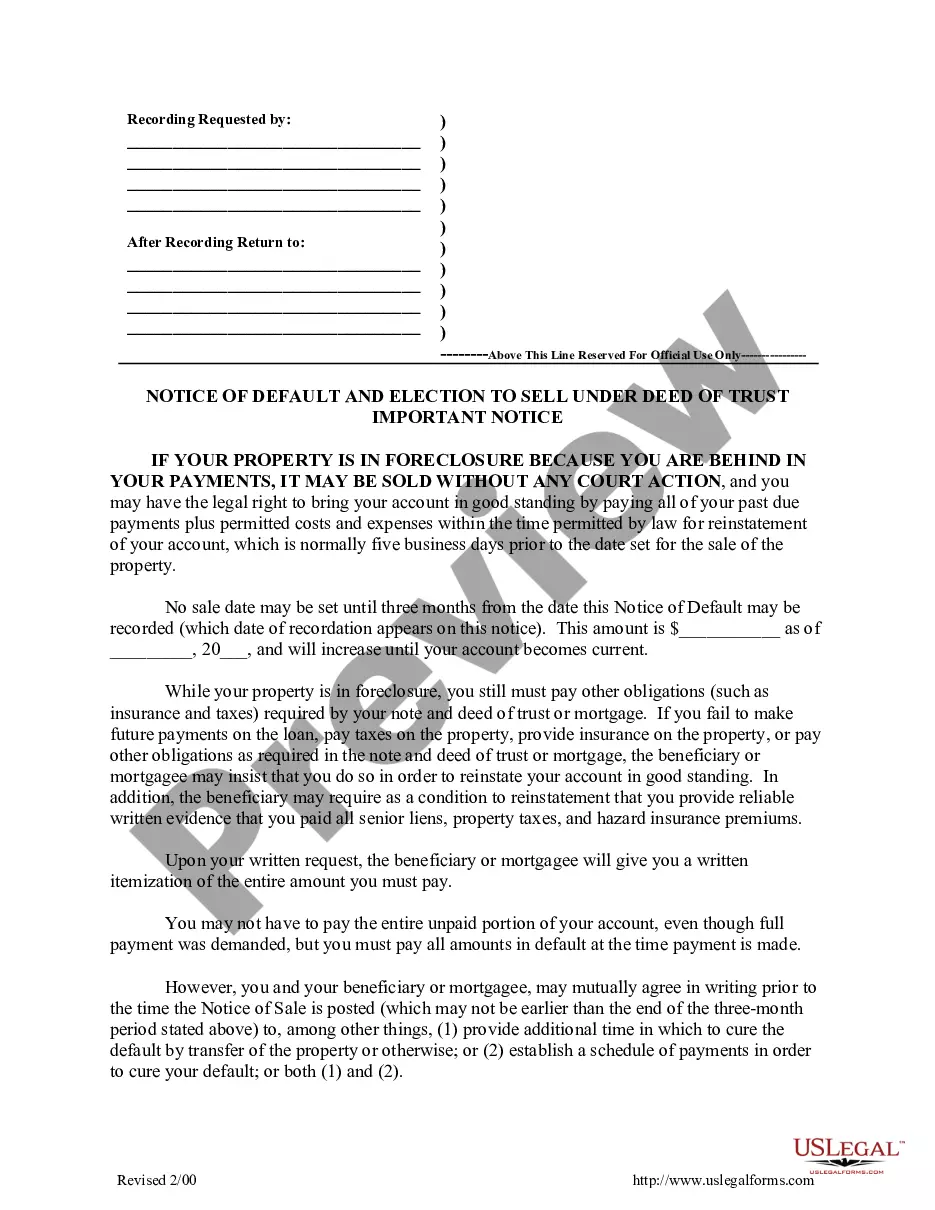

California Notice of Default and Election to Sell Under Deed of Trust

Description

How to fill out California Notice Of Default And Election To Sell Under Deed Of Trust?

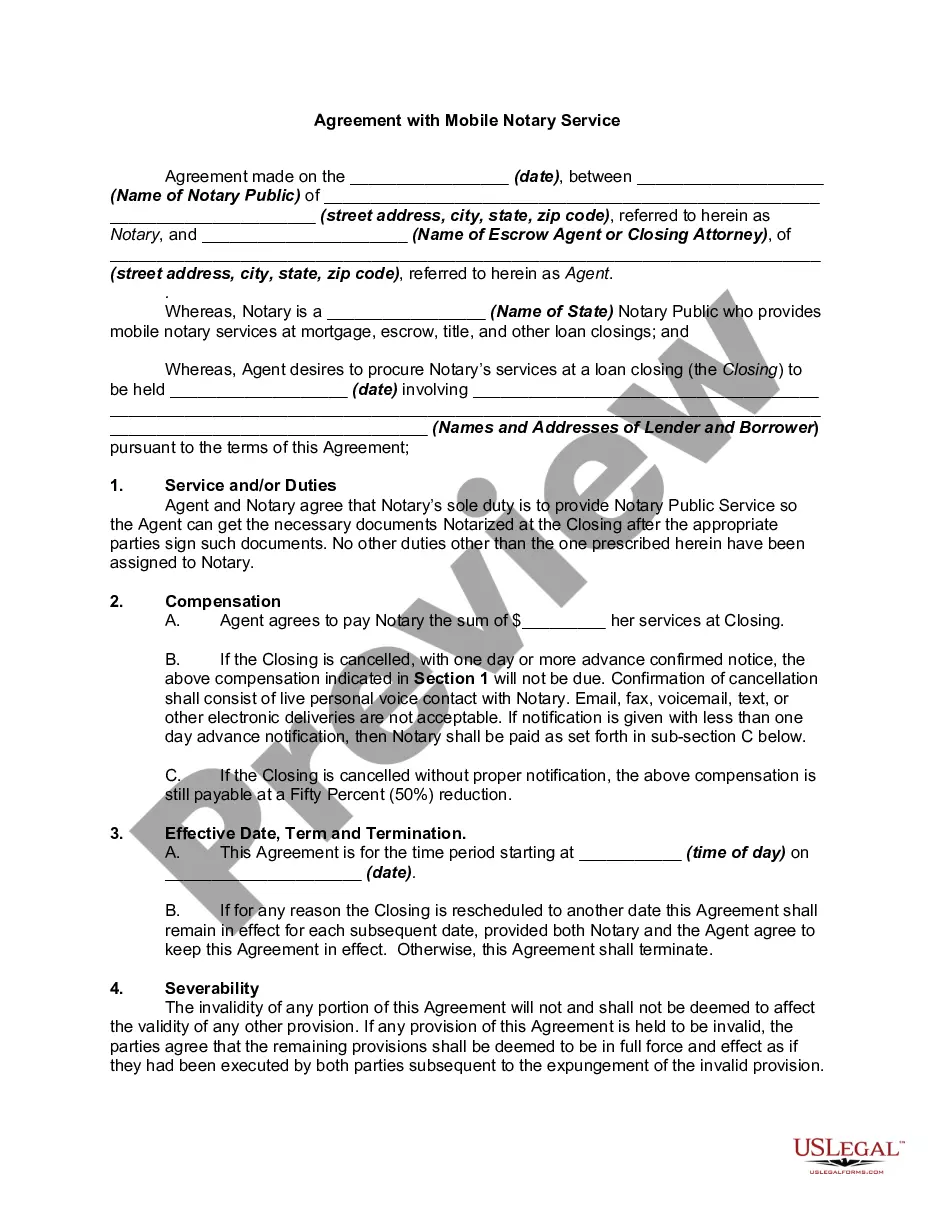

If you're in search of precise California Notice of Default and Election to Sell Under Deed of Trust copies, US Legal Forms is precisely what you require; discover documents supplied and verified by state-certified attorneys.

Using US Legal Forms not only alleviates your concerns regarding legal documentation; moreover, it saves you time, effort, and money! Acquiring, printing, and submitting a professional template is significantly less expensive than hiring a lawyer to handle it on your behalf.

And that's it. In just a few simple steps, you will acquire an editable California Notice of Default and Election to Sell Under Deed of Trust. Once your account is created, all future orders will be processed even more effortlessly. If you have a US Legal Forms subscription, simply Log In to your profile and click the Download button available on the form's page. Then, whenever you need to use this sample again, you will always find it in the My documents section. Don't waste your time and energy searching through countless forms on various platforms. Obtain accurate templates from a single secure platform!

- To start, complete your registration process by providing your email and creating a password.

- Follow the steps below to set up an account and obtain the California Notice of Default and Election to Sell Under Deed of Trust template to address your situation.

- Utilize the Preview feature or examine the document details (if available) to ensure that the template is the one you need.

- Verify its relevance to your state.

- Click on Buy Now to place an order.

- Choose a suggested pricing plan.

- Create your account and pay using your credit card or PayPal.

- Select a suitable format and save the document.

Form popularity

FAQ

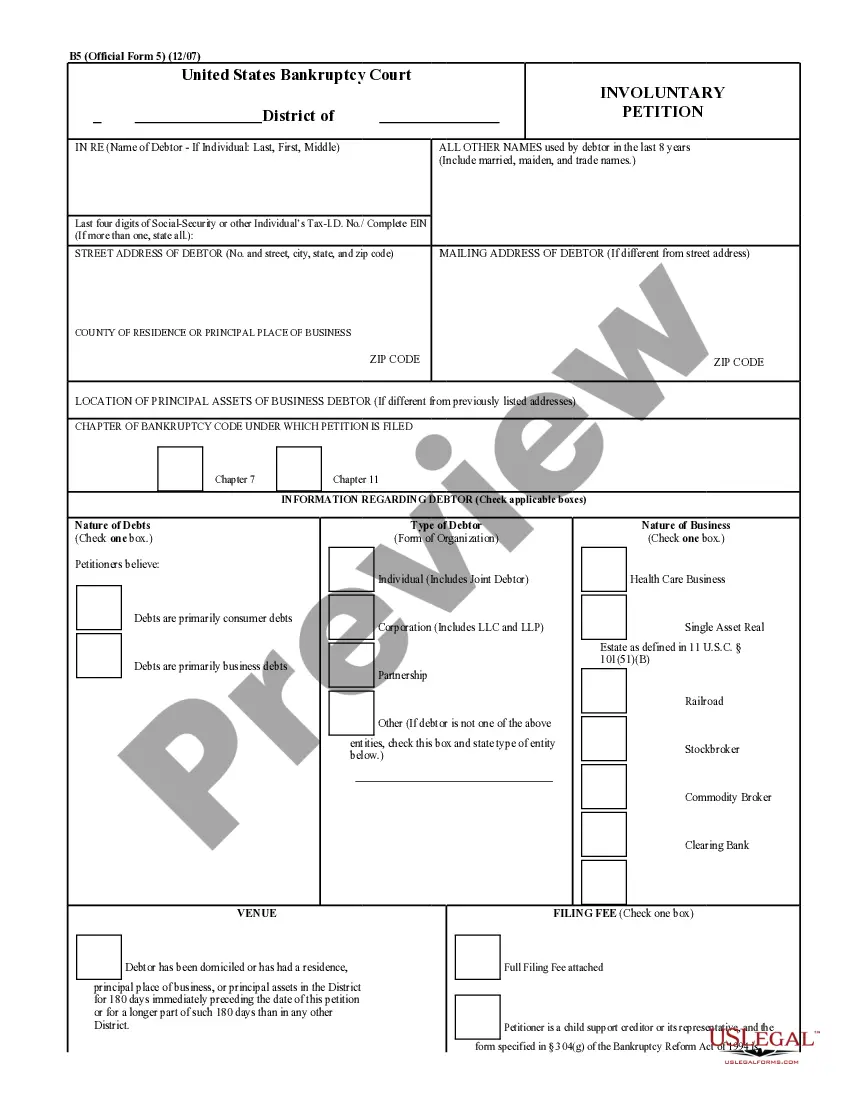

After you've received a Notice of Default, you have 3 months in which to attempt to get your loan current. As mentioned above, that means paying all back payments, interest, fees, property taxes, and insurance. After 3 months, the bank can officially set a date for the auction of your home.

The term notice of default refers to a public notice filed with a court that states that the borrower of a mortgage is in default on a loan. The lender may file a notice of default when a mortgagor falls behind on their mortgage payments.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

The notice of default doesn't affect your credit file, but when the account defaults this will be recorded.If the debt is regulated by the Consumer Credit Act, you must be sent a default notice warning letter and have time to act on it before the default is recorded on your credit file.

It takes several months for a lender to foreclose on a California property. If everything goes according to schedule, the process typically takes approximately 120 days about four months but the process can take as long as 200 or more days to conclude.

Pre-foreclosure in California is as short as 111 days, consisting of a 90-day default notice period followed by a 21-day foreclosure sale notice period.

After you've received a Notice of Default, you have 3 months in which to attempt to get your loan current. As mentioned above, that means paying all back payments, interest, fees, property taxes, and insurance. After 3 months, the bank can officially set a date for the auction of your home.

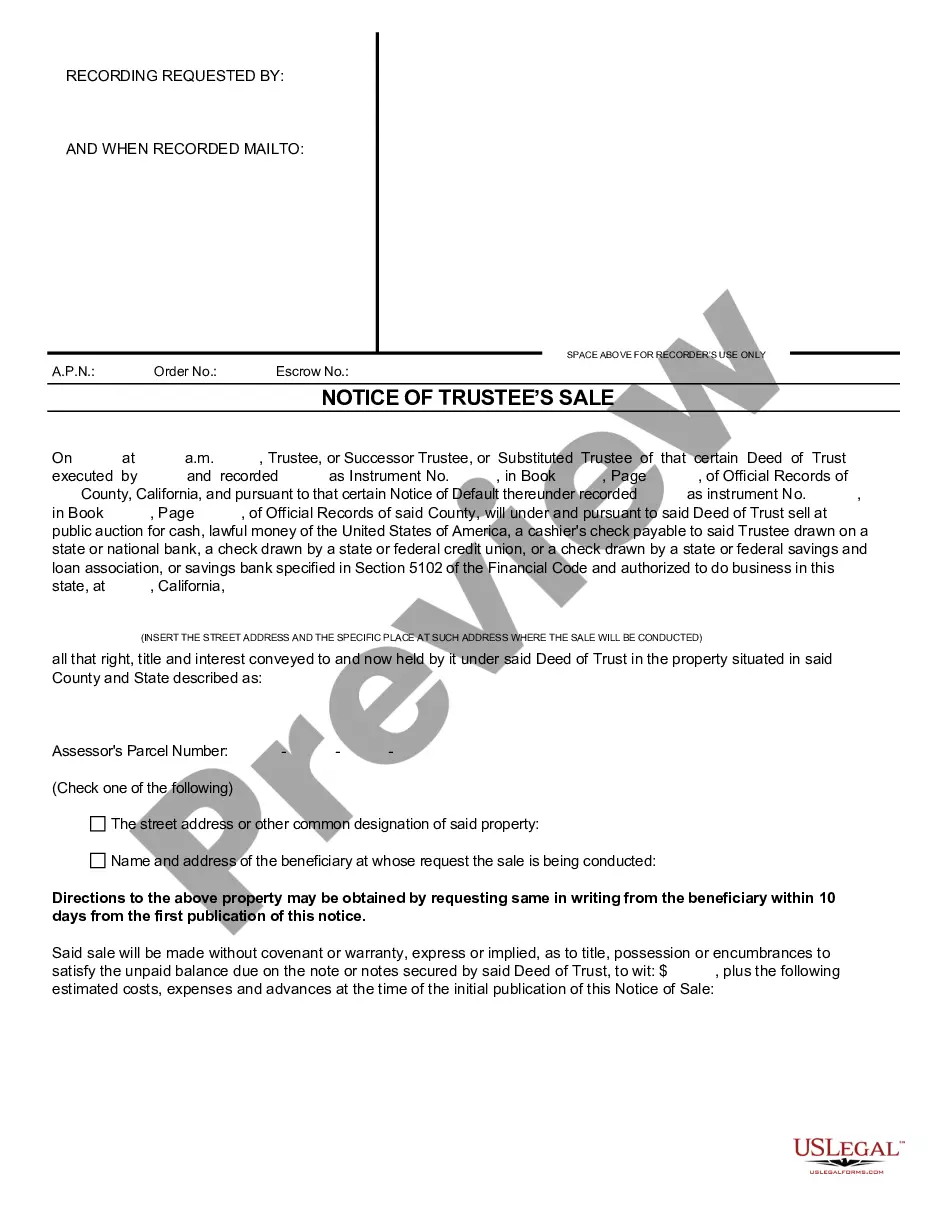

Step 1 Notice of Default. Record a Notice of Default with the county recorder. Step 2 Notice of Sale. If the borrower does not pay the balance stated in the Notice of Default within the deadline, the lender can go ahead with recording a Notice of Sale. Step 3 Auction. Step 4 Obtain Possession of Property.

In CA a Notice of Default does not expire.