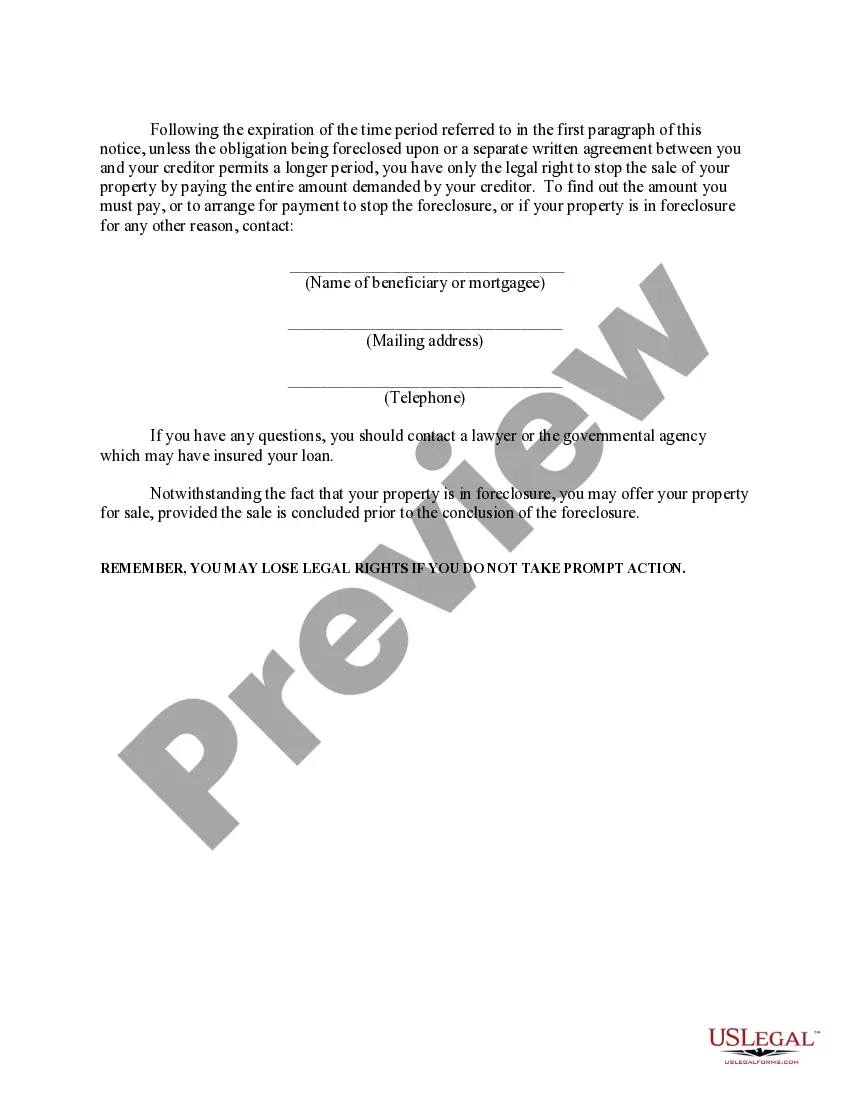

This form serves as a notice of default to the mortgagor for payments that are past due. The default notice states that while the property is in foreclosure, the mortgagor is still responsible for paying other obligations required by the note and the deed of trust. If the mortgagor fails to make future payments on the loan or other financial obligations, the beneficiary or the mortgagee may insist that he/she do so in order to reinstate the account into good standing. The form also emphasizes that the mortgagor could lose his/her rights in the property if prompt action is not taken.

California Notice of Default And Election to Sell Under Deed of Trust

Description

How to fill out California Notice Of Default And Election To Sell Under Deed Of Trust?

If you're in search of accurate California Notice of Default And Election to Sell Under Deed of Trust templates, US Legal Forms is exactly what you need; access files provided and verified by state-authorized legal experts.

Utilizing US Legal Forms not only spares you from complications related to legal documentation; additionally, you conserve time, effort, and funds! Downloading, printing, and submitting a professional template is considerably less expensive than hiring a lawyer to do it for you.

And that's it. In just a few simple clicks, you obtain an editable California Notice of Default And Election to Sell Under Deed of Trust. Once your account is created, all future orders will be processed even easier. When you have a US Legal Forms subscription, simply Log In to your profile and click the Download button you see on the form's webpage. Then, when you need to use this template again, you will always be able to find it in the My documents section. Don't waste your time reviewing hundreds of forms on various websites. Purchase professional templates from one secure service!

- To begin, complete your registration by entering your email and creating a secure password.

- Follow the instructions below to set up your account and locate the California Notice of Default And Election to Sell Under Deed of Trust template to address your situation.

- Utilize the Preview tool or examine the document description (if available) to ensure that the template is the one you need.

- Verify its applicability in your state.

- Click Buy Now to place an order.

- Select a preferred pricing plan.

- Create an account and pay with your credit card or PayPal.

- Choose an appropriate file format and save the document.

Form popularity

FAQ

After the lender files the Notice of Default, you get 90 days to bring your past-due bill current. After the 90 days pass, the lender files a Notice of Sale with the clerk. The Notice of Sale displays the location, date and time of the sale. It lists the trustee's name and contact information.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.

In CA a Notice of Default does not expire.

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

It takes several months for a lender to foreclose on a California property. If everything goes according to schedule, the process typically takes approximately 120 days about four months but the process can take as long as 200 or more days to conclude.

If a borrower falls behind on his mortgage payments, the mortgage lender might file a notice of default, which is an official public notice that the borrower is in arrears. It is one of the initial steps in the foreclosure process.

The term notice of default refers to a public notice filed with a court that states that the borrower of a mortgage is in default on a loan. The lender may file a notice of default when a mortgagor falls behind on their mortgage payments.

After you've received a Notice of Default, you have 3 months in which to attempt to get your loan current. As mentioned above, that means paying all back payments, interest, fees, property taxes, and insurance. After 3 months, the bank can officially set a date for the auction of your home.