What is Deed?

Deeds are legal documents that transfer ownership of real property. They are commonly used during sales or gifts of property. Explore our state-specific templates for your needs.

Deeds are essential documents for property transactions. Our attorney-drafted templates are quick and easy to complete.

Access everything needed for owner-financed real estate transactions, all in one convenient package.

Access everything needed for owner-financed real estate transactions, all in one convenient package.

Easily transfer property ownership from a trust to an individual, ensuring a clear legal title.

Use this agreement to outline the terms of buying or selling real estate through installments, securing both parties' interests.

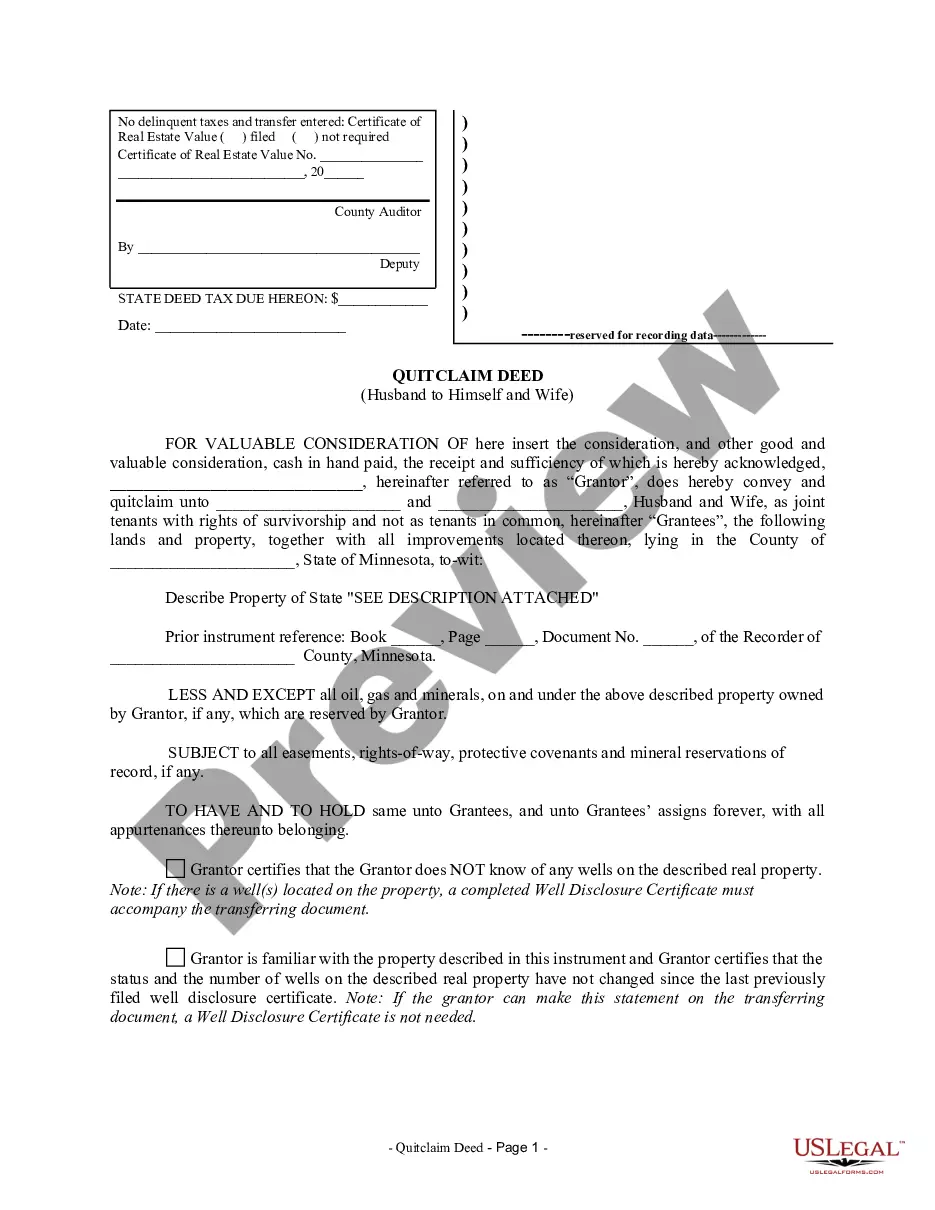

Transfer property ownership between individuals easily and efficiently without warranties or guarantees.

Use this document to legally transfer property ownership between individuals, ensuring clear title and protection against future claims.

Use this document to transfer property ownership from one partner to both partners, simplifying title and rights of survivorship.

Ensure your property transfers smoothly to a beneficiary upon death, avoiding probate complications and facilitating a clear transfer of ownership.

Safeguard ownership rights by transferring property from two individuals to one. Ideal for simplifying property claims and ensuring clear title transfer.

Transfer property ownership from four individuals to a couple using this straightforward deed form.

Essential for property transfers by executors, trustees, and other fiduciaries, ensuring legal compliance and clarity in ownership changes.

Deeds are vital for documenting property ownership changes.

Many deeds require notarization and sometimes witnesses.

Different types of deeds serve various purposes in property transfers.

Deeds should be recorded with local authorities to protect ownership rights.

Understanding the difference between deed types helps avoid future disputes.

A clear title is essential for a successful property transfer.

Parties involved in a deed must agree to the terms outlined.

Begin easily with these steps.

A trust can provide additional benefits and control over asset distribution, unlike a will.

Failing to create a plan may lead to unintended distribution of your property.

It's wise to review your plan regularly, especially after major life changes.

Beneficiary designations typically override wills, so they should align with your overall plan.

Yes, you can appoint separate individuals for financial and health care decisions.