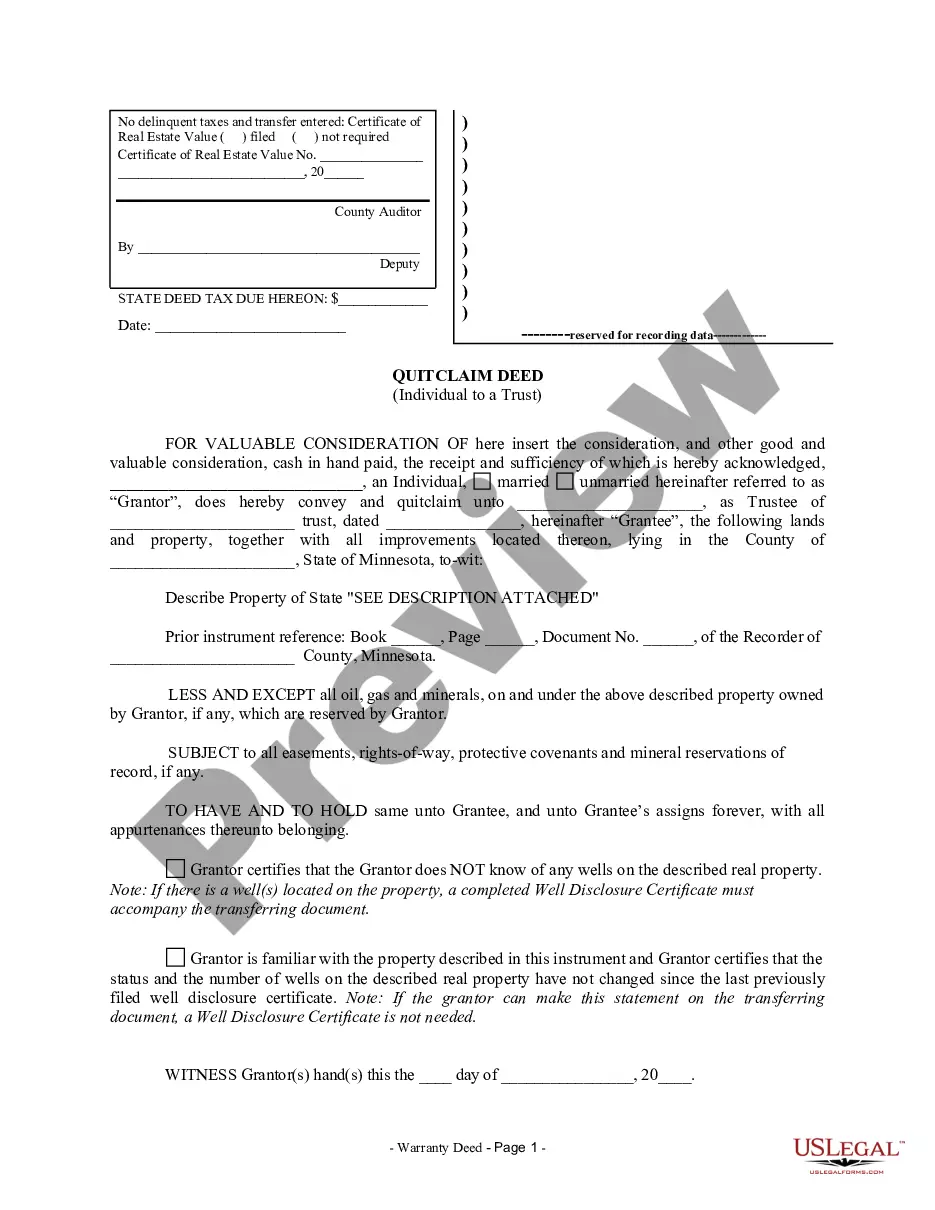

Minnesota Quitclaim Deed from Individual to a Trust

Description

How to fill out Minnesota Quitclaim Deed From Individual To A Trust?

Utilize US Legal Forms to acquire a printable Minnesota Quitclaim Deed from an Individual to a Trust. Our legally acceptable forms are created and consistently updated by experienced attorneys.

We offer the most comprehensive Forms library available online, providing affordably priced and precise templates for clients, legal experts, and small to medium-sized businesses.

The templates are categorized based on state requirements, and several can be viewed before downloading.

Create your account and complete payment via PayPal or credit card. Download the template to your device and feel free to reuse it multiple times. Use the Search field if you require another document template. US Legal Forms offers thousands of legal and tax templates and packages for both business and personal requirements, including the Minnesota Quitclaim Deed from Individual to a Trust. Over three million users have successfully utilized our platform. Select your subscription plan and acquire high-quality forms within a few clicks.

- To obtain templates, clients must possess a subscription and Log In to their account.

- Select Download next to any form you desire and access it in My documents.

- For those without a subscription, adhere to the following steps to effortlessly locate and download the Minnesota Quitclaim Deed from Individual to a Trust.

- Ensure you have the correct template according to the state requirements.

- Examine the document by reviewing the description and using the Preview function.

- Click Buy Now if it’s the form you need.

Form popularity

FAQ

To complete a Minnesota Quitclaim Deed from Individual to a Trust, you first need to obtain the appropriate form, which is available online or through legal service providers. Next, fill out the deed with accurate property descriptions and the names of the individuals transferring the property to the trust. After that, sign the deed in front of a notary public to ensure its validity. Finally, file the completed deed with your county recorder’s office to make the transfer official.

You do not necessarily need a lawyer to obtain a Minnesota Quitclaim Deed from Individual to a Trust. Many individuals successfully complete this process on their own by following the right steps and using the appropriate forms. However, consulting with a legal professional can provide clarity and ensure that all legal requirements are met. If you prefer a more straightforward approach, consider using US Legal Forms, which offers easy access to the necessary documents and guidance for your specific situation.

Transferring property to a family trust involves creating a Minnesota Quitclaim Deed from Individual to a Trust. Begin by drafting the deed to reflect the transfer accurately, and include the trust's name as the new owner. Once completed, sign the document in front of a notary, and file it with your local county recorder's office. Using US Legal Forms can simplify this process, providing you with the necessary templates and guidance.

To file a Minnesota Quitclaim Deed from Individual to a Trust, start by obtaining the appropriate form from a reliable source, such as US Legal Forms. Fill out the form accurately, ensuring all required information is included. After completing the deed, you must have it signed in the presence of a notary public. Finally, submit the signed deed to your local county recorder's office to complete the filing process.

Choosing between a quitclaim deed and a trust depends on your goals. A quitclaim deed is useful for transferring property quickly, while a trust can offer comprehensive estate planning benefits. Using a Minnesota Quitclaim Deed from Individual to a Trust can combine the advantages of both, providing a streamlined transfer process and a structured approach to asset management.

A quitclaim deed cannot be used in situations where there are existing liens or disputes over the property title. Additionally, if the property is subject to court orders or foreclosure, a quit claim deed may not be a viable option. Always consult with a legal professional to determine the best approach for your specific case.

While a quit claim deed is a straightforward way to transfer ownership, it has some disadvantages. Notably, it does not provide any warranties regarding the title, which means the recipient may inherit potential liabilities. Additionally, using a quit claim deed may not be the best option for all situations, so it's wise to consider your unique circumstances.

To retitle a house into a trust, you will need to complete a quit claim deed that specifies the trust as the new owner. After preparing the deed, you must sign it and have it notarized, then file it with the appropriate county office. Using the Minnesota Quitclaim Deed from Individual to a Trust ensures that your property is correctly titled and managed under the trust.

Yes, you can quit claim a house to a trust. This transfer helps in managing the property within the trust structure and can offer estate planning advantages. It is important to ensure that the quit claim deed is executed properly to reflect the trust as the new owner.

In Minnesota, a quit claim deed allows an individual to transfer their interest in a property to another party, such as a trust. The deed does not guarantee that the property has clear title, meaning it simply conveys what the grantor owns. By using a Minnesota Quitclaim Deed from Individual to a Trust, you can effectively manage your assets and simplify estate planning.