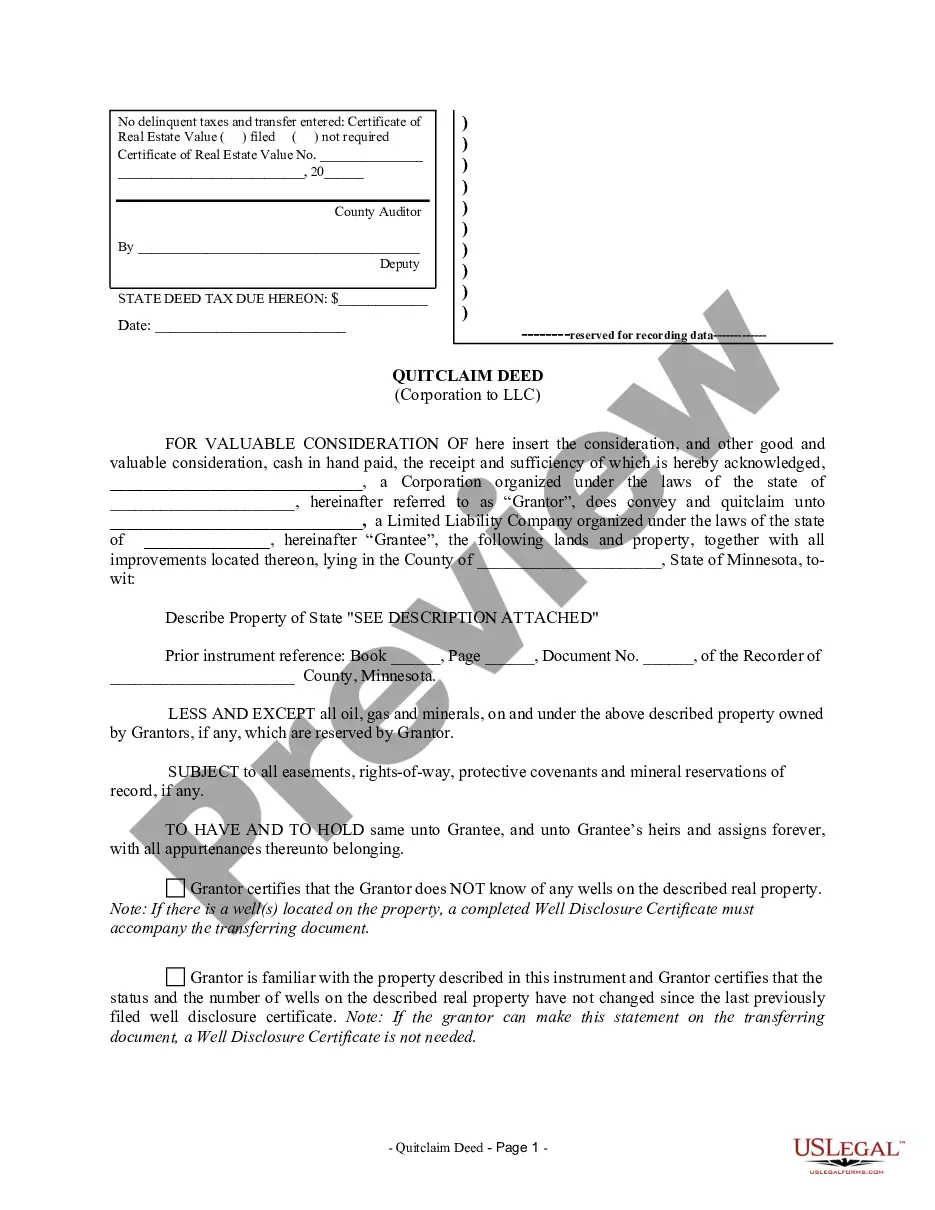

Minnesota Quitclaim Deed from Corporation to LLC

Description

How to fill out Minnesota Quitclaim Deed From Corporation To LLC?

Obtain any template from 85,000 legal documents like Minnesota Quitclaim Deed from Corporation to LLC via US Legal Forms. Each template is crafted and refreshed by attorneys licensed in the state.

If you already have a subscription, Log In. Once you’re on the form’s page, hit the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, follow these guidelines.

With US Legal Forms, you’ll consistently have instant access to the necessary downloadable template. The platform offers forms and categorizes them to simplify your search. Utilize US Legal Forms to quickly and effortlessly obtain your Minnesota Quitclaim Deed from Corporation to LLC.

- Verify the state-specific prerequisites for the Minnesota Quitclaim Deed from Corporation to LLC that you wish to utilize.

- Review the description and examine the template.

- When you’re certain that the template meets your needs, simply click Buy Now.

- Choose a subscription plan that fits your financial situation.

- Establish a personal account.

- Make a payment using one of two convenient methods: credit card or PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the file to the My documents section.

- After your reusable form is downloaded, print it or save it to your device.

Form popularity

FAQ

Yes, you can file a Minnesota Quitclaim Deed from Corporation to LLC online, making the process more convenient. Many platforms, including uslegalforms, provide easy-to-use templates and guidance for filing your deed electronically. This allows you to complete the necessary paperwork from the comfort of your home, saving you time and effort. However, ensure that you follow your local county's specific requirements for online submissions.

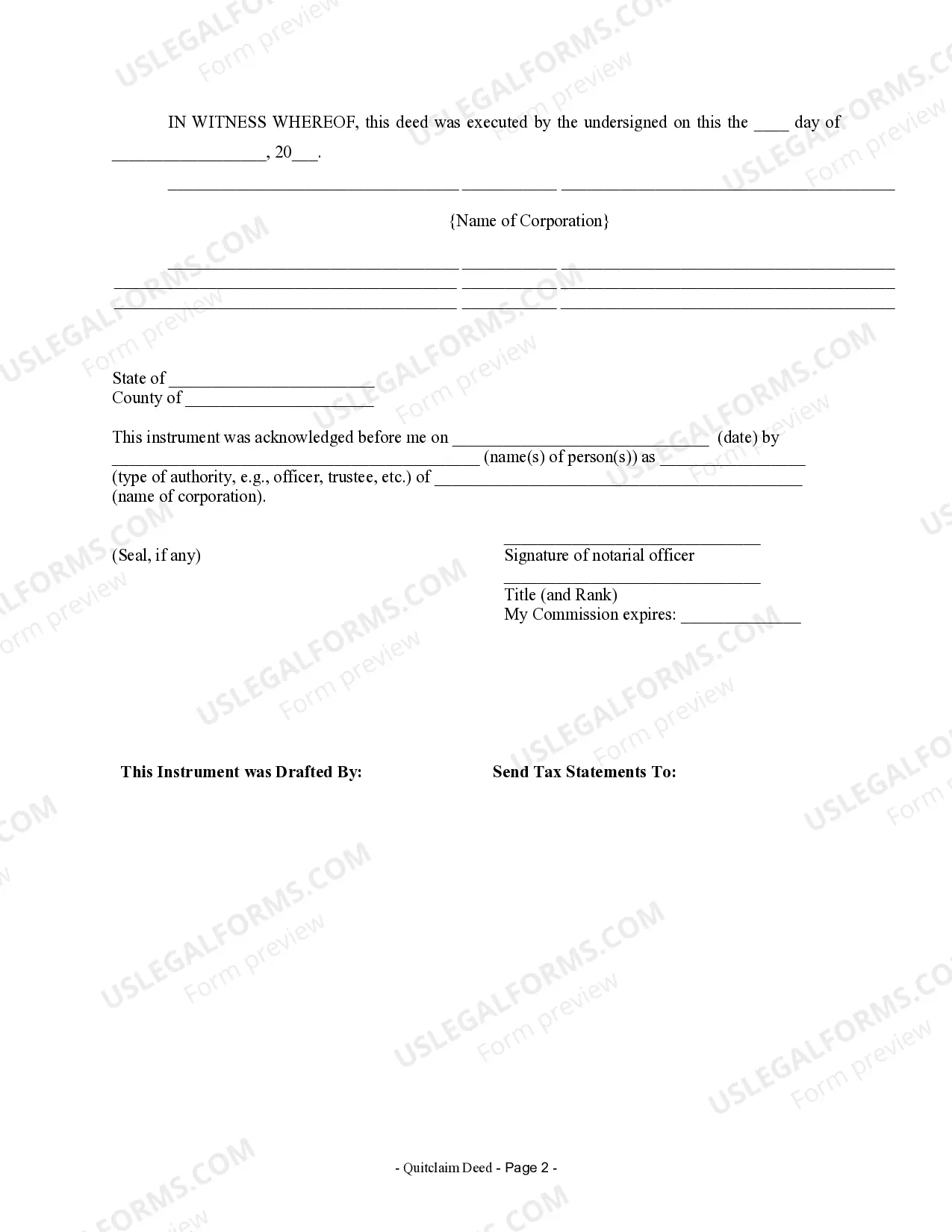

While it is not legally required to have a lawyer when executing a Minnesota Quitclaim Deed from Corporation to LLC, having legal guidance can simplify the process. A lawyer can ensure that all necessary documents are correctly prepared and filed, reducing the risk of errors. Furthermore, legal advice helps you understand the implications of transferring property ownership. Therefore, if you have any uncertainties, consulting a lawyer is a wise choice.

Yes, you can use a Minnesota Quitclaim Deed from Corporation to LLC to transfer ownership of a house to an LLC. This type of transfer can provide liability protection for the property and streamline management. However, it's important to follow proper legal procedures and ensure that all documentation is correctly filed. UsLegalForms offers resources and templates that can help simplify this process for you.

A Minnesota Quitclaim Deed from Corporation to LLC cannot be used in certain situations, such as when there are existing liens against the property. Additionally, if the property is held in a trust or if there are specific restrictions in the original deed, a quitclaim deed may not be appropriate. It's essential to consult with a legal professional to ensure that the quitclaim deed meets all legal requirements and is suitable for your specific circumstances.

A quit claim deed can be voided under certain circumstances, such as if it was executed under duress or if one party lacked the legal capacity to sign. Additionally, if the deed does not meet state requirements or if there is evidence of fraud, it could also be rendered void. To prevent such issues, using a Minnesota Quitclaim Deed from Corporation to LLC should be done with careful consideration and, ideally, professional guidance.

Yes, executing a quit claim deed to transfer property to an LLC is entirely feasible and often straightforward. This process allows property owners to effectively convey their interests in the property to the LLC without extensive legal hurdles. When utilizing a Minnesota Quitclaim Deed from Corporation to LLC, it’s essential to accurately complete the deed to avoid potential legal disputes.

While a quit claim deed can facilitate quick property transfers, it does come with disadvantages. It does not provide any warranties regarding the title, meaning that if there are any claims against the property, the new owner may face unexpected issues. Additionally, without proper documentation and legal advice, using a Minnesota Quitclaim Deed from Corporation to LLC could lead to complications down the line.

To transfer ownership of property to an LLC, you typically start by drafting a quit claim deed. This deed must clearly state the property being transferred and the parties involved. After completing the Minnesota Quitclaim Deed from Corporation to LLC, you should file it with the county recorder's office to ensure the transfer is legally recognized.

Yes, you can use a quit claim deed to transfer property ownership to an LLC. This type of deed allows for a quick and straightforward transfer without needing extensive legal documentation. When executing a Minnesota Quitclaim Deed from Corporation to LLC, ensure that all parties involved understand the implications of the transfer.

Many individuals choose to put their property in an LLC to protect their personal assets from liabilities associated with the property. This separation can limit personal liability should any legal issues arise. Additionally, using an LLC can offer tax benefits and simplify the process of transferring ownership, such as through a Minnesota Quitclaim Deed from Corporation to LLC.