Sample Letter to Credit Bureau concerning Decedent's Credit Report - Attorney

What this document covers

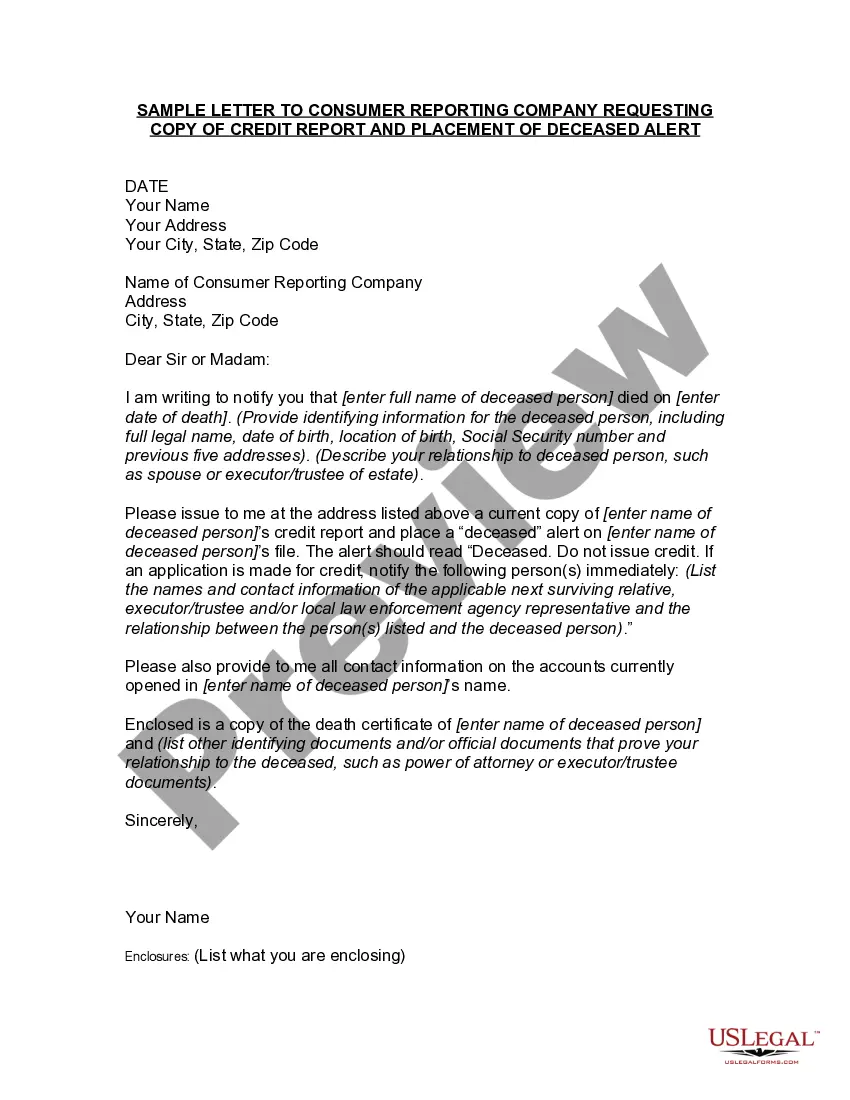

This Sample Letter to Credit Bureau concerning Decedent's Credit Report is a legal document designed to formally request a deceased individual's credit report from a credit bureau. It is specifically created for attorneys acting on behalf of an estate administrator. This letter differs from general credit report requests by including necessary authorizations and information required for handling a decedent's estate, ensuring compliance with legal standards in this sensitive context.

What’s included in this form

- Date: The date when the letter is being sent.

- Recipient's information: Credit bureau's name and address.

- Administrator information: Identifies the administrator of the estate.

- Enclosures: Mentions the certified copy of the Letters of Administration and payment for the credit report fee.

- Request: A clear request for the credit report of the deceased individual.

When to use this form

This form is necessary when an estate administrator needs to obtain a credit report of a deceased individual for settling debts, managing estate assets, or other probate-related matters. It is useful in situations where the administrator needs to assess outstanding debts or check accounts in the decedent's name to ensure proper handling of the estate.

Who can use this document

This form should be used by:

- Attorneys representing an estate.

- Estate administrators handling the affairs of a deceased individual.

- Individuals legally appointed as representatives of an estate.

How to prepare this document

- Identify the date and fill it in at the top of the letter.

- Enter the credit bureau's name and address correctly.

- Specify the name of the estate administrator and the deceased individual.

- Attach a certified copy of the Letters of Administration to the letter.

- Include a check for the appropriate fee for the credit report.

- Sign the letter before sending it to the credit bureau.

Notarization guidance

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Typical mistakes to avoid

- Forgetting to attach the Letters of Administration.

- Incorrectly addressing the credit bureau.

- Not including the payment for the credit report fee.

- Failing to sign the letter before submission.

Benefits of completing this form online

- Convenience of downloading and printing the form at any time.

- Editable format allowing for easy customization.

- Reliability of having a document drafted by licensed attorneys.

Legal use & context

- This letter serves as a formal request and complies with legal processes involved in managing a decedent's estate.

- It is necessary for obtaining sensitive credit information essential for settling the estate's obligations.

- Understanding state regulations regarding the release of credit information is crucial.

Quick recap

- Use this form to legally request a deceased person's credit report.

- Ensure all required enclosures are included with the request.

- Follow local laws regarding credit report requests and estate management.

Form popularity

FAQ

Experian. P.O. Box 4500. Allen, TX 75013. TransUnion Consumer Solutions. P.O. Box 2000. Chester, PA 19016-2000. Equifax. P.O. Box 740241. Atlanta, GA 30374-0241.

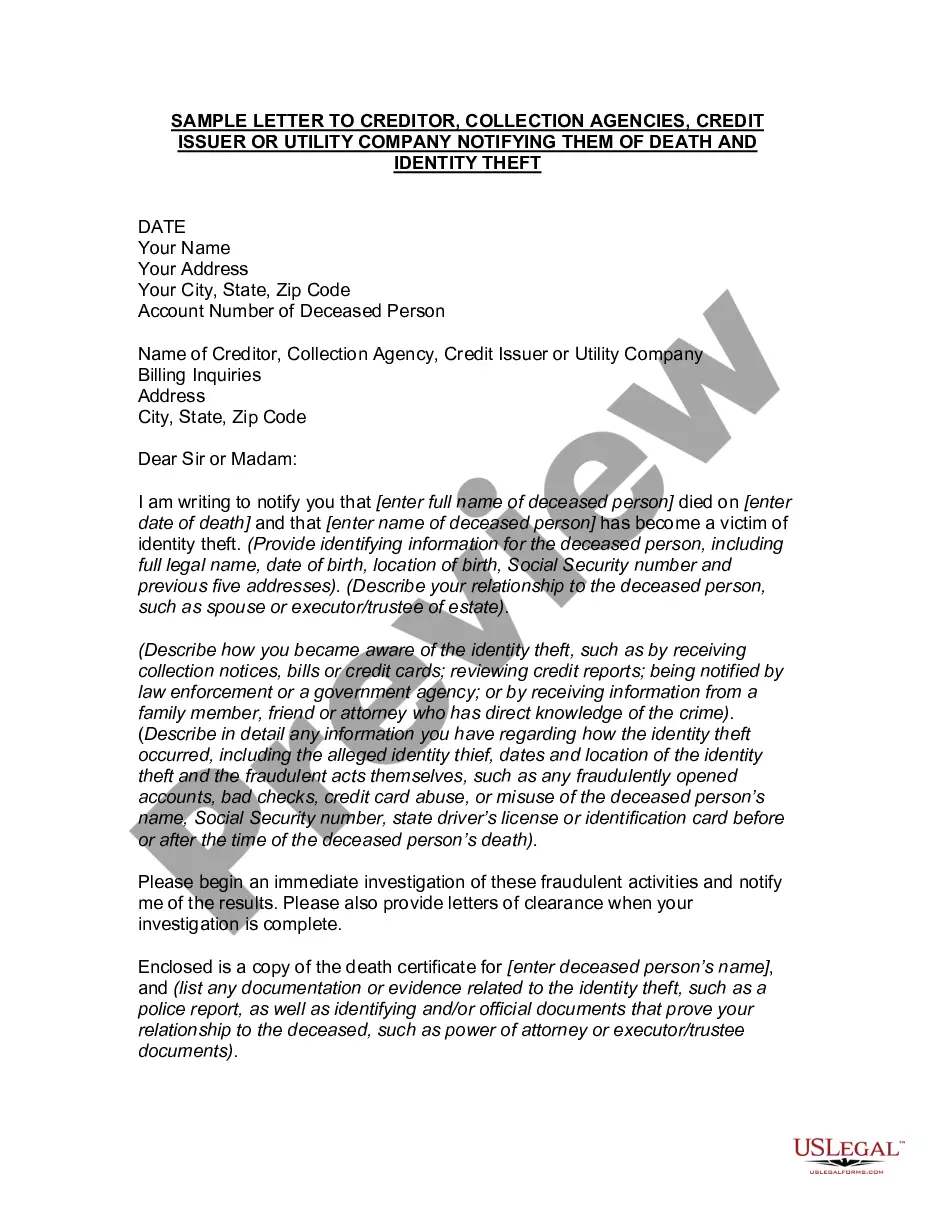

Ensure the Social Security Administration has updated their files for your loved one. Write a letter to one of the nationwide credit reporting agencies. Review your loved one's credit report. Contact all creditors that the deceased person did business with. Report any suspected fraud found on their credit report.

How to notify credit bureaus of death. A person's credit report is not automatically closed after someone passes away. Instead, credit bureaus wait for notification from the executor of the deceased's estate or the Social Security Administration.

Dear {Name}, This letter is to inform you that {Name} has passed away and to request that a formal death notice be added to {his/her} file in your accounts. {Name}'s full name was {Full Name}. At the time of death, {his/her} residence was {Address}, {City} in {County} County, {State}.

A 609 letter is a method of requesting the removal of negative information (even if it's accurate) from your credit report, thanks to the legal specifications of section 609 of the Fair Credit Reporting Act.

You may need to contact lenders and creditors to notify them the person is deceased and the accounts need to be closed, even if the account has a zero balance. Lender and creditor contact information can be found on the credit reports.

How do I obtain a credit report for a deceased person? The spouse or executor of the estate may request the deceased person's credit report by mailing a request to each of the credit reporting companies.

You may need to contact lenders and creditors to notify them the person is deceased and the accounts need to be closed, even if the account has a zero balance. Lender and creditor contact information can be found on the credit reports.

If you wish, you may mail a copy of your mother's death certificate to Experian, P.O. Box 4500, Allen, TX 75013. You may also submit it online by uploading your documents.