Minnesota Quitclaim Deed from Individual to Individual

Description

Key Concepts & Definitions

Quitclaim Deed: A legal instrument used to transfer an owner's interest in property from one person to another, without any warranties of ownership. Typically used between family members or within personal relationships where the level of trust is high.

Step-by-Step Guide on How to Use a Quitclaim Deed from Individual to Individual

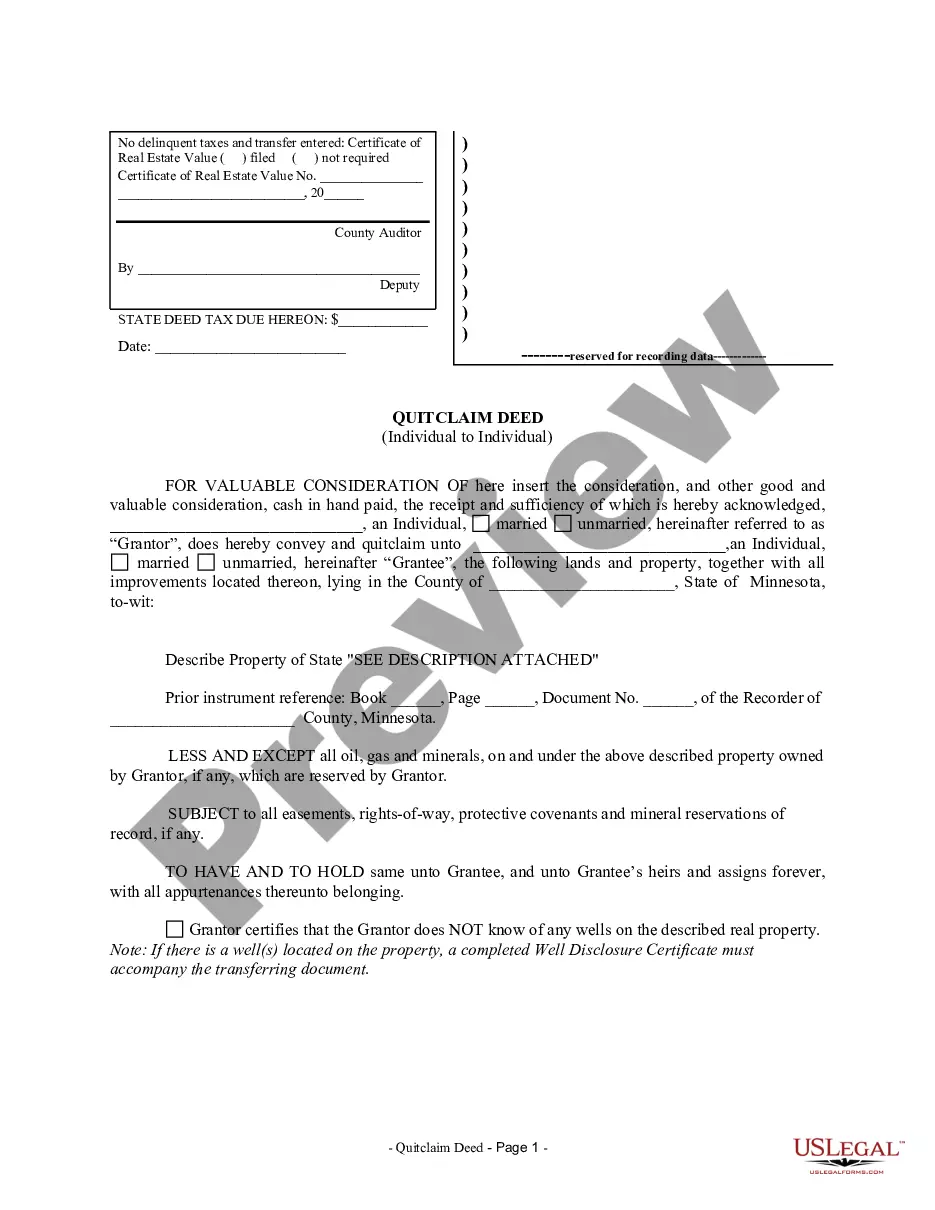

- Prepare the Quitclaim Deed Form: Start by obtaining a quitclaim deed form specific to your state or region in the United States. This form requires the legal description of the property, which includes the boundary lines, any easements, and other significant details.

- Fill Out the Form: Complete the form with the correct legal names of the grantor (current owner) and the grantee (new owner), along with the legal description of the property. Ensure all details align with property tax records.

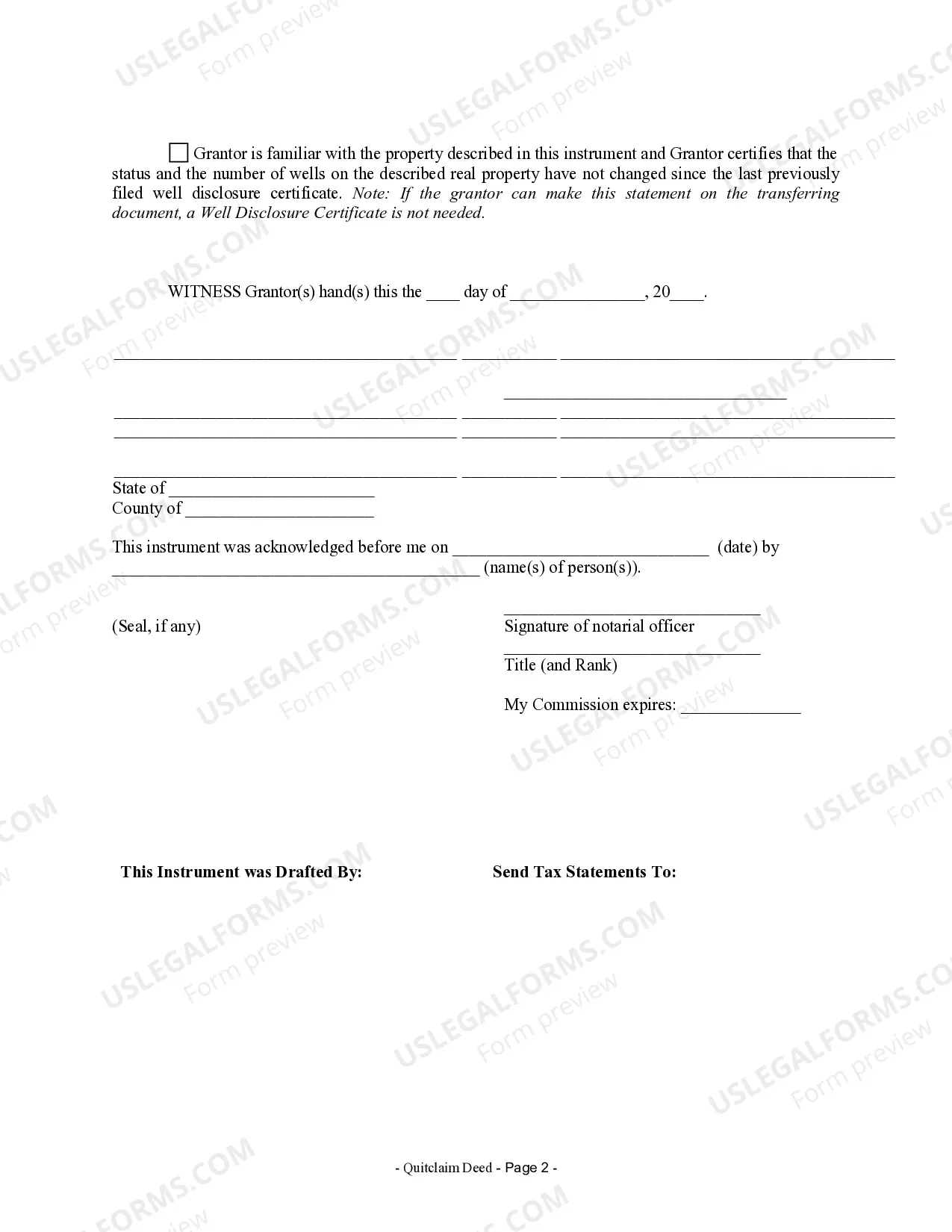

- Signature and Notarization: Both parties sign the deed in the presence of a notary public to validate the identities of the parties involved.

- File the Quitclaim Deed: File the signed deed with the local county recorder or land registry office to make the transfer official. This may require a filing fee.

- Update Property Tax Records: Notify the local property tax office of the change in ownership to ensure the property tax bills are sent to the new owner.

Risk Analysis

Using a quitclaim deed involves certain risks such as no guarantee of a clear title, potential issues with future sales of the property, and possible disputes over property ownership. It's advisable for individuals to conduct thorough due diligence and possibly engage legal assistance before proceeding.

Common Mistakes & How to Avoid Them

- Inaccurate Legal Descriptions: Ensure the legal description on the quitclaim deed exactly matches the one in the property's current deed or tax records.

- Failing to File the Deed: Not filing the deed with the appropriate local office can result in invalidating the transfer.

- Lack of Legal Consultation: Not consulting with a real estate attorney can lead to overlooking important legal implications of transferring property ownership via a quitclaim deed.

Pros & Cons of Using Quitclaim Deeds

- Pros: Simple and cost-effective method to transfer property ownership; requires fewer documents and less time compared to other methods of property transfer.

- Cons: Provides no warranties on the title; may lead to complications if there are issues with the title or property disputes in the future.

FAQ

- What is a legal description of a property? A legal description provides detailed boundaries and measurements of a parcel of property, which are registered with the local municipality.

- Are quitclaim deeds reversible? Generally, once a quitclaim deed is executed and filed, the transfer of ownership is considered final, unless errors in the deed can be proven or both parties agree to reverse the transaction under specific conditions.

How to fill out Minnesota Quitclaim Deed From Individual To Individual?

Obtain any template from 85,000 legal documents including the Minnesota Quitclaim Deed from Individual to Individual online with US Legal Forms. Each template is crafted and updated by state-licensed legal experts.

If you already possess a subscription, Log In. Once you are on the form’s page, click on the Download button and navigate to My documents to gain access to it.

If you haven't subscribed yet, follow the steps listed below.

With US Legal Forms, you will consistently have swift access to the relevant downloadable template. The platform provides you with access to documents and categorizes them to facilitate your search. Utilize US Legal Forms to acquire your Minnesota Quitclaim Deed from Individual to Individual quickly and effortlessly.

- Verify the state-specific requirements for the Minnesota Quitclaim Deed from Individual to Individual you intend to utilize.

- Review the description and preview the template.

- Once you’re assured the sample meets your needs, click Buy Now.

- Choose a subscription plan that truly fits your financial situation.

- Establish a personal account.

- Make payment using one of two convenient methods: by credit card or through PayPal.

- Choose a format to download the document in; two choices are available (PDF or Word).

- Download the document to the My documents tab.

- When your reusable form is prepared, print it out or store it on your device.

Form popularity

FAQ

While our focus is on the Minnesota Quitclaim Deed from Individual to Individual, it’s good to know that a quitclaim deed in Georgia requires the names of both the grantor and grantee, a legal description of the property, and the signature of the grantor. You must also have the deed notarized and recorded. If you need assistance, platforms like US Legal Forms can guide you through the process.

Yes, you can transfer a quitclaim deed to another party. When you use a Minnesota Quitclaim Deed from Individual to Individual, you can pass your rights in the property to someone else easily. Just remember to complete the necessary paperwork and record the new deed to make the transfer official and recognized by local authorities.

To transfer ownership of a property in Minnesota, you typically need to complete a quitclaim deed or a warranty deed. Using a Minnesota Quitclaim Deed from Individual to Individual simplifies the process, allowing you to quickly transfer ownership without extensive legal requirements. Ensure you fill out the deed correctly, sign it in front of a notary, and file it with your county recorder's office.

In Minnesota, a quitclaim deed works by allowing one party to transfer their rights in a property to another party. When you execute a Minnesota Quitclaim Deed from Individual to Individual, the deed must be signed, notarized, and recorded with the county. This process ensures that the transfer is legally recognized and protects the interests of both parties involved.

Yes, a quitclaim deed transfers ownership of property from one individual to another. When you use a Minnesota Quitclaim Deed from Individual to Individual, the grantor relinquishes any interest they may have in the property. However, it's important to note that this type of deed does not guarantee that the grantor actually owns the property. You should verify ownership before proceeding.

Filing a Minnesota Quitclaim Deed from Individual to Individual is a straightforward process. Once you have completed your deed, you must take it to your local county recorder's office. Ensure that the document is signed and notarized before filing. After submission, the recorder will officially record the deed, making it part of the public record and finalizing the property transfer.

Yes, you can fill out a Minnesota Quitclaim Deed from Individual to Individual yourself. However, it is essential to ensure that you understand the legal requirements and the correct information needed for the deed. Utilizing resources from platforms like USLegalForms can simplify the process, providing you with the correct forms and guidance. This way, you can confidently complete the deed without needing an attorney.

To complete a Minnesota Quitclaim Deed from Individual to Individual, you first need to gather the necessary information, including the legal description of the property and the names of both the grantor and grantee. Next, use a form specific to Minnesota quitclaim deeds, which can be found on platforms like USLegalForms. After filling out the form correctly, ensure it is signed in front of a notary public. Finally, you will need to file the completed document with the county recorder's office to make it official.

You do not necessarily need a lawyer to file a Minnesota Quitclaim Deed from Individual to Individual, as the process can be straightforward. However, having legal assistance can ensure all details are correct and compliant with state laws. If you prefer to handle it yourself, resources like US Legal Forms provide comprehensive instructions and form templates to help you navigate the process confidently.

Transferring a Minnesota Quitclaim Deed from Individual to Individual involves filling out the quitclaim deed form with the names of the grantor and grantee. Next, both parties should sign the document in front of a notary public. After notarization, you need to record the deed at the county recorder's office to make the transfer official. Platforms like US Legal Forms offer guidance and templates that can make this process smoother.