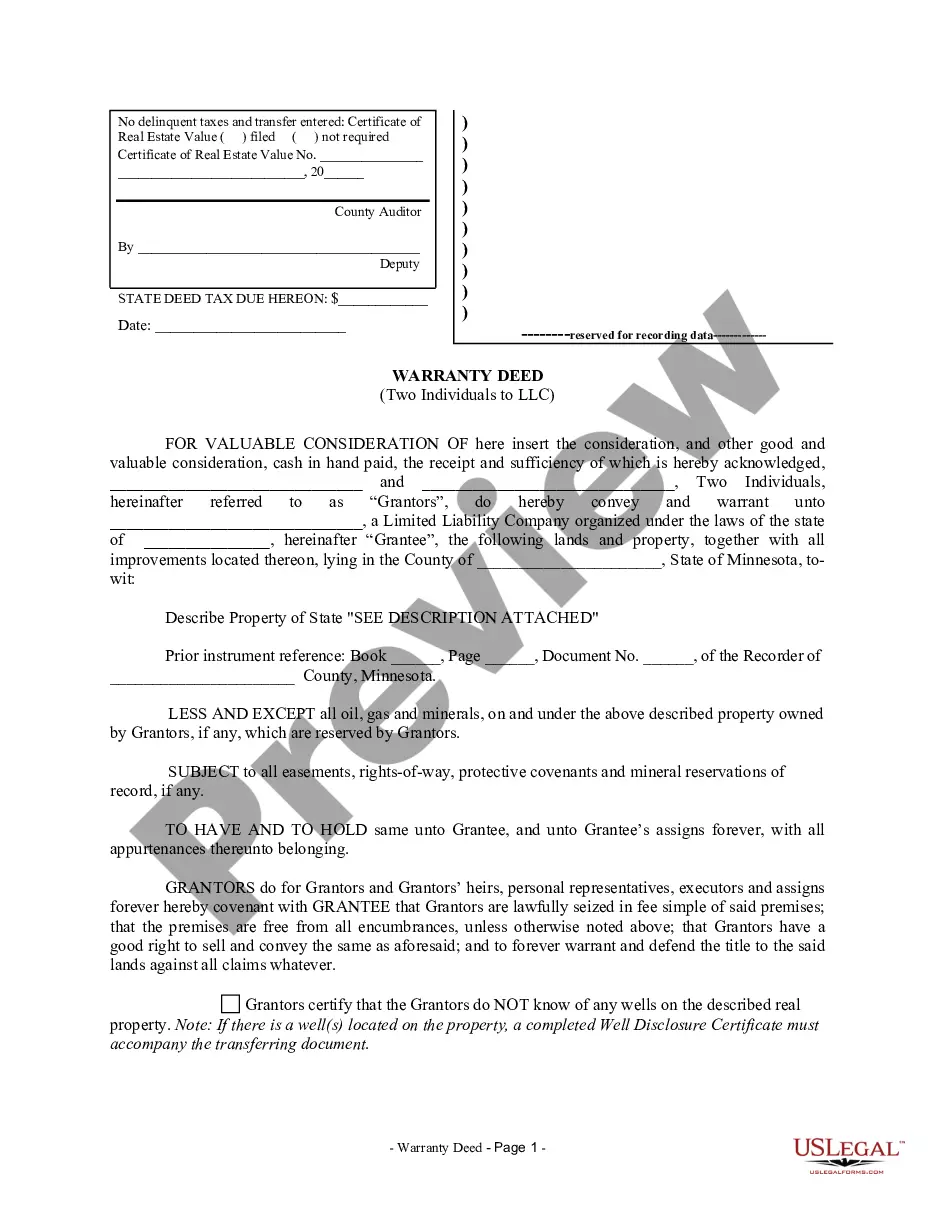

Minnesota Warranty Deed from two Individuals to LLC

Description

How to fill out Minnesota Warranty Deed From Two Individuals To LLC?

Obtain any template from 85,000 legal documents including Minnesota Warranty Deed from two parties to LLC online with US Legal Forms. Every template is crafted and refreshed by state-licensed legal experts.

If you already possess a subscription, Log In. Once you’re on the form’s page, click on the Download button and navigate to My documents to access it.

If you have not yet subscribed, follow the steps below.

With US Legal Forms, you’ll consistently have instant access to the correct downloadable template. The platform will provide you access to documents and organizes them into categories to enhance your search. Use US Legal Forms to obtain your Minnesota Warranty Deed from two parties to LLC quickly and effortlessly.

- Check the state-specific prerequisites for the Minnesota Warranty Deed from two parties to LLC you wish to utilize.

- Read the description and preview the sample.

- When you’re assured the template is what you require, simply click Buy Now.

- Choose a subscription plan that suits your budget.

- Create a personal account.

- Pay using one of two convenient methods: by credit card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents tab.

- Once your reusable form is prepared, print it out or save it to your device.

Form popularity

FAQ

To transfer ownership of a property in Minnesota, you typically need to prepare a Minnesota Warranty Deed from two Individuals to LLC or another type of deed, depending on your situation. Ensure that the deed includes all necessary information, such as the legal description and signatures. After preparing the deed, file it with the local county recorder’s office to ensure the transfer is legally recognized.

Yes, you can complete a warranty deed without an attorney, but it is essential to understand the legal requirements. By using a Minnesota Warranty Deed from two Individuals to LLC form, you can simplify the process. However, reviewing your deed for accuracy and compliance with state laws is crucial to avoid potential issues down the road.

To transfer a deed to an LLC, start by creating a Minnesota Warranty Deed from two Individuals to LLC. Fill out the deed with accurate property details and signatures from both individuals involved in the transfer. After that, file the completed deed with your local county office to finalize the transfer and make it legally binding.

Transferring property to an LLC offers several benefits, including asset protection and potential tax advantages. By using a Minnesota Warranty Deed from two Individuals to LLC, you can shield your personal assets from liabilities associated with the property. Additionally, an LLC can provide better management and operational flexibility for your real estate investments.

To transfer property to an LLC, you must execute a Minnesota Warranty Deed from two Individuals to LLC. This process involves completing the deed form, including the necessary legal descriptions of the property. After signing the deed, you must record it with the county recorder's office. This ensures that the transfer is official and recognized by law.

A warranty deed may be deemed invalid if it lacks essential elements such as proper signatures, legal descriptions, or if it has not been properly notarized and recorded. Additionally, if the grantor does not have the legal authority to transfer the property, the deed can also be invalid. It is crucial to ensure all requirements are met when executing a Minnesota Warranty Deed from two Individuals to LLC.

To transfer a deed to an LLC, start by drafting a new deed that clearly states the transfer of the property to the LLC. You will need to include essential details, such as the property's legal description and the names of the individuals transferring the property. After signing the deed, file it with the county recorder's office to complete the transfer. Platforms like uslegalforms can guide you through this process efficiently.

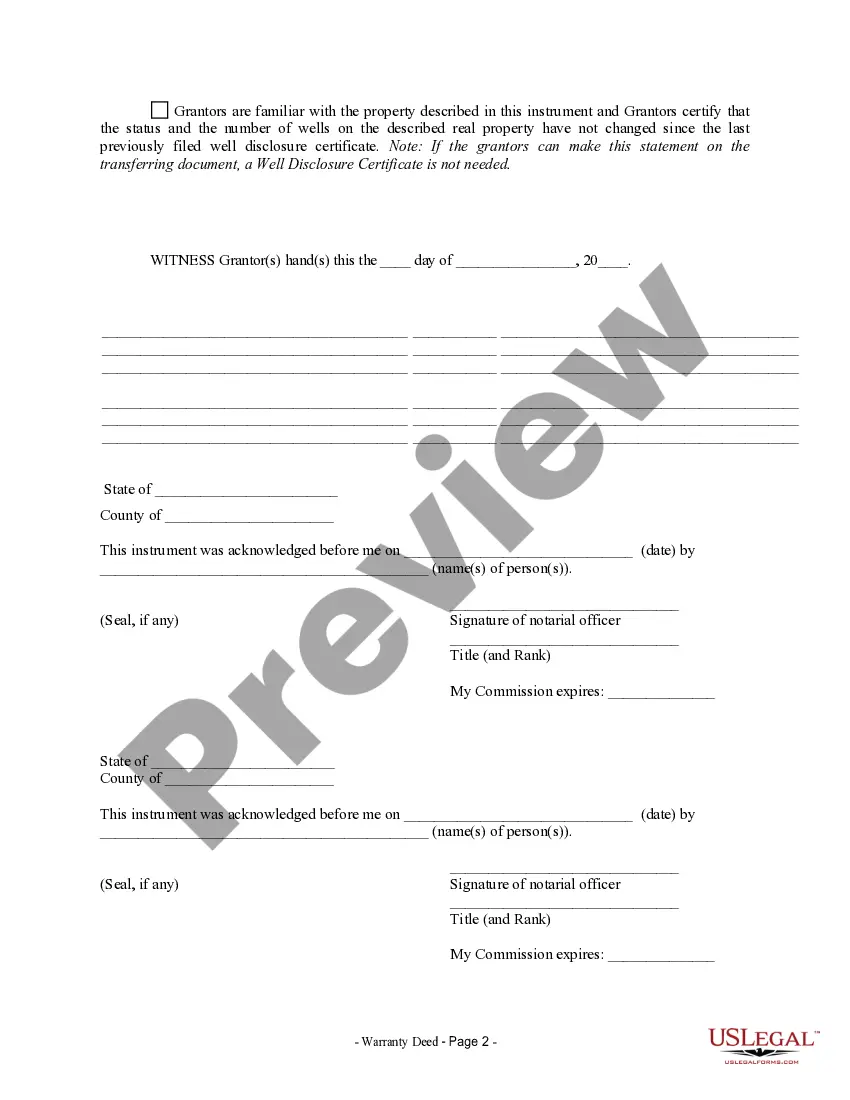

Typically, the designated members or managers of the LLC sign the deed on behalf of the company. This ensures that the LLC is legally bound by the transaction and can hold the property. It is essential to follow your state’s specific requirements for signatures when executing a Minnesota Warranty Deed from two Individuals to LLC.

A warranty deed provides the highest level of protection, ensuring that the seller guarantees clear title to the property and will defend the title against any claims. In contrast, a limited warranty deed only guarantees the title against issues that occurred during the seller's ownership. Understanding these differences is crucial when transferring property using a Minnesota Warranty Deed from two Individuals to LLC.

Generally, transferring property to an LLC is not considered a taxable event if the individuals transferring the property maintain the same ownership interest in the LLC. However, specific circumstances may trigger taxes, such as when a mortgage is involved or if the property has appreciated significantly. It is advisable to consult a tax professional to understand any potential tax implications when executing a Minnesota Warranty Deed from two Individuals to LLC.