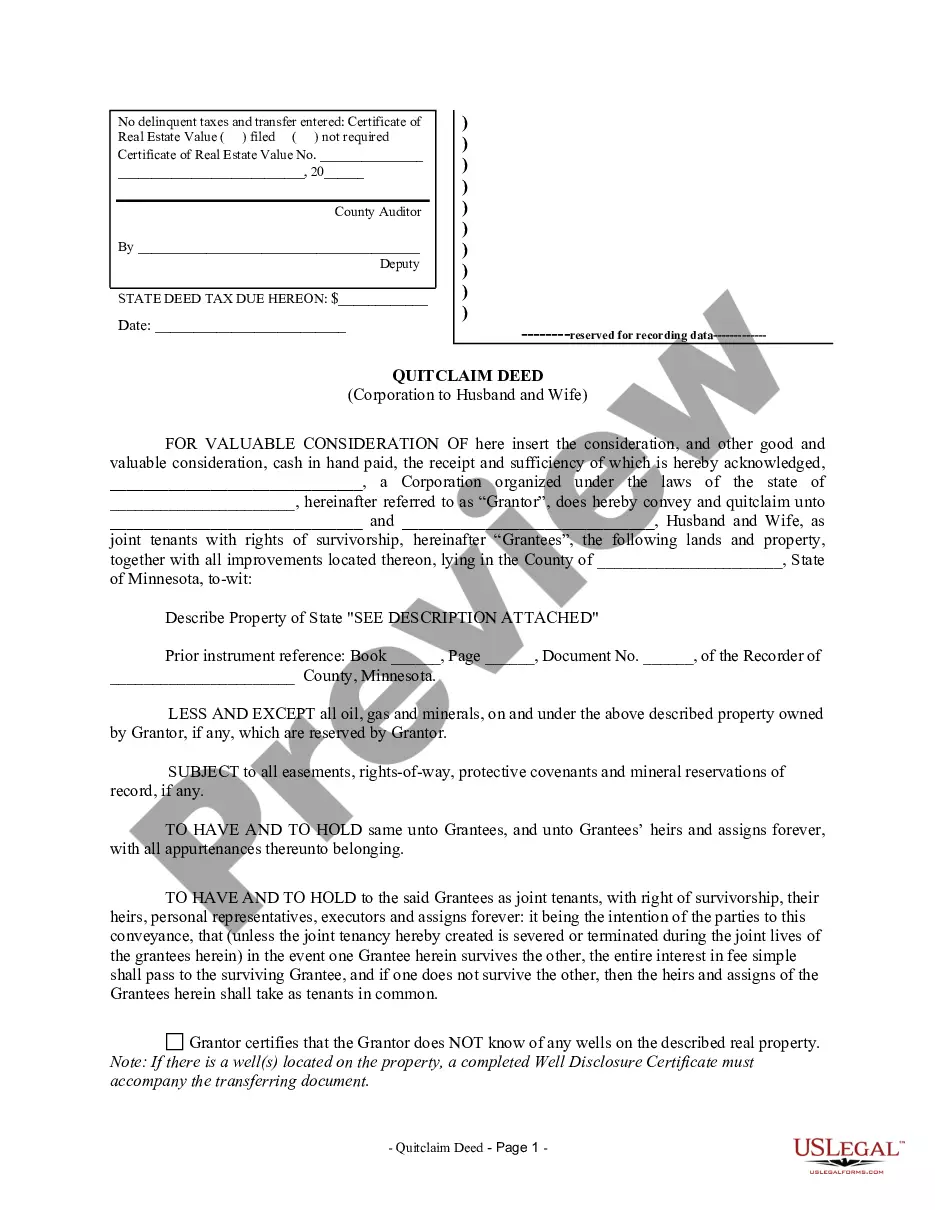

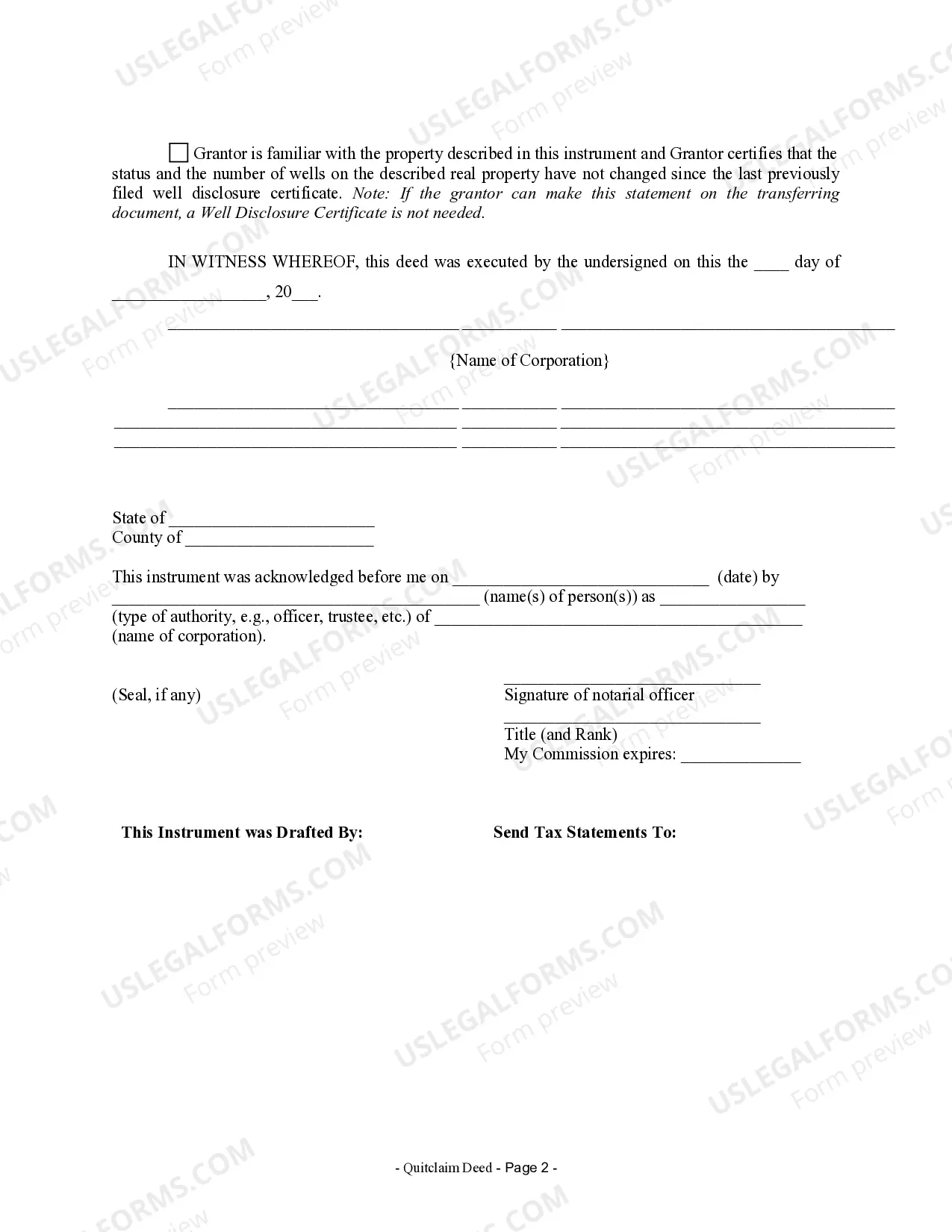

Minnesota Quitclaim Deed from Corporation to Husband and Wife

Description

How to fill out Minnesota Quitclaim Deed From Corporation To Husband And Wife?

Obtain any template from 85,000 legal documents, including the Minnesota Quitclaim Deed from Corporation to Husband and Wife, available online through US Legal Forms. Each template is composed and refreshed by state-certified legal professionals.

If you already possess a subscription, Log In. After reaching the form’s page, click the Download button and navigate to My documents to access it.

If you have not yet subscribed, follow the guidelines below.

With US Legal Forms, you’ll always have immediate access to the relevant downloadable template. The service grants you access to documents and categorizes them to ease your search. Utilize US Legal Forms to acquire your Minnesota Quitclaim Deed from Corporation to Husband and Wife quickly and effortlessly.

- Verify the state-specific criteria for the Minnesota Quitclaim Deed from Corporation to Husband and Wife you intend to utilize.

- Review the description and preview the sample.

- When you’re assured the template meets your needs, simply click Buy Now.

- Choose a subscription plan that aligns with your budget.

- Establish a personal account.

- Make payment in one of two convenient methods: by card or through PayPal.

- Select a format to download the document; two options are available (PDF or Word).

- Download the file to the My documents tab.

- Once your reusable form is downloaded, print it or save it to your device.

Form popularity

FAQ

A married couple may choose to execute a quitclaim deed for various reasons, such as estate planning or simplifying property ownership. This method can streamline the process of transferring property between spouses, especially when dealing with family-owned assets. A Minnesota Quitclaim Deed from Corporation to Husband and Wife serves as a practical tool for couples looking to manage their property efficiently.

A quitclaim deed between husband and wife is a legal document that transfers property interests from one spouse to another. This deed does not imply that the grantor has a clear title; rather, it conveys whatever interest they may have. When utilizing a Minnesota Quitclaim Deed from Corporation to Husband and Wife, couples can easily manage property ownership during marriage or in the event of separation.

Filling out a quitclaim deed in Minnesota involves several straightforward steps. You need to include the names of the grantor and grantee, a legal description of the property, and the date of the transfer. Using resources from uslegalforms can guide you in accurately completing a Minnesota Quitclaim Deed from Corporation to Husband and Wife, ensuring all necessary details are included.

People usually use quitclaim deeds to transfer property quickly and without the complexities of a traditional sale. This could include transferring property to a spouse or removing someone from the title. In the case of a Minnesota Quitclaim Deed from Corporation to Husband and Wife, it simplifies the process for couples who wish to consolidate ownership or change the title structure.

The purpose of a quitclaim deed is to transfer ownership or interest in a property without guaranteeing clear title. This type of deed is often used in situations where the parties know each other, like family or friends. Specifically, a Minnesota Quitclaim Deed from Corporation to Husband and Wife allows for easy transfer of property between entities and individuals, ensuring smooth transitions.

To file a Minnesota Quitclaim Deed from Corporation to Husband and Wife, start by obtaining the appropriate form from a reliable source, such as US Legal Forms. Ensure that all necessary details, including the names of the parties involved and the property description, are accurately filled in. Next, have the document notarized to validate the transfer. Finally, submit the completed quit claim deed to the county recorder's office in the county where the property is located for proper recording.

Individuals who benefit the most from a quitclaim deed include family members transferring property among themselves or spouses clarifying ownership in a marriage. It is also advantageous for those looking to resolve property issues quickly and without high legal costs. Using a Minnesota Quitclaim Deed from Corporation to Husband and Wife can provide a smooth and efficient way to manage property ownership, making it a popular choice in many personal situations.

In Minnesota, a quitclaim deed allows a property owner to transfer their interest in a property to another person without guaranteeing that the title is clear. This means the new owner may inherit any existing liens or issues related to the property. When using a Minnesota Quitclaim Deed from Corporation to Husband and Wife, it is crucial to file the deed with the county recorder to make the transfer official and public.

A quitclaim deed is commonly used in several scenarios, including transferring property between family members or in divorce settlements. It is also beneficial when a property owner wishes to add their spouse to the title. The Minnesota Quitclaim Deed from Corporation to Husband and Wife is a straightforward option for these situations, allowing for easy transfer of ownership without the need for extensive legal processes.

Yes, you can use a quitclaim deed to add your spouse to the property deed. This process is particularly relevant in situations where you want to transfer ownership or clarify rights in a property. When using a Minnesota Quitclaim Deed from Corporation to Husband and Wife, ensure that both parties sign the deed for it to be valid. This deed simplifies the transfer and can help avoid legal complications.