Minnesota Warranty Deed from Individual to a Trust

Definition and meaning

A Minnesota Warranty Deed from Individual to a Trust is a legal document used to transfer real estate ownership from an individual (the grantor) to a trust (the grantee). This deed provides a warranty that the grantor holds good title to the property and has the right to convey it, protecting the interests of the trust and its beneficiaries.

How to complete a form

To accurately complete the Minnesota Warranty Deed, follow these steps:

- Enter Grantor details: Provide the full name of the individual transferring the property.

- Identify the Trust: Include the name of the trust and the trustee's name.

- Specify Property: Clearly describe the property being transferred, including location and any specific identifiers.

- Sign and Date: The grantor must sign the document in the presence of a notary public.

Ensure all fields are filled correctly to avoid any legal issues.

Who should use this form

This form is appropriate for individuals who wish to transfer real estate property to a trust. It is commonly used by property owners planning for estate management or tax benefits, as well as those aiming to simplify the transfer of assets upon their passing.

Legal use and context

This warranty deed serves legal purposes, ensuring that the transfer of property is recorded and enforced under Minnesota law. It denotes that the grantor guarantees the title's validity, providing legal assurance to the trust and its beneficiaries.

Key components of the form

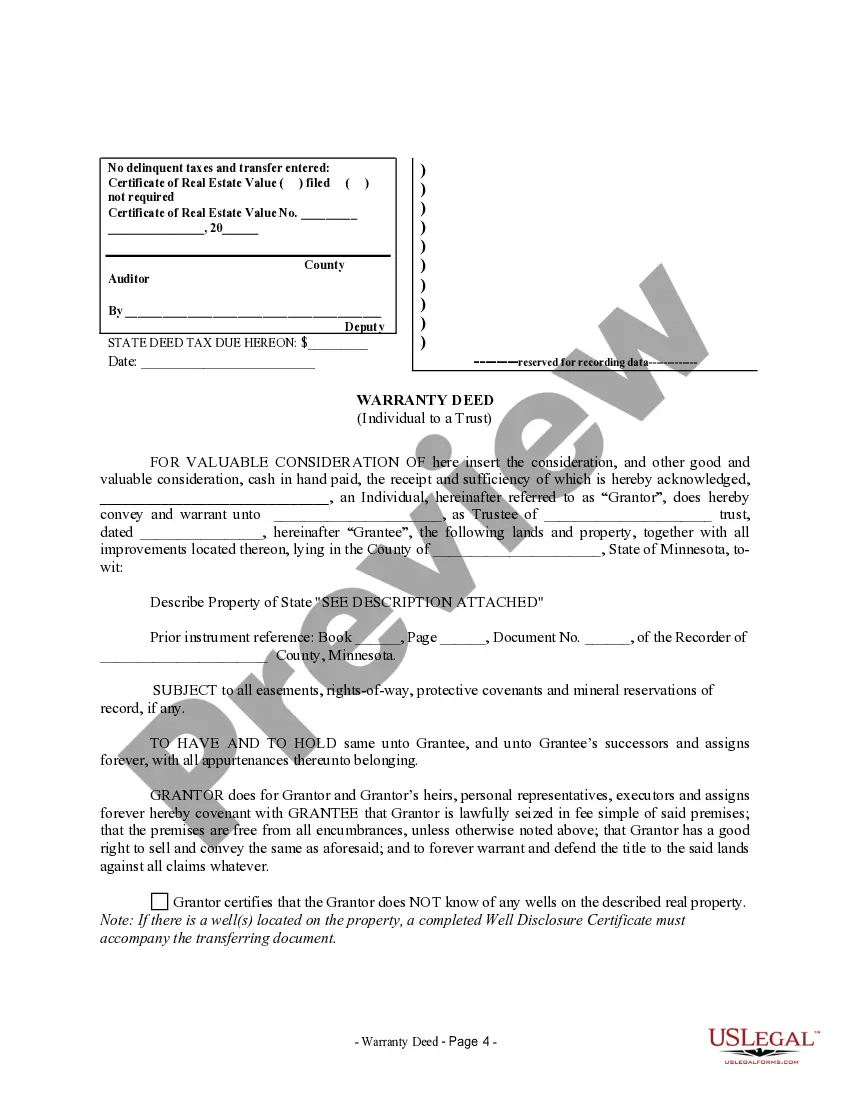

The main components of the Minnesota Warranty Deed include:

- Grantor and Grantee information: The names of the individual transferring the property and the trust receiving it.

- Property Description: A detailed account of the property being transferred.

- Warranties: Legal assurances regarding the title of the property.

- Notary Section: A space for notarizing the deed to validate it legally.

What to expect during notarization or witnessing

When notarizing the Minnesota Warranty Deed, expect the following:

- The grantor will need to present a valid form of identification.

- The notary will verify the grantor's identity and willingness to sign.

- The completed document will be signed by the grantor in the presence of the notary.

- The notary will affix their seal and provide their signature, making the document legally binding.

Ensure that the notary is licensed and recognized in Minnesota to avoid complications.

Form popularity

FAQ

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Trustee's deeds convey real estate out of a trust.This type of conveyance is named for the person using the form the trustee who stands in for the beneficiary of the trust and holds title to the property.

A general warranty deed is used to transfer an interest in real estate in Minnesota in most real estate transactions. A Minnesota warranty deed conveys real property with warranty covenants to the buyer. It requires an acknowledgement of the grantor's signature.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

A general warranty deed is used to transfer an interest in real estate in Minnesota in most real estate transactions. A Minnesota warranty deed conveys real property with warranty covenants to the buyer. It requires an acknowledgement of the grantor's signature.

A trustee deed offers no such warranties about the title.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

Yes, Minnesota has a law that lets you transfer the title to real estate when you die to avoid probate. It is an estate planning tool called a Transfer on Death Deed (TODD). It is like the "payable on death" (POD) designation on a bank account.They have no rights or control of the property until the owner dies.