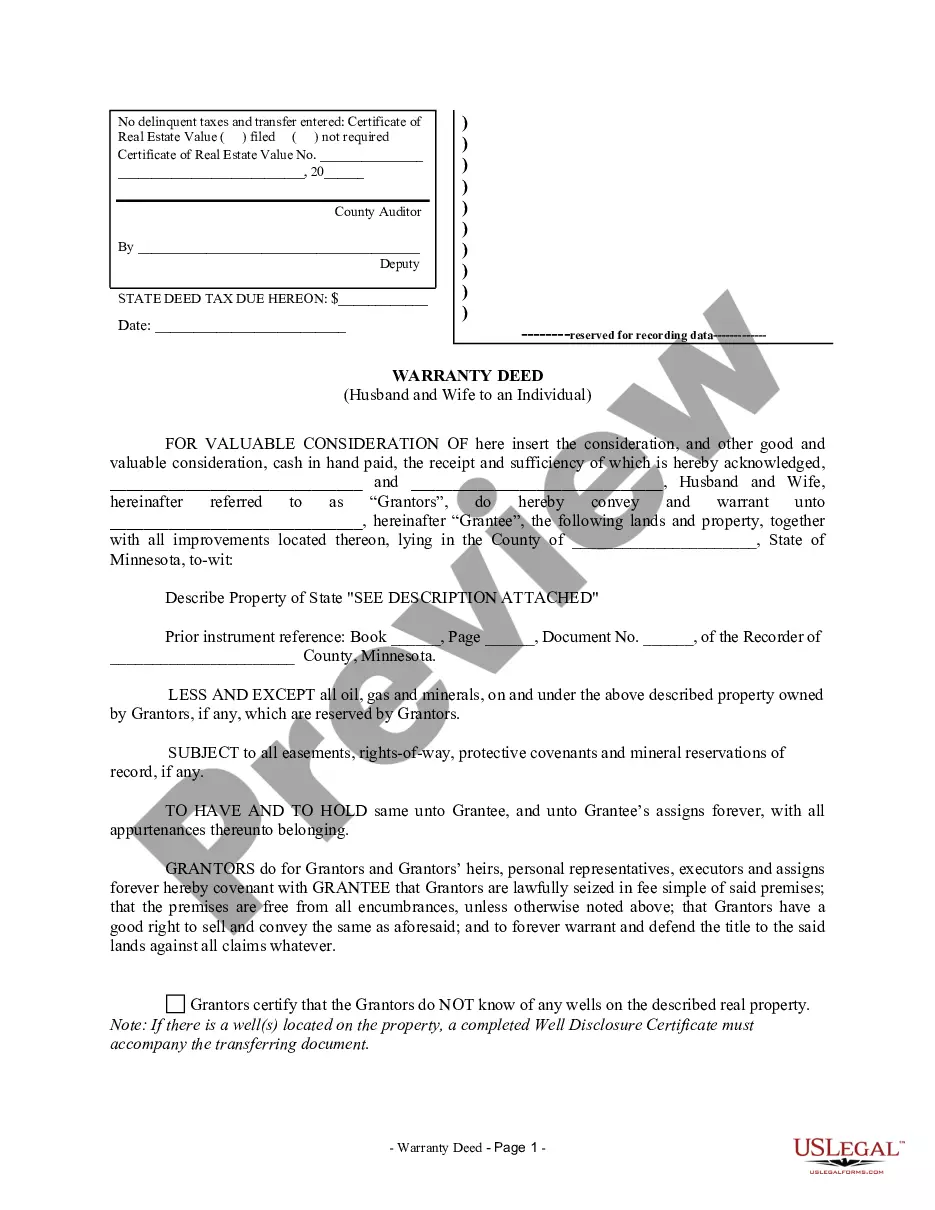

Minnesota Warranty Deed from Husband and Wife to an Individual

Definition and meaning

A Minnesota Warranty Deed from Husband and Wife to an Individual is a legal document used to transfer property ownership between the grantors, who are typically a married couple, and the grantee, an individual. This type of deed guarantees that the grantors hold a clear title to the property and have the right to convey it, ensuring the grantee receives certain protections regarding property claims. The deed includes a comprehensive legal description of the property, identifies the parties involved, and outlines any exceptions or reservations regarding the transfer.

How to complete a form

Completing the Minnesota Warranty Deed form involves several important steps:

- Identify the parties: Clearly state the names of the grantors (Husband and Wife) and the grantee (Individual).

- Property description: Enter a detailed description of the property being transferred. If necessary, include a statement saying 'SEE DESCRIPTION ATTACHED.'

- Consideration: Indicate the amount of consideration being exchanged for the property.

- Signatures: Both grantors must sign the document in the presence of a notary public.

- Notary acknowledgment: Have a notary public acknowledge the signatures to validate the deed.

- Record the deed: Submit the completed warranty deed to the appropriate county office for recording.

Who should use this form

This form is suitable for married couples wishing to transfer property ownership to an individual, whether it's a family member, friend, or business associate. It's particularly used in situations such as gifting a property, informal property transfers, or during estate planning when the couple intends to designate ownership to another person. Individuals with limited legal knowledge can also utilize this form as it provides clear instructions for completing the transfer.

Legal use and context

The Minnesota Warranty Deed is a critical document in real estate transactions, providing assurance to the grantee that the property is free from liens and other claims. This deed is primarily used in situations involving the transfer of property ownership where the parties want to ensure all rights and titles are legally transferred. Legal context for using this form includes situations of marital property division, estate transfers, or donations between family members.

Key components of the form

The essential components of the Minnesota Warranty Deed include:

- Grantors: The names of the people transferring the property.

- Grantee: The name of the individual receiving the property.

- Legal description of property: A complete description that identifies the property.

- Consideration: The amount exchanged for the property.

- Signatures: The signatures of the grantors and a notary acknowledgment.

Common mistakes to avoid when using this form

When completing the Minnesota Warranty Deed, it's essential to avoid several common mistakes:

- Inaccurate property description: Ensure the property description is clear and matches public records.

- Missing signatures: Both grantors must sign the deed for it to be valid.

- Incorrect notarization: Have the document notarized properly before submission.

- Omitting consideration: Always include the consideration amount as it provides clarity on the transaction.

Form popularity

FAQ

To sign over property ownership to another person, you'll use one of two deeds: a quitclaim deed or a warranty deed.

Adding someone to your house deed requires the filing of a legal form known as a quitclaim deed. When executed and notarized, the quitclaim deed legally overrides the current deed to your home. By filing the quitclaim deed, you can add someone to the title of your home, in effect transferring a share of ownership.

To add a co-owner, the bank would have to create a new home loan agreement, which must be registered after paying the due stamp duty and registration charges. The bank would also insist on making the co-owner a co-borrower in the home loan applicable.

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances. Free and clear means that no one else has rights to the title above the owner.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

Yes you can. This is called a transfer of equity but you will need the permission of your lender. If you are not married or in a civil partnership you may wish to consider creating a deed of trust and a living together agreement which we can explain to you.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.