What is Probate?

Probate refers to the legal process of administering a deceased person's estate. It involves validating the will, paying debts, and distributing assets. Explore state-specific templates to streamline your process.

Probate is the legal process for managing a deceased person's estate. Our attorney-drafted templates are quick and easy to complete.

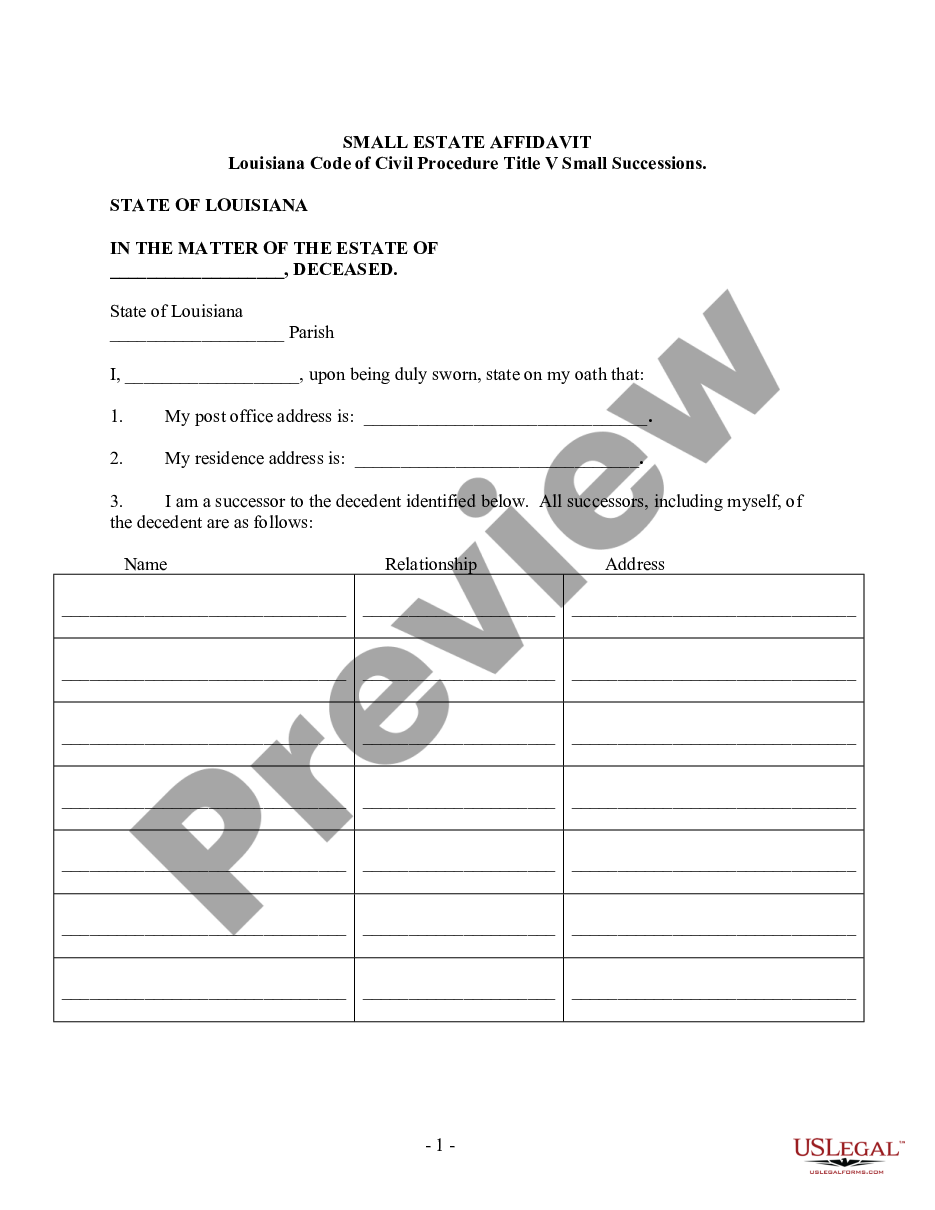

Easily settle small estates under $125,000 without formal probate, streamlining the inheritance process for heirs.

Essential for heirs desiring to claim their inheritance without formal administration of succession.

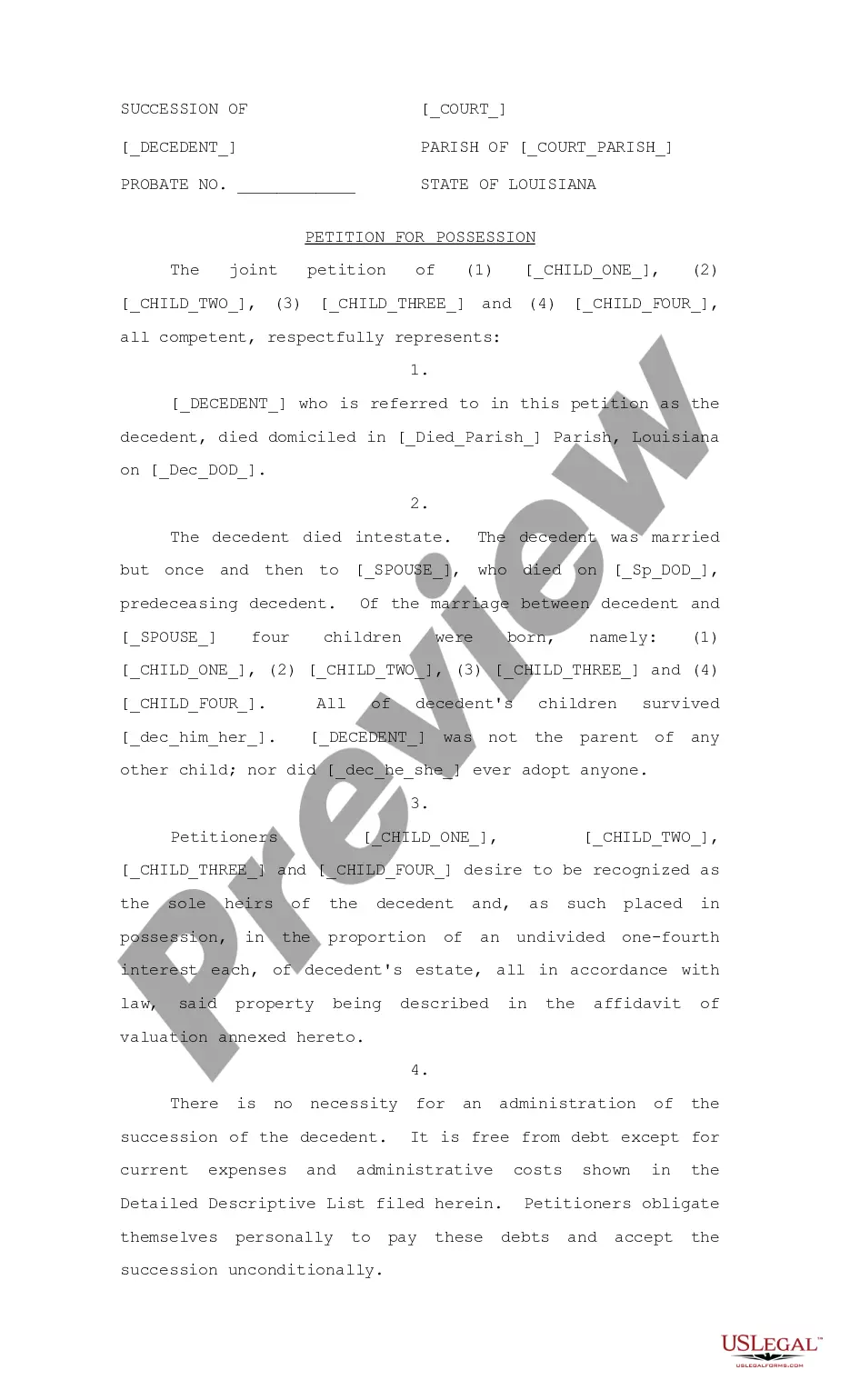

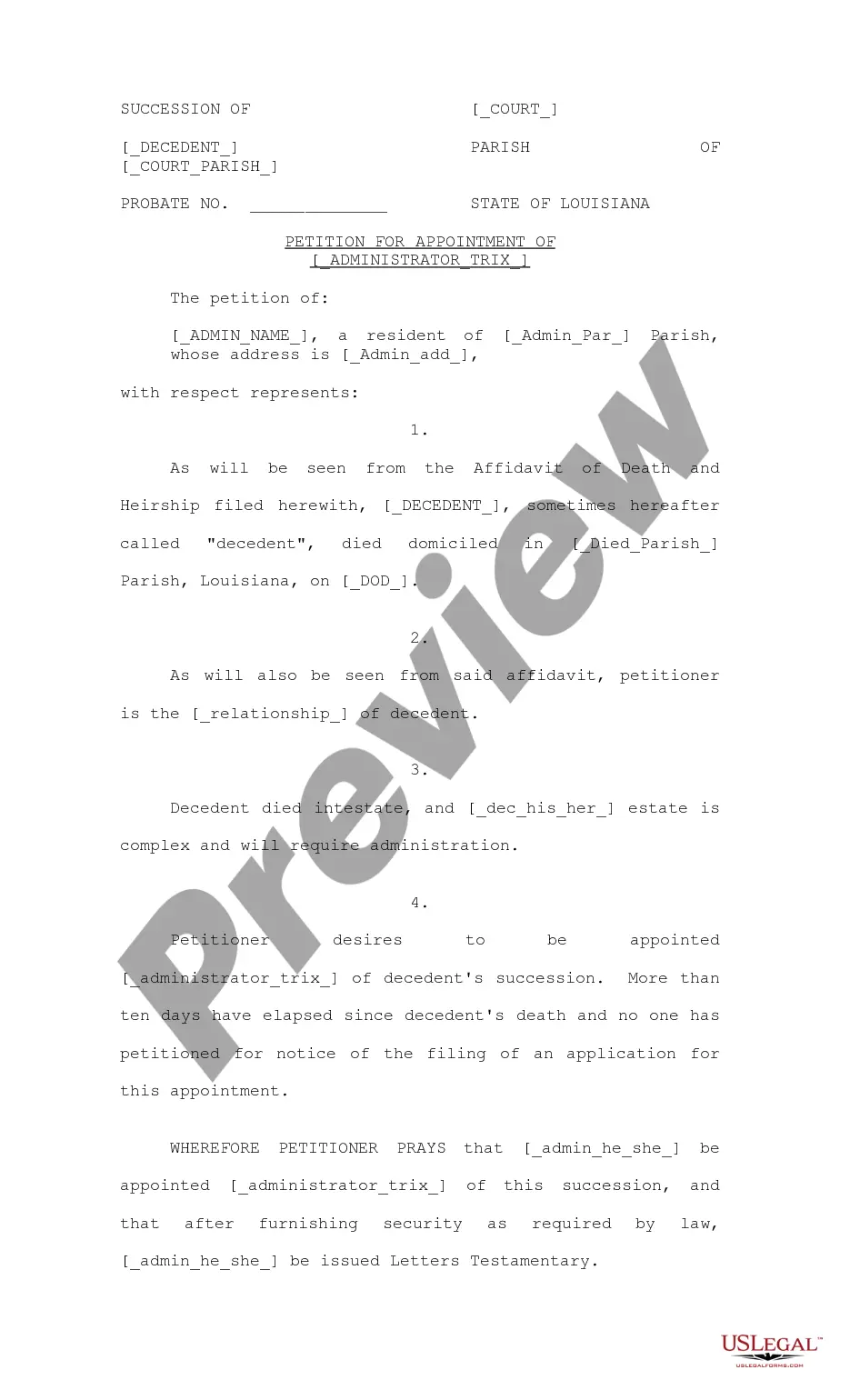

Secure authorization to manage the estate of a deceased person when no will exists and responsibilities need to be assigned.

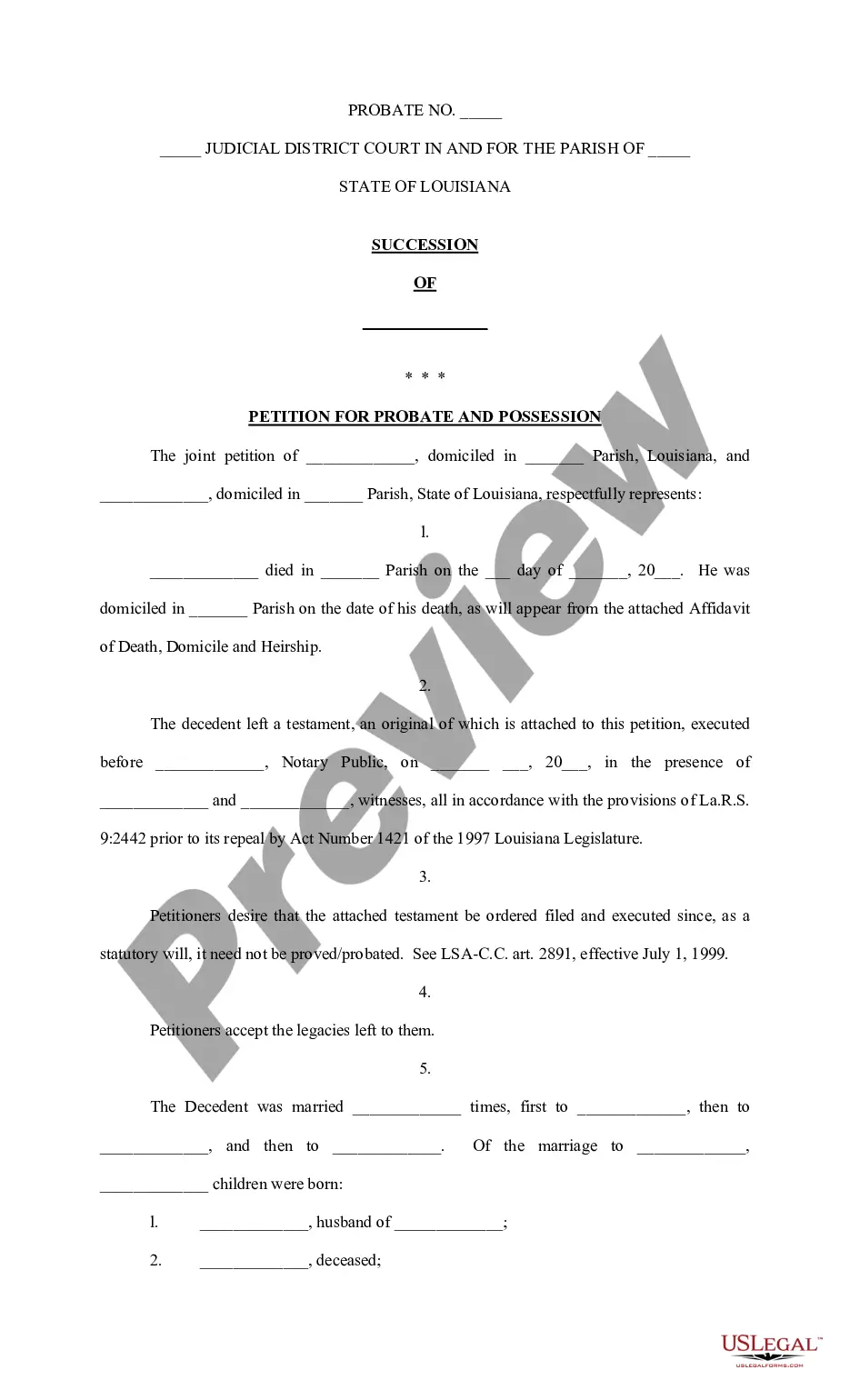

Use this to initiate probate proceedings and establish heirship in Louisiana when someone passes, especially with a testament.

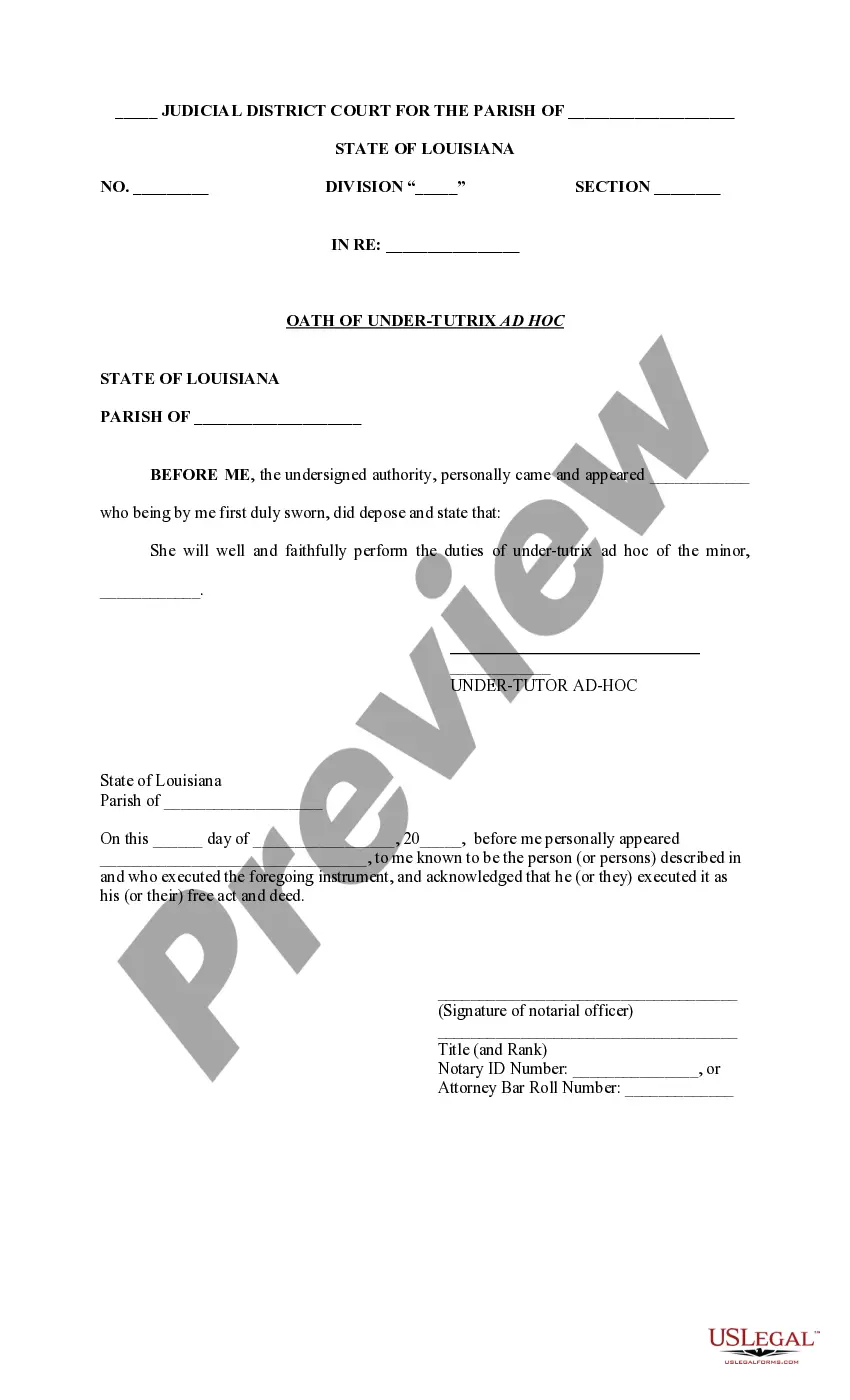

Securely appoint an under-tutrix ad hoc for a minor's care when legal guardianship needs to be temporarily assigned.

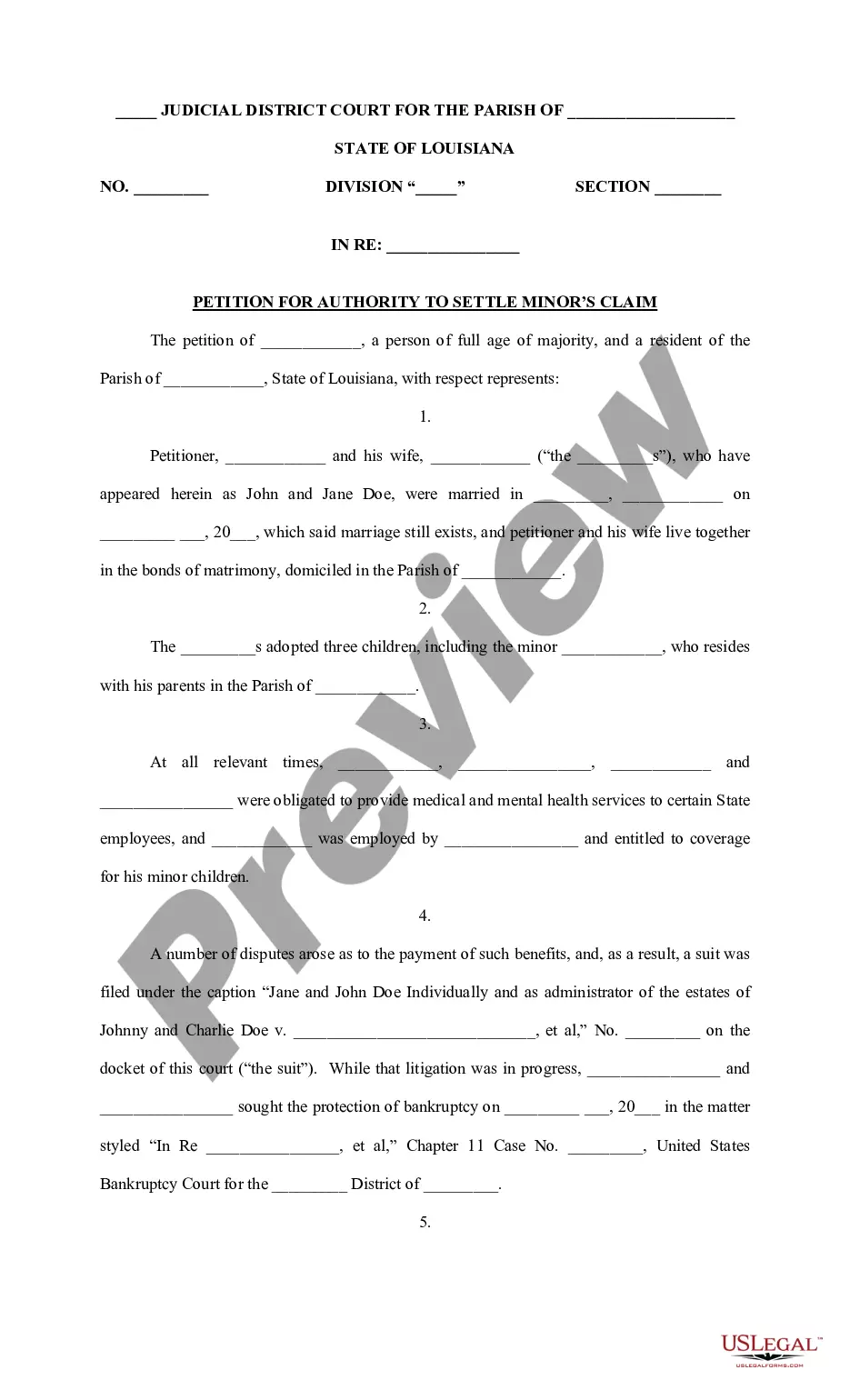

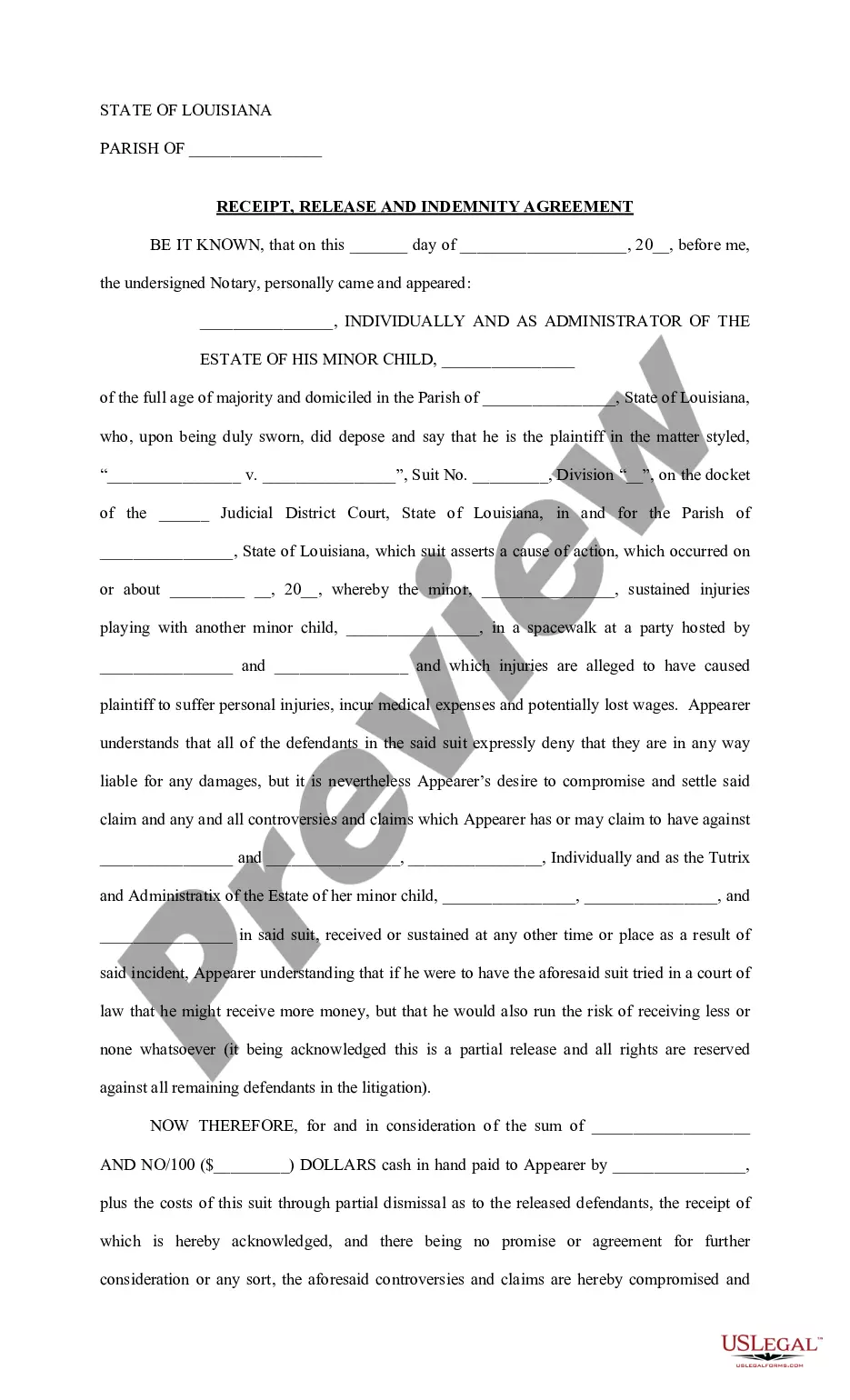

Secure court approval for settling a minor's claim, ensuring proper handling of their interests in legal disputes.

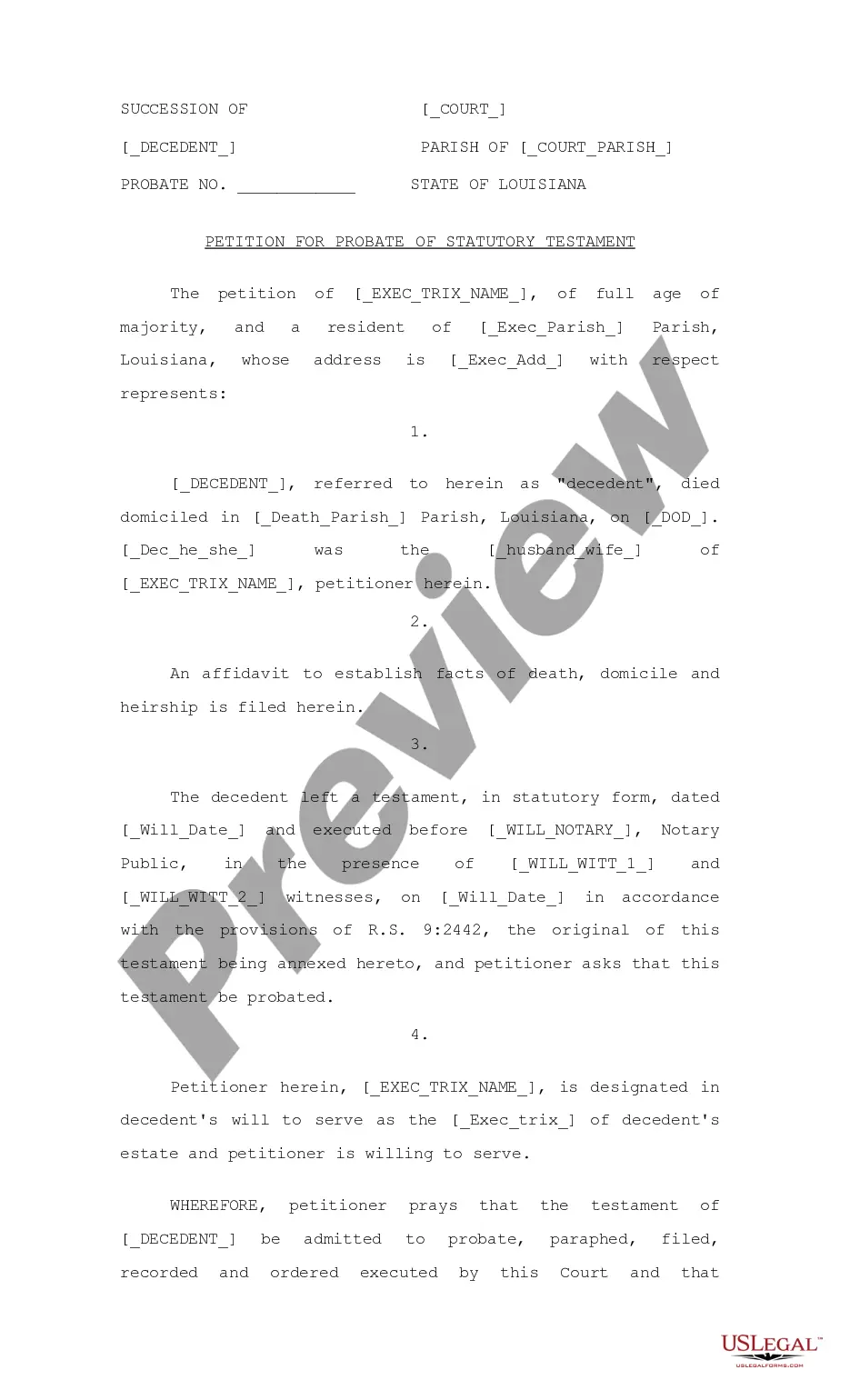

Essential for probating a statutory will, affirming the testator's wishes, and appointing an executor for the estate.

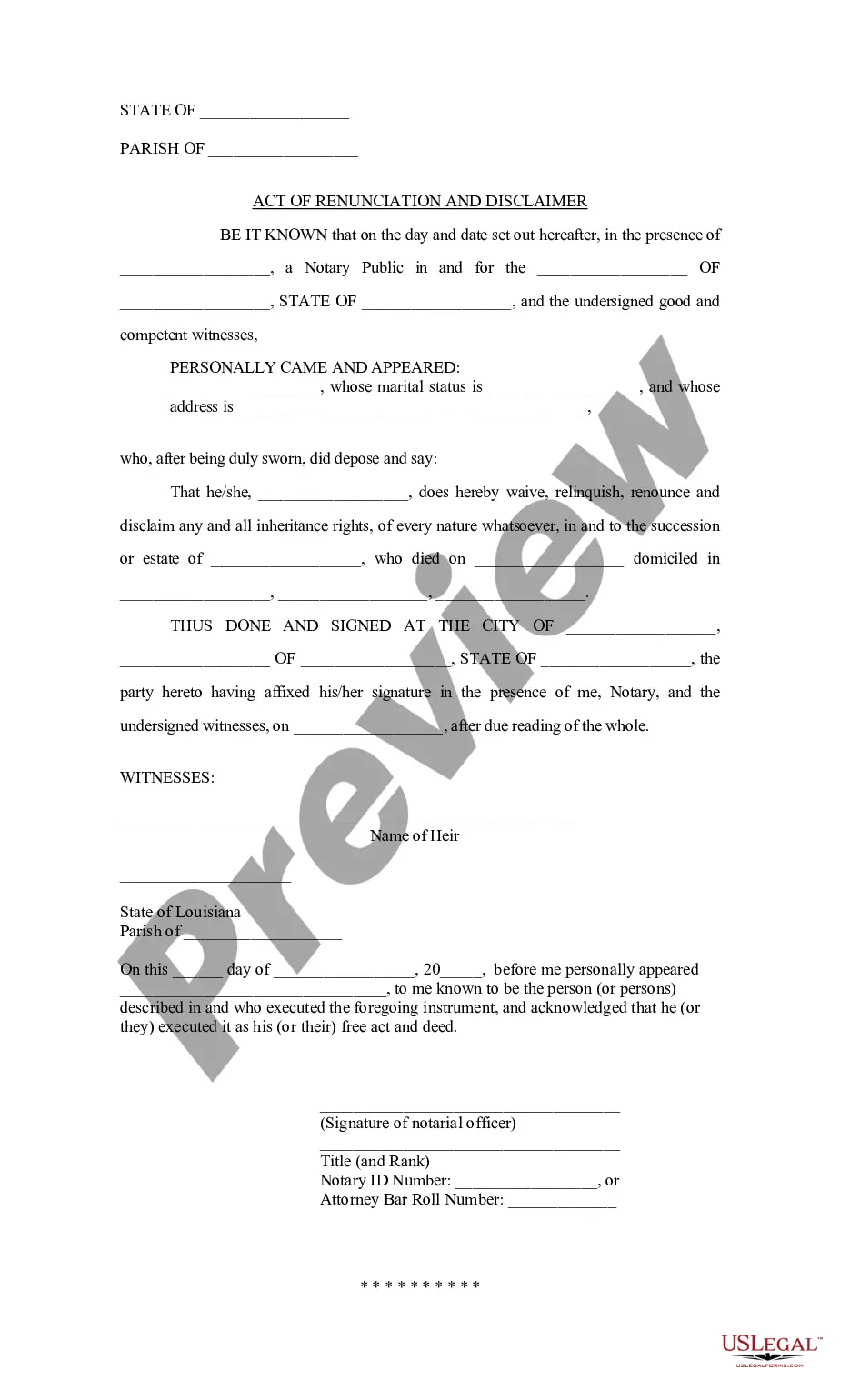

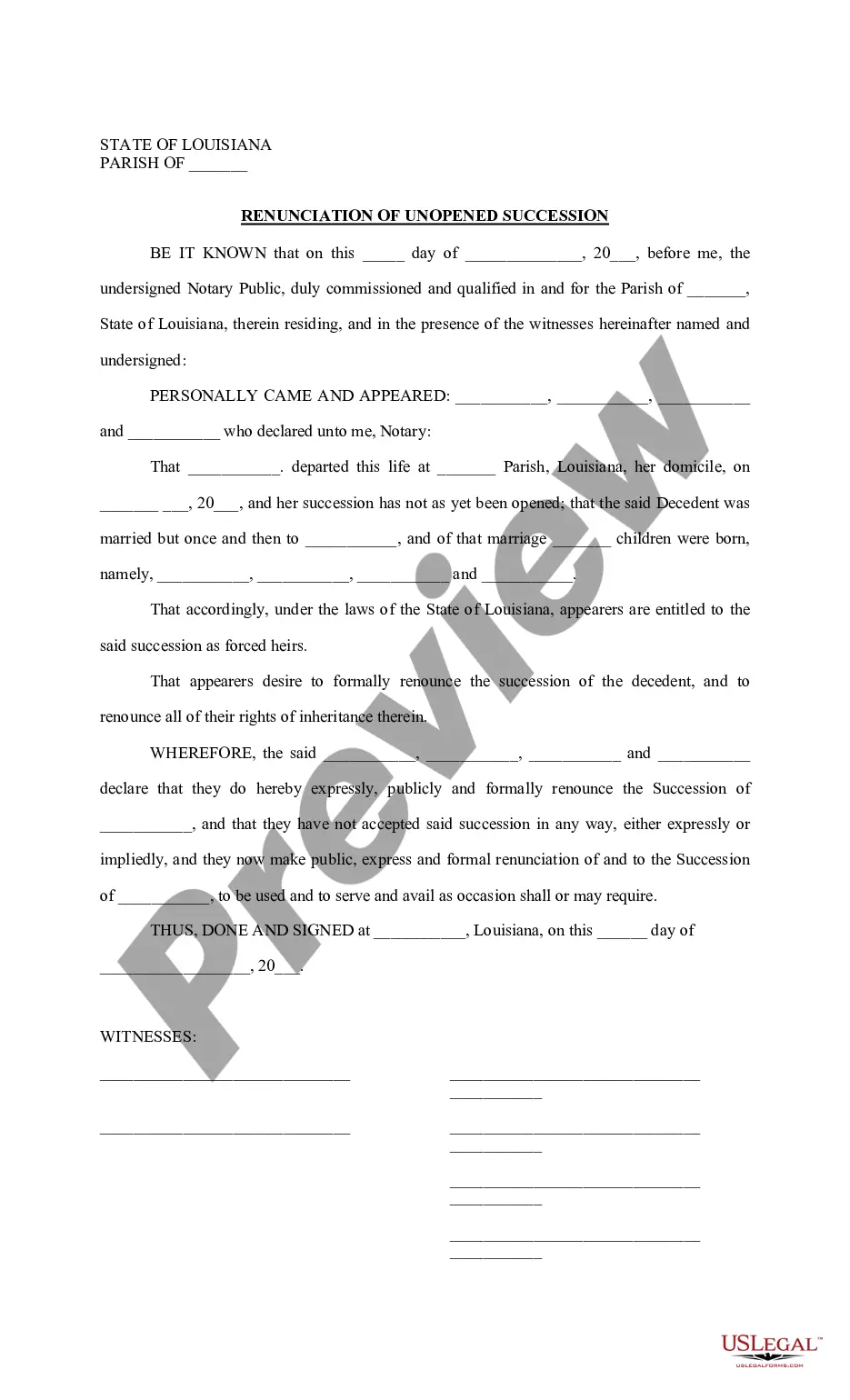

Waive your inheritance rights with this key legal document, ensuring clarity in estate matters following a loved one's passing.

Use this document to formally renounce your rights to an unopened succession, preventing any inheritance claims.

Use this document to settle claims involving personal injury while ensuring protection against future liabilities.

Probate is necessary for settling a deceased person's estate.

Not all assets require probate for transfer.

Probate can involve court supervision and legal fees.

The executor or administrator must act in the estate's best interest.

Probate can take several months to complete.

Many documents require notarization or witnesses.

Beneficiaries cannot access assets until probate concludes.

Begin your probate process with these simple steps.

Do I need a trust if I have a will?

What happens if I do nothing?

How often should I update my plan?

How do beneficiary designations interact with my plan?

Can different people handle finances and health decisions?