This package is designed to assist a farm owner in operating a farm, in matters such as employment, financial, and leasing transactions. The forms included are essential tools for promoting the farm's operation in a legally protected manner. Purchase this package and save 50% over purchasing the forms separately!

The following forms are included in this package:

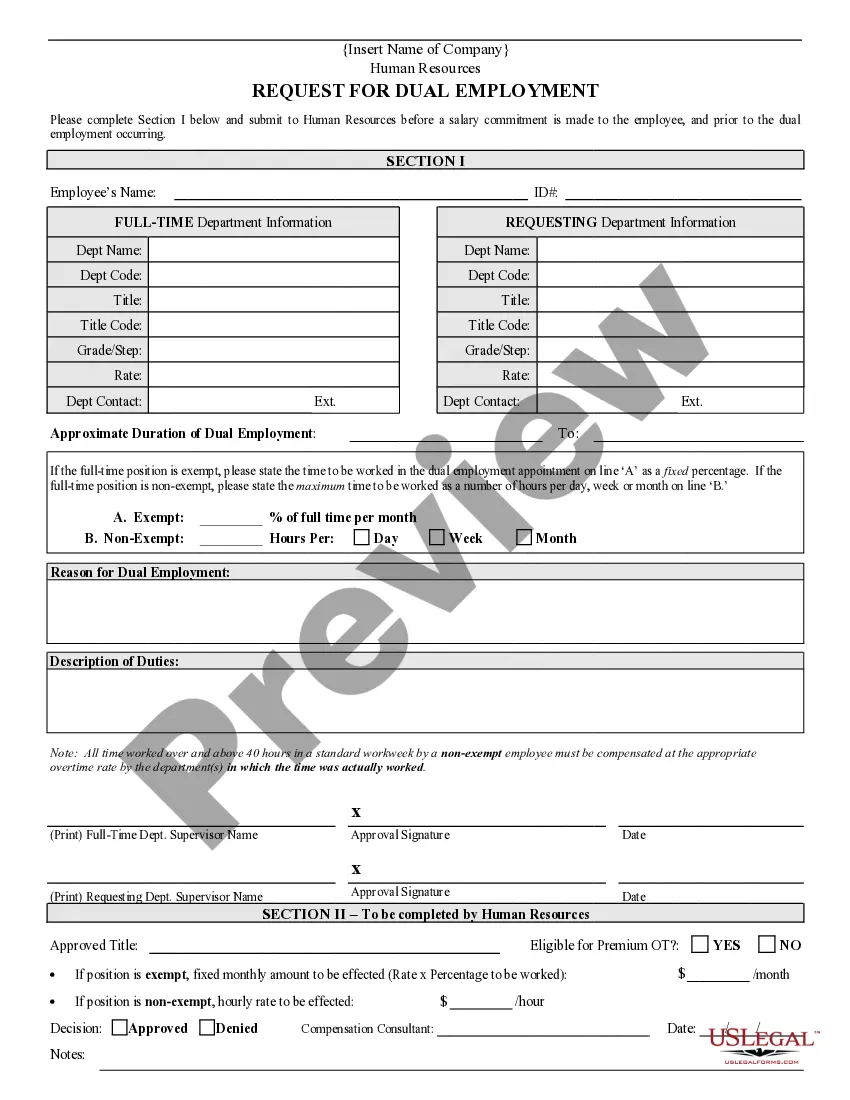

Agreement to Manage Farm - This form is an agreement to manage a farm. The manager represents and acknowledges that he is an independent contractor. All persons engaged by manager to perform work pursuant to this agreement will either be independent contractors or employees of manager. This agreement is not one of agency by manager for owner, but one with manager engaged independently in the business of managing properties as an independent contractor.

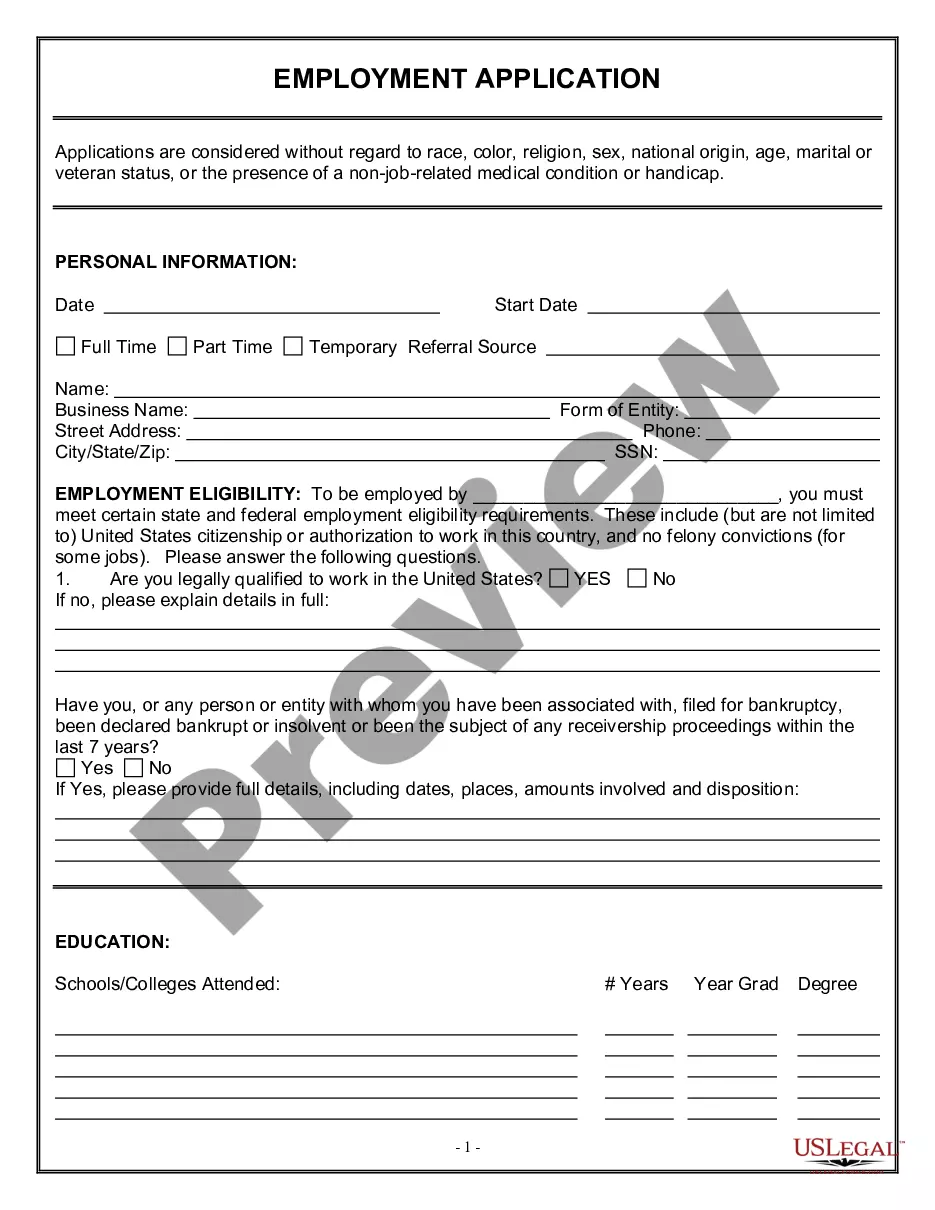

Farm Hand Services Contract - This is an agreement between a farmer or employer and a farm hand whereby the employer hires the farm hand as an independent contractor to perform various farm related duties as agreed upon in the contract.

Farmer's Tax Guide - This is a free bonus publication providing detailed tax information related to farm operations.

Security Agreement with Farm Products as Collateral - In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Farm Lease - This form is a lease agreement for farm land. The lessor will pay all ad valorem taxes assessed against the leased property. The lessee shall pay all taxes assessed against all personal property located on the premises and will also pay all privilege, excise and other taxes duly assessed. The lessee will pay the taxes when due so as to prevent the assessment of any late fees or penalties.