Wayne Michigan Equity Share Agreement

Description

How to fill out Equity Share Agreement?

Drafting legal documents is essential in contemporary society. Nonetheless, you do not always have to seek professional help to generate some of them from the ground up, such as Wayne Equity Share Agreement, with a service like US Legal Forms.

US Legal Forms offers over 85,000 documents to select from in various categories ranging from living wills to property agreements to divorce filings. All documents are categorized by their applicable state, simplifying the search experience.

You can also discover comprehensive resources and guides on the site that make any tasks related to document handling straightforward.

If you are already subscribed to US Legal Forms, you can find the relevant Wayne Equity Share Agreement, Log In to your account, and download it. It is important to mention that our platform cannot fully replace a lawyer. If you encounter a particularly challenging situation, we recommend consulting an attorney to evaluate your form before signing and submitting it.

With over 25 years in the industry, US Legal Forms has established itself as a reliable provider of various legal documents for millions of clients. Join today and acquire your state-specific paperwork seamlessly!

- Review the document's preview and description (if available) to understand what you'll receive upon downloading the document.

- Confirm that the template you have selected is tailored to your state/county/region since state laws can impact the validity of certain documents.

- Browse similar forms or start the search anew to find the appropriate file.

- Click Buy now and create your account. If you possess an existing account, proceed to Log In.

- Choose the pricing plan, then a suitable payment option, and purchase Wayne Equity Share Agreement.

- Decide to save the form template in any available file format.

- Access the My documents section to re-download the document.

Form popularity

FAQ

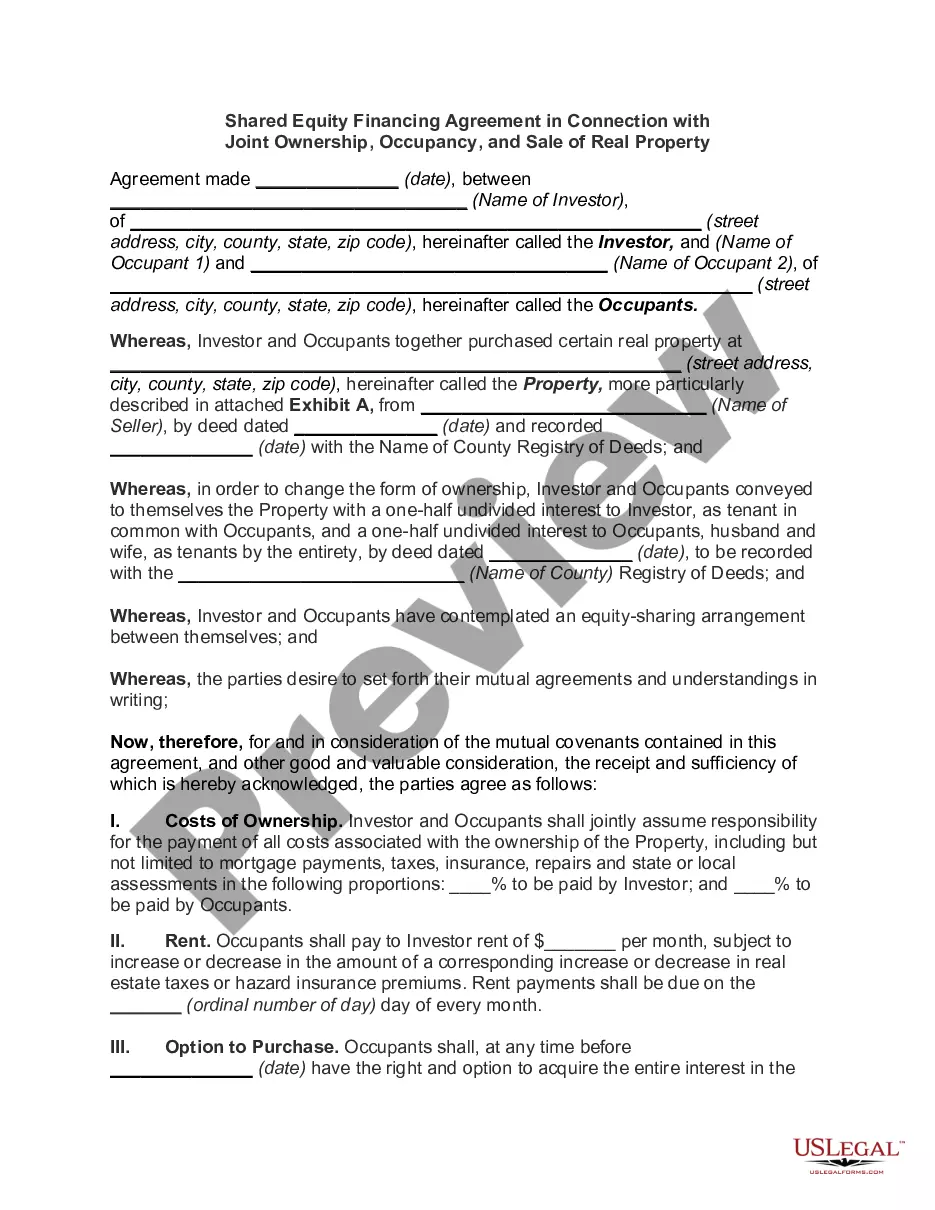

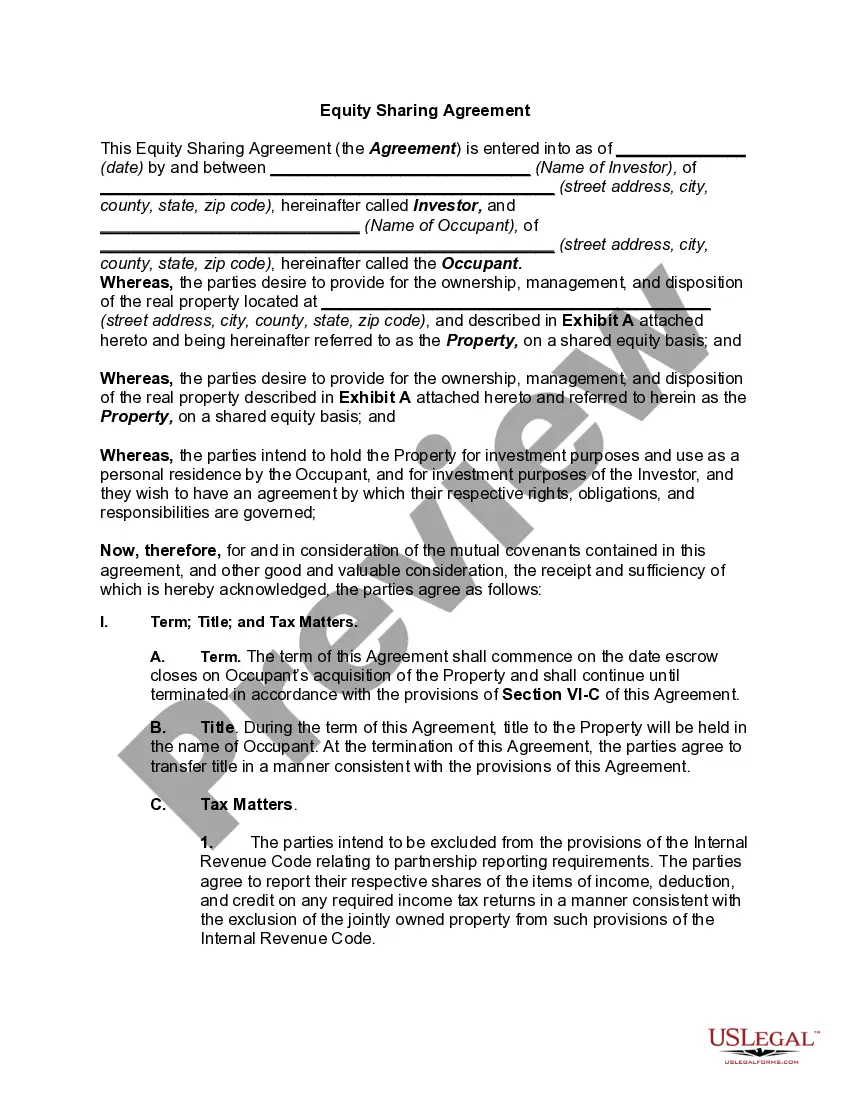

A shared equity mortgage is an arrangement under which a lender and a borrower share ownership of a property. The borrower must occupy the property. When the property sells, the allocation of equity goes to each part, according to their equity contribution.

Are There Any Fees? Yes, Unison charges a 2.5% origination fee that is deducted from your investment amount. So for you example, if you're approved for a $25,000 investment, the actual amount you receive will be reduced by $625 to $24,375.

The housing market determines whether a shared appreciation mortgage is a good deal. In a market where home prices are rising long-term, it's usually not a good deal for the borrower because she will still owe the outstanding principal balance if the property's value decreases.

A shared equity finance agreement allows multiple parties to go in on the purchase of a property, splitting the equity ownership accordingly. This type of arrangement is often structured when one party on their own cannot afford to purchase a home?for instance, when a parent helps an adult child.

Home equity loans, HELOCs, and home equity investments are three ways you can take equity out of your home without refinancing.

The biggest benefit of home equity sharing is that it's not a debt. There are no monthly payments, no interest, and you can use the funds as you wish. Equity sharing agreements may also be easier to qualify for than a loan would be. For example, home equity sharing company Unlock allows for credit scores as low as 500.

Home equity loans, home equity lines of credit (HELOCs), and cash-out refinancing are the main ways to unlock home equity. Tapping your equity allows you to access needed funds without having to sell your home or take out a higher-interest personal loan.

A home equity sharing agreement allows you to cash out some of the equity in your home in exchange for giving an investment company a minority ownership stake in the property.

Alternatives to Refinance: Increase Liquidity Cash-Out Refinance Mortgage.Home Equity Line of Credit (HELOC)Apply With Another Lender.Take Action to Improve Your Situation and Apply Later.Take Steps to Improve Your Credit Score.Improve Your Debt-to-Income Ratio.Find Stable Income If You Don't Have It.