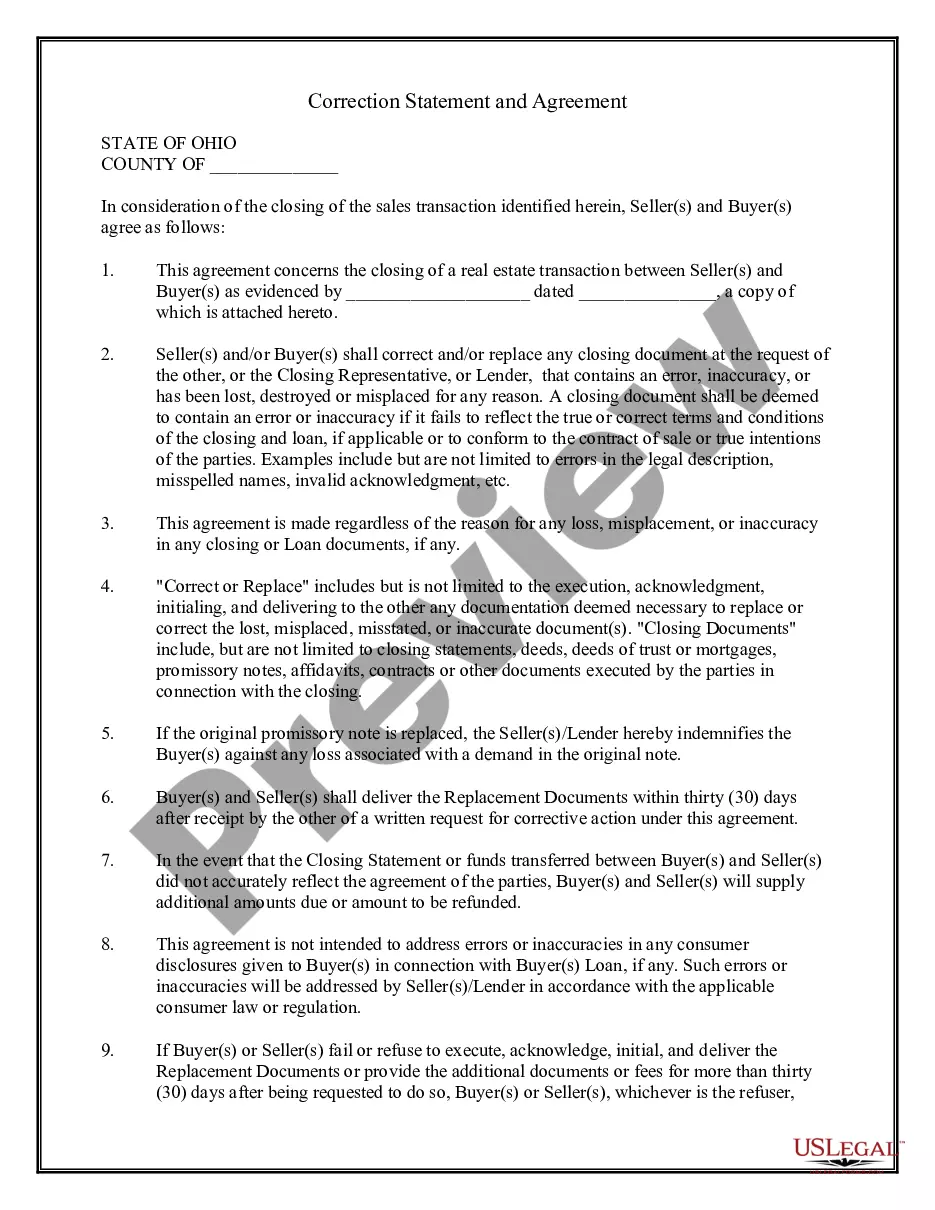

This Correction Statement and Agreement form is for a buyer and seller to sign at the closing for a loan or purchase of real property agreeing to execute corrected documents in the event of certain errors. It also is used to provide replacement documents in the event any documents are lost or misplaced.

Franklin Ohio Correction Statement and Agreement

Description

How to fill out Ohio Correction Statement And Agreement?

If you've previously utilized our service, sign in to your account and obtain the Franklin Ohio Correction Statement and Agreement on your device by selecting the Download button. Ensure that your subscription is active. If it is not, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your file.

You have continuous access to every document you have purchased: you can find it within your profile in the My documents section whenever you need to access it again. Utilize the US Legal Forms service to quickly locate and save any template for your personal or professional requirements!

- Ensure you have located the correct document. Browse through the description and use the Preview feature, if available, to verify it meets your needs. If it does not suit you, use the Search bar above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription option.

- Create an account and process your payment. Use your credit card information or the PayPal method to finalize the purchase.

- Obtain your Franklin Ohio Correction Statement and Agreement. Choose the file format for your document and store it on your device.

- Fill out your sample. Print it or use professional online editors to complete and sign it electronically.

Form popularity

FAQ

To file articles of amendment in Ohio, you will need to complete the necessary forms and submit them to the Secretary of State's office. This submission will include the Franklin Ohio Correction Statement and Agreement, clearly stating the changes to your articles. Double-check your paperwork for accuracy, as mistakes can delay processing. Using USLegalForms can provide you with the structured forms and instructions you need to file confidently.

To amend articles of organization in Ohio, you must file a document known as the Articles of Amendment. This process involves identifying the changes you plan to make and preparing the necessary paperwork, including the Franklin Ohio Correction Statement and Agreement. Accurate filing ensures that your organization's records are up-to-date. You can simplify this process by utilizing USLegalForms, which offers tailored templates and easy guidance.

To amend your LLC in Ohio, you will need to file an Amended Articles of Organization with the Secretary of State. This process is crucial if there are any changes, such as a new name or changes in management. You can take guidance from platforms like uslegalforms, which provide resources to help you navigate the Franklin Ohio Correction Statement and Agreement efficiently. Ensuring your documents are up-to-date keeps your business compliant and operational.

In Ohio, the Franklin Ohio Correction Statement and Agreement has taken a step towards modernization by replacing JPay. This new system aims to streamline processes for inmates and their families, offering better payment options and more accessible communication. By transitioning to this system, Ohio ensures that all parties involved have a smoother experience when managing inmate transactions. It's an important advancement for maintaining connections in the correctional environment.

You should file an amended IT 1040 or SD 100 any time you need to report changes to your originally filed return(s). Additionally, if the IRS makes changes, either based on an audit or an amended federal return, that affect your Ohio return(s), you are required to file an amended IT 1040 and/or SD 100.

Starting a Lawsuit A civil action is started in the Franklin County Municipal Court by filing the appropriate complaint, petition, or appeal, along with the filing fee, on the third floor at 375 South High Street, Columbus, Ohio 43215, in person or by mail.

Small Claims Court Limits for the 50 States StateDollar LimitOhio$6,000Oklahoma$10,000Oregon$10,000Pennsylvania$12,00047 more rows

Form IT-1040 is a Form used for the Tax Return and Tax Amendment. You can prepare a 2021 Ohio Tax Amendment on eFile.com, however you cannot submit it electronically. In comparison, the IRS requires a different Form - Form 1040X -to amend an IRS return (do not use Form 1040 for an IRS Amendment).

Electronic filing options ? Online services is a free, secure electronic portal where you can file returns, make payments, and view additional information regarding your Ohio individual and school district income taxes. Ohio income tax forms ? Forms are available at tax.ohio.gov/forms.

Go to the clerk's office and ask for a Small Claim Questionnaire. The filing fee is $20.00 plus service. Fill in the form with your case number, your name and address, and the name and address of the judgment debtor. You will be given a court date when you file.