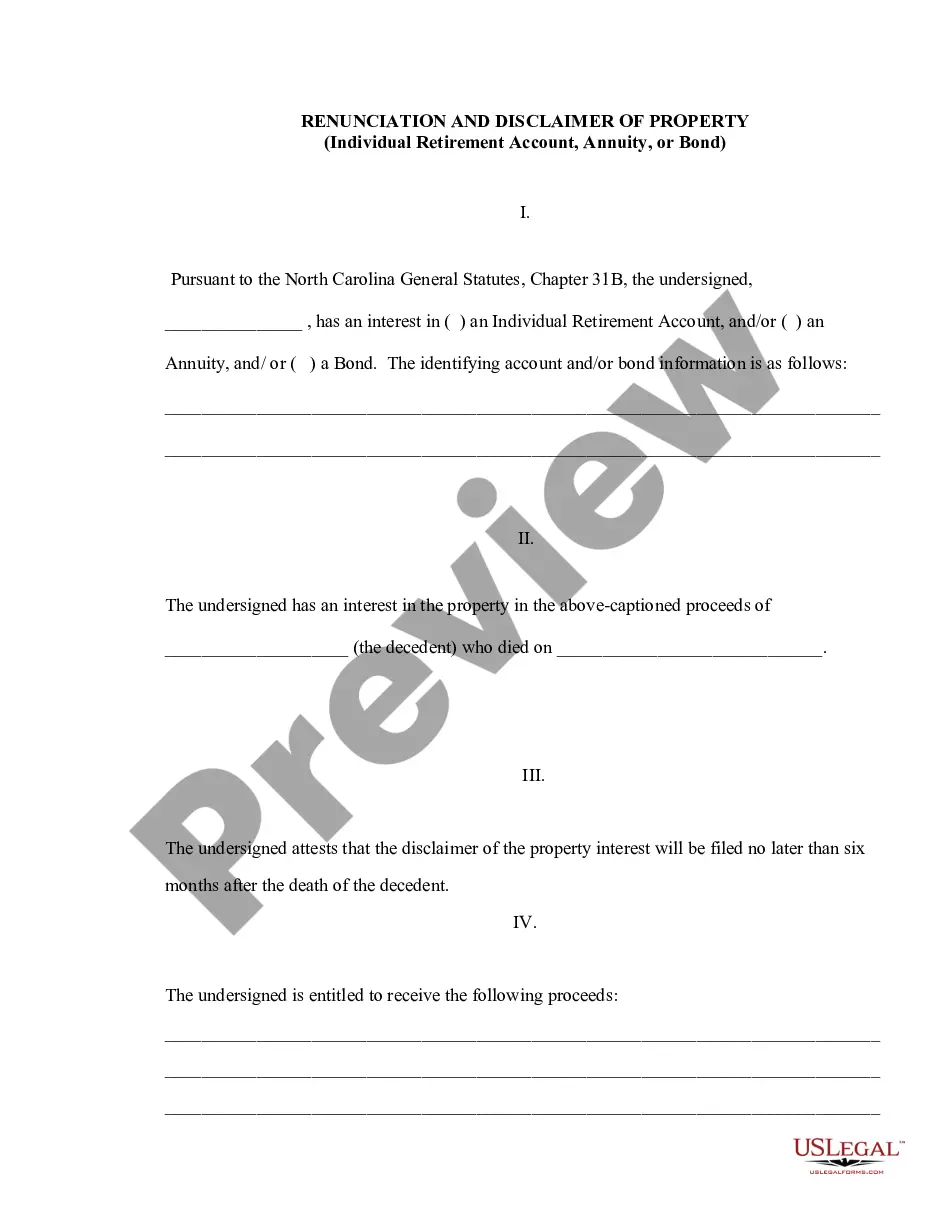

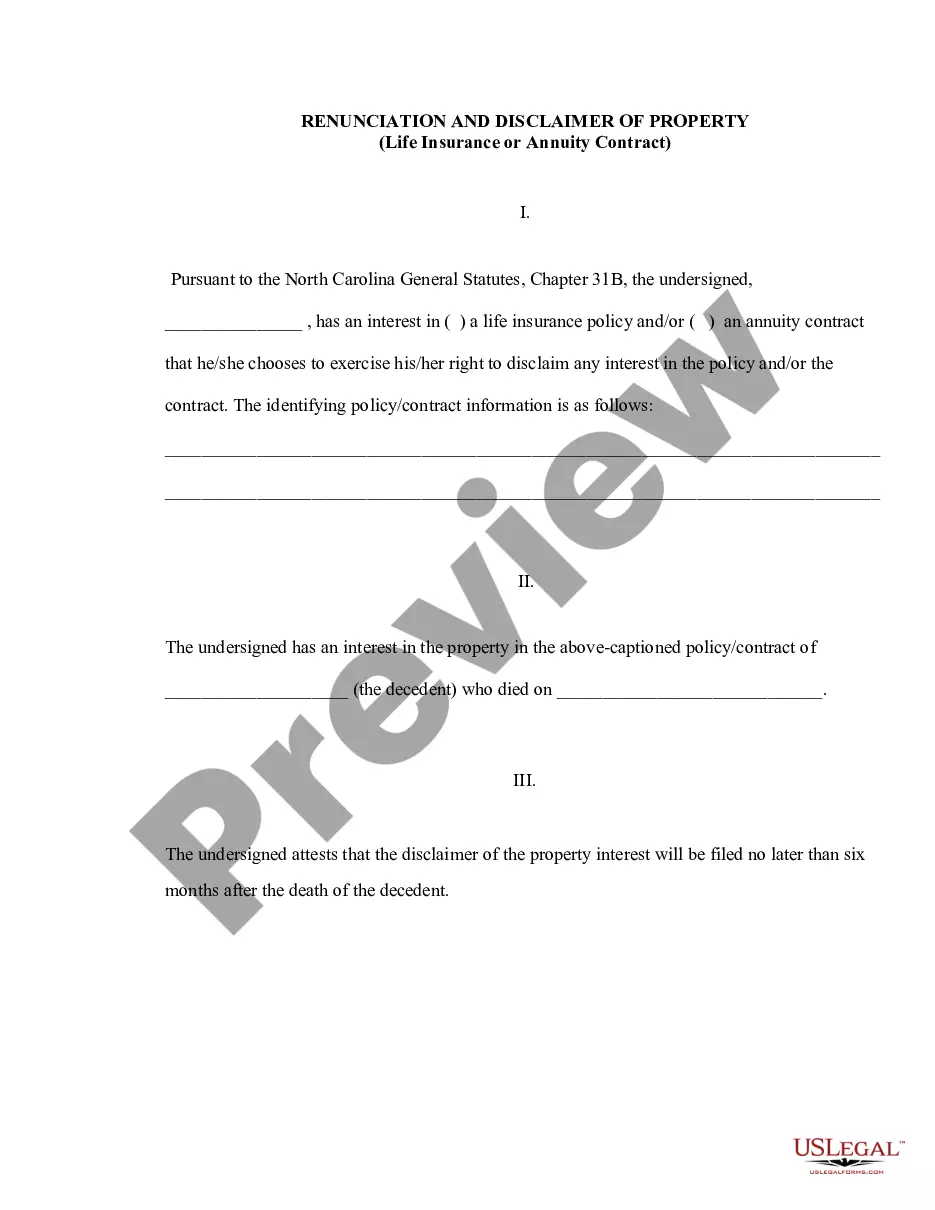

Fayetteville North Carolina Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond

Description

How to fill out North Carolina Renunciation And Disclaimer Of Property - Individual Retirement Account, Annuity, Or Bond?

Are you in search of a reliable and cost-effective provider of legal documents to obtain the Fayetteville North Carolina Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond? US Legal Forms is your ideal choice.

Whether you require a simple agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your divorce proceedings in court, we have you taken care of. Our website features over 85,000 current legal document templates for both personal and business needs. All the templates we provide are not one-size-fits-all and are tailored according to the specifications of individual states and counties.

To obtain the document, you must Log In to your account, find the desired template, and click the Download button next to it. Please note that you can access your previously acquired form templates at any time through the My documents tab.

Is it your first visit to our site? No problem. You can easily create an account, but first, ensure to do the following.

Now you may register for an account. After that, select the subscription plan and proceed with payment. Once the payment is done, download the Fayetteville North Carolina Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond in any offered format. You can revisit the site whenever necessary and re-download the document at no additional cost.

Acquiring updated legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time searching for legal documents online.

- Verify if the Fayetteville North Carolina Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond complies with the laws of your state and locality.

- Review the form’s specifics (if available) to ascertain who and what the document is meant for.

- Restart the search if the template does not fit your particular situation.

Form popularity

FAQ

North Carolina does not have an inheritance tax, so you do not need a waiver for that purpose. However, if you are involved in estate matters, you should be aware of other tax responsibilities that may arise. Consulting with a professional can help clarify any obligations you face concerning the Fayetteville North Carolina Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond.

Yes, you can disclaim an inheritance in North Carolina. The process is straightforward, but it requires adherence to state laws to be valid. Make sure to consult a legal professional or use uslegalforms for assistance in handling the Fayetteville North Carolina Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond correctly.

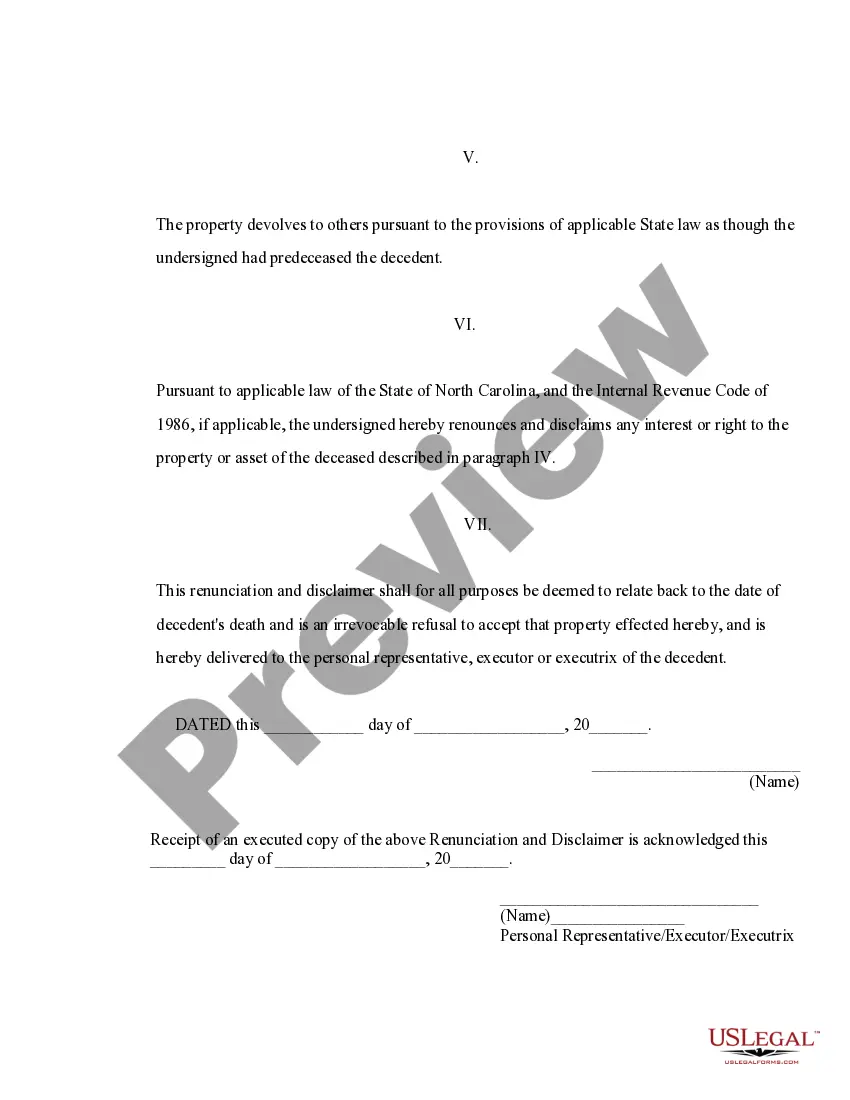

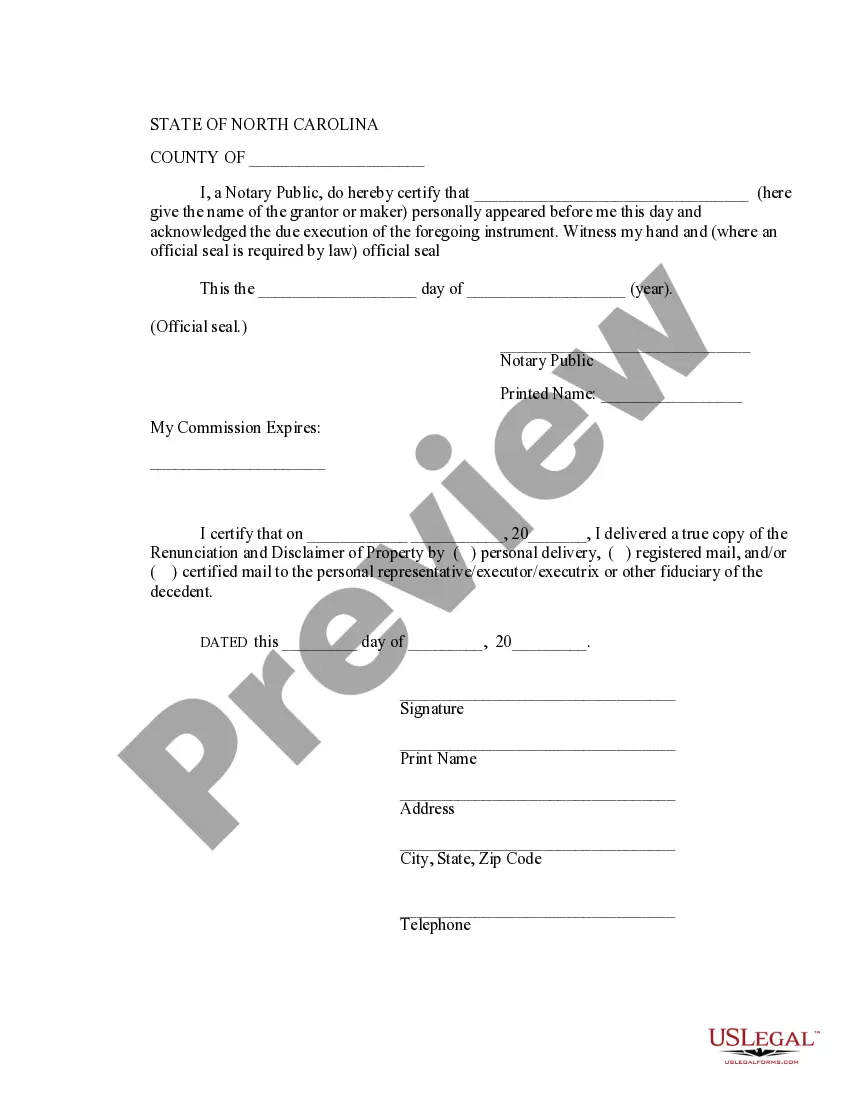

To disclaim an inheritance in North Carolina, you must prepare and submit a formal disclaimer document to the appropriate parties, such as the estate executor. This document should include specific details about the property and state your intention clearly. Utilizing platforms like uslegalforms can streamline this process and ensure compliance with local laws regarding Fayetteville North Carolina Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond.

The statute of renunciation in North Carolina outlines the legal process for rejecting an inheritance. Under this statute, beneficiaries must file a written disclaimer within nine months of the decedent's death. This is crucial for ensuring that the Fayetteville North Carolina Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond is conducted properly to avoid unintended consequences.

If you decide to refuse your inheritance in Fayetteville, North Carolina, it will be treated as if you never received it. This means the property, whether it is an Individual Retirement Account, Annuity, or Bond, will pass to the next beneficiary designated in the will or by law. It's important to understand that renouncing an inheritance does not incur tax liability, which can be beneficial in certain situations.

In North Carolina, the statute of limitations for recovering personal property is typically three years. This time frame emphasizes the importance of acting swiftly when there are claims regarding property ownership or rights. If you are navigating issues related to the Fayetteville North Carolina Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond, understanding these time constraints can be critical. Utilizing platforms like uslegalforms can provide further guidance and resources for navigating these legal matters.

The law of renunciation allows an individual to refuse an inheritance or property, providing them with an opportunity to disclaim assets. This process is especially relevant in the context of the Fayetteville North Carolina Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond. By renouncing an inheritance, individuals can prevent unintended tax consequences or complex disputes among beneficiaries. It is essential to follow the proper legal procedures to execute this effectively.

In North Carolina, a spouse does not automatically inherit everything. Instead, the distribution of property depends on the type of property and how it is titled. If a spouse passes away without a will, the laws of intestacy govern the distribution of assets. Therefore, understanding the Fayetteville North Carolina Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond is crucial for ensuring clarity in inheritance matters.

North Carolina's inheritance laws dictate how property is distributed among heirs upon someone’s death. The laws vary depending on whether there is a will, with intestate succession applying when no will exists. Certain assets may be exempt from inheritance, including specific accounts and property types. For those looking to understand their rights and options, including the Fayetteville North Carolina Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond, consulting resources like US Legal Forms can provide valuable insights.

Disclaiming part of an inheritance in North Carolina requires you to specify the portion you wish to renounce in your written disclaimer. This document needs to detail which assets you are declining, such as specific property or a fraction of an account. The disclaimer must be signed and filed in a timely manner, typically within nine months of the inheritance's acceptance. Accessing resources on US Legal Forms can help you navigate the Fayetteville North Carolina Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond process effectively.