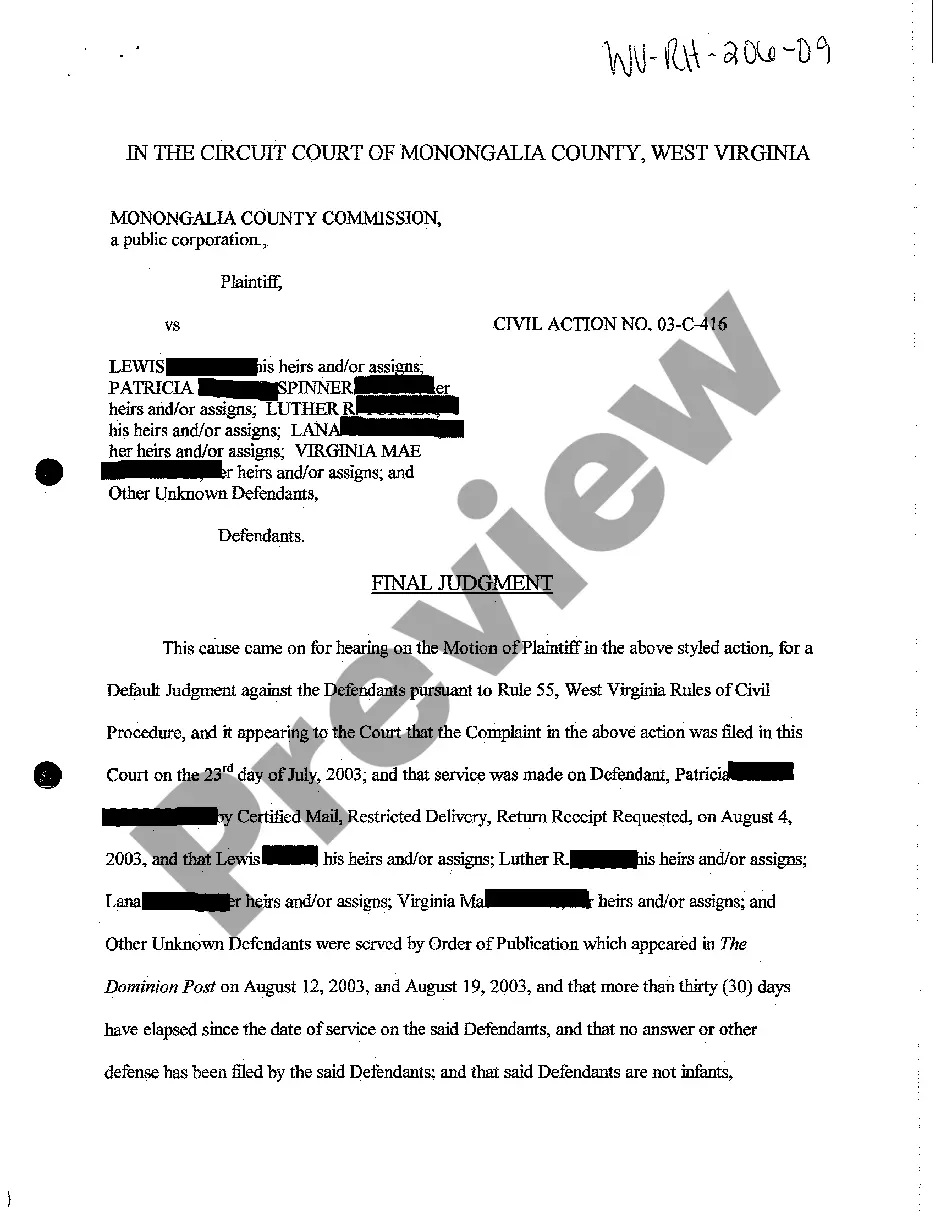

Wisconsin Form NF is a set of documents used in Wisconsin to report changes in a business's ownership or structure. It is filed with the Wisconsin Department of Financial Institutions (DFI). The form includes the Statement of Change of Control of Corporation, Statement of Change of Structure of Corporation, and the Statement of Change of Beneficial Ownership of Corporation. The form is used to report changes in the ownership, structure or beneficial ownership of a Wisconsin corporation, limited liability company, limited liability partnership or limited partnership. The form must be completed and signed by all parties involved in the change of control or structure transaction. It must then be filed with the DFI within 15 days of the change.

Wisconsin Form NF

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Wisconsin Form NF?

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state regulations and are verified by our specialists. So if you need to complete Wisconsin Form NF, our service is the best place to download it.

Obtaining your Wisconsin Form NF from our service is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button after they find the proper template. Later, if they need to, users can get the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a brief guide for you:

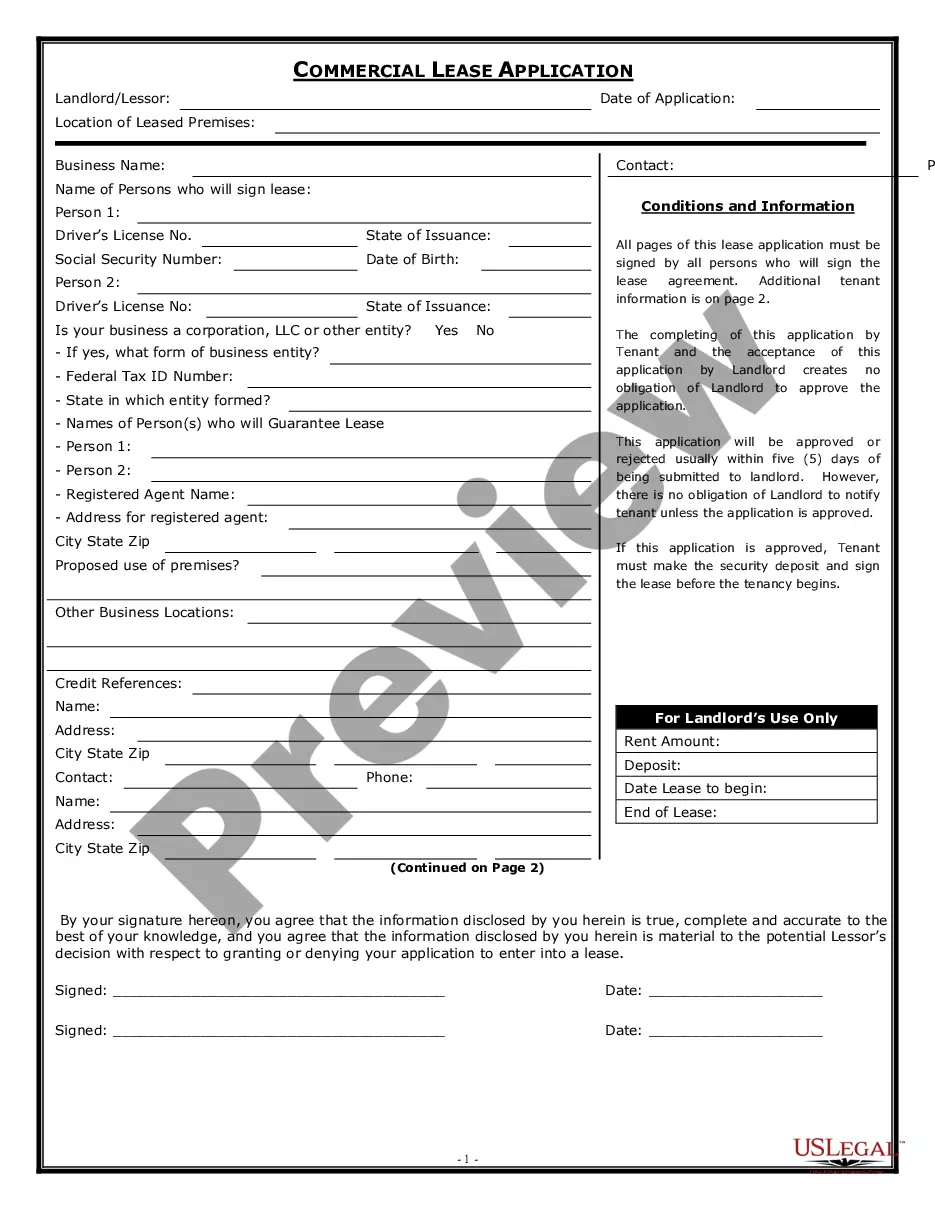

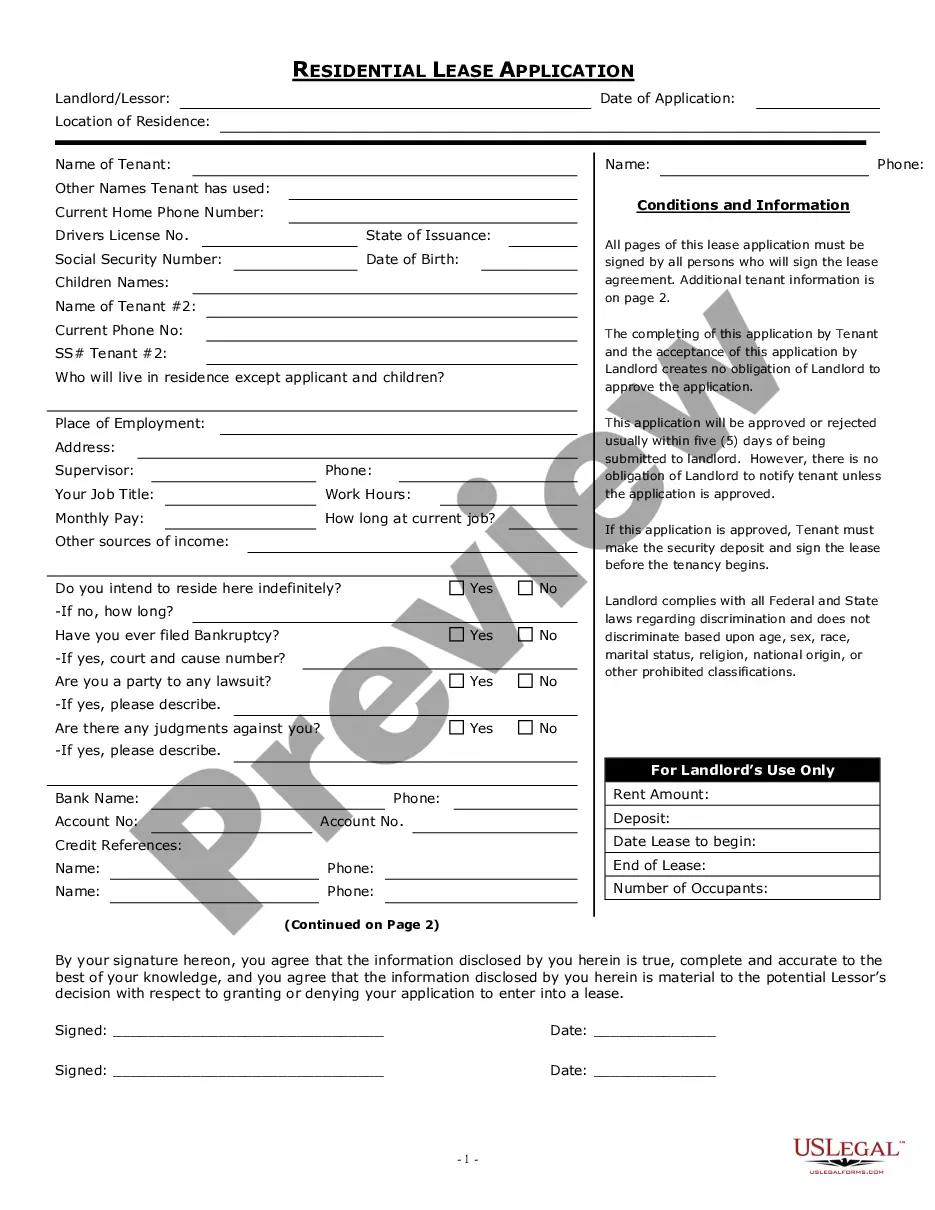

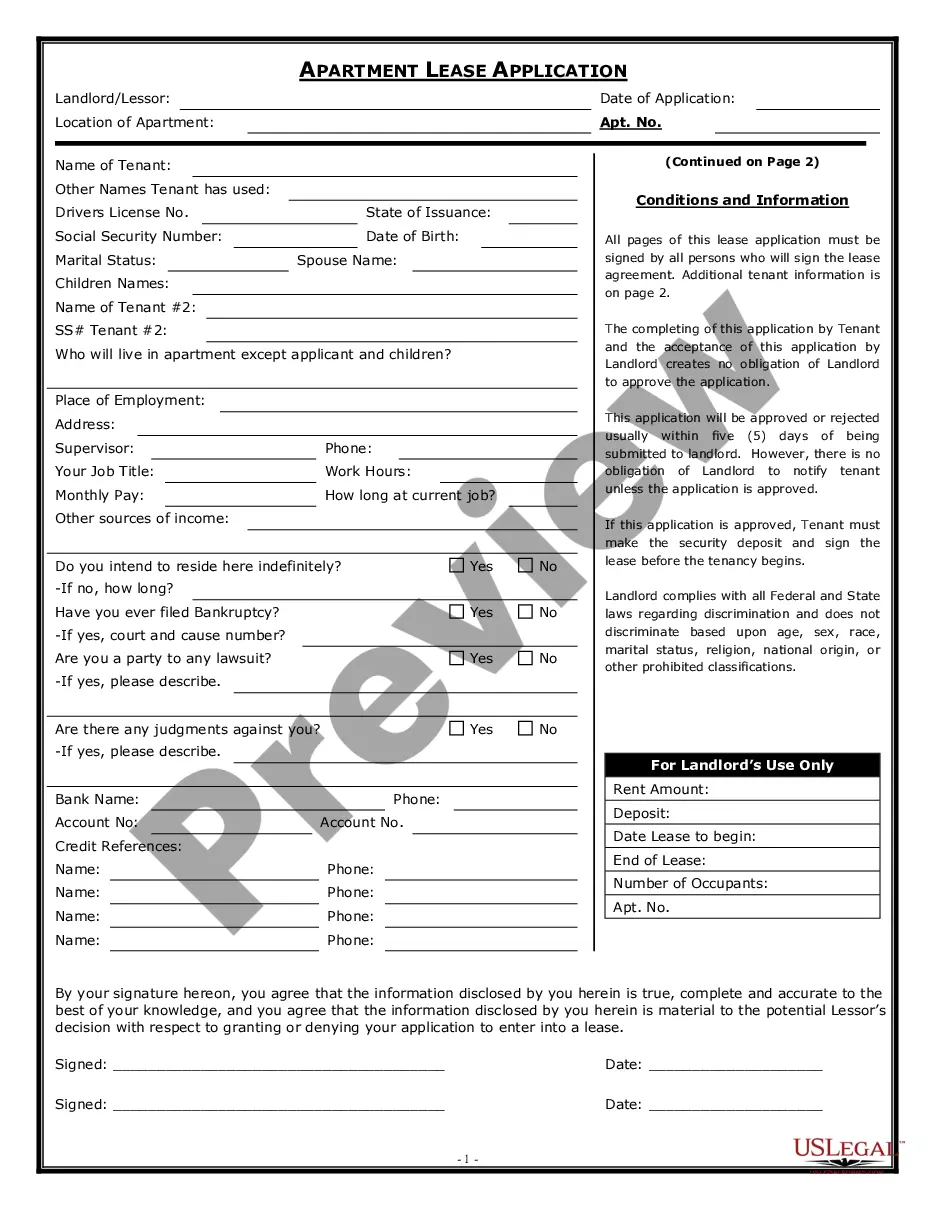

- Document compliance check. You should attentively examine the content of the form you want and check whether it satisfies your needs and complies with your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate template, and click Buy Now once you see the one you need.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Wisconsin Form NF and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to get any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

Form W-4 requires Wisconsin residents to complete the Wisconsin Form WT-4 if adjusting Wisconsin state taxes.

Withholding Formula (Effective Pay Period 04, 2022) If the Taxable Wages Are:Amount of Tax Is:Over $0 but not over $12,7603.54%Over $12,760 but not over $25,520$451.70 plus 4.65% of excess over $12,760Over $25,520 but not over $280,950$1,045.04 plus 5.30% of excess over $25,5201 more row ?

All employees must fill out a Federal W4 and a Wisconsin WT-4. If you have any questions on how you should fill out the Federal W4 or Wisconsin WT-4 please consult your tax advisor. The Federal W4 no longer has a box to list the number of exemptions you wish to claim.

WHO MUST COMPLETE: Effective on or after January 1, 2020, every newly?hired employee is required to provide a completed Form WT?4 to each of their employers. Form WT?4 will be used by your employer to determine the amount of Wisconsin income tax to be withheld from your paychecks.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

If you are a nonresident or part-year resident of Wisconsin and your Wisconsin gross income (or the combined gross income of you and your spouse) is $2,000 or more, you must file a Form 1NPR, Nonresident and Part-Year Resident Income Tax Return. The Form 1NPR and instructions can be downloaded from our website.

You may claim exemption from withholding of Wisconsin income tax if you had no liability for income tax last year, and you expect to incur no liability for income tax this year. To claim complete exemption from withholding use Wisconsin Form WT-4, Employee's Wisconsin Withholding Exemption Certificate.

An employee who pays 100% of the employee's estimated tax for the next calendar or taxable year on or before the last day of the current calendar or taxable year is completely exempt from payroll withholding of tax.