Washington Self-Employed Paving Services Contract

Description

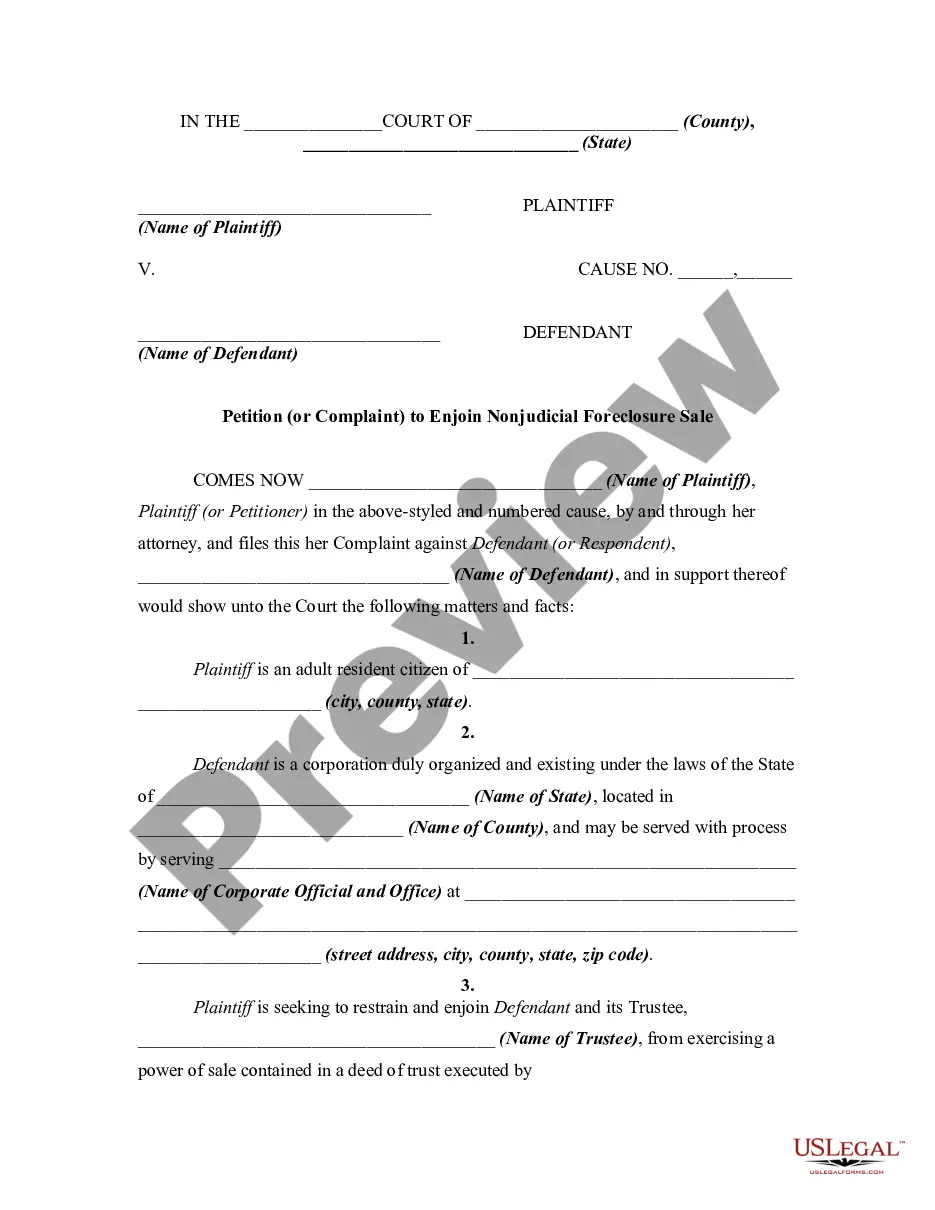

How to fill out Self-Employed Paving Services Contract?

If you wish to acquire, download, or print legal document templates, utilize US Legal Forms, the premier source of legal forms accessible online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you need.

A range of templates for business and personal use are categorized by types and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal document format.

Step 4. After you have identified the form you need, select the Purchase now button. Choose your preferred pricing plan and enter your information to create an account.

- Utilize US Legal Forms to locate the Washington Self-Employed Paving Services Contract in just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and then click the Download button to obtain the Washington Self-Employed Paving Services Contract.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you have selected the form for the correct state/country.

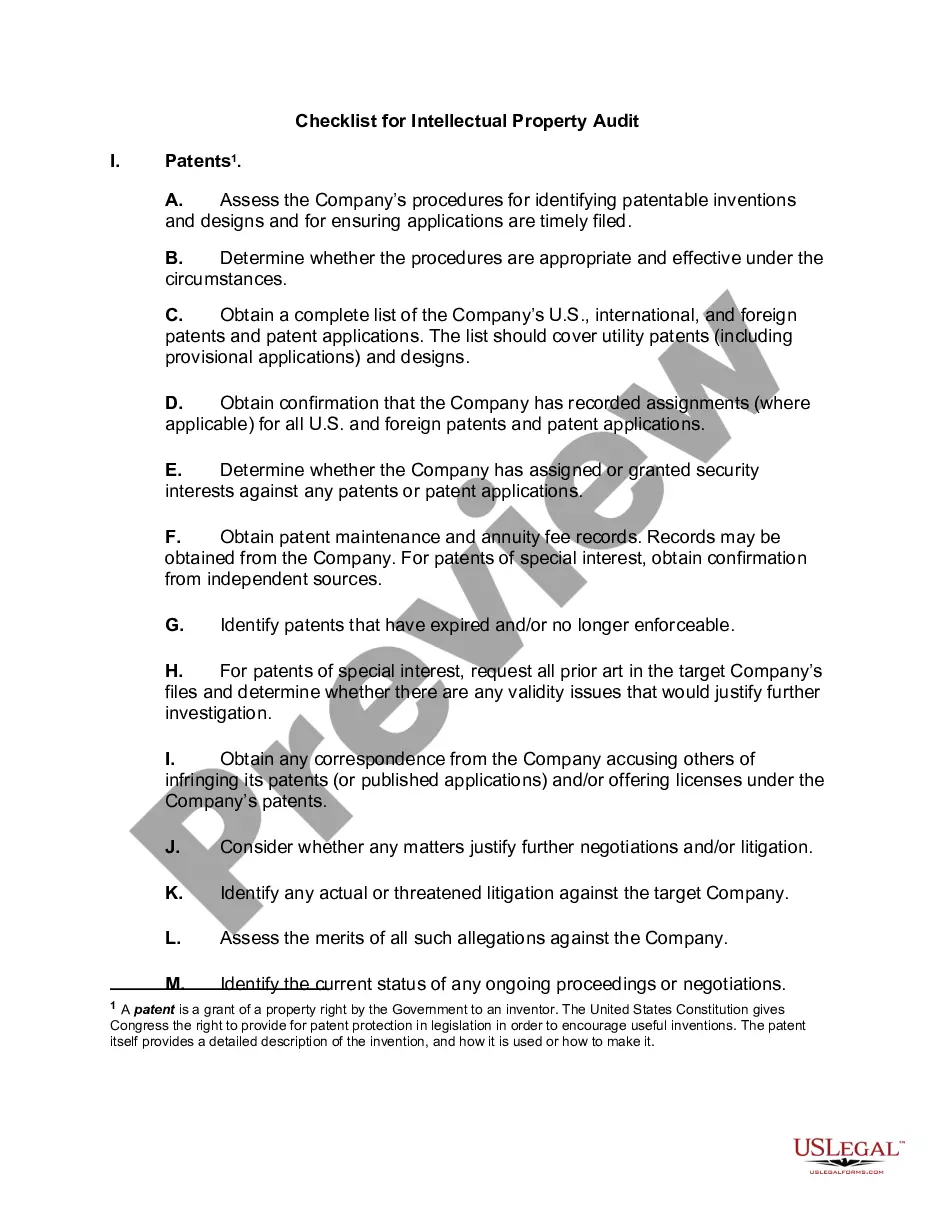

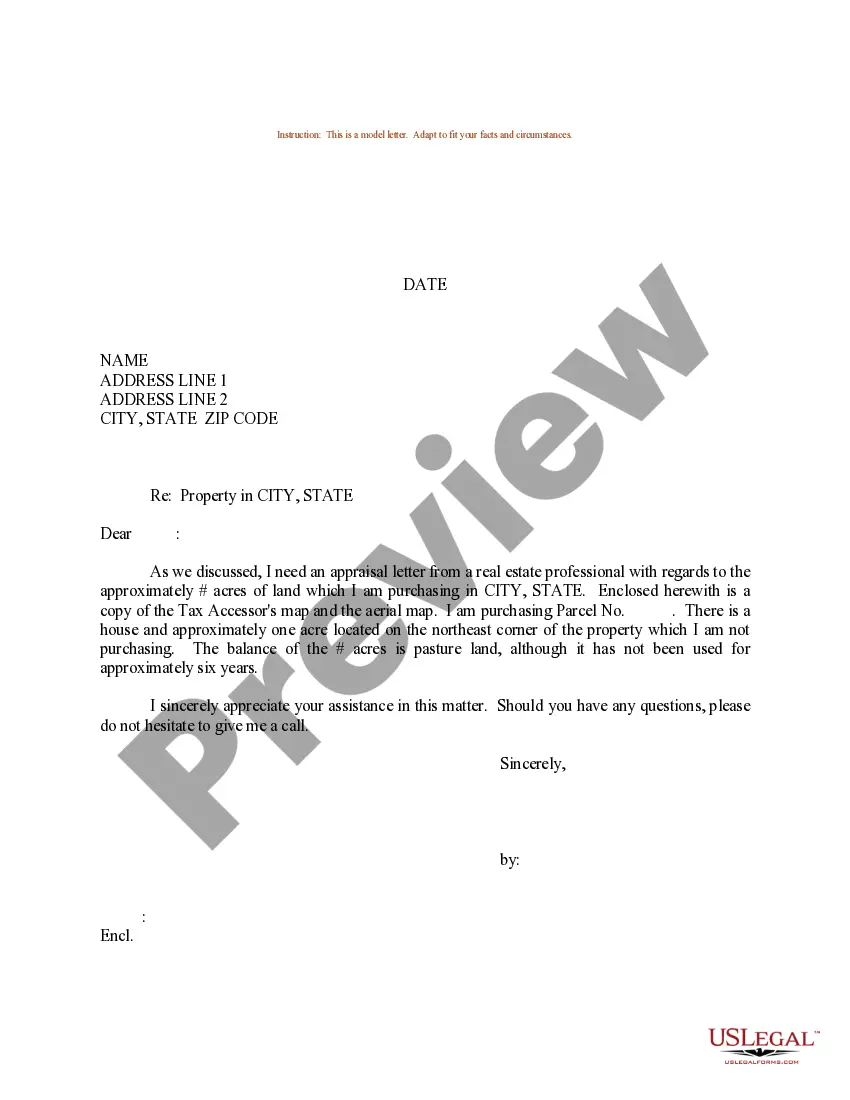

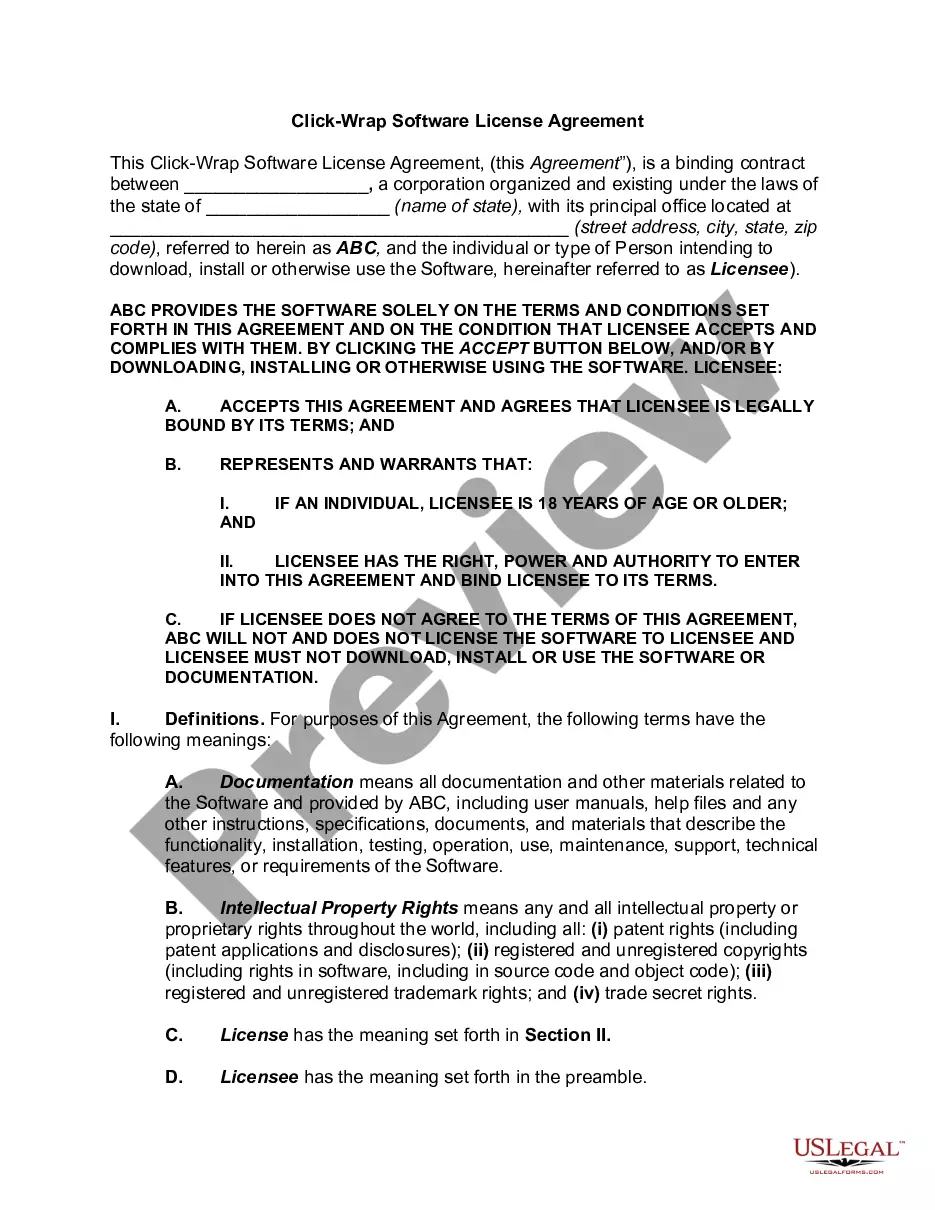

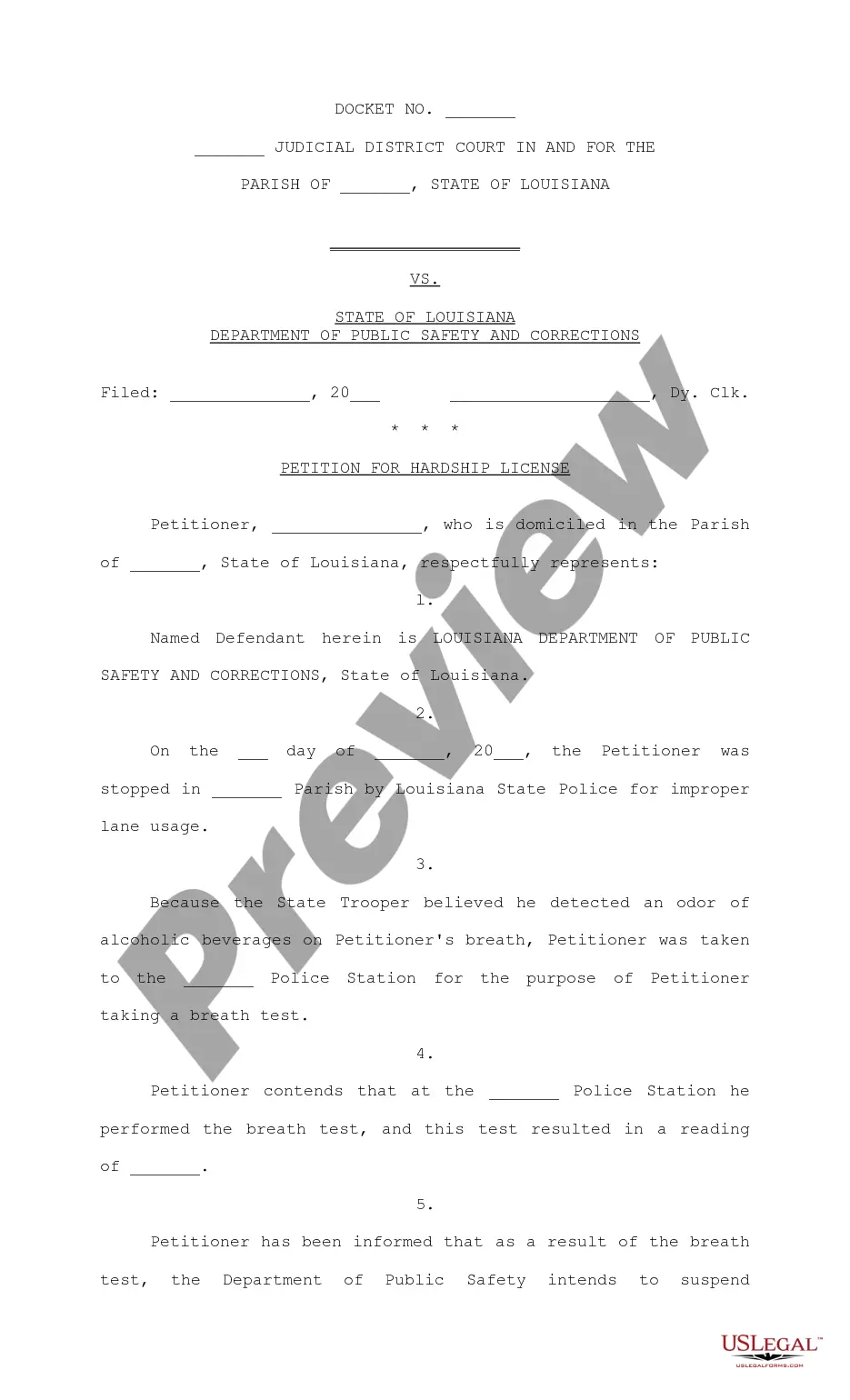

- Step 2. Use the Review option to scrutinize the form’s content. Remember to read the description.

Form popularity

FAQ

Do You Need a General Contractor's License in Washington State? Yes! Washington state imposes substantial penalties and fines on people who complete work for others without first obtaining a Washington state general contractor's license.

If you are an independent contractor, you must register with the Department of Revenue unless you: Make less than $12,000 before expenses per year; Do not sell retail; Do not pay or collect any taxes.

Can You 1099 Someone Without A Business? Form 1099-NEC does not require you to have a business to report payments for your services. As a non-employee, you can perform services. In your case, the payer has determined that there is no relationship between you and your employer.

Must pass 1 of the following 2 options: The individual:Is customarily engaged in an independently established trade, occupation, profession, or business, of the same nature as that involved in the contract of service.Has a principal place of business that is eligible for a business deduction for IRS purposes.

Legal methods you can use to avoid paying taxes include things such as tax-advantaged accounts (401(k)s and IRAs), as well as claiming 1099 deductions and tax credits. Being a freelancer or an independent contractor comes with various 1099 benefits, such as the freedom to set your own hours and be your own boss.

As an independent contractor, you are engaged in business in Washington. You must register with and pay taxes to the Department of Revenue (DOR) if you meet any of the following: You are required to collect sales tax. Your gross income equals $12,000 or more per year.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

What percent do independent contractors pay in taxes? The self-employment tax rate is 15.3%, of which 12.4% goes to Social Security and 2.9% goes to Medicare. Income tax obligations vary based on net business profits and losses, among other factors.