The courts have inherent power to restrain the sale of mortgaged premises in foreclosure proceedings, but are reluctant to exercise such power except where it is shown that particular circumstances, extrinsic to the instrument, would render its enforcement in this manner inequitable and work irreparable injury, and that complainant has no adequate remedy at law. Furthermore, a party must show a probable right of recovery in order to obtain a temporary injunction of a foreclosure action.

Hawaii Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding as to Promissory Note's Terms of Payment upon Assumption of Note

Description

How to fill out Complaint Or Petition To Enjoin Foreclosure Sale Due To Misunderstanding As To Promissory Note's Terms Of Payment Upon Assumption Of Note?

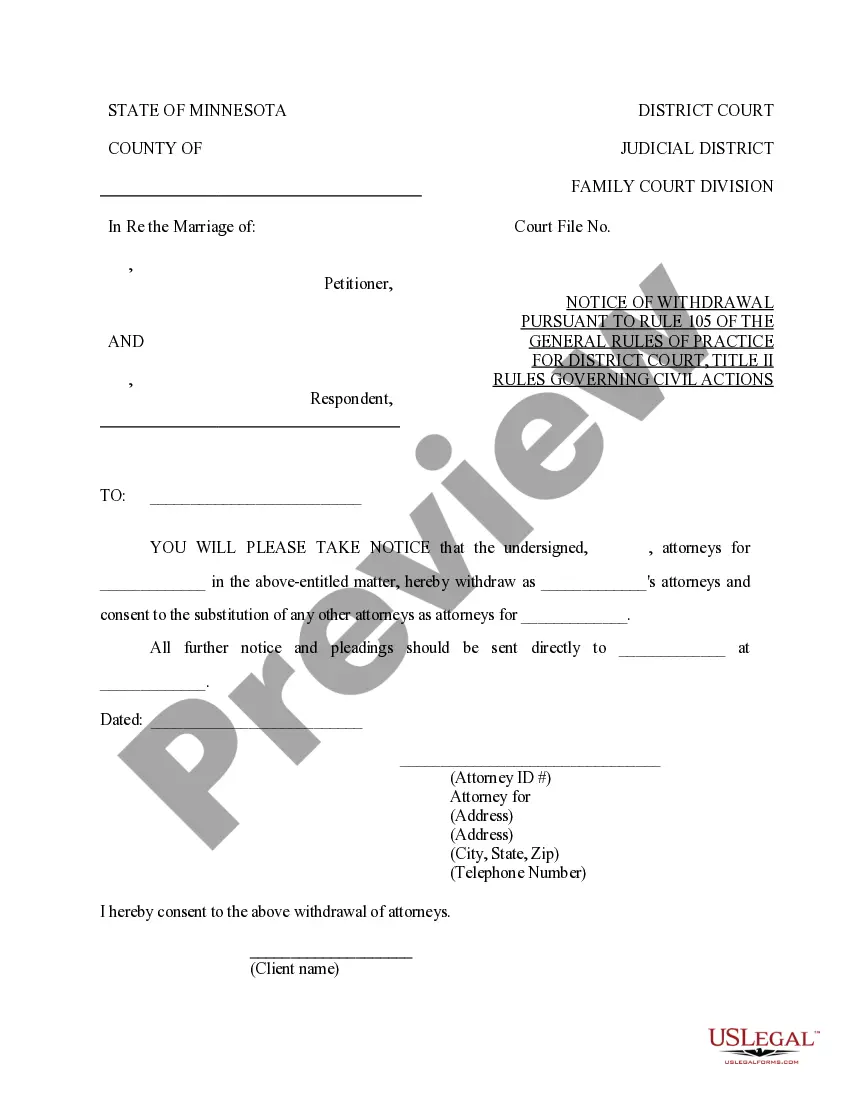

You can spend hours on-line searching for the legitimate papers format that fits the federal and state specifications you need. US Legal Forms offers thousands of legitimate types that happen to be analyzed by specialists. It is simple to down load or printing the Hawaii Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding as to Promissory Note's Terms of Payment upon Assumption of Note from your assistance.

If you currently have a US Legal Forms profile, you may log in and click on the Obtain key. Following that, you may comprehensive, modify, printing, or indication the Hawaii Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding as to Promissory Note's Terms of Payment upon Assumption of Note. Every legitimate papers format you purchase is your own property eternally. To obtain another duplicate associated with a acquired form, visit the My Forms tab and click on the related key.

If you work with the US Legal Forms web site initially, follow the easy directions beneath:

- Initial, make sure that you have selected the best papers format to the region/town of your choosing. Read the form description to make sure you have picked the right form. If available, make use of the Review key to search from the papers format also.

- If you would like get another variation in the form, make use of the Look for area to get the format that meets your requirements and specifications.

- When you have found the format you would like, simply click Purchase now to continue.

- Find the prices prepare you would like, key in your accreditations, and register for your account on US Legal Forms.

- Total the purchase. You should use your bank card or PayPal profile to cover the legitimate form.

- Find the structure in the papers and down load it to the gadget.

- Make alterations to the papers if necessary. You can comprehensive, modify and indication and printing Hawaii Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding as to Promissory Note's Terms of Payment upon Assumption of Note.

Obtain and printing thousands of papers themes while using US Legal Forms website, which offers the largest selection of legitimate types. Use specialist and condition-distinct themes to handle your business or specific needs.

Form popularity

FAQ

In Hawaii, there are two types of foreclosures: judicial and nonjudicial. In a JUDICIAL FORECLOSURE, the Mortgagee files a lawsuit against you in order to obtain a court judgment that you owe the balance due under your loan and to obtain an order to sell the property.

Foreclosure Sales in Hawaii With a credit bid, the lender gets a credit up to the amount of the borrower's debt. The highest bidder at the sale becomes the new owner of the property.

5 Alaska, Arizona, California, Connecticut, Hawaii Idaho, Minnesota, North Carolina, North Dakota, Texas, Utah, and Washington are considered non-recourse states.

In a judicial foreclosure, after the judge orders the sale of a home, it's usually auctioned off to the highest bidder. The homeowner has some time after the sale to buy the home back from the successful bidder (called the right of redemption). The amount of time depends on whether the sale satisfied the debt.

Historically, most foreclosures were non-judicial. More recently, lenders have begun shifting to judicial foreclosures as a way to bypass having to follow the terms of the state's Mortgage Foreclosure Dispute Resolution. Judicial foreclosures in Hawaii involve the lender filing a lawsuit to initiate the foreclosure.

To summarize, deadline is 10 years after maturity if the recorded deed of trust recites a maturity date, and 60 years after recording if it does not. Lenders typically do not recite maturity dates, so usually it is 60 years after the deed of trust was recorded, i.e. a ton of time.