Vermont Receipt of Payment for Obligation

Description

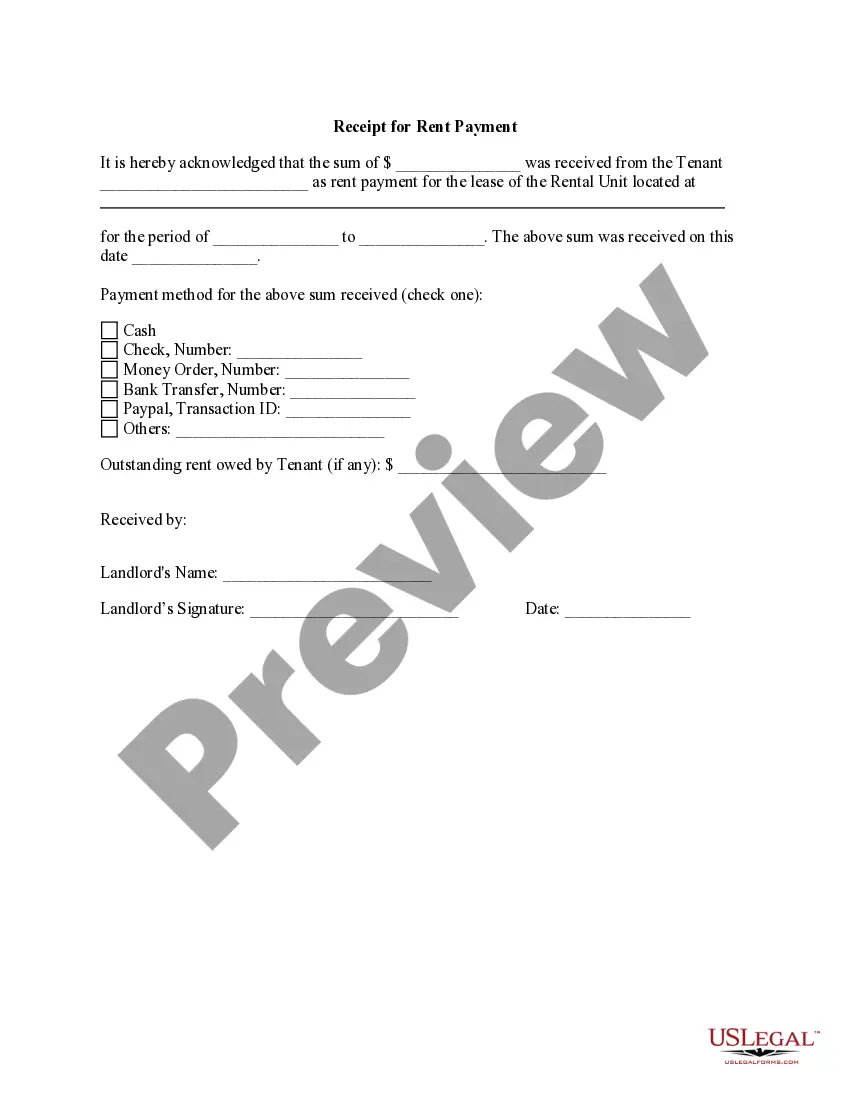

How to fill out Receipt Of Payment For Obligation?

Are you currently within a placement the place you need papers for sometimes business or specific functions virtually every day time? There are a lot of legal record web templates available on the Internet, but finding kinds you can depend on is not straightforward. US Legal Forms delivers a huge number of type web templates, like the Vermont Receipt of Payment for Obligation, that are created to satisfy federal and state needs.

In case you are currently informed about US Legal Forms internet site and also have an account, just log in. After that, you can download the Vermont Receipt of Payment for Obligation format.

Unless you offer an bank account and wish to start using US Legal Forms, adopt these measures:

- Obtain the type you require and make sure it is for the right city/area.

- Utilize the Preview switch to examine the form.

- See the outline to ensure that you have chosen the proper type.

- When the type is not what you`re searching for, make use of the Research discipline to get the type that suits you and needs.

- If you get the right type, click on Get now.

- Pick the prices prepare you need, fill out the necessary details to produce your account, and pay money for an order with your PayPal or charge card.

- Choose a handy document structure and download your backup.

Get all the record web templates you might have bought in the My Forms food selection. You can obtain a further backup of Vermont Receipt of Payment for Obligation any time, if necessary. Just select the needed type to download or print the record format.

Use US Legal Forms, the most comprehensive variety of legal forms, to save some time and avoid faults. The support delivers professionally produced legal record web templates which can be used for a selection of functions. Make an account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

Ing to Maine's prompt payment laws, the project owner must pay the prime contractor by the later of 20 days from delivery of invoice, or 20 days from the end of the "billing period." This may be modified by agreement.

Vermont's Statute of Limitations on Debt The State of Vermont has a six-to-eight-year statute of limitations on written contracts, while oral contracts and collection of debt on accounts each have a six year statute of limitations. Judgements carry an eight-year statute of limitations.

Vermont Statute Of Limitations In Vermont, an injured person has three years from the date of the injury or accident to file a personal injury lawsuit in the state's civil court system.

An action brought on a promissory note signed in the presence of an attesting witness shall be commenced within 14 years after the cause of action accrues, and not after.

On private projects, Massachusetts Prompt Pay law requires property owners to make progress payments to Prime Contractors within 45 days after approval of invoice. The invoice must be approved or denied within 15 days.

SECTION OVERVIEW AND POLICIES New York State Finance Law (SFL) §179-f requires the State to pay vendors promptly (within 30 days for most vendors, 15 days for qualified Small Business vendors). When the State fails to pay the vendor by the Net Due Date, the vendor may be entitled to interest.

In 1982, Congress passed the Prompt Payment Act to require Federal agencies to pay their bills on a timely basis; to pay interest penalties when payments are made late, and to take discounts.

Deadlines for Payment However, if the contract is silent, then the prompt pay deadlines are enforced. For all payments from the owner or public entity to the prime contractor, they must be released within 20 days of either the end of the billing period, or delivery of a request for payment; whichever is later.