Nebraska Revocable Trust for Child

Description

How to fill out Revocable Trust For Child?

If you wish to obtain, acquire, or download authentic document templates, utilize US Legal Forms, the leading collection of legal forms available online.

Take advantage of the website's straightforward and convenient search to find the documents you require.

A wide range of templates for both business and personal applications are organized by categories and jurisdictions, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Use US Legal Forms to obtain the Nebraska Revocable Trust for Child with just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Download button to get the Nebraska Revocable Trust for Child.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct jurisdiction/region.

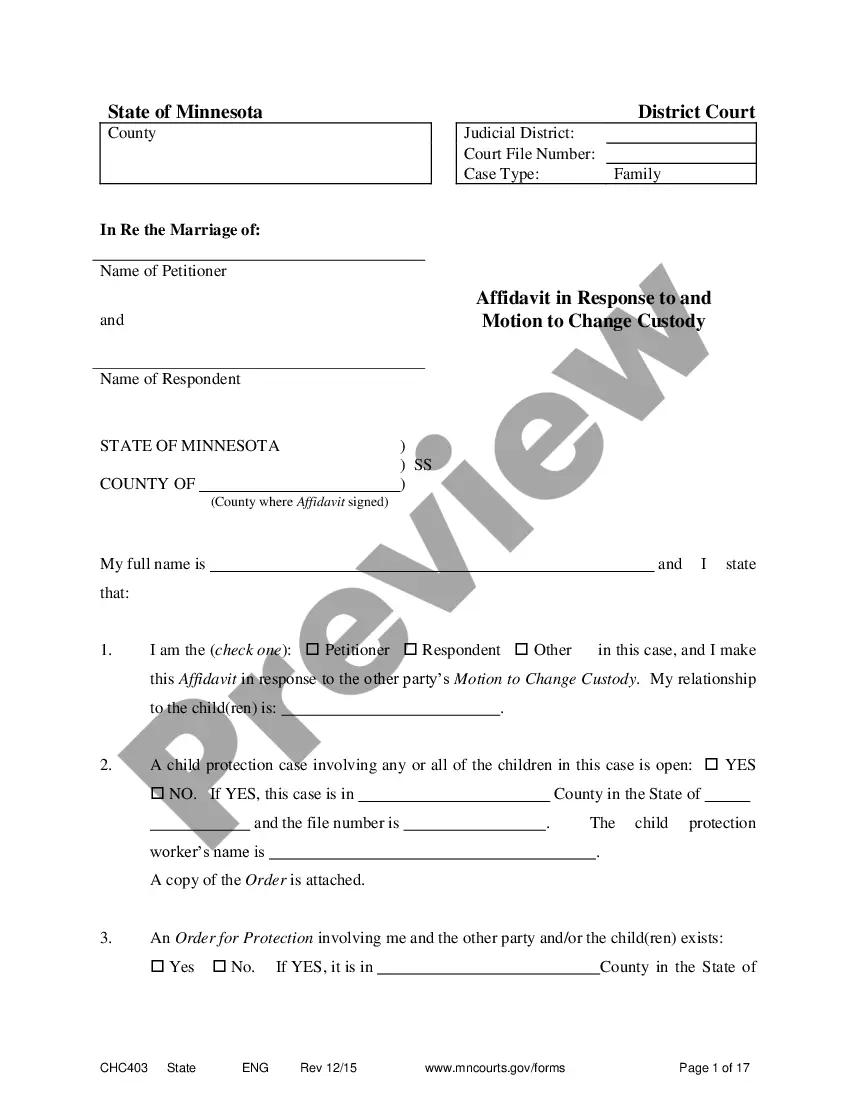

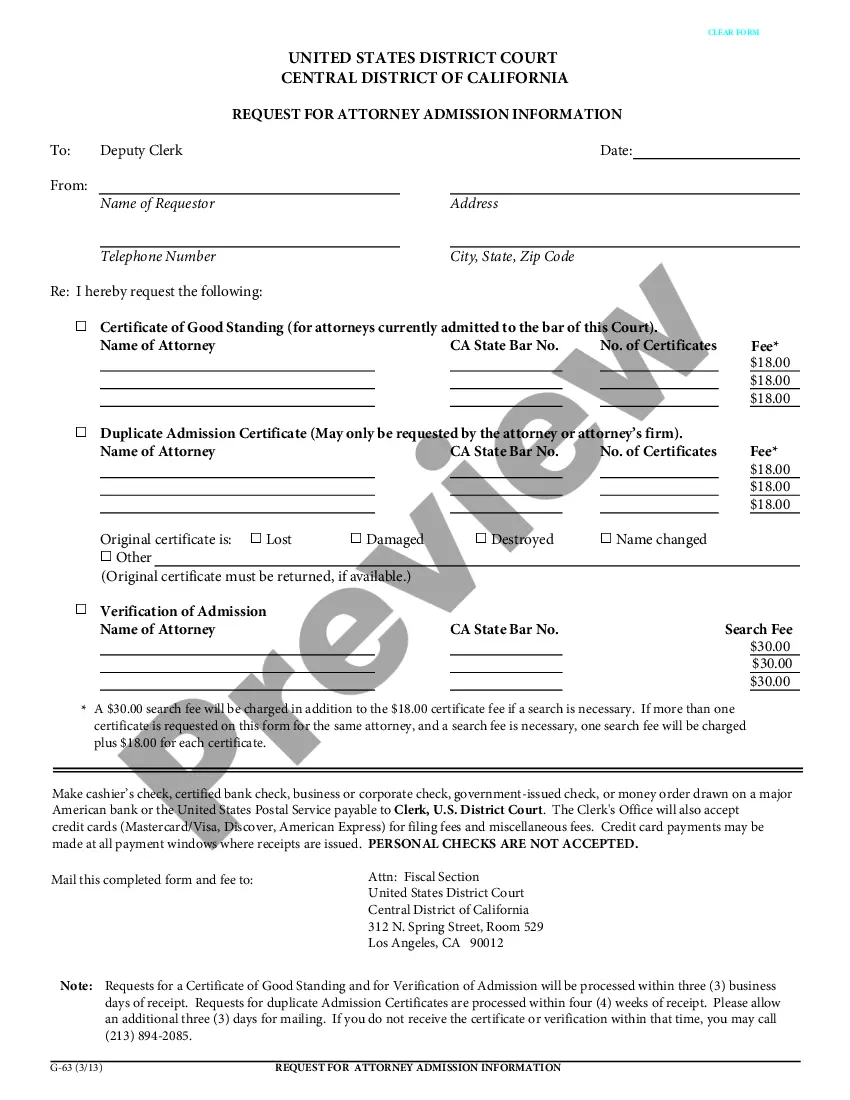

- Step 2. Use the Review option to inspect the document's content. Remember to read the information carefully.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form design.

Form popularity

FAQ

Setting up a trust for your child, like a Nebraska Revocable Trust for Child, involves a few key steps. Begin by determining the assets you want to place in the trust and identifying your child as the beneficiary. You can create the trust document either on your own or with the assistance of a legal professional to ensure accuracy and compliance with state laws. Platforms like US Legal Forms offer templates and guidance to help simplify this process, making it easier for you to secure your child's future.

To fill out a Nebraska Revocable Trust for Child, start by gathering essential information about your assets and beneficiaries. You will need to provide details such as your name, the name of your child, and the assets you wish to include in the trust. Next, ensure that you follow your state's specific guidelines to complete the necessary forms. Using reliable resources, like US Legal Forms, can guide you through the process and ensure that your trust fulfills your intentions.

Setting up a trust requires careful consideration to avoid common pitfalls. Many individuals overlook the importance of regular reviews and updates to their Nebraska Revocable Trust for Child, which can leave it misaligned with current goals and family situations. Additionally, failing to fund the trust properly can result in assets not being protected as intended. Using a platform like uslegalforms can help ensure you address these issues effectively.

The greatest advantage of a revocable trust is flexibility. As your family dynamics and financial situation change, you can modify the trust to meet those needs. With a Nebraska Revocable Trust for Child, you retain control over the assets while providing a clear plan for their distribution. This allows for adaptability in meeting the changing needs of your child.

A family trust can sometimes create family tensions, particularly if members feel the distribution of assets is unfair. Moreover, setting up a Nebraska Revocable Trust for Child may require difficult conversations about wealth and expectations with your family. It's important to engage in open discussions to ensure everyone understands the purpose and benefits of the trust.

While trusts can provide numerous benefits, they do come with some downsides. For instance, maintaining a Nebraska Revocable Trust for Child can involve ongoing management and administrative costs that might be unexpected. Additionally, if not properly structured, a trust can lead to unforeseen tax implications that could affect your family's finances.

One of the biggest mistakes parents make is not clearly specifying the beneficiaries and their needs within the trust. This can lead to confusion and conflict among family members. In the context of a Nebraska Revocable Trust for Child, it is vital to outline how the funds will be used and when distributions will occur. By doing so, you ensure that your child's future is secured without ambiguity.

One of the biggest mistakes parents make when setting up a trust fund is failing to consider their child's specific needs. A Nebraska Revocable Trust for Child should reflect how you want to provide for education, health, and other critical expenses. Additionally, not regularly reviewing and updating the trust can lead to complications over time. Working with an expert can help prevent these common pitfalls.

To set up a trust for children effectively, consider creating a Nebraska Revocable Trust for Child. Start by identifying the assets you want to include and the specific needs of your children. Engage with a knowledgeable attorney or platform like USLegalForms to ensure proper drafting and adherence to laws. This proactive approach helps secure your child's financial future.

The best type of trust for a child is often a Nebraska Revocable Trust for Child. This trust allows you to make decisions on how and when your child receives their inheritance, ensuring responsible use of the funds. Additionally, it can include provisions for education and healthcare, so you cater to their future needs. Always consult with a professional for personalized guidance.