Nebraska Revocable Trust for Property

Description

How to fill out Revocable Trust For Property?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide array of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords. You can find the latest editions of forms such as the Nebraska Revocable Trust for Property in moments.

If you already have a subscription, Log In to download the Nebraska Revocable Trust for Property from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously stored forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device.Make edits. Fill out, modify and print and sign the downloaded Nebraska Revocable Trust for Property. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another version, simply visit the My documents section and click on the form you require.

- Ensure you have selected the appropriate form for your region.

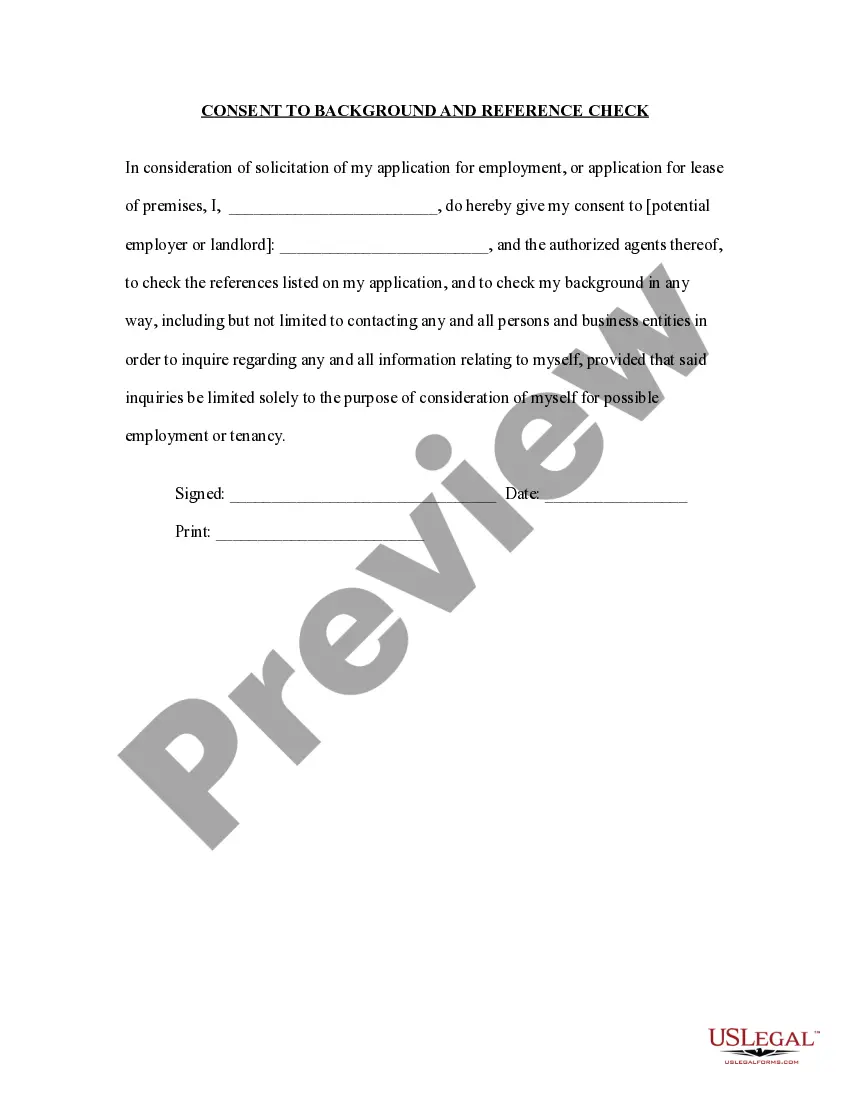

- Click the Preview button to review the form's content.

- Examine the form details to confirm you have selected the correct form.

- If the form does not meet your requirements, utilize the Search area at the top of the screen to find a suitable one.

- If you are satisfied with the form, verify your choice by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your details to create an account.

Form popularity

FAQ

While our focus is on Nebraska Revocable Trust for Property, a common mistake parents often make when setting up any trust is failing to properly communicate their intentions and wishes to their children. This can lead to misunderstandings and disputes down the line. Engaging with a professional service like uslegalforms can provide clarity and guidance to ensure your trust is set up effectively.

A revocable trust in Nebraska, commonly referred to as a Nebraska Revocable Trust for Property, allows you to manage your assets during your lifetime while retaining control over them. You can make changes or revoke the trust at any time, providing flexibility. This type of trust also helps avoid probate, simplifying the transfer of assets after your death.

Setting up a trust, such as a Nebraska Revocable Trust for Property, can be complex, leading to potential pitfalls. One significant risk is improper funding, which can result in delays or complications during the trust's administration. It's crucial to understand the legal nuances and seek help if needed to avoid costly mistakes.

While a Nebraska Revocable Trust for Property offers many benefits, it can come with some downsides. One common negative aspect is the potential for ongoing management costs, including legal fees. Additionally, if not funded correctly, the trust may not provide the intended protection or benefit during your lifetime.

In Nebraska, you do not need to register a trust, including a Nebraska Revocable Trust for Property. However, certain assets held in the trust may require specific documentation to establish ownership. It's important to properly manage and maintain the trust to ensure its validity and effectiveness.

To place your house in a Nebraska Revocable Trust for Property, you need to draft the trust document and then transfer the title of your home into the trust’s name. This process includes executing a new deed that names the trust as the owner. It’s advisable to work with a legal professional or use services like UsLegalForms to ensure that all legal requirements are met correctly.

Yes, a Nebraska Revocable Trust for Property typically becomes irrevocable upon the death of the trust creator. This means that the terms of the trust cannot be changed after your passing, providing a clear guide for asset distribution. It’s essential to carefully plan the trust's terms to ensure your wishes are honored after your death.

The greatest advantage of a Nebraska Revocable Trust for Property is its ability to allow you to change or revoke the trust at any time during your lifetime. This flexibility helps you adapt to changing circumstances or decisions regarding asset distribution. Additionally, a revocable trust can simplify the transfer of assets to beneficiaries, avoiding the lengthy probate process.

The best trust for putting your house in is often a Nebraska Revocable Trust for Property, as it offers flexibility and control during your lifetime. This type of trust allows you to retain ownership and management rights over your property while planning for future distribution. Furthermore, it can help avoid probate, ensuring a smoother transition for your heirs.

A downside of a Nebraska Revocable Trust for Property is that while it offers flexibility, it does not provide protection from creditors. Additionally, since assets in a revocable trust are considered part of your estate, they may still be subject to estate taxes. Therefore, it’s important to evaluate your assets and financial situation before deciding solely on this type of trust.