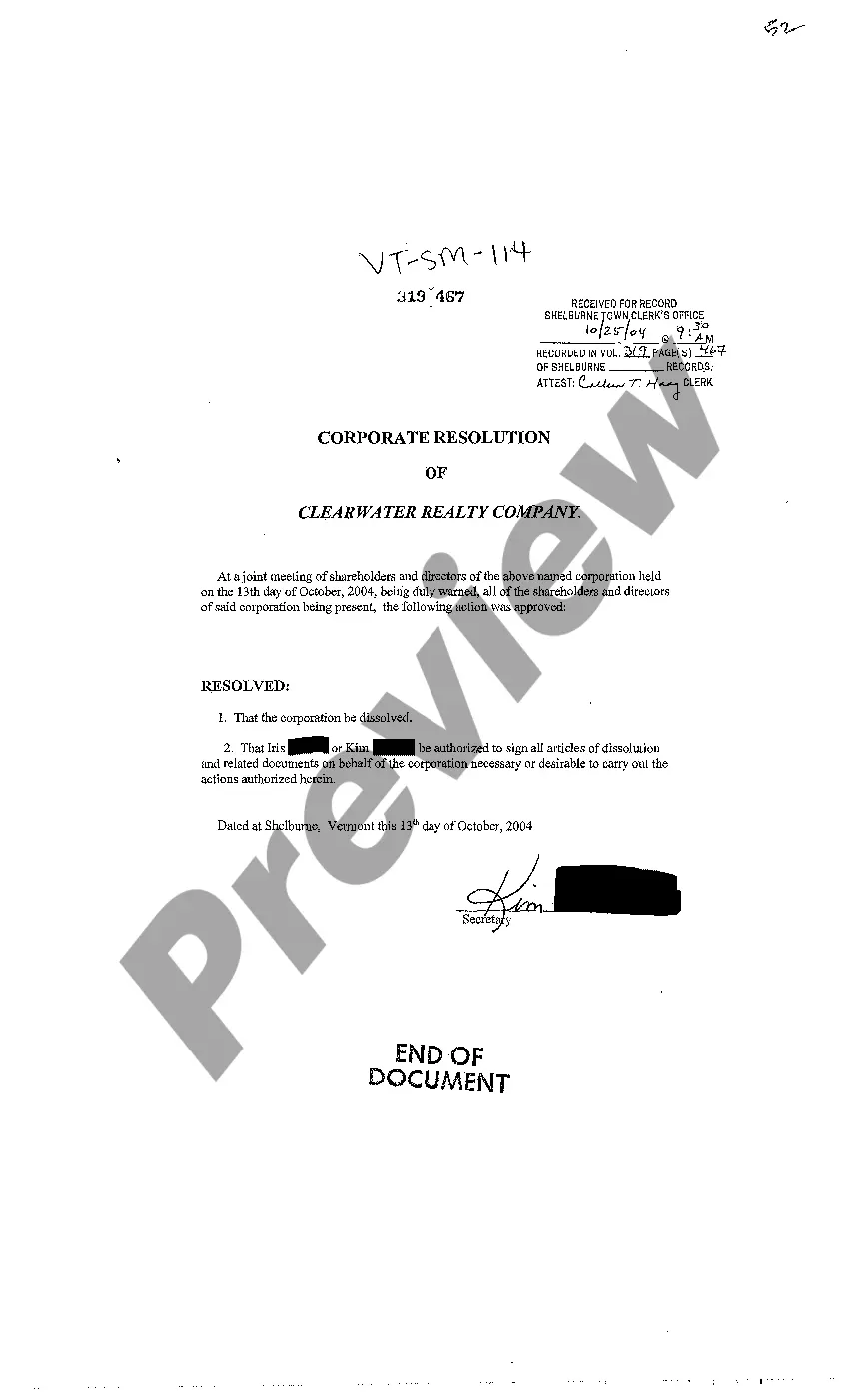

Vermont Corporate Resolution of Dissolution

Description

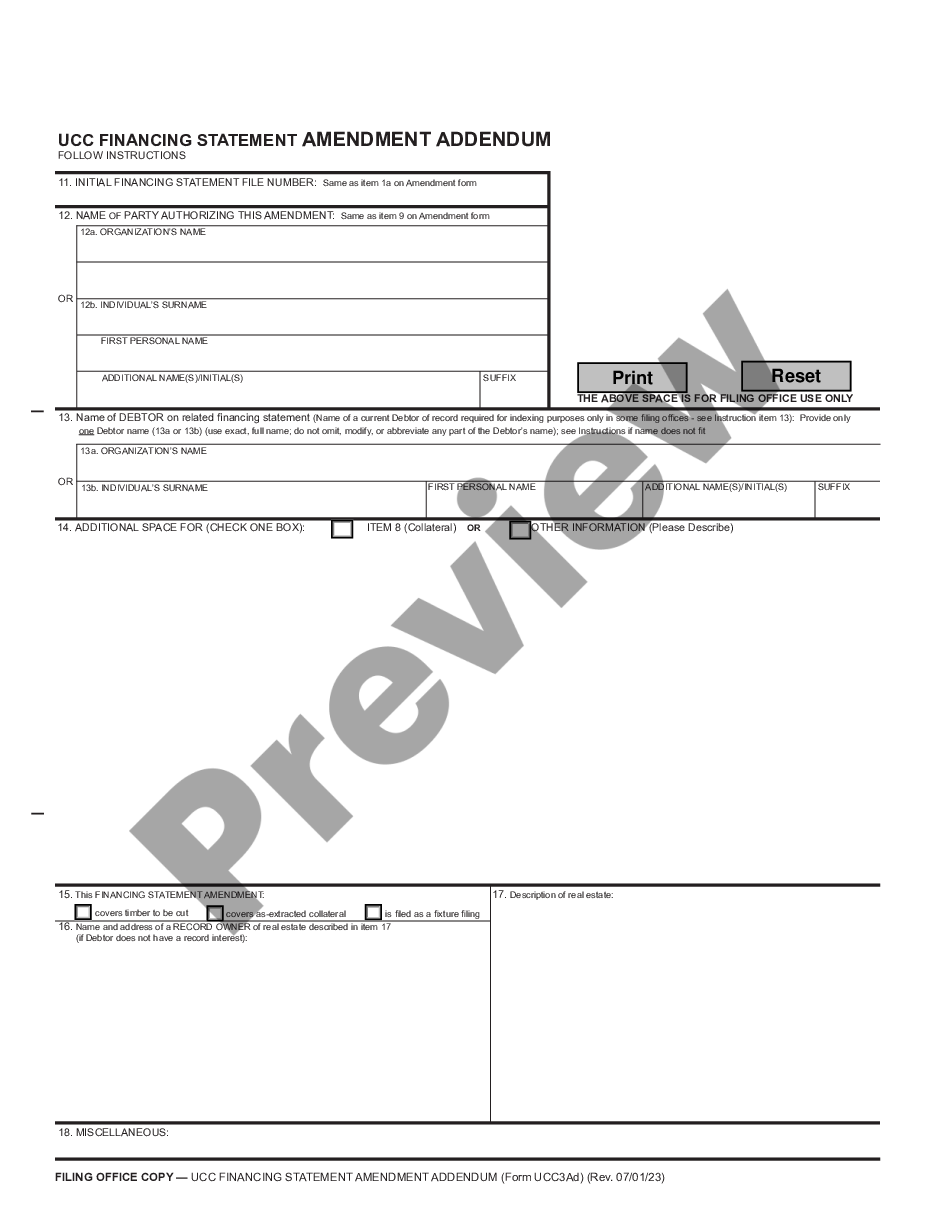

How to fill out Vermont Corporate Resolution Of Dissolution?

Searching for a Vermont Corporate Resolution of Dissolution online might be stressful. All too often, you find files that you just believe are alright to use, but find out afterwards they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax documents drafted by professional lawyers in accordance with state requirements. Have any document you are searching for within a few minutes, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll instantly be included in your My Forms section. If you do not have an account, you should register and choose a subscription plan first.

Follow the step-by-step guidelines below to download Vermont Corporate Resolution of Dissolution from the website:

- See the document description and press Preview (if available) to check if the template meets your requirements or not.

- In case the document is not what you need, get others using the Search field or the listed recommendations.

- If it is right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the document in a preferable format.

- After getting it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms catalogue. In addition to professionally drafted templates, customers are also supported with step-by-step instructions on how to get, download, and fill out forms.

Form popularity

FAQ

How long does it take to dissolve a California corporation? The California Secretary of State's processing times vary from season to season, but on average, processing time is around 3-4 weeks.

You'll need to formally close your LLC or Corporation. Otherwise, you can still be on the hook for filing your inactive business' annual reports, filing state/federal tax returns, and keeping up any business licenses.

It takes at least three months for a company to be officially dissolved. However, if the process is complex and some tasks need to be completed to close the business, it will take longer.

Administrative dissolution is an action taken by the Secretary of State that results in the loss of a business entity's rights, powers and authority. Reinstatement is the action taken that restores an administratively dissolved business entity's rights, powers, and authority.

File a Final Return and Related Forms. Take Care of Your Employees. Pay the Tax You Owe. Report Payments to Contract Workers. Cancel Your EIN and Close Your IRS Business Account. Keep Your Records.

What is the difference between dissolution and termination of an entity?Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

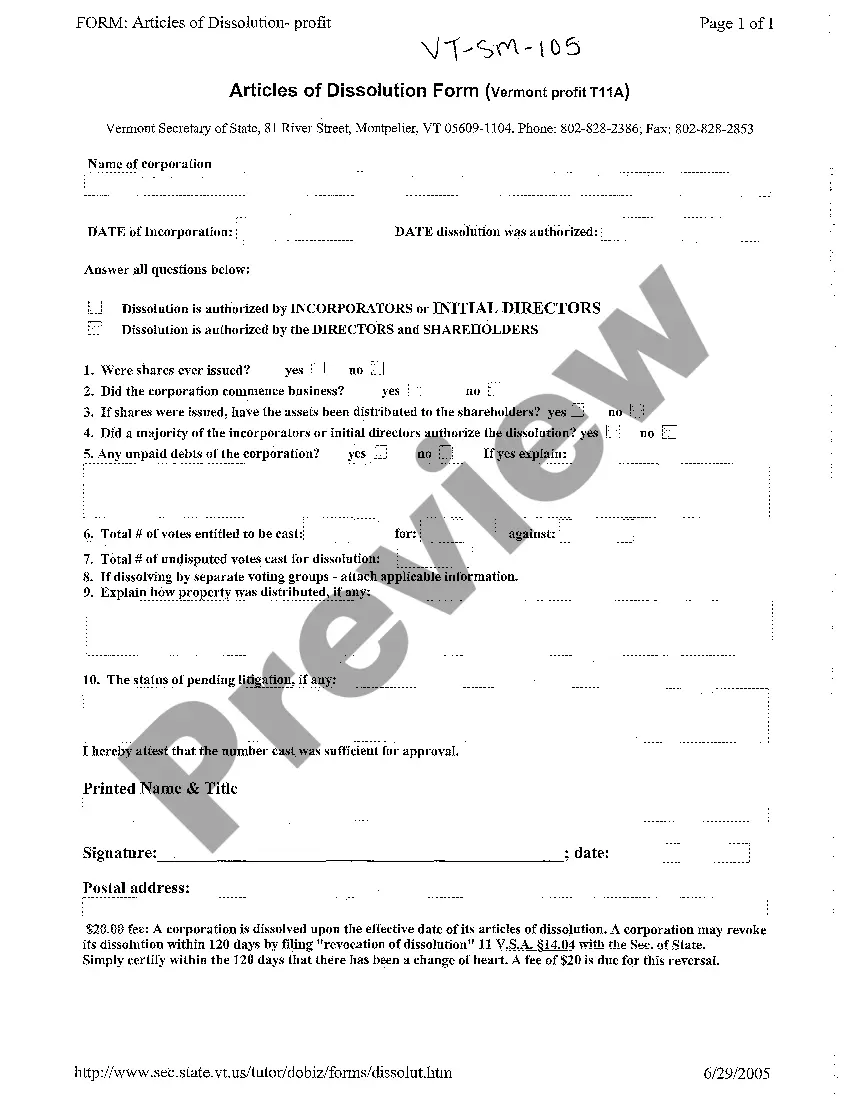

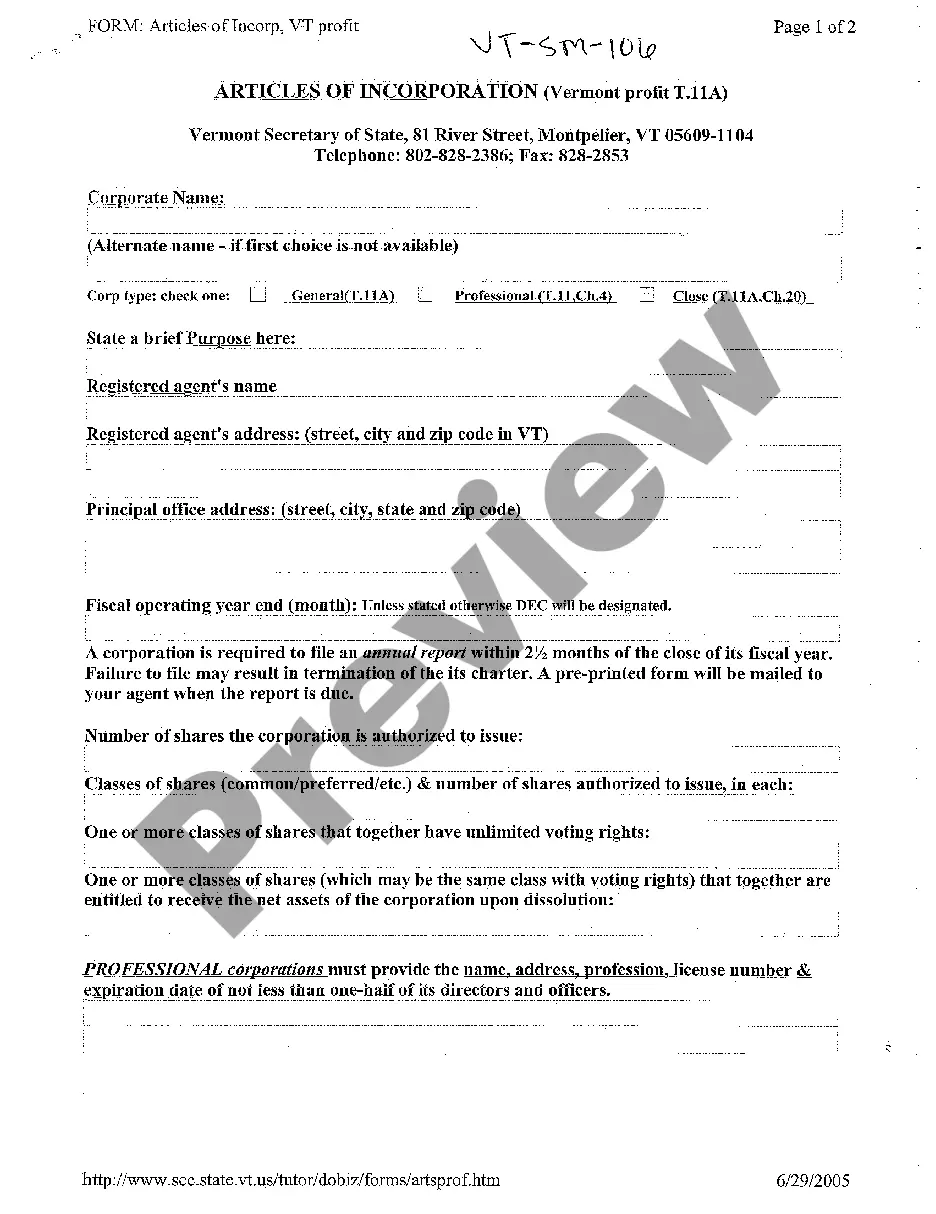

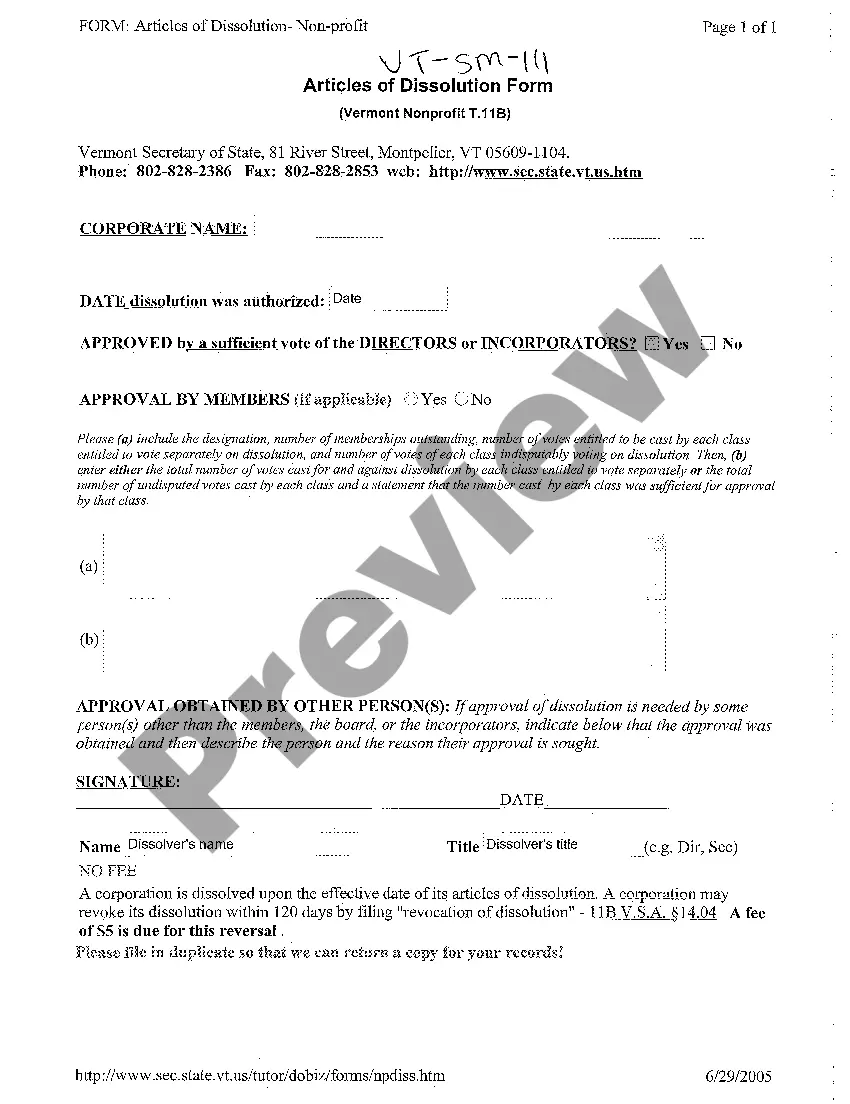

Fill out and file the Articles of Dissolution with the Vermont Secretary of State. Fulfill all tax obligations with the state of Vermont, as well as with the IRS. Cancel any relevant licenses and permits, along with closing your business bank account. Notify customers, vendors, and creditors of your dissolution.

If you don't officially close the company, they'll still bill you, possibly with late fees. Some states will dissolve the LLC after that, but not all.If you have outstanding company debts, you need to settle up. You have to file a final tax return, pay final payroll taxes and cancel your EIN account with the IRS.

File all delinquent tax returns. Pay all delinquent tax balances, including penalties, fees, and interest. File a revivor request form.