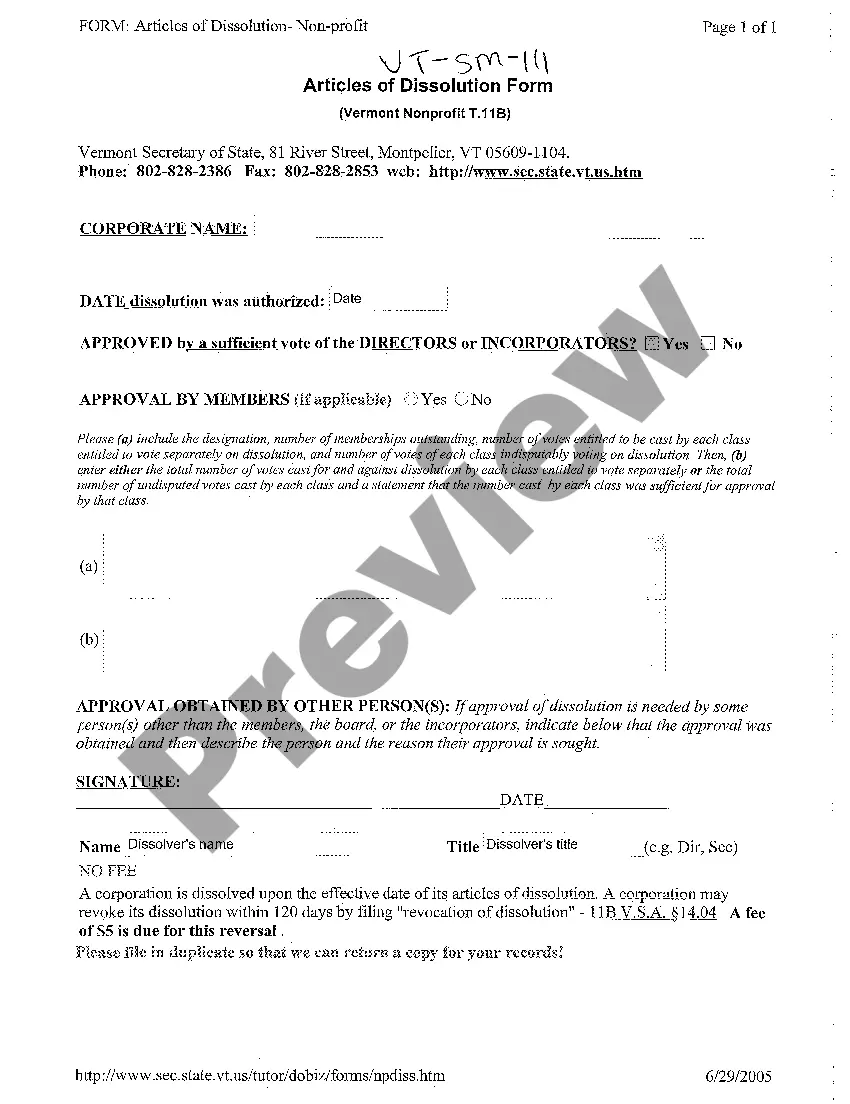

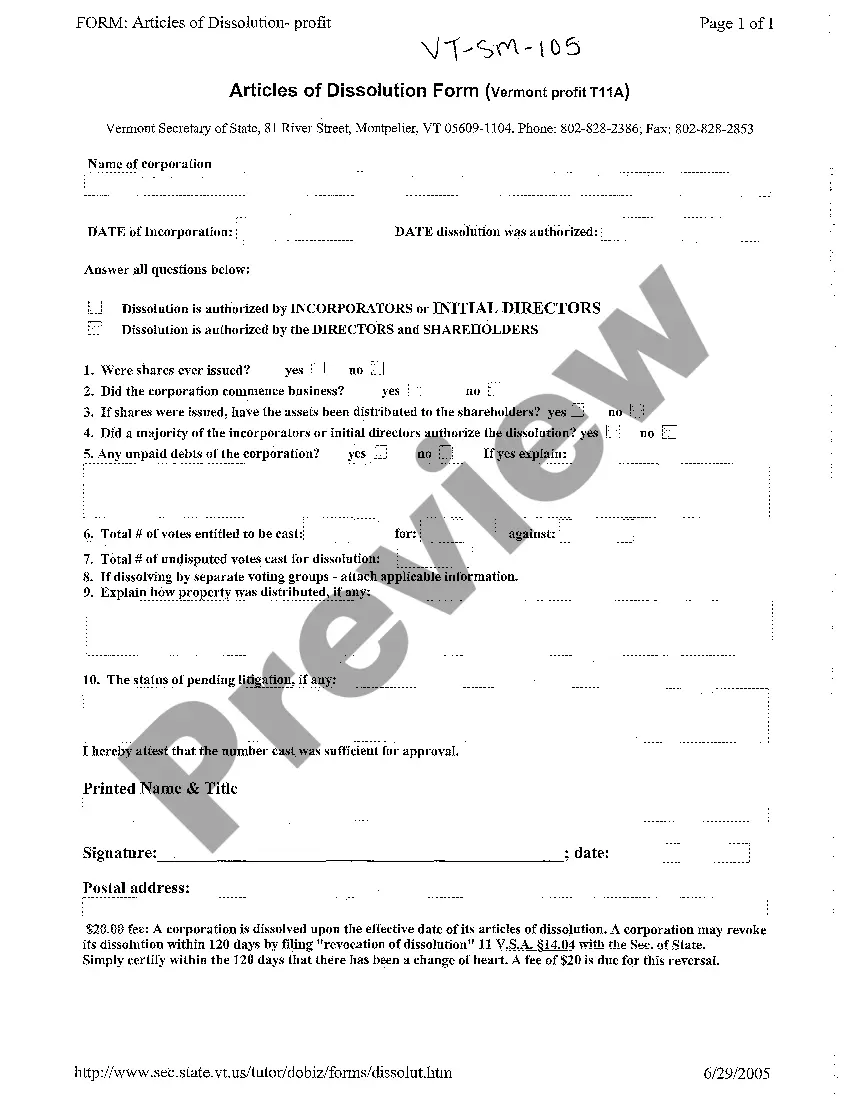

Vermont Articles of Dissolution Form

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

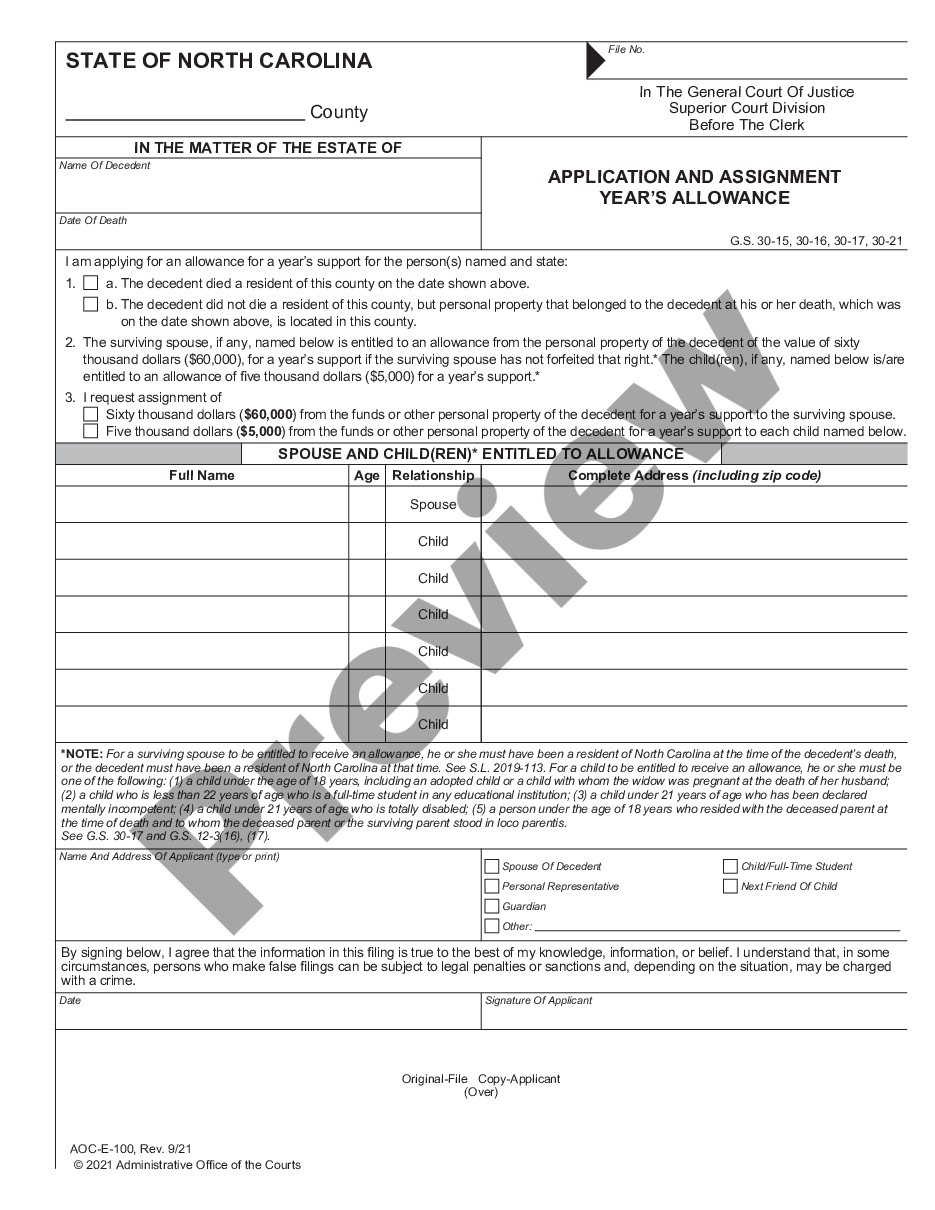

Looking for another form?

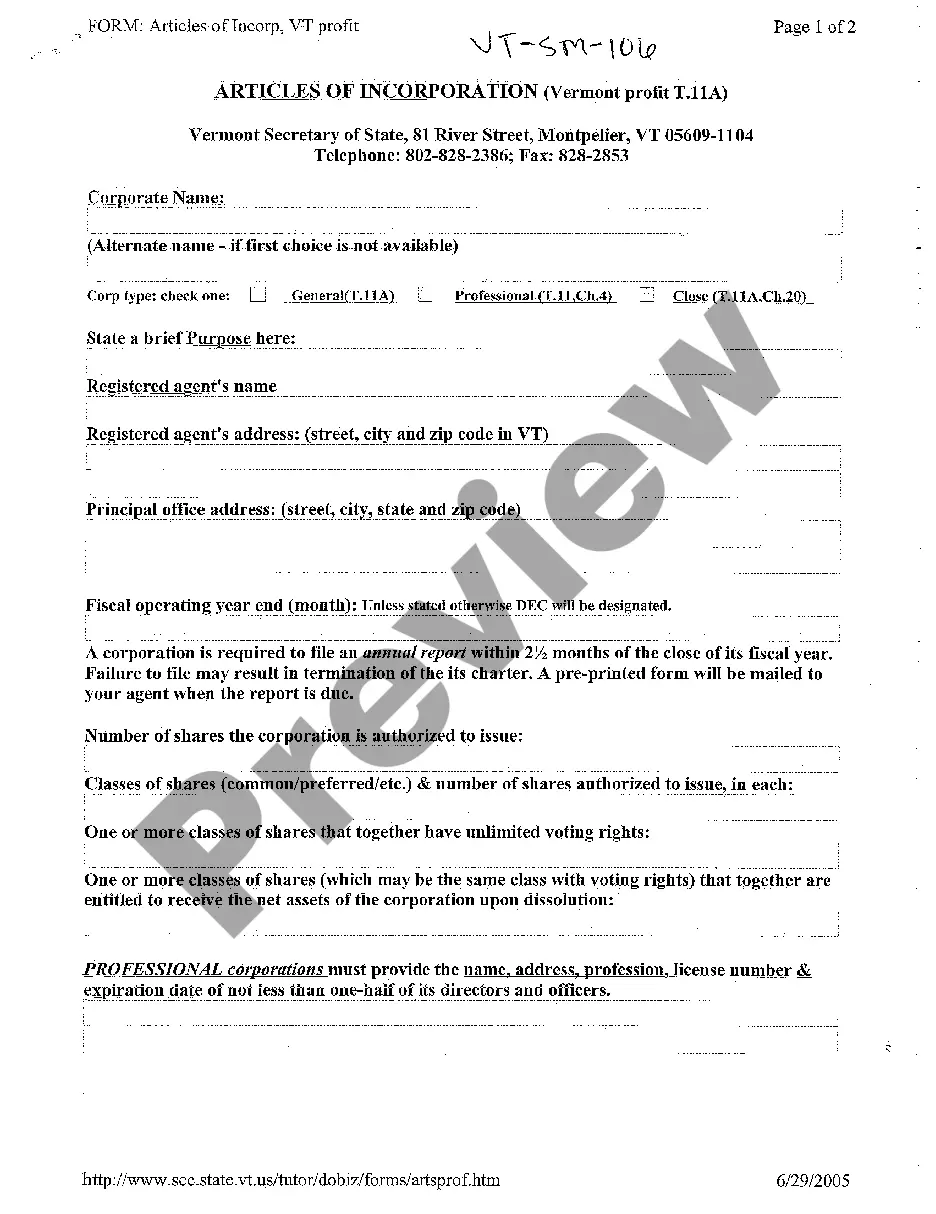

How to fill out Vermont Articles Of Dissolution Form?

Searching for a Vermont Articles of Dissolution Form on the internet can be stressful. All too often, you find documents that you believe are fine to use, but discover later they’re not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional lawyers in accordance with state requirements. Have any form you’re searching for quickly, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It will automatically be included to your My Forms section. In case you don’t have an account, you should register and choose a subscription plan first.

Follow the step-by-step recommendations listed below to download Vermont Articles of Dissolution Form from our website:

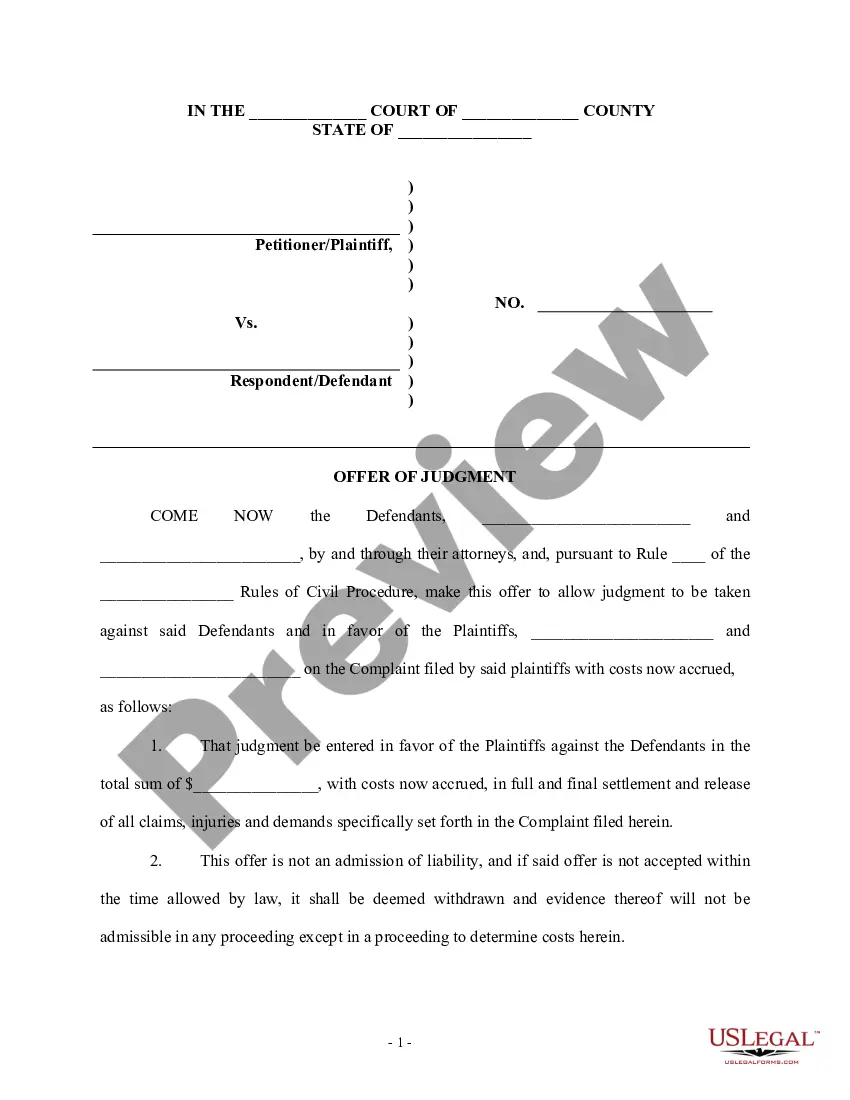

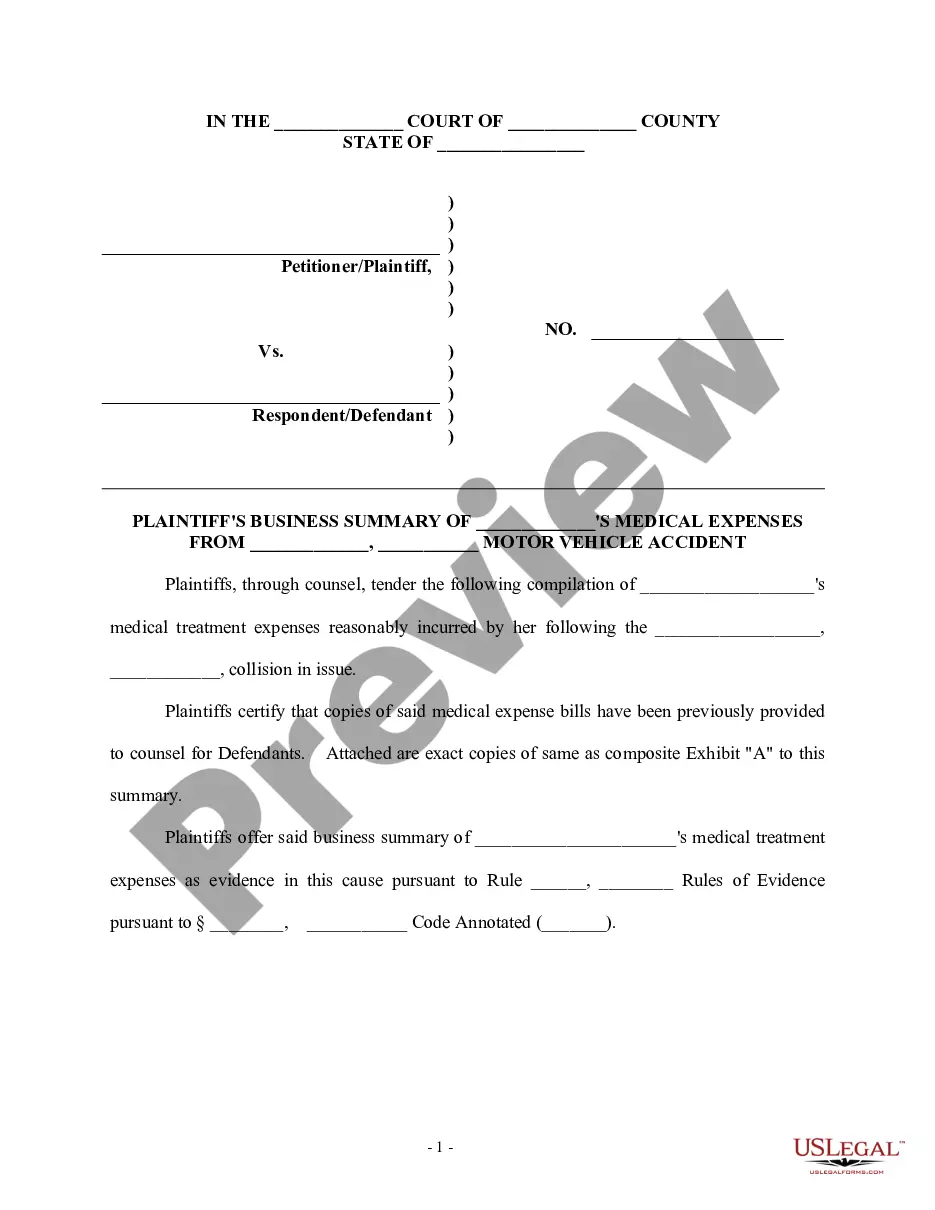

- See the document description and press Preview (if available) to verify if the template suits your requirements or not.

- In case the form is not what you need, find others with the help of Search engine or the provided recommendations.

- If it’s right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the document in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates straight from our US Legal Forms library. In addition to professionally drafted templates, users will also be supported with step-by-step instructions regarding how to get, download, and fill out templates.

Form popularity

FAQ

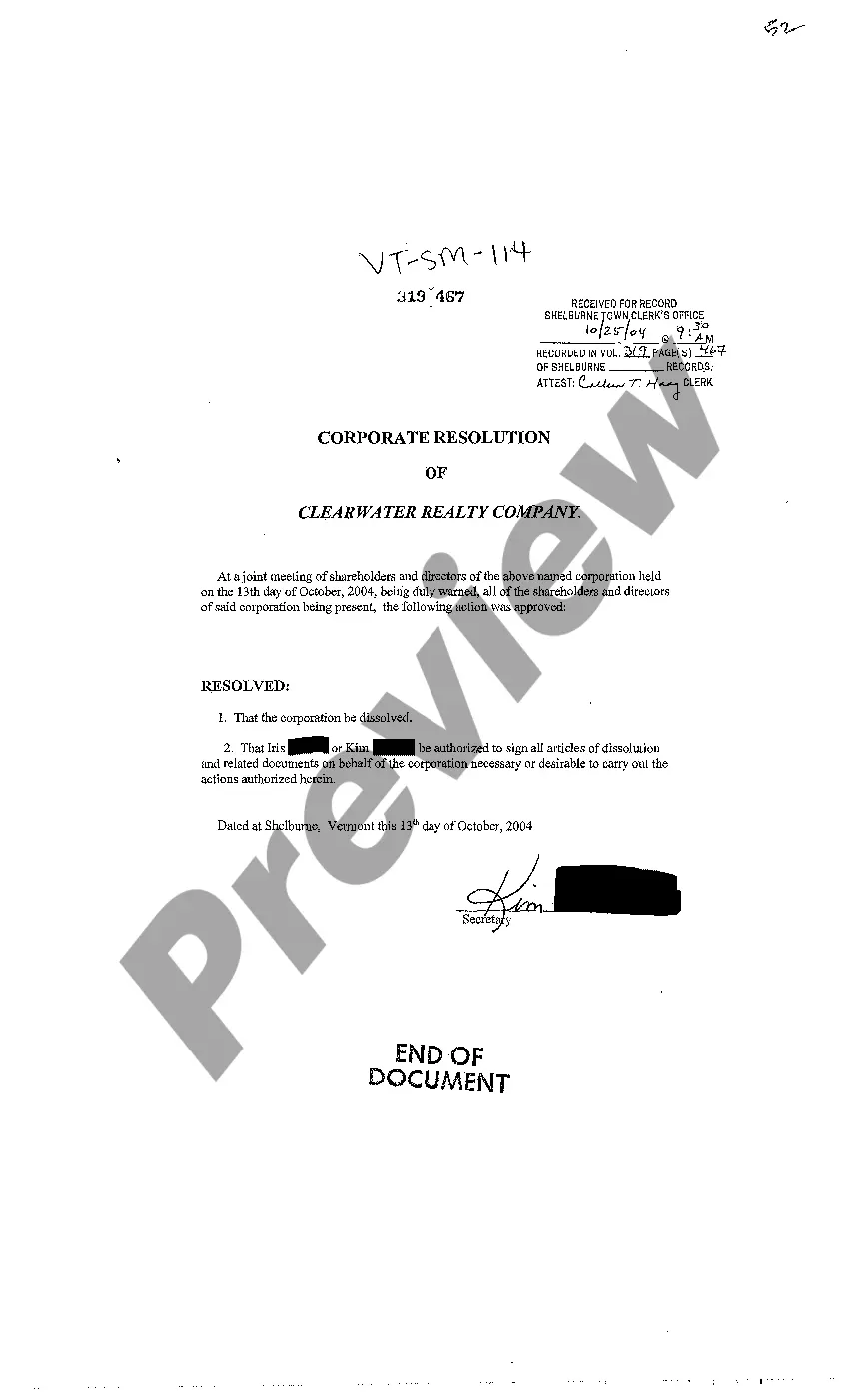

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

The power of the Secretary of State, however, is broad, and in many states, an LLC can be dissolved for nearly any reason the Secretary deems fit. Voluntary dissolution is the result of members willingly choosing to close their business.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

A letter of dissolution is an official notification of the end of a business relationship with a partner, client, vendor, or another party.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

File Articles of Dissolution with the state. Visit an online legal document creation service such as Legal Docs.com or Legal Zoom.com and write the LLC's Articles of Dissolution. These documents are necessary to legally separate each LLC member from the entity.