Virginia Alternative Method

Description

How to fill out Alternative Method?

If you wish to acquire, access, or print authentic document templates, make use of US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you need. A vast array of templates for business and personal purposes is organized by categories and states, or keywords.

Utilize US Legal Forms to secure the Virginia Alternative Method in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to each form you have acquired in your account. Click the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the Virginia Alternative Method with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and select the Download button to retrieve the Virginia Alternative Method.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Confirm that you have chosen the form for the correct city/state.

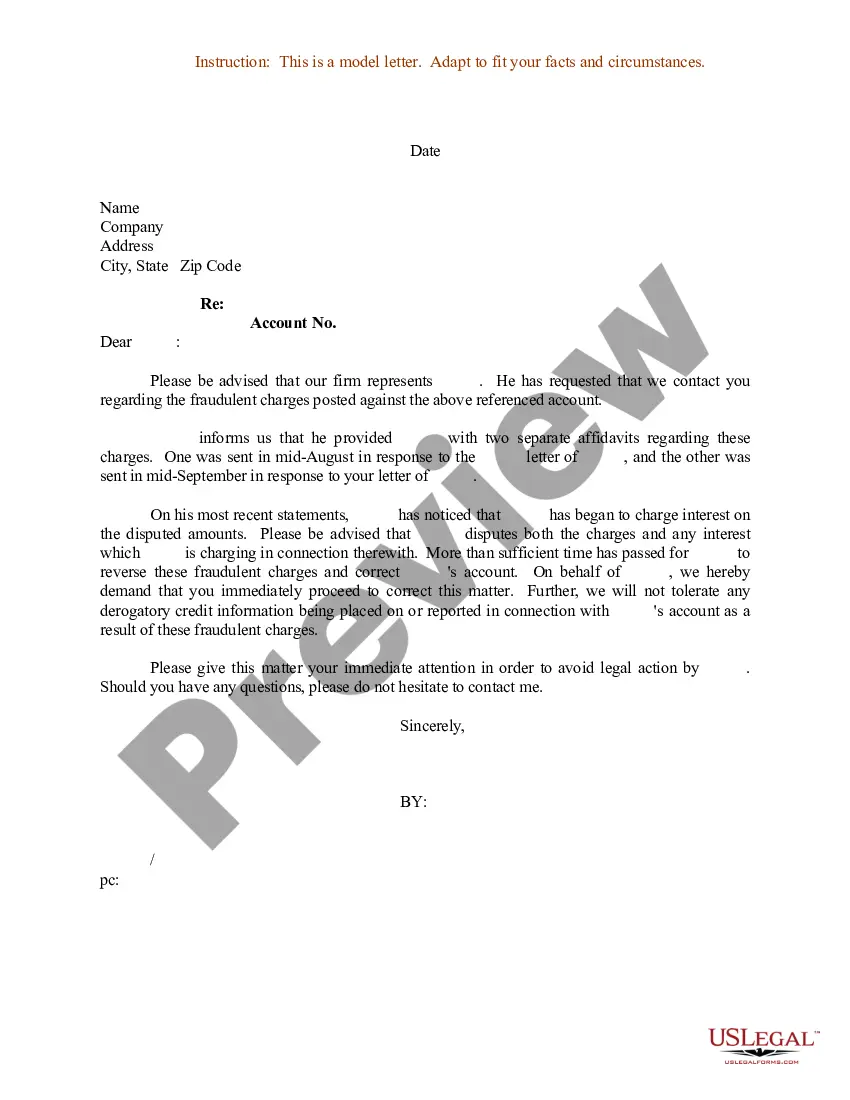

- Step 2. Use the Preview option to review the form's content. Remember to read the summary.

- Step 3. If you are unhappy with the form, utilize the Search field at the top of the page to locate alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Select your preferred payment plan and enter your credentials to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and either print or sign the Virginia Alternative Method.

Form popularity

FAQ

In general, an employer who pays wages to one or more employees in Virginia is required to deduct and withhold state income tax from those wages. Since Virginia law substantially conforms to federal law, if federal law requires an employer to withhold tax from any payment, we also require Virginia withholding.

Virginia state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VA tax rates of 2%, 3%, 5% and 5.75% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses. The Virginia tax rate and tax brackets are unchanged from last year.

Withholding Formula (Effective Pay Period 19, 2019)Subtract $4,500 from the annual gross wages.Multiply the number of personal and dependent exemptions claimed, not including the number of exemptions claimed for age and blindness, by $930.00.Multiply the number of exemptions claimed for age and blindness by $800.00.03-Oct-2019

You may be subject to backup withholding if you fail to provide a correct taxpayer identification number (TIN) when required or if you fail to report interest, dividend, or patronage dividend income.

Most employees are subject to withholding tax. Your employer is the one responsible for sending it to the IRS. In order to be exempt from withholding tax you must have owed no federal income tax in the prior tax year and you must not expect to owe any federal income tax this tax year.

Virginia law conforms to the federal definition of income subject to withholding. Virginia withholding is generally required on any payment for which federal withholding is required. This includes most wages, pensions and annuities, gambling winnings, vacation pay, bonuses, and certain expense reimbursements.

Helpful Paycheck Calculator Info: Virginia's progressive state income tax system has four tax brackets, ranging from 2% to 5.75%. Filing status has no affect on state income taxes, only income does.

What Is Withholding? Withholding is the portion of an employee's wages that is not included in their paycheck but is instead remitted directly to the federal, state, or local tax authorities. Withholding reduces the amount of tax employees must pay when they submit their annual tax returns.

Virginia law conforms to the federal definition of income subject to withholding. Virginia withholding is generally required on any payment for which federal withholding is required. This includes most wages, pensions and annuities, gambling winnings, vacation pay, bonuses, and certain expense reimbursements.

Federal income tax withholding was calculated by:Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage.Subtracting the value of allowances allowed (for 2017, this is $4,050 multiplied by withholding allowances claimed).More items...