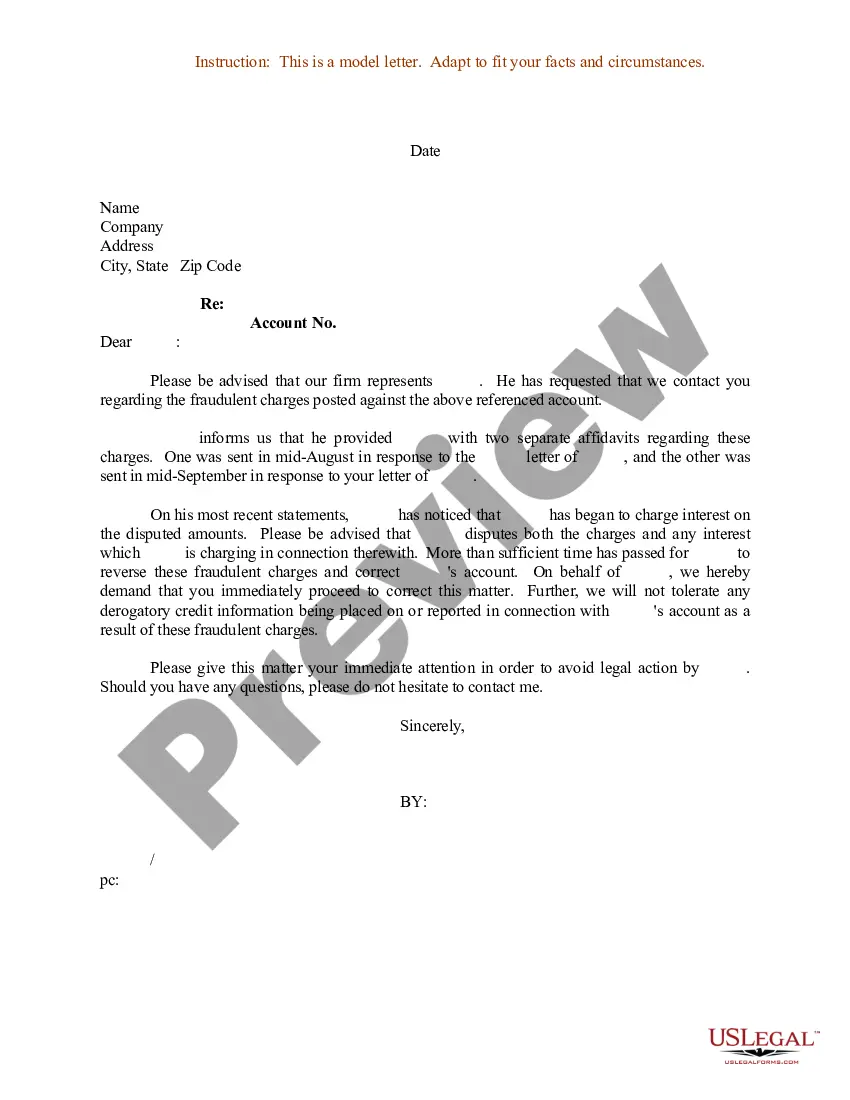

Maryland Sample Letter for Fraudulent Charges against Client's Account

Description

How to fill out Sample Letter For Fraudulent Charges Against Client's Account?

Choosing the best legal file format could be a have a problem. Obviously, there are a lot of layouts available on the net, but how do you discover the legal kind you want? Use the US Legal Forms website. The support gives thousands of layouts, including the Maryland Sample Letter for Fraudulent Charges against Client's Account, which you can use for organization and personal requires. All of the kinds are checked by pros and fulfill federal and state demands.

If you are previously registered, log in for your accounts and click the Down load button to have the Maryland Sample Letter for Fraudulent Charges against Client's Account. Make use of accounts to look with the legal kinds you possess purchased earlier. Visit the My Forms tab of your accounts and acquire yet another version from the file you want.

If you are a fresh customer of US Legal Forms, listed below are simple guidelines that you should stick to:

- First, make certain you have selected the correct kind for your personal metropolis/region. It is possible to examine the shape utilizing the Review button and study the shape information to ensure it is the right one for you.

- If the kind will not fulfill your expectations, utilize the Seach discipline to find the right kind.

- Once you are positive that the shape is suitable, click on the Purchase now button to have the kind.

- Pick the prices plan you would like and type in the essential details. Make your accounts and pay money for your order utilizing your PayPal accounts or charge card.

- Opt for the file structure and acquire the legal file format for your gadget.

- Comprehensive, change and print and indicator the received Maryland Sample Letter for Fraudulent Charges against Client's Account.

US Legal Forms is the most significant collection of legal kinds where you can discover different file layouts. Use the company to acquire expertly-manufactured documents that stick to status demands.

Form popularity

FAQ

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Contact the Credit Card Company Log into your credit card account or call the number on the back of your credit card to inform the card issuer. Submitting a dispute online can often be done in under a minute. You just need to submit information identifying the charge, such as the date and amount of the transaction.

Under the rules of the FDCPA, you must receive a written notification of a debt. After that, you have 30 days to contact the debt collector ? also by letter ? and give your reasons why you don't owe the debt or why the amount is incorrect.

Contact your bank right away. To limit your liability, it is important to notify the bank promptly upon discovering any unauthorized charge(s). You may notify the bank in person, by telephone, or in writing.

A dispute is appropriate if you have hard evidence that clearly shows the debt doesn't belong to you, was already paid, or if the amount due is incorrect. The more information you can provide to the debt collection agency concerning the dispute, the better.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Dispute in writing, and include any evidence that supports your claims (such as copies of cancelled checks showing you paid the debt or a police report in the case of identity theft). If the debt collector knows that you don't owe the money, it should not try to collect the debt.

Include your personal information and details concerning the charge-off in your letter. If you have evidence proving that the charge-off is inaccurate, you should provide it. Make sure to give the credit bureau clear information concerning your debt, including the creditor's name and account number.