Nevada Revocable Living Trust for Minors

Description

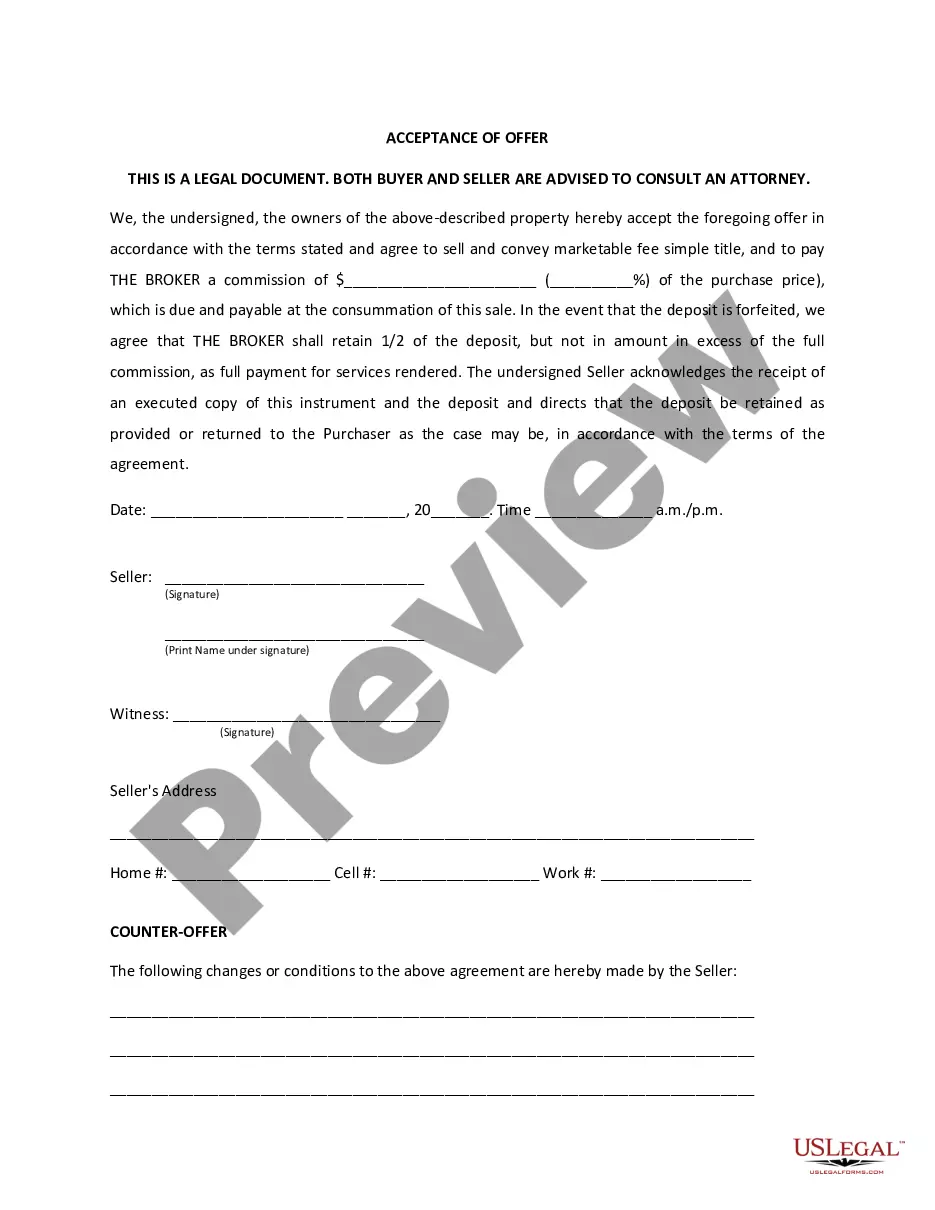

How to fill out Revocable Living Trust For Minors?

You can spend numerous hours online searching for the legal document template that meets the state and federal requirements you seek.

US Legal Forms offers thousands of legal templates that are scrutinized by experts.

You can download or print the Nevada Revocable Living Trust for Minors from our platform.

Review the form description to confirm you have chosen the right type.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Nevada Revocable Living Trust for Minors.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of the purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the appropriate document format for your region/area of choice.

Form popularity

FAQ

The best type of trust to get often depends on your specific needs, but a Nevada Revocable Living Trust for Minors is a highly beneficial option. This trust offers flexibility, control, and financial security for your children's inheritance. It helps you outline your wishes clearly and safeguards the assets until your children are old enough to manage them. By using a platform like uslegalforms, you can easily draft a trust that meets your family’s requirements.

The best type of trust for a child is typically a Nevada Revocable Living Trust for Minors. This trust allows you to maintain control of the assets and dictate how they are used for your child's benefit. It also provides flexibility, allowing you to make changes as needed while ensuring that funds are protected for their future. This approach integrates both estate planning and financial prudence.

Trust accounts for minors are financial accounts set up to protect and manage funds on behalf of a child. These accounts often become part of a Nevada Revocable Living Trust for Minors, allowing for more comprehensive estate planning. Funds in these accounts can be used for education, healthcare, and other necessary expenses. This ensures that your child's financial future is secure until they are ready to manage it themselves.

A minor trust, specifically a Nevada Revocable Living Trust for Minors, is designed to manage assets for children until they reach adulthood. This type of trust allows you to set terms for how and when the assets will be distributed. You gain control over your child's inheritance and ensure it is used for their benefit. It provides a structured plan, offering peace of mind for parents.

One danger of trust funds, including a Nevada Revocable Living Trust for Minors, is the potential for mismanagement. If a trustee is not careful, assets can be squandered or misallocated, impacting the minors involved. Additionally, trusts may face scrutiny from beneficiaries questioning the actions of the trustee. Using established legal platforms like uslegalforms can help mitigate these risks by providing guidance and templates for proper management.

Filling out a Nevada Revocable Living Trust for Minors requires careful attention to detail. Start by providing your personal information, including your name and address. Then, list your assets, assigning them to the trust. Finally, specify the terms of the trust, including who will manage it and how assets will be distributed upon your passing.

Setting up a Nevada Revocable Living Trust for Minors involves a few key steps. First, gather essential documents such as property titles and financial statements. Then, you will need to draft the trust agreement, naming a trusted individual or institution as the trustee. Finally, consider using platforms like uslegalforms to streamline the process, ensuring all legal requirements are met.

One significant disadvantage of a Nevada Revocable Living Trust for Minors is the ongoing management required. Unlike a will, a trust may need regular updates to reflect changes in assets or family status. Furthermore, establishing a trust can incur legal fees, which might be a concern for some families. Nevertheless, the benefits often outweigh these drawbacks.

Yes, creating a Nevada Revocable Living Trust for Minors allows your parents to manage their assets effectively. A trust can help ensure that your needs are met in the event something happens to them. It provides a clear plan for distributing assets, which can prevent family disputes. Additionally, it offers a level of privacy that a will does not.

A living trust does not need to be recorded in Nevada; it remains a private arrangement. With a Nevada revocable living trust for minors, you can maintain control over your assets without public disclosure. For security, it is crucial to keep the trust document in a safe place and inform your successor trustee of its location.