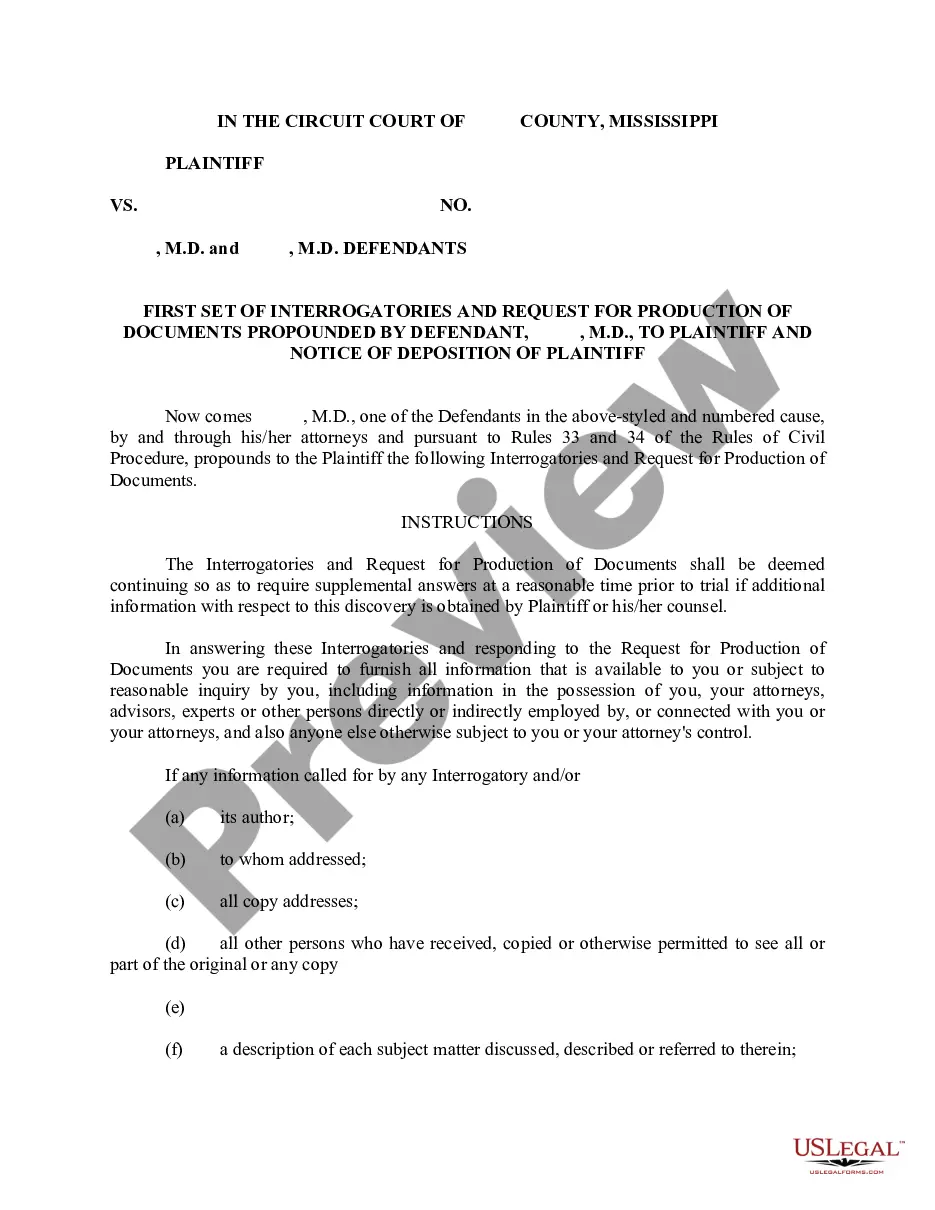

Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights

Description

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options, Nonqualified Stock Options And Stock Appreciation Rights?

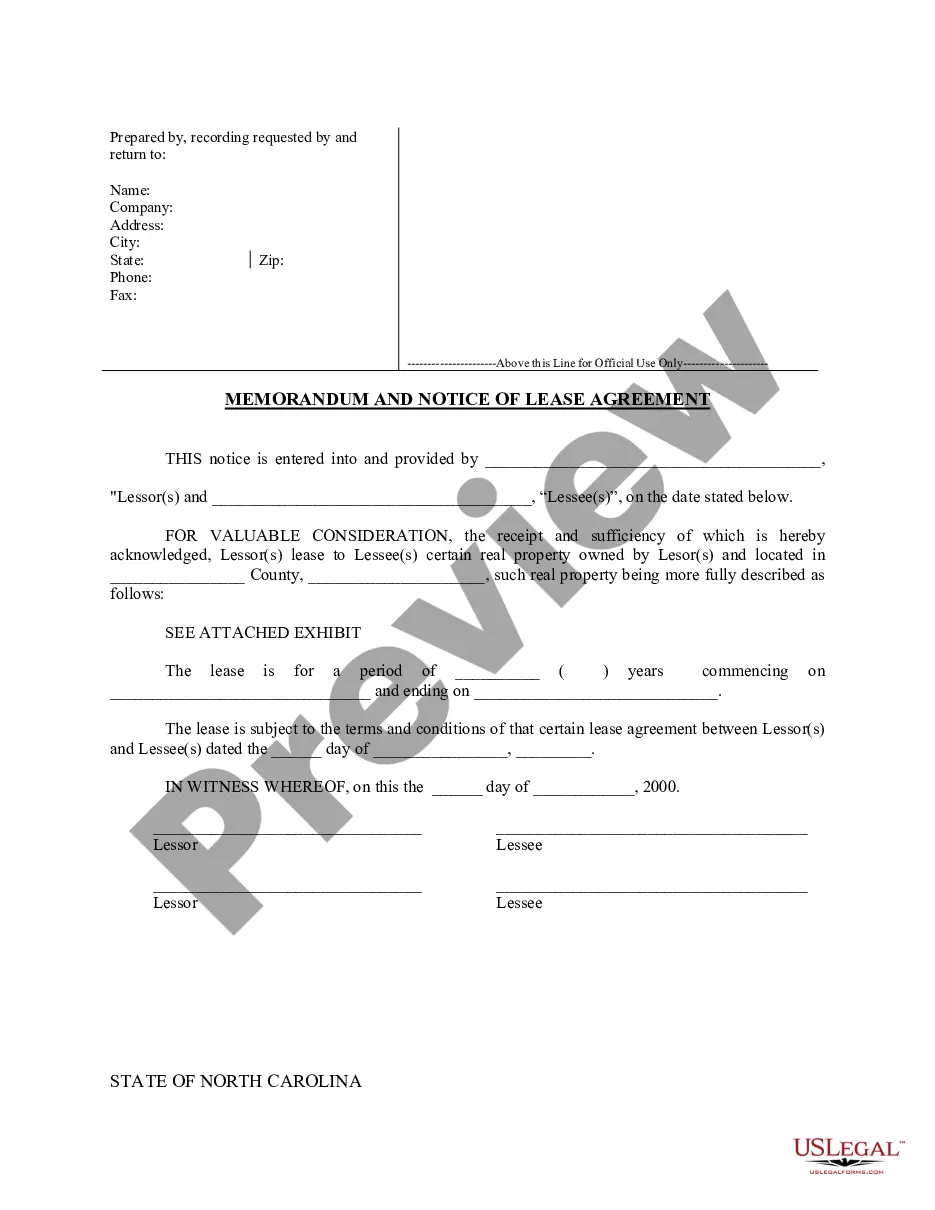

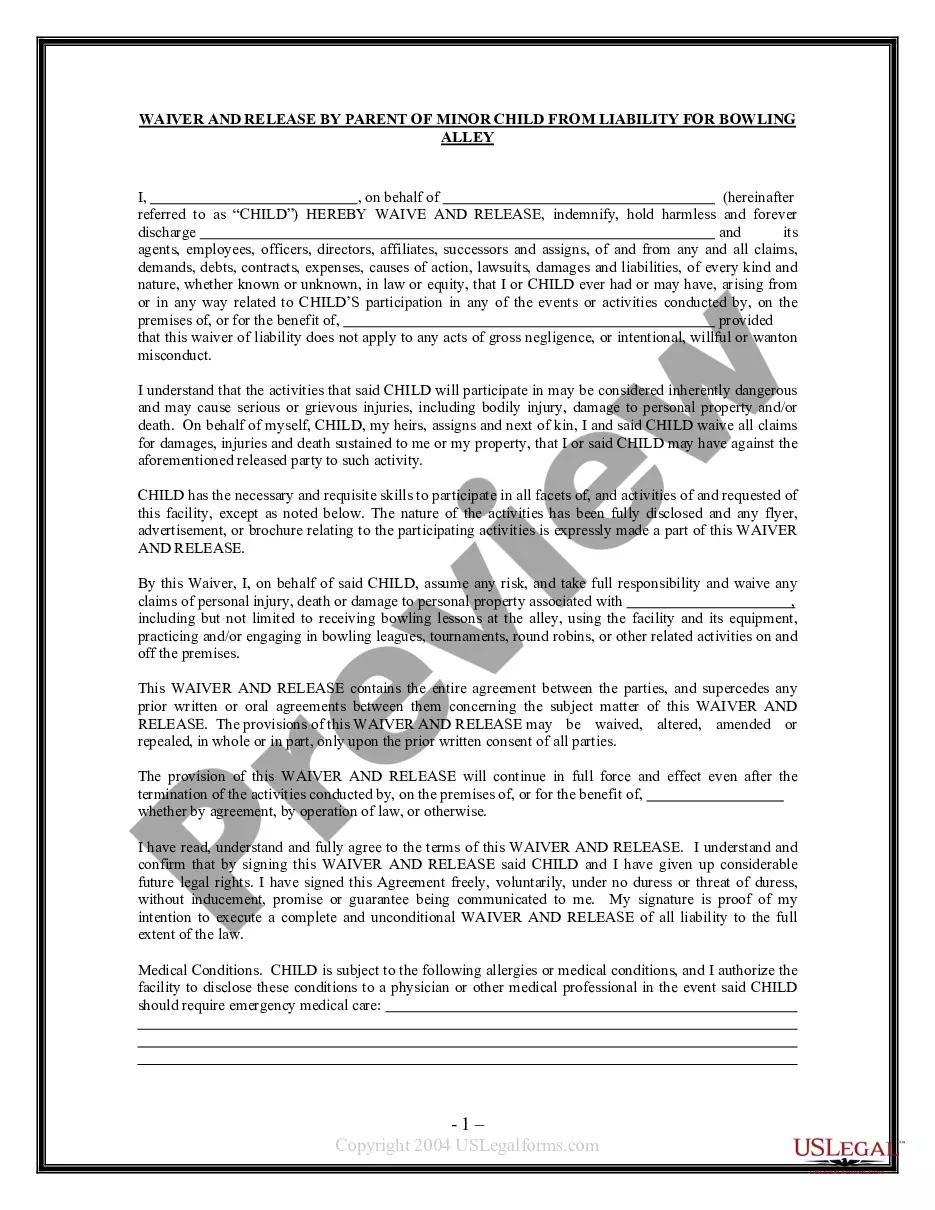

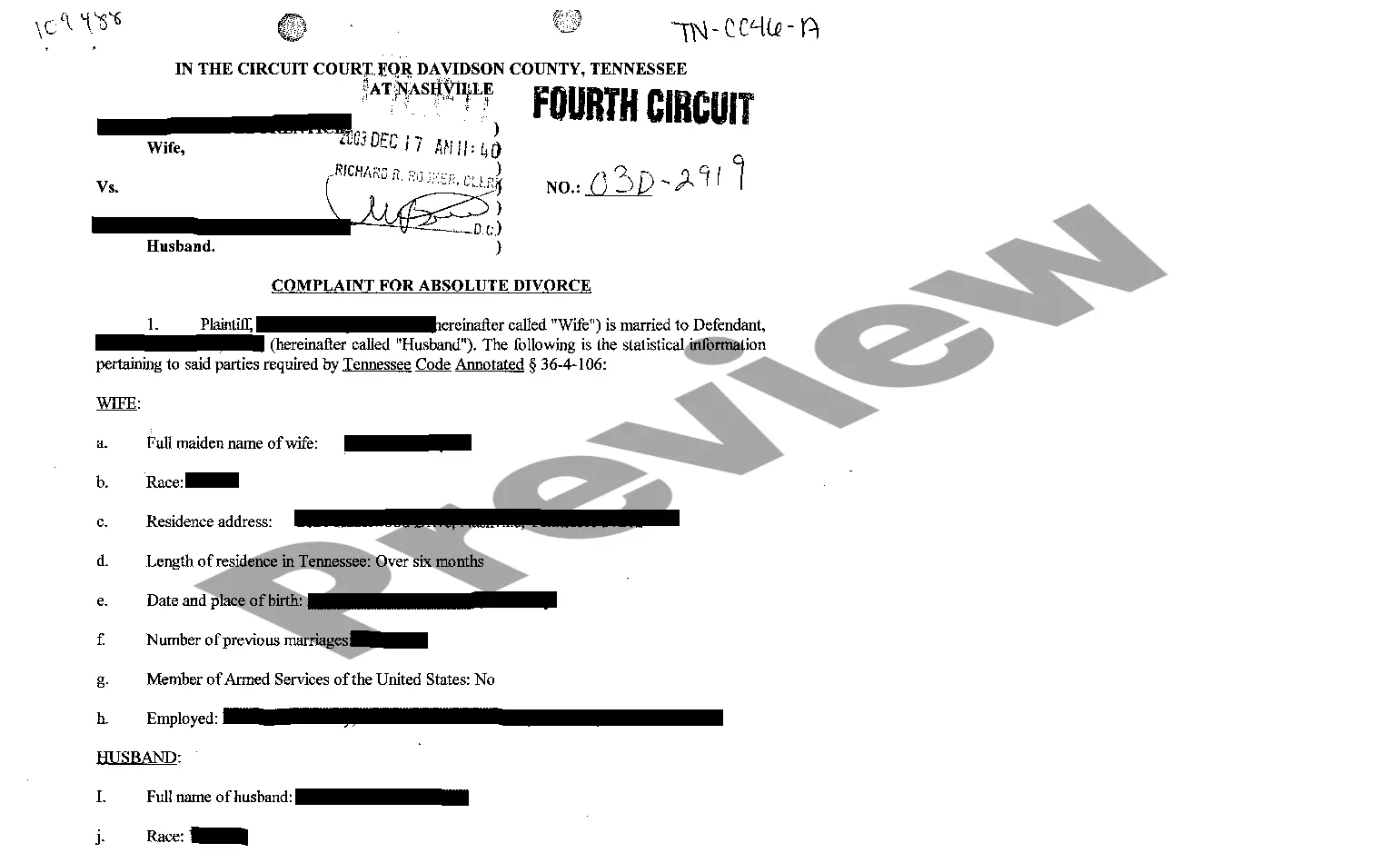

When it comes to drafting a legal form, it’s better to leave it to the professionals. Nevertheless, that doesn't mean you yourself can not find a sample to use. That doesn't mean you yourself can’t find a sample to use, nevertheless. Download Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights right from the US Legal Forms site. It gives you numerous professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. As soon as you are registered with an account, log in, look for a particular document template, and save it to My Forms or download it to your device.

To make things less difficult, we have provided an 8-step how-to guide for finding and downloading Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights quickly:

- Make sure the document meets all the necessary state requirements.

- If possible preview it and read the description prior to buying it.

- Click Buy Now.

- Select the appropriate subscription to meet your needs.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Select a preferred format if a few options are available (e.g., PDF or Word).

- Download the file.

As soon as the Stock Option Plan which provides for grant of Incentive Stock Options, Nonqualified Stock Options and Stock Appreciation Rights is downloaded you are able to fill out, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

Incentive stock options, or ISOs, are options that are entitled to potentially favorable federal tax treatment. Stock options that are not ISOs are usually referred to as nonqualified stock options or NQOs.These do not qualify for special tax treatment.

Depending upon the tax treatment of stock options, they can be classified into qualified and non-qualified stock options. Qualified stock options are also called Incentive Stock Options (ISO). Nonqualified: Employees generally don't owe tax when these options are granted.

Non-qualified stock options may go to employees, company partners, vendors, or others that aren't on the company payroll. These stocks function much like ISOs, except you pay taxes on the spread between the grant price and exercise price at your standard income tax rate.

Incentive stock options (ISOs) can only be granted to employees. Non-qualified stock options (NSOs) can be granted to anyone, including employees, consultants and directors.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.