Michigan Installments Fixed Rate Promissory Note Secured by Personal Property

What this document covers

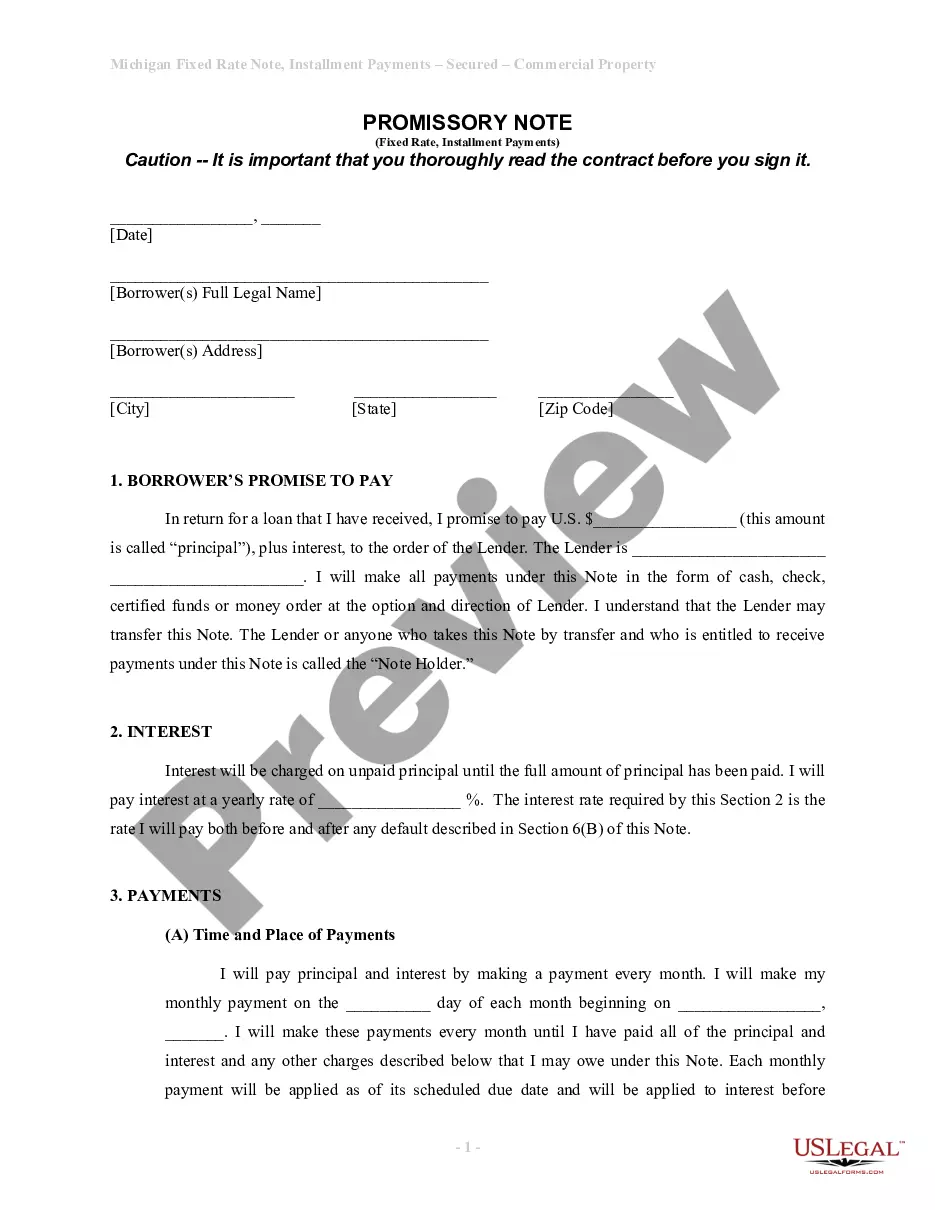

The Michigan Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document where a borrower promises to repay a loan through regular, fixed installment payments. This form differs from other promissory notes by including a provision for securing the loan with personal property, providing additional reassurance to the lender. It is essential for both parties to understand the terms outlined in this note, including repayment schedules and security agreements.

What’s included in this form

- Borrower's promise to pay principal and interest to the lender.

- Specified interest rate and calculation method for the payment of interest.

- Details regarding the timing, location, and amount of monthly payments.

- Borrower's right to prepay the loan, including conditions surrounding prepayments.

- Provisions for late payment penalties and potential default scenarios.

- A security clause detailing the personal property securing the loan.

When to use this form

This form is useful when an individual or business borrows money and wishes to secure the loan with personal property. It is particularly appropriate for situations where the borrower has specific assets to provide as collateral, ensuring the lender has recourse in the event of default. Common scenarios include purchasing equipment, vehicles, or other personal property when the lender requires additional assurance of repayment.

Who needs this form

This form is intended for:

- Borrowers who need to secure a loan with personal property.

- Lenders looking to formalize loan agreements with repayment terms.

- Parties involved in financial transactions requiring documented agreements.

Instructions for completing this form

- Identify the parties involved in the loan: the borrower and lender.

- Fill in the total loan amount, specifying the principal and the interest rate.

- Detail the repayment schedule, including the start date and amount of monthly payments.

- Include information about the secured personal property in the designated section.

- Both parties should sign and date the form to validate the agreement.

Is notarization required?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to specify the interest rate clearly, leading to confusion over payment amounts.

- Not including all parties involved, which can lead to enforceability issues.

- Incorrectly stating the amount of the loan or missed payments.

Why complete this form online

- Convenient downloads allow for quick access to necessary legal documents.

- Forms are created by licensed attorneys, ensuring reliability and compliance with legal standards.

- Editability allows users to customize the form to their specific needs.

Legal use & context

- The promissory note is a legally enforceable contract, detailing obligations for both borrower and lender.

- Understanding your rights and obligations under this document is essential for both parties involved.

- Consulting with an attorney is advisable to clarify any terms before signing.

Looking for another form?

Form popularity

FAQ

Not all promissory notes need to be secured; however, a Michigan Installments Fixed Rate Promissory Note Secured by Personal Property can offer significant advantages. When a promissory note is secured, it typically provides the lender with a safeguard in case of default, reducing their risk. By using personal property as collateral in this type of note, both parties can establish clearer terms and foster a stronger financial relationship.

In Michigan, a promissory note does not necessarily require notarization to be enforceable; however, having it notarized adds a layer of authenticity and can prevent future disputes. A Michigan Installments Fixed Rate Promissory Note Secured by Personal Property becomes more robust with notarization, as it verifies the identity of the signers. While notarization is not a legal requirement, it is often recommended for better legal protection. If you need help with this process, USLegalForms offers reliable resources to guide you through creating notarized documents.

To secure a Michigan Installments Fixed Rate Promissory Note Secured by Personal Property, you need to attach the note to a specific piece of property. This involves creating a security agreement that clearly states the terms, including the property being used as collateral. Complete the necessary paperwork to formally establish the connection between the note and the property. Consider using platforms like USLegalForms to ensure you have the correct documentation tailored to Michigan's laws.

In Michigan, the statute of limitations for enforcing a promissory note is six years from the date of default. This means that if a borrower fails to meet their obligations, the lender has six years to take legal action. Understanding the timeline is crucial, especially when dealing with a Michigan Installments Fixed Rate Promissory Note Secured by Personal Property. For comprehensive insights, uslegalforms can provide detailed information tailored to your situation.

Qualifying for an installment agreement generally depends on the financial situation of the borrower. Any individual or business that demonstrates a reliable source of income can typically establish an agreement using a Michigan Installments Fixed Rate Promissory Note Secured by Personal Property. Lenders will look at credit history, income levels, and overall financial stability. To clarify your eligibility, uslegalforms offers the resources you need.

A promissory note can indeed be secured by real property, which adds a layer of security for the lender. In the context of Michigan Installments Fixed Rate Promissory Note Secured by Personal Property, however, the focus generally remains on personal property. It's vital to understand the differences and implications of securing a note with real versus personal property. If you need guidance, uslegalforms can help you navigate the specifics.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

After issuance, a Promissory Note must be stamped according to the regulations of the Indian Stamp Act.All Promissory Notes are valid only for a period of 3 years starting from the date of execution, after which they will be invalid. There is no maximum limit in terms of the amount which can be lent or borrowed.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.